The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

Blood Money

You have a once-in-a-lifetime opportunity to make $50,000 for a single day's work......but it's the day of your kid's high school graduation.

Have you ever had a decision in front of you that you knew in your heart the correct answer would result in you losing a ton of money? Here's an extreme example. You have a once-in-a-lifetime opportunity to make $50,000 for a single day's work......but it's the day of your kid's high school graduation. $50,000 is a lot of money! But it's also your kid's graduation! Is a single one-hour ceremony really worth losing $50,000?

These are the types of scenarios I refer to as "blood money." It's money for the sake of money, even at the expense of something even more important or meaningful (perhaps our dignity). Over the course of my adult life, I've encountered maybe a dozen of these opportunities. A high-paying job/project that I should say "no" to because it would surely steal my job. A financial windfall that would come with major strings attached. Work that needed to be done at the expense of attending an important life event.

I wish I could tell you I always made the right choices in these scenarios, but unfortunately, I haven't. The pain of my regret is where I coined the term "blood money." I looked at the financial reward for x decision and felt disgusted in myself. The financial rewards I received might as well been drenched in blood. I ripped meaning from my life for the benefit of dollars. It's the antithesis of what I believe in, yet I've fallen for it more than once.

There are several families in my coaching going through similar situations. Blood money is on the table. The culturally right decision is to say yes to this money, but the consequences could be dire. What will they choose? Only time will tell. My strongest encouragement to them is to remember what their purpose is. If they are honoring that, they will (usually) make the right choices.

Always choose wisely, as everything is connected to everything.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Crazy Enough to Believe

$118,000 of student loan debt seems overwhelming because, well, it is.

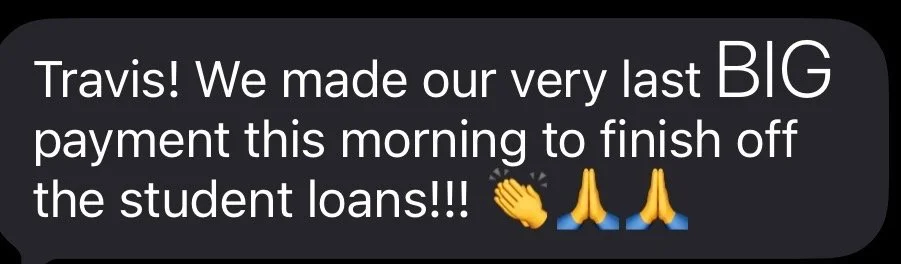

I received the most wonderful text a few days ago. Instead of telling you about it, I'll paste a screenshot for you:

Whoa! Talk about an amazing way to start the day, receiving a dramatically positive life update from a former client. However, I think more context is in order. I haven't seen this client in more than two years. After doing a lot of coaching work, this couple decided they had the tools they needed to win....then promptly kicked me to the curb (which is the goal!). I was grateful for the opportunity to work with them, and firmly believed they would take the reins and crush it going forward.

I knew they were well-positioned to succeed the last time we met, but since I haven't been meeting with them, I really didn't know what was happening behind the curtain. After receiving that text, I immediately opened their file to refresh my memory. I knew they had a TON of debt, but I didn't remember how much. Here's what I discovered. My last meeting with them was 28 months ago, when they were sitting on about $118,000 in student loan debt. Ouch!

Seeing the numbers on that spreadsheet took me back to those coaching meetings. $118,000 of student loan debt seems overwhelming because, well, it is. It was intense! However, at the same time, this couple didn't seem rattled. Instead, they were surprisingly optimistic. They were crazy enough to believe they could pay it off. Frankly, that's the secret. The only way to attack $118,000 of student loan debt is to violently attack $118,000 of student loan debt, month by month. This couple had faith, discipline, unity, and perseverance. They were also crazy enough to believe they could do it!

Of all the principles I've learned from watching families (including my own) get out of large amounts of debt, the power of being crazy enough to believe is often the make-or-break factor of success. Conventional wisdom says we'll never be able to pay off $118,000 in student loan debt. If you believe that's true, you surely won't. However, if you're even a fraction as crazy as this couple to actually believe it's possible, not only will it be possible, but inevitable.

I couldn't be happier for this family. They are needle-mover world-changers, and I have a feeling there's about to be a wave of generosity and impact in their wake. They deserve to live in this reality, not because of entitlement, but because of the work they put into making it happen. $118,000 of debt, 28 months. Unreal!

