The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

Small, Tiny, Unexpected, Amazing Wins

Parents, do you ever wonder if all your hard work is paying off? Seriously, it usually seems like our words are in one ear, out the other. Are they even listening? Are they even watching? Is it moving the needle? Am I completely screwing them up without even realizing it?

Then, out of the blue, when you need it most, you get the tiniest but most amazing win.

That happened to us yesterday. We were in the middle of a tough stretch. Finn didn't want to get dressed for church, and Pax stormed out of the room after I beat him at checkers. It was a mess. Pax recovered quickly, but Finn was spiraling.

Sensing this situation was heading in a bad direction, Pax took matters into his own hands. He walked into his bedroom, grabbed his wallet, and returned to the living room where Finn was melting down. I didn't know what he was doing, so I just kept my mouth shut and watched as a curious third party.

"Finn, I'll buy you a donut at church today," he said, reaching into his wallet to find a $1 bill. Finn wasn't in an emotional place to receive the gift, but I was so proud of Pax!

Pax is starting to understand the purpose of money. He's figured out that it's best used (and more fun) to make a difference in others. This isn't the first time I've seen this behavior from him, and I hope it won't be the last.

Money isn't easy to come by for a 7-year-old, so it's pretty sweet to see him proactively and excitedly try to use it to bless his twin brother (who was treating him poorly, by the way). I won't say he "gets it," but he's showing signs of starting to get it. As his parent, I'm definitely going to encourage the heck out of him. The seeds have been planted, and now we water.

Parents, keep your eyes open for the small, tiny, unexpected, amazing wins. We need them. Sometimes, that's the one thing that gives us enough energy to keep going. Small wins are still wins, and small wins will eventually turn into big wins. Keep watering!

I Broke My Promise To You

Oh no. I did it again. I promised you I wouldn't, and I promised Sarah I wouldn't. But I did it again.

Oh no. I did it again. I promised you I wouldn't, and I promised Sarah I wouldn't. But I did it again.

Yesterday morning, Finn and I went to our nearby meat market to pick out steaks and made homemade butter for the first time. So, for dinner, we had steaks and baked potatoes (topped with Finn's butter)....great stuff! As dinner was coming to a close, that's when it happened.

Me: "Hey guys, I have an idea. How about we jump into the car and go get some ice cream at _____?"

Sarah: "I don't think that's a good idea. Besides, you told me to punch you in the face if you ever suggested this idea again."

Me: "It should be ok"

Then, they all took turns jokingly pretending to punch me in the face.

Shortly after that, I stepped back into my worst nightmare. It took 27 minutes from when we stepped in until we received our ice cream. Lovely. I can't believe I fell for it again....I'm such a fool.

As he chows down his ice cream cone, Finn says, "This ice cream sure is good, but they are really bad at giving you it." Truer words have never been spoken, little Finny man.

Countless other places deserved (and have earned) our business, yet I decided to spend our hard-earned money at a place that doesn't deserve it. How ridiculous and irresponsible of me!

This entire experience, which Sarah will surely remind us is all my fault, made me reflect on all the places we wrongfully choose to spend money—businesses that have lost the right, don't appreciate it, serve us poorly, offer a poor product, or simply don't align with our values. There are a few businesses on my list that need to be unapologetically cut.

The truth is, I mourn the loss of some of these businesses in my life. Businesses that I have fond memories of (before they decided to disrespect their customer base with poor performance). Or businesses that have drawn a line in the sand, value-wise, to the point I can't continue to patronize them.

There's a silver lining to all this. For every dollar we don't spend at these businesses anymore, there's one dollar we get to spend at a business that has earned the right to serve us. Businesses that offer a great product at a reasonable price, practice hospitality, and are grateful for the business.

Find these businesses in your life, then double down. They don't have to be small businesses; they need to be excellent businesses. If they happen to be small and/or local, great! But expect, demand, and reward excellence, period!

Golden Corral Fancy

There’s no fancy like Golden Corral fancy!

I returned home last night after a long but productive week in Houston, TX. Since beginning intermittent fasting about a year ago, I’ve come to greatly appreciate (and anticipate) my two meals per day. Further, my love for Taco Bell is unparalleled! For those two reasons, I savored the heck out of a lunch Taco Bell run this week. While sitting there by myself (enjoying a Beefy Burrito smothered in Diablo sauce), I had a few flashbacks.

Growing up in a small town in NW Illinois, we didn’t have much for dining. A few bars, a couple local restaurants, a Casey’s, and eventually a Subway in my teen years. Therefore, going out to eat was a special occasion in my family……which always required a 30-45 minute drive. In the Shelton household, there were three dining levels:

Casual: Taco Bell (see where I get it from?!?!)

Upscale: Pizza Hut (I can still taste those Book-It personal pan pizzas and breadsticks!)

Fancy: Golden Corral (this was the pinnacle of dining experiences)

Now, before you get all judgy with me, let me refresh your memory on just how amazing Golden Corral is:

All you can eat!

Cuisines from all over the world, such as Italian (pizza and pasta), Mexican (tacos and nachos), Asian (stir fry), and American (meat, potatoes, and casseroles).

Don’t even get me started on the dessert bar and self-serve ice cream station!

Some dude carving hunks of meat and placing them oh so gently on your plate like a food butler.

You can re-fill your pop as many times as you’d like…..every kid’s dream!

There’s no fancy like Golden Corral fancy! To this day, I smile when I see one. I even took the boys on their first-ever Golden Corral experience last summer.

Yes, there’s more to this post than a trip down memory lane. I’m really grateful for this part of my childhood. I think it’s one of the contributing factors to being grounded in my adulthood. These experiences, which build the foundation of our sense of reality, create a healthy perspective and allow for contentment. I love a fancy steakhouse or Michelin-starred restaurant like the next guy, but I’ll also take Taco Bell or Golden Corral any day of the week (sorry, Pizza Hut, you lost your mojo).

As a parent, I want the same for my kids. It’s my job to help my children build a proper foundation of reality. Sure, we’ll do some special things along the way, but I want them to live with contentment and be grateful for what they have. This will be tremendously important as they grow and begin their own adult lives. I’d even take it a step further and propose it will fundamentally transform their relationship with money, stuff, and lifestyle. They deserve a healthy relationship with the world, and I’m on a mission to help them find it. I hope you take a page from the same playbook with your kids!

The Eyes Never Lie

We humans have many ways to cover up what's really happening behind the curtain. We can mask the truth with our words, our voice's tone or pitch, or even our gestures. But the eyes never lie.

I have a little life hack for you today. If you ever want to know how someone feels about their work, there are two occasions when you can find out: while they are working, or talking about their work. And here's the trick. Look at their eyes. It's in their eyes. You can see it, almost feel it.

We humans have many ways to cover up what's really happening behind the curtain. We can mask the truth with our words, our voice's tone or pitch, or even our gestures. But the eyes never lie.

In my prior career, I used this trick when meeting clients, colleagues, interviewees, vendors, or prospective clients for the first time. The eyes were a dead giveaway, and based on that read, it would influence how I engage with them. Not in a bad way, per se, but I wanted to meet them where they were at. In my current work, it helps me gauge someone's work/life happiness and satisfaction. If someone is fulfilled and content in their work, it's a much different conversation than if they despise or merely tolerate their job.

This is also a useful tool when meandering about life. Engaging with a restaurant server, talking to your doctor or mechanic, or discussing something with your children's teachers. As specific examples, I recently had drastically opposite experiences in the past week. I distinctly remember meeting a young man. He was working a job that's universally disrespected and looked down upon. It's not the kind of job our parents dream of for us. However, his eyes absolutely lit up. I could tell he was engaged and full of life. It was practically contagious. On the flip side, I spent some time with an uber-successful businessman. He has more wealth and status than most of us will ever entertain. His eyes told a different, sobering story. The moment I asked him about his work, something changed. It was a visceral shift. I could see a deep discontent or uneasiness. The eyes never lie.

Here's my question for you today. What do your eyes say about you? Sure, we can tell people we're "doing great," put a smile on our face, and even raise the pitch of our voice by an octave, but what do your eyes say? Once in a while, I'll look in the mirror and not like what I see. That's the moment I know a change is needed. Maybe some of you are in the same boat. I hope you're brave enough to act on that instinct. It will probably be hard, but it will certainly be worth it.

“You’re Offensive, Travis!”

I had some suspicions about why people might have unsubscribed that day, but with all the self-talk polluting my brain, I decided to seek outside counsel. I contacted a few friends and asked for their perspectives.

Some days, when I hit "publish" on a particular topic, I know people will immediately hit "unsubscribe." It used to bother me, but I'm coming to terms with the reality this blog isn't for everyone. And even if it is, it might not be forever. No matter what, I'm grateful for each person who decides to make this part of their day. Thank you from the bottom of my heart!

The other day, however, I published an article I was not expecting to be controversial. It was about people who absolutely love their lives, and how they got there. I personally thought the piece was uplifting and encouraging, yet a wave of people unsubscribed. I was confused, and the self-talk started to creep in. Does my writing suck? Am I not funny enough? Or witty enough? Are my ideas not insightful? Are these topics not valuable to people? Are they too long? Too short?

I had some suspicions about why people might have unsubscribed that day, but with all the self-talk polluting my brain, I decided to seek outside counsel. I contacted a few friends and asked for their perspectives. The first person wrote back with the following sentence:

"That post was offensive!"

Wait, what?!?! He went on to explain that my entire post was about how living one's dream life does exist, and if that's true, it's up to each of us to pursue it—or not. "That's an offensive idea." He pointed out that this idea (and others I discuss on the blog) is culturally and societally challenging. It forces us to look in the mirror and reckon with our own journey. If our dream life exists, and we're not currently living it, the burden of decisions and consequences falls on the shoulders of the person staring at us in the mirror. "That's offensive!"

He then listed out my various offenses:

"Telling people they should find meaning in their work."

"Showing people they don't have to use debt. Especially your take on credit cards."

"Encouraging everyone to use a budget, even if they make a lot of money."

"Saying that money won't make them happy."

"It's ok to spend money on things you don't need."

"Continually telling people they should give more. Then telling them they should give even more."

"Every time you mention your huge pay cut when leaving your past career. This one makes me uncomfortable every time."

"Any time you tell people to openly share their ideas with the world."

He pretty much just summed up my blog, my heart, and my mission. Uh oh, where is he going with this?

"You're offensive, Travis. Keep being offensive. We need it."

I think he makes a good point. Living counter-culturally can come across as offensive to some. Even when well-intentioned and sincere, pursuing a different path from the majority looks weird. Many of you regularly share your meaning over money stories, and the reactions you receive from others could certainly be referred to as "offended.” That tells me you’re on the right track - keep it up!

I hope you have a meaningful and offensive day!

Meaning By Subtraction

Time is money, as they say. Or, through the lens of meaning, time is peace, margin, and freedom to pursue other things. So while these specific financial investments may not provide meaning and joy, they allow more time for the things that do (while possibly avoiding tasks that suck meaning and enjoyment from their lives).

In a recent post, I discussed the many things in my life that add value but don't cost an arm and a leg. I was trying to make the overarching point that we don't need to have or spend boatloads of money to live a meaningful and enjoyable life.

Upon reading this post, many of you spent time inventorying your own list of things that add value to your life and sent them to me! I loved reading your lists. There were some overlaps with my list, but by and large, your lists were uniquely unique. There are so many fun and thoughtful things! This little exercise perfectly highlights how everyone has different values, and should behave with our money accordingly.

However, I noticed something! My list included all the things I pay to have/do that add value to my life. Many of you included things you pay to NOT have/do. Here are a few examples:

"$80 to have my house cleaned"

"Hiring someone to cut my lawn - $35 per week"

"I occassionally pay for someone to come to my house to cook dinner for our family"

"Paying $30 for someone else to shovel my drive while I relax with a hot coffee by the cozy fireplace."

"Paying to have my groceries delivered. I hate grocery shopping!"

It's interesting how these items fall into the bucket of adding joy and value to people's lives. They aren't fun. They aren't getting something or creating an experience or memory. Rather, these items create time. Time is money, as they say. Or, through the lens of meaning, time is peace, margin, and freedom to pursue other things. So while these specific financial investments may not provide meaning and joy, they allow more time for the things that do (while possibly avoiding tasks that suck meaning and enjoyment from their lives).

I love the depth of this self-reflection exercise. If you haven't already done so, I encourage you to take an inventory of all the things that add value, meaning, and enjoyment to your life, paying special attention to the free or inexpensive ones. Once you have this list formulated, lean into it. Intentionally add them to your budget and your schedule. Double down on these little, meaning-filled nuggets of value.