Whatever absurd goal you're carrying with you today, there are a lot of factors in play that will determine whether or not you achieve it. Are you crazy enough to believe you can? The answer to that question will speak volumes about what's about to happen.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

The Little Things Are the Big Things

Despite being a huge Sammy Sosa fan, he always drove me nuts. He wanted to hit a home run on every pitch.

Growing up in the 90s west of Chicago, I was obsessed with the Chicago Cubs. In fact, I made at least one trip to Wrigley Field per year for 20 consecutive years. I love that place. And in the 90s, there was no better place to sit than the right field bleachers. There was nothing like the moment Sammy Sosa made his dramatic run-out to start the game. The fans, including me, would lose their minds.

Despite being a huge Sammy Sosa fan, he always drove me nuts. He wanted to hit a home run on every pitch. Without fail, every single swing was an attempt to club the ball 500 feet, which resulted in so many strikeouts. It's hard to blame him, though, as he was one of the best long-ball hitters ever. However, I couldn't help but think that maybe his swing-for-the-fences-on-every-pitch approach did more harm than good.

A blog reader recently shared a story about how someone in his life wanted “a big plan." Caveat: No budget. A budget is too small. He was looking for something bigger. Budgets are like singles or doubles......he wanted to hit that home run (or maybe a grand slam!).

This resonated with me, as I've seen this play out with clients before. The budget can seem so small, so insignificant. But just like in the case of Sammy Sosa, I can't help but think how much more effective people could be by focusing on the small things, too. I'll take it a step further. Sometimes, the small things are the big things.

A while back, I started working with a couple that made $500,000+ per year. The income was rolling in! When we started working together, they requested that we skip the entire budgeting component of my coaching. And by "requested," I mean they insisted. Reluctantly, but with warning, I obliged.

Fast forward six months, and the couple was displeased with their progress. They set some big goals (home run swings) and went into it with a lot of confidence, yet six months in, they hadn't achieved much (several strikeouts). That's when I reintroduced the budgeting idea to them. In their minds (and words), budgeting was something "poor people had to do." I laughed and explained that not only is budgeting for high earners, but it's actually more important for high earners to budget than lower earners.

Fortunately, and probably for a lack of alternatives, they decided to trust the process for a season. In just the first month, they made more progress toward their very large goal than in the six prior months combined. Why? Because they focused on the little things. Sometimes, the little things are the big things.

I know I beat a dead horse on this topic, but it's so, so important. When we do the small things well, it unlocks the big things. When we focus on getting singles and doubles, we'll score far more runs (and incur far fewer strikeouts) than had we just swung for the fences every pitch.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Plumbers and Alyssas

It reminds me of the old business parable about the plumber: "You were only here for 15 minutes! Why are you charging me $200?!?!"

Every week, my assistant Alyssa sends me an e-mail that breaks down what she worked on, what she's working on, and how much time she logged. My contract with her is an hourly rate with a minimum number of hours per month, so she's continually clocking her time.

Yesterday, when I opened her weekly e-mail, I was startled to learn that she had logged only 40% of the hours I paid her for in January. Oops! Conventional wisdom would say that I overpaid her; I got ripped off. After all, if she only worked 40% of the hours she was paid for, that means she technically made 2.5x our billable hourly rate. Know what I think of that? Excellent!

While our contract is based on a specific hourly rate (with a minimum of x hours), I don't actually pay her for her time. Instead, I pay her for her impact. I'm better because of her. While she might have logged fewer hours than anticipated, which was primarily because my month was jam-packed with consulting work, I can still look back at the month and say she did a phenomenal job at helping me keep my proverbial train on the tracks. And if she made more per hour for doing so, great for her!

Even if she only logged 10% of the hours I'm paying her for, that's still a win for me. The impact she's having on my work life is tremendous. If I'm measuring her fee based on the number of hours she worked, it appears I grossly overpaid. However, if I'm measuring her fee based on the impact she had on me and my business, I underpaid her! Perspective matters.

It reminds me of the old business parable about the plumber:

"You were only here for 15 minutes! Why are you charging me $200?!?!"

"You weren't paying me for my time. You were paying to have an unclogged toilet. Your toilet is now unclogged."

A job well done is a job well done, regardless of how much time it takes. Why should someone be rewarded for taking too much time and punished for taking too little time? While Alyssa logged fewer hours than anticipated last month, it was enough to achieve the mission. I call that a giant win! I’m so grateful for her and what she brings to my work life.

It's amazing how different the world looks when we look at life through this lens. Pay for impact.....period. Life-altering stuff.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Our Bellies (and Minds) Deceive Us

When I mentioned the overspending, one spouse jumped in: "What do you mean we overspent on dining out?!?! We hardly ever go out to eat!"

In the middle of a client meeting, I brought up the couple's rampant overspending on dining out. To provide some context, for the past few months, this couple had overspent their monthly dining out budget by hundreds of dollars. In fact, just the prior month, the couple spent $1,000 on this category (vs. their $500 budget). Considering the couple was struggling to meet their financial goals, this category was clearly becoming an elephant in the room. When I mentioned the overspending, one spouse jumped in: "What do you mean we overspent on dining out?!?! We hardly ever go out to eat!"

The second spouse added, "Yeah, we maybe go out to eat once per week. And when we do, it's usually just fast food."

"If that's true, how do you explain the $1,000 you spent last week?" I asked.

"We didn't. No way. Zero chance."

That's when I pulled out the transaction log. 42 transactions were allocated to dining out. I don't know about you, but 42 card swipes at restaurants over a 30-day window doesn't feel like "hardly ever go out to eat."

They were stunned. 42 times!?!? We scanned the list. Yep, yep, yep, yep. All those happened......it just didn't feel like it in the moment. A quick meal here. A pit stop on the way home from practice there. It doesn't take much for a $500 dining out budget to accidentally balloon to $1,000, or $1,500, or even $2,000. The moment we lose intentionality and discipline, all bets are off.

I told this couple not to feel guilty; it happens to the best of us! I think we've all been there before. The important part isn't feeling bad about it, but rather developing an awareness of our gaps.

Want to know what happened next? The couple became quite aware of their dining out spending. Month after month, they locked in on the desired number. With fewer trips out to eat, they made sure to enjoy them more. They chose wisely, carefully. And they started meeting some of their other financial goals! Huge win!

Our bellies (and our minds) can deceive us. I'm the world's biggest fan of dining out, but we must be intentional and practice discipline. The same goes for all the areas in our monthly budget. It's never about spending less, but spending better. Find your better.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Yeah, I Don’t Know

"Dad, what brand is it?"

"I don't know."

"What size is it?"

"I don't know."

I used to love keeping up with technological innovations: the newest TVs, stereos, cellphones, gadgets, and all things electronics. However, as my time became more limited and my skill set in this area fell behind, I eventually conceded that it's not my lane. And as I often write about, I believe in knowing what our lanes are.....and what they aren't.

I have a handshake deal with my friend Ryan. Technology IS his lane. Technology to him is what work and money are to me. People trust him for his expertise and guidance. Here's my handshake deal with him. Whenever I need to purchase technology for my personal or professional life, he will send me a link. He doesn't explain this benefit, that feature, or xyz risk to me. I can't handle all that. Instead, he sends me a link. I explain roughly what I'm trying to accomplish, and he sends me a link. That's it.

For the past few months, we've been in the market for a new living room TV. As always, I explained my situation to Ryan and waited for a link. Well, I'm pleased to announce that yesterday was the day! He texted me a Best Buy link and said it was less than half the retail price. I immediately opened the link and purchased the TV. The entire thing took four-and-a-half minutes. A few moments later, Pax asked me about it:

"Dad, what brand is it?"

"I don't know."

"What size is it?"

"I don't know."

"What kind of screen is it?"

"I don't know."

"What makes it good?"

"No idea."

"Why did you buy it without knowing anything about it?"

"Because I trust Ryan."

This is one of my favorite things in life! I know a few things really, really well. Then, to fill in all my gaps, I attempt to recruit people around me who specialize in said things. The fact that I just purchased a new TV in less than five minutes without knowing anything about it, yet trusting it's going to be awesome, is a wonderful feeling! I'm pumped, and the family is, too.

I know I've tried to make this point multiple times recently, but hopefully this example illustrates it well. We don't have to be an expert in everything. We don't have to have strong opinions about everything. We don't need to be a know-it-all. Sometimes, we need to simply stay in our lane and trust people who run in their lanes. It makes life so much richer.....and simpler!