Life is much more fun when we invest in the little things that brighten our day. Keep investing. They are worth their weight in gold, but luckily, they don't have to be as expensive!

Speaking of meaning-filled nuggets, I watch this live performance of Twenty One Pilots’ Holding On To You whenever I need a little pick-me-up! It’s free, and it’s life-giving stuff for me. Maybe you’ll enjoy it, too.

The Irony of Feeding Ourself

At the risk of being Captain Obvious here, I think feeding our family is important. You know, food on the table, a roof over our heads, clothes on our backs, and transportation to get to and from. See, that was very Captian Obvious-y of me.

But it's true. Through the course of life, it's imperative that we find ways to create enough income to care for our family's basic needs. For this reason, and to no surprise, most people's primary objective for work is to financially provide. There are a lot of other good parts that fall into it (like meaning, fulfillment, relationships, etc.), but at a very core level, providing for one's family is key.

While I totally get why and how this happens, this instinctual need to provide can also be self-sabotaging. If we're not careful (and we often aren't), it causes us to focus on ourselves first, and others second. This behavioral dynamic is counter-productive when endeavoring to make an income, as we're being paid to add value to others. Therefore, the act of focusing on ourselves first makes us less valuable in the marketplace.

Therefore, I've adopted a saying that I use often with my clients....especially business owners. "The best way to feed ourselves is to feed others." Said another way, when we help people thrive, we subsequently get to thrive. When others win, we win. When we add value to an organization, value is added to our bank account. Cause and effect.

When we make it about us, we lose (albeit slowly in many cases). Instead, we should endeavor to add value, add more value, and maybe add a bit more value. Then, we will undoubtedly get fed. It’s hard to view work through this lens, but when we do, it changes everything.

The best way to win is to help others win. I hope you help a lot of people win today!

The Subway Roulette of Life

Confession: I'm obsessed with subways. As a kid who grew up in a small farm town, the mere idea of a subway blew my mind. We board a secret train and are violently propelled through a hidden underground tunnel through a labyrinth of routes, intersections, and stations. It mesmerized me then….and still does!

Confession: I'm obsessed with subways. As a kid who grew up in a small farm town, the mere idea of a subway blew my mind. We board a secret train and are violently propelled through a hidden underground tunnel through a labyrinth of routes, intersections, and stations. It mesmerized me then….and still does!

However, it's what happens next that most fascinated me. After the train stops, we walk up a set of stairs and enter an entirely new world. We descend from one world, and ascend into a completely different one. New sights, new people, new scenery, new vibe. Still to this day, I get a euphoric feeling when walking out of a subway station.

New York, Hong Kong, London, Prague, Paris, and Beijing. I've spent meaningful time on all these systems, and I've felt like a little kid each time. Sometimes, I'll hop into a subway tunnel and pick a destination station at random just so I can be surprised by whatever I find at the top of the stairs. Some of the best experiences, meals, and memories are tied to a little game I like to call Subway Roulette. It's a choose-your-own-adventure game, but we don't really know what we're choosing until we arrive.

First time boarding the Hong Kong subway with our dear friends, the Hoags & Keungs

Life is the same way! We have so many choices. An infinite number of decisions with an infinite number of possible outcomes. And they are just that: choices. Each day, we have the opportunity to make thousands of decisions that can alter our life. The ball is in our hands.

The scary part, though, is that just like in Subway Roulette, we don't know what's waiting for us on the other side of our decisions. We might have a guess. We can picture it in our head. We can somewhat orient ourselves around the idea. We can even try to shape it just the way we want. However, it's a complete mystery until we get there.

Our parenting journey is a perfect example of this concept. Sarah and I talked about having kids on our first date! Becoming parents was one of the focal points of our relationship. We would start having kids around 30, have 2-3, then be done by 35. We were so naive and foolish! But we set our little plan into motion, not really knowing what was at the top of those stairs. Little did we know that infertility would gut us from the inside out. It was a long and grueling journey.

Five years into our battle to become parents, I remember waking up on my 35th birthday with a deep sadness. So much for my plan! It was a mess....I was a mess....we were a mess. But fast forward just three months, and we were shocked and blessed with the adoption of two little baby boys. "2-3 kids, then be done by 35." Our dream came true.....in the most unexpected way possible. God has a sense of humor.

Life is Subway Roulette. Make the best choices possible, hold on, and embrace what's on the other side of those stairs.

Joyful Bang For the Buck

I've been reflecting on everything in my life that give me joy, happiness, and value. Based on my experience, the best things in life rarely cost much (if anything). I'll share a partial list of mine, and I encourage you to think about yours

I had an epiphany last week while cruising around in the new ride. It almost seems illegal to have this much fun driving a car that cost me $9,000 (plus $41/month for insurance). It's been an absolute blast, and I can't wait to find excuses to hop in and get on the road. Sarah needs a gallon of milk? Great! There's a prescription at the drug store ready for pick-up? You bet! One of the kids needs to be dropped off at a friend's house? I got you!

This entire experience has me thinking about the correlation between money and fun. Or, as many people put it, money and "enjoying life." The narrative is we need money to enjoy life. It's this very narrative that causes millions of Americans to live in a perpetual state of misery so they can afford xyz fun thing. Why? To "enjoy life." I find it tremendously ironic that we'll intentionally live in misery for the privilege of having money to enjoy life. I would argue we should just cut to the chase and live an enjoyable life....period.

Along those same lines, I've been reflecting on everything in my life that give me joy, happiness, and value. Based on my experience, the best things in life rarely cost much (if anything). I'll share a partial list of mine, and I encourage you to think about yours:

Pick-up basketball with Pax: Free

Lego time with Finn: Free

Netflix time with Sarah: $15/month

Coffee and a newspaper on a Saturday morning: $3

A nice glass of bourbon: $4

Lunch with a friend: $12

Sunday mornings at church with my people: Free

A good book: $7 at my local used bookstore

Engaging with friends on social media: Free

A walk on a nice spring day: Free

Publishing our podcast: Free

Writing this blog: Free

Listening to Twenty One Pilots music: $15/month

Listening to podcasts: Free

A Northern Vessel cortado and donut: $6

Watching my Cyclones on TV: Free

Each of these things adds tremendous value to my life. I'm grateful for each, and I recognize none have a high financial bar. Sure, I could splurge on a fancy meal, an elaborate trip, or an extravagant purchase. There's nothing wrong with any of these things, but they aren't a prerequisite to living a fun and meaningful life.