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

What a Privilege

"What a privilege to be tired from the work that you once prayed for."

I recently stumbled upon a quote that stopped me in my tracks:

"What a privilege to be tired from the work that you once prayed for."

I've had quite the month. I'm utterly exhausted. Some days were fun, many were a grind, and a handful excruciating. All the while, though, I kept thinking about that quote. What a privilege it is, indeed, to be tired from the work I once prayed for.

It's so easy to lose sight of how blessed we are. I'm immensely grateful for every opportunity on my plate. Nearly seven years ago, with two toddlers and Sarah locked into her stay-at-home mom role, I left my prior career, and our family took a 90% pay cut. Overnight, we went from having plenty to not having nearly enough. Every month was a struggle. The budget was cut down to about nothing, and we had to be tediously careful with every dollar spent. Month after month, we struggled to build the business and get our legs under us. Fast forward to today, and there's no other word to use than "grateful."

I'll never take for granted how this journey has played out. We've experienced the worst of the worst and the best of the best. Though I have some scars from along the way, I'm not sure I'd undo any of it if I had the chance. Instead, I think those scars will continuously help remind me what a privilege it is to be tired from the work (and life) I once prayed for.

I hope this resonates today. Have a blessed day!

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

It’s Okay

Have you been on social media lately? Wow, it's a crazy world out there.

Have you been on social media lately? Wow, it's a crazy world out there. If a Hollywood blockbuster apocalyptic thriller came to life and lived in the digital world, that would be today's social media environment. Every single time I open any single one of my social media apps, I'm instantly met with a barrage of unhinged humanity.

Today, I want to share a little life hack with you. Some of you already practice this, which might be where I picked up on the habit. Alright, here goes: We don't have to have an opinion about everything. Do you know how emotionally, mentally, and spiritually draining it is to have a strong opinion about each and every topic? It's exhausting!

Sure, there are events, situations, and developments in our lives that naturally elicit feelings. However, I'm not sure we humans were meant to have strong opinions about everything, especially things that are five standard deviations beyond our purview, our understanding, and our expertise. "I don't know" is a perfectly acceptable answer. In fact, I think I use the phrase "I don't know" more than any other phrase. I'd actually take it one step further. If we never admit that we "don't know," it brings into question whether we know anything.

What does this have to do with the overarching topic of this blog? Here's how. It's nearly impossible to live a meaningful life if we let ourselves be spread razor-thin by everything going on around us. Sometimes, we need to practice humility and not know something. After all, if we truly want to be masters of our crafts, our lives, our influence, and our relationships, we must not allow ourselves to be consumed by all the world has to offer (er, shoved down our throats). This isn’t me saying that we shouldn’t care what’s going on around us. I think we should care deeply. However, there’s something brutally unhealthy about having steadfast, unwavering opinions about every single thing. It can drive us into the ground.

I'll probably have a lot of opinions today, but I'm going to try to focus them on things that actually fall within my purview, influence, passions, and skillsets.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

No Right Time

"This isn't the right time." What do you mean this isn't the right time?!?! You are broke, miserable, and relationally hanging on by a thread. Doesn't this time seem as good as any?

A young couple was hurting. Deeply in debt, tension in the marriage, and jobs they loathed. They felt stuck. They wanted a better life, but it felt utterly unattainable. After about 30 minutes, we visually mapped on the whiteboard how they could simply (but not easily) free themselves from this debt and the life they feel stuck in. All it would take is 15 months, a ton of intentionality, a dose of humility, and a bunch of discipline.

"This isn't the right time."

What do you mean this isn't the right time?!?! You are broke, miserable, and relationally hanging on by a thread. Doesn't this time seem as good as any?

"We have too much going on right now. Maybe in a year or two when things line up a little better."

That's when I had to break the news to them. There is no right time. The right time will never come. Their lives will absolutely not get easier. Nothing will line up better. This needle they are hoping to thread doesn't exist.

Literally every month of their life from here until they die will be the wrong time. If that's true, then there's no better time than now! Seriously! Regardless of what you're hoping to accomplish, there is no right time. It might seem like a better time might, possibly, perhaps, maybe be on the horizon......but it's not. There's no such thing. As such, there's no better time than the present!

This is the #1 rule when engaging in our goals, financial or otherwise. If we recognize there really isn't ever going to be a good time, then we might as well start now. Yes, today is a bad day to start; so is tomorrow. So we should probably just get started today.

I can read your mind. You have something you want to do. It's been itching at you. You desperately want to get going, but now's not the right time. I agree, it's not......but no right time will ever exist. Therefore, let's get started.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

The Wrong Question

"What would you rather have, an in-person job that pays $150,000 or a work-from-home job that pays $125,000?"

I've seen countless machinations of this question on social media over the past few years, but here's how someone framed it on a post I stumbled upon a few days ago:

"What would you rather have, an in-person job that pays $150,000 or a work-from-home job that pays $125,000?"

I see what they are doing here. They are trying to establish the monetary value of being able to work from home, or the monetary value of not having to go into an office. When I read this, though, I feel like they are asking the wrong question.

Is working from home inherently better than working in person? Some say yes, some say no. What if one job is a soul-sucking, outside of our competencies, void of meaning (to us) job? What if one job checks every box we could possibly have when it comes to awesome work, such as values, culture, skills, meaning, and trajectory?

This takes me back to the infamous statistic showing that 70% of Americans dislike or hate their jobs. One of the contributing factors to this phenomenon is the fact that we look at work as a necessary evil, and are willing to sell ourselves to the highest (and/or least sucky) bidder.

If we could get over the hump of treating work like a necessary evil, we would make different choices. If we would make different choices, we would end up in different places. If we would end up in different places, we would find much higher levels of meaning, satisfaction, and fulfillment in our work.

Some people may think I'm being hyperbolic here, but I've noticed a common theme over the course of hundreds of conversations with people who are weighing job options. The compensation is almost always, and oftentimes, the only factor that gets put on the table for consideration when making decisions. I always find that to be fascinating! That's when I start asking the other questions. What about the specific role? What about the values and culture of the organization? What about the upward mobility? What about the meaning you find in this opportunity?

I strongly believe that if we start asking better questions, we'll end up in better places. We can't undo all the questionable decisions we made in the past, but the next decision opportunity is right around the corner!

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Back Against The Wall

No, I'm not a big fan of having my back against the wall. It sucks. It sucks on a macro level, and it sucks on a micro level. However, there's no better way to figure something out than to have no other options.

Over the last week, I've encountered several challenges in my client work where it felt like my back was against the wall. The issue was unique, material, and complex. It also required me to figure it out.....with no Plan B available. These were true back-against-the-wall, "or else" moments. To be honest, sometimes it feels like it would be easier to just throw my hands in the air and admit defeat. However, something interesting happens when our backs are against the proverbial wall: We figure it out. Somehow, some way, we work through it. I hate to admit it, but if my back wasn't against the wall, I'm not sure I would have found the way. But once I do figure it out, I will forever possess that skill for later use. Over and over and over I encounter these types of scenarios in my work.

Last night, as I was reflecting on the onslaught of back-against-the-wall challenges I've recently tackled, I thought back to when Sarah and I first got married. I had just been involuntarily relocated to a different state, and we had $236,000 of debt. The easiest path would have been to give up and succumb to the terrors in front of us. However, since our backs were against the wall and it felt like a red-alert-lockdown-type of moment, we were forced to figure it out. 4.5 years later, we were debt-free. As much as I would love to take credit for being so wise (though I clearly wasn't, as evidenced by the $236,000 of debt), it was the back-against-the-wall nature of our situation that forced us to figure it out.

No, I'm not a big fan of having my back against the wall. It sucks. It sucks on a macro level, and it sucks on a micro level. However, there's no better way to figure something out than to have no other options. While I don't wish your back to be against the wall, if you ever find yourself in that situation (or are there today!), I encourage you to use it! Use that pressure to fuel you into a better reality. Use it to aid you in your "figuring it out" stage. It's often a messy process, but it will be worth it. Also, as an added bonus, once you have figured it out, you'll possess that skill for the rest of your life! That's pretty dang cool.

Now, if you'll excuse me, I have some more back-against-the-wall client challenges facing me today. Wish me luck, and good luck to you as well.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Respecting Lanes

Enter my young friend. Despite being half my age, she has a wealth of knowledge in a lane where I desperately need help.