Money doesn't create meaning; meaning creates meaning. Find the little things in life that add value and aggressively invest in them. Don't fall for the lie that we need to spend tons of money to "enjoy life." Instead, simply enjoy life. There's so much to savor and appreciate. Have a wonderful day!

What We Don’t Know WILL Hurt Us

According to a recent Northwestern Mutual survey, Americans believe they will need approximately $1.46M in their investment portfolio to comfortably retire.

According to a recent Northwestern Mutual survey, Americans believe they will need approximately $1.46M in their investment portfolio to comfortably retire.

As I suspected, personal finance social media is abuzz about this. There's a wild debate about whether this average number of $1.46M is enough. Financial experts are quick to use the 4% rule, which I agree is a prudent way to find a quick rule-of-thumb answer. To summarize, there's a principle in the investment world that says when we start to withdraw money from a large block of invested capital, we can take an amount equal to 4% of our total investment portfolio in the first year, then adjust that dollar amount upward for inflation each year after that. If we follow that strategy, statistically speaking, we shouldn't run out of money during our lifetime.

Let's use a real example. If we have $1.46M in our portfolio when we retire, 4% of that number is $58,400. In other words, a family who retires today with a $1.46M portfolio can generate an annual income of $58,400. This decision has more considerations and nuance, but that's a pretty fair back-of-the-envelope rule of thumb.

This is where the experts came unglued. "You can't retire on $58,000/year!!!!!" In short, people focused on what balance is needed to achieve the annual income they deemed acceptable. Many concluded that $2.0M ($80,000/year retirement income) or even $2.5M ($100,000/year retirement income) is adequate.

Through all this discourse about the appropriate level of retirement lifestyle, they failed to consider the most important factor of all: inflation. Let's go back to the above example. As I mentioned, according to the 4% rule, if someone retires today with a $1.46M portfolio, they could generate an annual retirement income of $58,400. There's one key word in my last sentence...."today." Whether you believe $58,400/year is an acceptable number or not, $58,400 today is not the same as $58,400 in 10 years.....or 20 years.....or 30 years.

If you're 50 and want to retire at 60, that $1.46M portfolio will still generate an annual income of $58,400. However, due to inflation, $58,400 in 10 years will feel like $43,500 feels like today.

If you're 40 today, that same $58,400 at age 60 will feel like $32,300 feels like today. Ouch!

If you're 30 today, that same $58,400 at age 60 will feel like $24,000 feels like today. Uh oh!

Can you see the problem here? Millions of people have a belief structure that, even if they actually meet their goals, are unknowingly barreling toward a challenging situation.

What we don't know WILL hurt us. This sentiment applies to this topic, and others. That doesn't mean we need to become experts in all areas, but gaining awareness of the bigger picture is often the gateway to being better and having better. For that reason, I'm grateful you're here. I hope to provide context and perspective in a few of these areas, but we should all seek other places to grow in other areas as well.

What other resources/content (money or not) do you enjoy consuming on a regular basis?

A Leprechaun, a Mermaid, and Loch Ness Walk into a Bar

There's a very real and heavy cultural pushback against any narrative suggesting we can successfully pursue meaning over money. It seems so far-fetched. We're told it's impossible to live with deep meaning without going broke, so why even bother? We're encouraged to find something "good enough" and hold onto it for dear life. It could be worse, right? Sure, we might not like our life and our work, but it could suck a whole lot more! Therefore, compromise, lower the bar, and dilute your dreams. This is the message jammed down our throats, day in and day out.

"I'm living my dream!"

I've heard this exact phrase from three people in the last two weeks. It's hard to imagine how four simple words can have such profound ripple effects. Considering seven out of ten Americans dislike or hate their job, it's pretty rare to find people who voluntarily say they are living their dream.

Yet, people do it every day—I see them with my own eyes! Unicorns exist, leprechauns are real, mermaids aren't figments of our imagination, Bigfoot is stomping around in remote woods, and the Loch Ness Monster is swimming just below the surface.

There's a very real and heavy cultural pushback against any narrative suggesting we can successfully pursue meaning over money. It seems so far-fetched. We're told it's impossible to live with deep meaning without going broke, so why even bother? We're encouraged to find something "good enough" and hold onto it for dear life. It could be worse, right? Sure, we might not like our life and our work, but it could suck a whole lot more! Therefore, compromise, lower the bar, and dilute your dreams. This is the message jammed down our throats, day in and day out.

Yet, I regularly encounter people living it out in the most beautiful and counter-cultural ways. To call these people encouraging would be the understatement of a lifetime. I dare call them heroes.

I have a new tradition. Every time someone tells me they are living their dream, I ask them a few questions. First, I ask what part(s) of their life they are referring to. What constitutes "living my dream?" It's usually a combination of work, family, friends, and serving (never money). Then, I ask them the juicy question: How?

Today, I want to give you a little glimpse into how these dream livers answer this question. How have they managed to live their dream? Here's what they said:

Know and believe that our dream life DOES exist.....it IS possible.

Define what we truly want.....and why. It's hard to hit a target we can't see. Know what matters.

Make very intentional decisions. Whether they are small decisions or huge decisions, ensure our choices align with our dreams. "Will this pull me closer or push me further from my vision?"

Pray about it....and pray for it.

Watch doors open, watch doors close. When an opportunity doesn't work out, it's not a failure. It just means a door is closing.....and other doors will surely open.

Don't be afraid to walk through the doors. The unknown is scary, but regret is scarier.

Don't let money dictate our steps. Yes, we must make enough to live, but money isn't the objective. Sometimes, we need to make choices that will (at least temporarily) hurt our finances. Always meaning over money.

Allow the dream to change as we change. It's not etched in stone, and can be a moving target.

It probably won't be easy. A dream life is often a hard life.

Are you living your dream life? If not, just know that unicorns ARE real.

“Daddy, When Does the New Month Start?”

I received at least a dozen messages about yesterday's post. Specifically, people were curious how we have open financial conversations with our kids (at age-appropriate levels) while avoiding them feeling the weight of it.

It reminds me of a recent interaction in my house. As I was working on something, Finn approached me with a question. "Daddy, when does the new month start?" "In about a week, bud. Why?" "I want to go to Chuck-E-Cheese to play games. Can we put it in the budget next month?"

I loved his heart in the question. There's something important to him. He recognizes it costs money. He also knows we handle our finances with intentionality. Therefore, he asked if we could prioritize it in the budget.

My response to him? "Of course we can, bud. But we might actually still have money left in the kids category this month. If we do, we should totally go to Chuck-E-Cheese today." I opened the budgeting app and we looked at how much was left. $75! He celebrated wildly, and then a few hours later, we shared laughs over Chuck-E-Cheese games." Side note: Did you know they recently got rid of their creepy animatronic band? I was so mad. Despite being terrifying, that dysfunctional band was a fun remnant of my childhood.

The narrative of our family's money conversations is intentional. We never use the phrase "We can't afford it." Those four words are the ultimate parenting shut-down. It wins the conversation every time. However, it also confuses our kids. For example, if our kid asks for a $30 Lego set and we respond with "We can't afford it," the child may think we literally don't have $30. It also leads them to believe that if we did have $30, we would 100% buy it. It's a weird narrative for kids to wrestle. All the while, we parents are oblivious to how these comments impact them.

Instead, we should talk about money through the lens of intentionality and prioritization. If our kids want something we aren't willing to buy right now, Sarah and I respond that "it's not in the budget this month." We CAN afford it, but it's not part of the plan right now. From there, we can choose not to prioritize it, or discuss adding it to a future budget. Either way, approaching things from the intentionality angle staves off the "I want it now" syndrome.

When we take this approach with our children, they learn the importance of patience, prioritization, planning, delayed gratification, communication, and responsibility. They also learn it's okay to buy fun things. We don't demonize wants. We don't treat fun purchases as wasteful. It's all part of developing a healthy perspective around spending, saving, and giving. Spending on fun things is important.....but it must be done responsibly. Even a seven-year-old can comprehend this if approached well.

Parents, what say you? I'd love to hear your feedback on this topic and any other ideas for engaging in healthy money conversations with your kids.

Don’t Let the Kids Feel It

We parents, whether intentionally or unintentionally, are placing immense guilt on our children. Kids feel the weight of this burden. They carry it perpetually. "Do you know how much this is costing us?" "Wow, that appointment was expensive." "We're paying a lot of money for you to ____."

Today was (hopefully) the last of a string of dentist appointments for one of our kids. It's been an expensive few months. We're grateful for our medical sinking fund, but it's starting to put some pressure on our monthly budget.

Today's post isn't a sob story about our recent medical costs. Instead, it's about something often associated with expensive times in life. When these situations arise, it's common to discuss them verbally. Communication is good. Conversation is good. Discourse is good. All good.....with one exception. We need to ensure the kids don't feel it.

We parents, whether intentionally or unintentionally, are placing immense guilt on our children. Kids feel the weight of this burden. They carry it perpetually. "Do you know how much this is costing us?" "Wow, that appointment was expensive." "We're paying a lot of money for you to ____."

These single, seemingly innocent comments can have a detrimental effect on our kids. I have clients who share stories about remarks made by their parents 25 years ago, and as a result, they've refused to accept any help or aid from them ever since. These are deep wounds. Kids, turned teens, turned adults who feel like they are a burden to their own parents. Their parents probably haven't even thought twice about their seemingly innocent comment since the moment it left their mouth 25 years ago, yet it's impacting their relationship decades later. That's how powerful the weight of this guilt feels to our kids.

While I will openly discuss finances with my kids (to varying degrees), I will never openly discuss how an activity/expense tied to them impacts us. We need to let our yes be yes, and our no be no. Sports and school activities are a prime example of this. It's common for parents to say yes to something, but then perpetually hold it over their kids' heads. I know parents aren't doing it to be intentionally hurtful. Rather, they do it as an incentive or an act of accountability for the child to follow through. But I also know the damage it's causing to our young people.

Don't share that burden with them. Share it with each other. Share it with a friend. Share it with me. Just don't share it with them. They aren't yet able to process something like that in a healthy way. Let them remain kids. Say no if you need to say no, but please don't say and then hang it over them. Future you will be grateful for this choice when your kids haven't carried that unknown guilt for decades.

You got this, parents! It's not easy, but it's worth it.

Beware the Guilt Monsters

I recently gave a gift to someone, an acquaintance. It was a cool gift. It was a thoughtful gift. It was an impactful gift. It was a somewhat impulsive gift. As I usually do with giving, I will keep the details of this one confidential. For the sake of this piece, let's say it costs around $300. In any event, this gift significantly moved the recipient. It's unique, personal to them, totally unexpected, and meets them exactly where they need to be met. Huge win! (Side note: This gift made me happier than any personal use of this money could have possibly derived.)

Then, something else happened. Someone heard about this gift and hit me with, "It's not fair that you only gave to them." Ah, yes, this is where the guilt monsters come out to play. You know about the guilt monsters, don't you? They are the little comments, actions, and reactions that often circle moments of fortune or generosity. Sometimes, they are levied intentionally, while other times, it's bit more subconscious. Either way, it's a subtle way for people to say, "What about me?"

Guilt is a terrible boss. If we give in to the guilt monsters, two things can happen:

It alters our giving behavior to the point where we make gifts we wouldn't otherwise make, primarily to stave off the guilt monsters.

It impairs our giving behavior by making it easier not to give than to give. After all, the guilt monsters won't come out to play if we simply refuse to be generous.

Both of these outcomes are bad! In the first scenario, gifts are made to reduce guilt (instead of maximizing impact). In the second scenario, giving decreases or stops altogether.

It's imperative that we tune out the guilt monsters. They aren't stopping, that's for sure. In fact, as you venture deeper into your generosity journey, it will only increase. To be frank, it sucks. There's no other way around it. On the flip side, however, the guilt monsters are a great indicator of where our giving shouldn't go. Whenever someone puts guilt on us, it should be an immediate red flag that they aren't in a healthy position to receive generosity. Good to know! It sucks, but it just helps us better fine-tune where our gifts should and shouldn't be made.

One last thought on the guilt monsters. At some point, after ignoring the guilt monsters long enough, they don't seem to pester us as much. They realize their guilt monstering (I just coined the verb) doesn't work, so they need to guilt someone else.

Don't let the toxic words, actions, and reactions of others break your generous spirit. If anything, let it embolden you. Double down on your giving. Nah, strike that. Triple down on your giving! Serve those who you are called to serve, do it with a joyful heart, use whatever you have to make an impact, and never lose sight of the meaning.

Don’t Fall for the Facade

That's the dilemma - and danger - of facades. We watch everyone's perfectly curated lives, very well knowing how imperfect things are behind our home's front door. It can be demoralizing. Self-talk creeps in. Doubt can take over. We begin asking ourselves why our life sucks so badly compared to our friends, family, co-workers, and neighbors.