About 15 years ago, Sarah and I were watching Netflix on the couch when I received an urgent text. It was about 1 AM, and the text was from one of my youth group kids, a 16-year-old girl. After making a few questionable decisions, she found herself in an uncomfortable position at a house party. She was somewhere between not wanting to make poor choices, scared of getting hurt, and nervous that she would end up in the car with an impaired driver. Needless to say, she was freaking out. One of my policies as a youth group leader was that if the kids ever found themselves in a tough spot, I would pick them up, no questions asked. On this particular night, she was nervous about calling her parents, so she texted me. Sarah and I jumped into the car, picked her up, and took her home.

Fast forward 15 years, I recently reached out to this young lady for advice. Yes, I was her youth group leader. Yes, I'm nearly twice her age. Yes, I walked alongside her during some of her most difficult teenage moments. But today, I need her wisdom, insights, and expertise. She works in a field that falls outside my purview, and today, I need her help.

I spent my entire life being disregarded and dismissed by the generation ahead of me. I was constantly treated like my wisdom, insights, and expertise didn't count. After all, these people were decades older than me. I was just a kid to them. What could some young dude have to offer them?!?! They were worse off for having this short-sighted perspective. I always promised myself that one day, when the roles reversed, I wouldn't do the same.

Well, as Father Time would have it, I'm no longer the youngest guy in most rooms. I now regularly find myself being on the older end of the age range in conversations. How am I doing with the promise I made myself? I suppose I need to let others answer that question for me, but considering I'm actively seeking advice from a woman whom I walked alongside during her teenage years, I'd like to think I'm succeeding.

We all have lanes. I have lanes, and you have lanes. Some of my strongest lanes revolve around the intersection of meaning, work, and money. I can help move the needle in this area of people's lives. Another lane is helping businesses gain greater clarity and control over the inner workings of their financial operations. Those are lanes I specialize in. Simultaneously, I need to recognize all the things in life that aren't my lane.

Enter my young friend. Despite being half my age, she has a wealth of knowledge in a lane where I desperately need help. I'm not going to her for career, financial, or business advice. I'm not going to her for parenting advice. I'm not going to her for marriage advice. I deeply respect her lane, and as such, I need to have the humility to allow her to speak into that area of my life.

This is a dynamic that most of us confront on a daily basis. In and out of the workplace, we constantly interact with other generations. If we simply get over ourselves and respect people's lanes, we can open ourselves up to so many wonderful things. It's not always easy, but it's always the right (and best!) thing to do.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Silver Lining to the Memory Loss

I discovered something wild yesterday while I was working in my home office. I stumbled upon a random and mysterious yellow envelope. It had been sent through the Postal Service, but I didn't recognize it. I eagerly but nervously opened it, only to discover it housed 13 handwritten cards addressed to me.

I discovered something wild yesterday while I was working in my home office. I stumbled upon a random and mysterious yellow envelope. It had been sent through the Postal Service, but I didn't recognize it. I eagerly but nervously opened it, only to discover it housed 13 handwritten cards addressed to me.

Unreal! The cards were from high school students who attended a talk I gave on December 4th. Turns out, I received this package of cards during the stretch when I was suffering cognitive function decline and short-term memory loss as a result of a neck injury. In fact, I didn't piece this together until yesterday, but I actually gave this talk the morning of the day when my cognitive function deteriorated. I remember this talk well, but I don't recall much about a family event I attended later that evening.

As I read through the cards yesterday, I couldn't help but think how this was such beautiful timing. I've had an absolutely brutal week. It was the kind of week where one can start questioning if they are actually in the right place. Is this where I belong? Am I doing the right things? Is this where I'm meant to be?

As I opened the first card and read the generous words, those doubts I had been carrying were immediately swept away. In an instant, I was jolted back to reality, a reality where I recognize I'm exactly where I'm called to be. Following meaning is a treacherous endeavor. It sometimes means turning our backs on comfort, status, material gain, and an easier path. In its place can be uncertainty, risk, pain, frustration, and heartache.

I've been on all sides of this coin: the good, the bad, and the ugly. I've experienced comfort, status, material gain, and an easier path. I've also performed a drastic 180-degree turn and ran headfirst into uncertainty, risk, pain, frustration, and heartache. I don't claim to be a know-it-all here, but I can confidently testify that despite being the hardest seven years of my life, it's been the most rewarding, fulfilling, and impactful seven years of my life. Knowing what I know now, I'd never go back to "the old way."