We had a wonderful Easter church service yesterday morning. It's always a special day, and we're grateful for the opportunity to celebrate. It was fun crossing paths with many friends who were also there to celebrate the big day. Based on what they saw, most people probably believed we were having an amazing Easter Sunday. They would have been terribly wrong. It was a facade. We were in the midst of one of the worst days of our parenting lives. We were absolutely miserable. Grateful, but miserable.

When I say facade, I'm not referring to an intentional act of deception. Rather, people don't know what they don't know—a half-truth of sorts. We weren't trying to be disingenuous; we were just trying to live life. Meanwhile, some people who saw us appearing to be having a great day were also having a harder day than was visible on the surface.

That's the dilemma - and danger - of facades. We watch everyone's perfectly curated lives, very well knowing how imperfect things are behind our home's front door. It can be demoralizing. Self-talk creeps in. Doubt can take over. We begin asking ourselves why our life sucks so badly compared to our friends, family, co-workers, and neighbors.

Social media only escalates this dynamic. Social media allows us the opportunity to perfectly and intentionally curate what gets shared with the world. It puts this entire concept on steroids, blasts it out to hundreds or thousands of people, and then gets further juiced by the positive reinforcement of likes and comments.

This is also an ever-increasing problem when it comes to money. I regularly hear people put certain families on a pedestal, essentially viewing them as the pinnacle of success. They drive the best cars, live in the biggest houses, wear the nicest clothes, go on the fanciest trips, and have the perfect kids. You know who I'm talking about! I get an interesting perspective in my work. I get an intimate, up-close perspective of what really goes on behind the curtain. Here's what I can tell you. Looks can be oh-so deceiving. That perfect family that you unfairly compare yourself with? All is not what it seems.

Behind the appearance of wealth and success is often stress, turmoil, financial tension, growing debt, lack of career freedom, and marital strife. I'm not saying this to demean any family. I have so much empathy for these families. I'm not trying to knock them off some perceived pedestal. Instead, I want to encourage you to stop comparing yourself to someone else's half-truth facade. There's more going on than you know, and it's probably not as rosy as it appears.

On the other hand, perhaps we should try living with a little less facade. I'm not advocating that we air all our dirty laundry to every listening ear, but maybe we can be a bit less curated and a little more authentic. Let's be ok with our imperfections. Our lives aren't perfect, but neither is theirs.

Your Far-Fetched Life

When I started publicly sharing ideas, stories, and insights, I never anticipated the amount of active pushback I'd receive. Perhaps I was naive, but I missed the mark by a mile on that one. Whenever you share ideas publicly, you (knowingly or unknowingly) open the door for reciprocating feedback from the public.

When I started publicly sharing ideas, stories, and insights, I never anticipated the amount of active pushback I'd receive. Perhaps I was naive, but I missed the mark by a mile on that one. Whenever you share ideas publicly, you (knowingly or unknowingly) open the door for reciprocating feedback from the public.

The feedback ranges from encouraging to discouraging, serious to humorous, and loving to hateful. If I had a nickel for every time someone told me to "go eff yourself," I'd have a lot of nickels. My favorite all-time comment was when someone said my wife was going to have an affair and leave me for her CrossFit trainer. That would be sad, so let's hope something like that doesn't happen. Luckily, Sarah doesn't do CrossFit....

However, one common piece of feedback stings a bit. It doesn't sting because it hurts me, or I take offense to it. Rather, it stings because I feel terrible for people who feel that way. It's when people tell me these ideas of meaning over money are "far-fetched," "out of touch," or "unattainable." It's not that they don't want to prioritize meaning over money, but they don't believe it's even a possible path. Thus, they must concede to a life of chasing money and throwing away decisions that provide meaning.

I don't feel any anger toward these people. More than anything, I have empathy. I wish I could shake them and show them first-hand how much better their lives could be. I wish I could be like one of the ghosts on A Christmas Carol who can teleport the person to their alternate reality and peep at what it looks like. I want them to see, touch, and feel it with their own eyes, hands, and hearts.

I don't believe what I believe simply because I've lived it in my own life. A sample size of one is too small to rely on, and it would be foolish for me to believe my way is the right way. Instead, I've been privileged to watch hundreds of people follow a similar path. Friends, clients, podcast listeners, blog readers, social media DMs, and people who approach me at my speaking events. Hundreds!

Like the countless clients who made drastic 180-degree shifts in their careers to aggressively pursue meaning when they knew it would likely result (at least initially) in far less money.

Like the young man in New Zealand who DM'd me out of the blue to tell me he discovered the podcast, binged 70 episodes in two weeks, and it changed his life, career, and marriage—not because of me, but because of meaning.

Like YOU, the blog readers, who generously and repeatedly share profound stories about choosing meaning when seemingly everyone advises you to do the opposite. People see what you're doing. You're l bending the culture.

You are normalizing a "far-fetched" life, one decision, one story, one impactful act, and one meaningful day at a time.

Tyler Joseph Cuts Me Again

Much to my delight, Twenty One Pilots released another single this week. This song, Next Semester, has a 90s punk rock beat (think Blink 182). That's not necessarily my style, but Tyler Joseph has a way of creating powerful experiences in unexpected ways. Next Semester is a deeply powerful and emotional song that cuts to the core of what many of us experience along our journey: mistakes, fear, anxiety, doubt, and regret. Also, like many of their songs, there's a strong lean into faith.

Much to my delight, Twenty One Pilots released another single this week. This song, Next Semester, has a 90s punk rock beat (think Blink 182). That's not necessarily my style, but Tyler Joseph has a way of creating powerful experiences in unexpected ways. Next Semester is a deeply powerful and emotional song that cuts to the core of what many of us experience along our journey: mistakes, fear, anxiety, doubt, and regret. Also, like many of their songs, there's a strong lean into faith.

One lyric repeated multiple times is, "Can't change what you've done. Start fresh next semester." This one cuts to the core, as most of us carry many regrets. We've done things we wish we could undo....but we can't. That's a deeply depressing and frustrating reality.

However, Tyler's next words are the key element: "Start fresh next semester." While we can't change the past, every day is an opportunity to carve a new path—a continual second chance.

The lyrics and emotion of the song cut through me in so many ways. I think about all the mistakes I've made in my life—deep, painful, and life-altering mistakes. Decisions I wish could be erased or reversed. I think most of us have similar feelings about moments in our past.

I also think about my coaching work. When I meet couples face-to-face and discuss deeply personal topics such as money, marriage, and careers, many regrets and past mistakes rise to the surface. These past events have a habit of taking hold of us and influencing our behavior, perspective, and decisions (often in toxic ways).

These elephants in the room can sabotage us every step of the way. I don't mean to sound overly dramatic, but they can be haunting....and destructive. For this reason, it's imperative that we confront our guilt and regrets head-on.

First, we can't play the woulda, coulda, shoulda game. We can't what-if our way into a healthy place. Unless we have a Delorian (call me if you do!), the past is 100% cemented in time. We must reckon with the reality that we can do nothing about it.

Second, and more importantly, we can choose to step into a different, better, and brighter future. Remember, making no choice is still making a choice. Something will happen to us tomorrow, whether proactively or reactively.....whether actively or passively….whether good or bad. It won't stay the same. Tomorrow's coming, and it's going to alter our path one way or another.

Once we accept this idea, we can embrace a better future we most certainly deserve. This, right here, is where people's lives change. I've seen it play out in hundreds of people's lives. Whether it's debt, a dead-end career, living month-to-month, stuck in a bad relationship, or failing to get a needed education, better is out there for you.

Can't change what you've done. Let go of the regret. The past is the past.

Start fresh next semester. Tomorrow is a new day. Make it the beginning of something beautiful.

Creativity is a Renewable Resource

Today is my 500th article published in 500 days. It feels weird even typing that. 238,000 words sent into cyberspace, hoping to move the needle in someone's life. It started with a handful of people already subscribed to my previous blog (plus a few new pity follows from friends and family). Fast forward 500 days and the addition of many new faces, and The Daily Meaning has been e-mailed 62,000 times.

18 months ago, while enjoying a coffee with my close friend and mentor, Gary Hoag, I confided that I was struggling with my writing. Specifically, I struggled finding the time and the ideas to publish 2-3 pieces per month. His advice was simple and absurd: "Just write every day." Ah yes, why didn't I think of that!?!? I don't have time or ideas to write 2-3 times per month, so let's go ahead and write 30 times per month. Does this sound as crazy to you as it did to me? To be honest, I'd probably jump off a cliff if Gary suggested it. For that reason, and perhaps combined with a momentary lapse in judgment, I took his advice.

Today is my 500th article published in 500 days. It feels weird even typing that. 238,000 words sent into cyberspace, hoping to move the needle in someone's life. It started with a handful of people already subscribed to my previous blog (plus a few new pity follows from friends and family). Fast forward 500 days and the addition of many new faces, and The Daily Meaning has been e-mailed 62,000 times (plus however many people have stopped by the website to read it). Wow…just wow!

Out of curiosity, I just Googled, "What is a normal open rate for e-mail newsletters?" Depending on the source, anything between 15%-25% should be viewed as "good." In other words, if 1,000 e-mails are sent, it would be a success if 150-250 of them are opened. Not you guys, though….. you're built differently. Of the 62,000 e-mails that have been sent, approximately 70% have been opened. What!?!? I noticed this trend early on, and it's boggled my mind ever since. To say I'm grateful would be the world's biggest understatement. Releasing this blog into the world each morning, and the engagement you show in return, is one of the biggest joys of my life. I never take that opportunity (and responsibility) for granted.

If there's one lesson I've learned from this crazy endeavor, it's this: creativity is a renewable resource. In the past, I would have tightly held my "good ideas" while seeking the perfect time to release them into the world. It was a form of hoarding, in some sense. But it does no good stuck in my brain. On the flip side, sharing our creativity is an act of generosity. It allows the opportunity to make a difference and add value to people's lives.

Something else happens when we release our creativity into the world. It's like pruning a shrub. After we prune a shrub, there's less plant remaining; we took something away. In short order, however, it grows faster, fuller, and better. Creativity is much the same way. When we share something with the world, we're initially left with less. However, the act of sharing spurs our creativity to grow faster, fuller, and better. It's the ultimate renewable resource.

Yes, you're creative. Whether you're a traditional creative (artist, photographer, musician, etc.) or someone who views yourself as "not a creative person," you ARE creative. You have something to share. Something that matters. Something that will add value to other people's lives. Share it. Just share it. It's a renewable resource.

The Drink That Satiates

When I was a kid, I distinctly remember an advertising battle between Coke and Pepsi. The rivalry ran so deep that they would openly bash one another in their TV and print ads (at least that's how my questionable childhood brain remembers it). Anyway, one of the nuances I remember playing out was this back-and-forth debate about taste tests. Despite Coke being the overwhelmingly favorite drink of consumers, Pepsi continually (and oddly) produced studies showing they were preferred in taste tests.

When I was a kid, I distinctly remember an advertising battle between Coke and Pepsi. The rivalry ran so deep that they would openly bash one another in their TV and print ads (at least that's how my questionable childhood brain remembers it). Anyway, one of the nuances I remember playing out was this back-and-forth debate about taste tests. Despite Coke being the overwhelmingly favorite drink of consumers, Pepsi continually (and oddly) produced results showing they were preferred in taste tests.

Here's where things get interesting, and it has to do with one particular word: "taste." Pepsi would win taste tests, yet people would buy Coke. Why? People don't taste pop; they drink it. Pepsi's taste was more appealing (dare I say sexy?), but it wasn't satiating. The surface-level appeal works great as long as you're just tasting it......but that's not how the product is consumed.

Happiness is the same thing. It tastes great. It's extremely appealing....even sexy. We violently pursue it with our actions and behaviors (often counterproductively). But just like Pepsi, it's not satiating. And like our pop-drinking experience, we're not in the tasting business. We don't taste life.....we drink it….we live it.

This is why, in my humble but convicted opinion, we often live with a void in our lives. We do everything we can to fill this void with happiness, but happiness is fleeting. I drove my new (to me) 350Z for a bit yesterday. It was only 36 degrees out, but I rolled the top down and cranked up the Twenty One Pilots. It made me happy. It was pure fun. It was also fleeting. That's not to demean the experience or treat it as if it doesn't matter. Rather, it's fair to recognize money, stuff, and status cannot satiate us. They can provide a momentary jolt of happiness (tastes great!), but it doesn't fill the void.

It's okay to taste the Pepsis of life. They taste good! They're appealing. They're fun. Absolutely nothing wrong with that! On the flip side, we need to recognize those things can never and will never satiate. They aren't the prescription for what ails us. They aren't the solution to fill the void.

Instead, what we're really searching for meaning and fulfillment. We're looking for something that motivates us to get out of bed and gives us the opportunity to make a difference. That idea takes a few different forms. First, generosity. Generosity fills our tanks unlike any material self-satisfying purchase can. Generosity always wins, and the giver is often the biggest beneficiary of the gift. Second, we need to pursue work that matters. Not work that pays a ton. Not work that gives us status. Not work that's fun. Not work that's easy. Work that matters. Using our gifts and passions to make a difference. Be productive. Add value to others. It’s simple, but powerful.

That's the Coke of life. It's not as appealing or sexy, and it doesn't give us that instant jolt, but man, it satiates! Drink up!

Smooth Out Your Lumpy Stuff

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses.

A few days ago, I wrote about my recent car maintenance frustrations. It was a bit unexpected, but I received a wave of messages from people asking for more insight on how to execute this concept.

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses. The goal is to smooth out the lumpy by slowly and steadily funding them over time, eliminating (or significantly reducing) the stress experienced when situations arise. Common sinking fund categories include car, house, travel, medical, giving, and kid activities. Each of these categories has a habit of sneaking up on us. When they do, these sudden and unexpected expenses sabotage our disposable income.....zapping our ability to make progress in other areas.

Here's a step-by-step of the mechanics:

Set up a separate savings/checking account for your desired category and name it accordingly. Most credit unions will let you set up multiple accounts, but most banks won't (with the exception of Wells Fargo). If your bank doesn't, I recommend CapitalOne's 360 Performance Savings.

Allocate money in your budget for this category. The amount can be steady or vary by month, but it must be included in the budget.

Just like you pay your electric bill, you pay your sinking fund. Whatever dollar amount you budget gets transferred to the sinking fund. I prefer to automate these transactions.

When expenses arise for a particular sinking fund category, use your primary checking account to pay the expense.

Immediately after paying for the expense, instruct your sinking fund to send that amount back to your checking account, essentially reimbursing your checking account from the sinking fund.

Repeat.

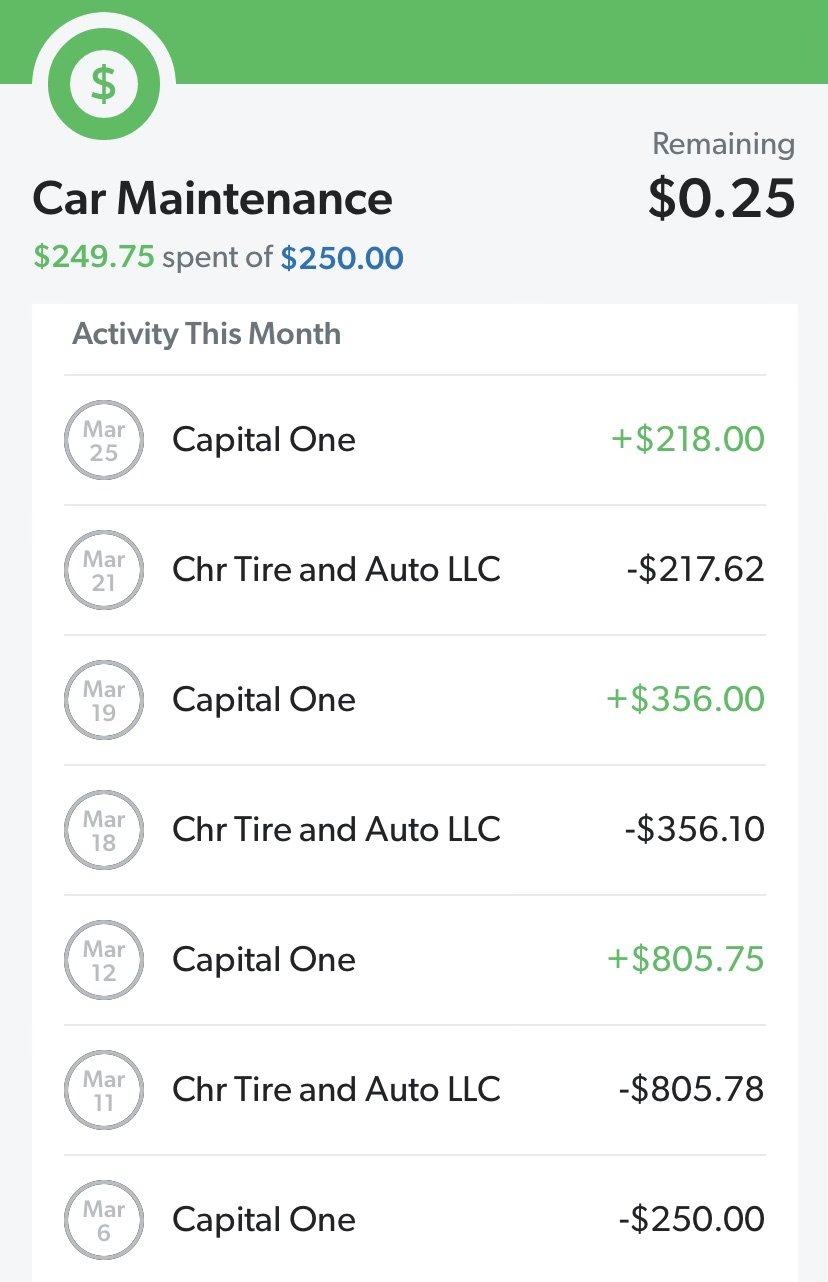

I'll share an example of my car fund from this month. For 19 years, I've budgeted (and automated) a monthly transfer from my primary checking account into my car fund. We currently budget $250/month. After March's $250 contribution (completed on 3/6), our car fund balance was $2,487. Then, we got hit with a hat trick of car bills: $806 for brakes on my main car, $356 for known issues with my new car, and $218 for the unknown issue with my new car. I budgeted $250, but got hit with $1,380 of actual expenses.....ouch! This situation would have crushed our budget had we not had a sinking fund. Instead, I simply reimbursed my checking account from my car fund for each, resulting in a total monthly car fund expense of $250 (the original planned contribution). It took something extremely lumpy and made it smooth. It went from a potential disaster to a minor inconvenience. Below is an image of how we executed it in our budget.

Setting up these extra accounts and steps may appear to make things more complex, but you'll quickly see how truly simplifying (and freeing) it can be! Best of luck smoothing out your lumpy stuff!