I hope some of you have similar stories. If so, please share them with others. In a world that pushes one way to see the world, these stories can be powerful. On the flip side, if you don't have any of these stories, perhaps now is a great time to create them. It's not supposed to be easy, but it is supposed to be rewarding.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

If It Bleeds, It Leads

"Any thoughts on why the stock market is struggling so much right now? Do you think it will continue to be bad?" I stared at my screen for at least two minutes, trying to think of an adequate response. What in the world is he talking about?!?!

I received a text from a buddy yesterday. I haven't interacted with him much over the past six months, so he kinda caught me off guard:

"Any thoughts on why the stock market is struggling so much right now? Do you think it will continue to be bad?"

I stared at my screen for at least two minutes, trying to think of an adequate response. What in the world is he talking about?!?! My response:

"As of the closing bell last a few hours ago, the stock market is at the 12th highest price it's ever been in 155 years. What makes you think things are going so bad?"

"I've been seeing things about it on Twitter, TikTok and also the news. Everyone says it's bad and will keep being bad."

There's an old saying that's as relevant today as it was when originally coined: "If it bleeds, it leads." Fear sells. Fear triggers emotion. Emotion triggers reaction. Reaction triggers engagement. Engagement triggers revenue. Revenue triggers $. Translation: Fear = $.

We live in a fear-based society, and nowhere is this more true than in the reporting of financial markets. After all, it's really easy to report how bad things are when the market has a bad day. It's fun for the media to blast big red numbers on the screen, alongside a curated short-term graph that shows a jagged line moving in a down-and-to-the-right trajectory. Fear!

Truth is, the stock market returned 17.7% in 2025 and is up approximately 1% in this young year. The 12 best day-end stock market prices in history have all occurred in the last 31 days. Here, let me show a picture:

This is what the U.S. stock market has looked like over the past five years, yet at the same time, a huge portion of our society thinks we're in the middle of a crash. It’s literally lingering at the peak of the best price in human history, yet many people think we’re in the toilet. If it bleeds, it leads. Fear = $.

My biggest encouragement is to simply ignore the noise. We're not going to stop the media or people around us from using fear to manipulate our emotions. Therefore, we must insulate ourselves from the madness. I find it best to simply ignore it. Period. Live a meaningful life, make an impact on others, give generously, and enjoy some good food.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

E

I used to aggressively pursue balance, but eventually, after years and years of failure, I realized balance is a myth.

As I sit here, my brain is completely blank. I've gotten 6 hours of sleep, combined, over the past two nights. I'm absolutely fried. The tank is on E. I have so many ideas, yet at the same time, nothing is coming out. All I can seem to think about is how important sleep is and how detrimental a lack of it can be.

The word we always use is "balance." Balance, balance, balance. Everything is about balance. I used to aggressively pursue balance, but eventually, after years and years of failure, I realized balance is a myth. Balance is something that works well on paper, but terribly in real life.

Now, I can admit that getting 6 hours of sleep over two nights is never a good thing. You got me on that one. However, setting my extreme example aside, it never feels like life is balanced. Rather, it's a perpetual swinging of the pendulum from one side to the other. We're either unbalanced one way, or unbalanced the other way.

There's nothing wrong with this. In fact, I'd argue it's a healthy and normal rhythm of life. It doesn't mean we shouldn't try to maintain a healthy lifestyle; instead, it means we should simply give ourselves more grace while we try to figure it out. Every day, week, month, and season is different, and each deserves its own rhythm. We should try to embrace it for whatever it is, wherever that pendulum falls.

I'm sure my life will be perpetually unbalanced one way or another, but I hope to go easy on myself as I navigate that journey the best I can. For now, though, I'm gonna try to get some shut-eye.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

3 Men, 3 Mindsets

A story is told of a visitor to London during the time of the construction of St. Paul's Cathedral, the architect of which was Sir Christopher Wren. The visitor stopped at the construction site and asked some of the workmen what they were doing. One said, 'I am working to get money to keep my family.' Another said, 'I am working here because it is the kind of work I have been trained to do.' A third man said, 'I am helping Sir Christopher Wren build a great cathedral.

Today's post is inspired by a recent piece written by my great friend, Gary Hoag. If you're a longtime reader of this blog, you probably know that Gary is the inspiration and encouragement behind this blog. If you didn't know that, now you do! In either case, you should totally subscribe to Gary's daily writings.

An excerpt from Gary's recent article:

"A story is told of a visitor to London during the time of the construction of St. Paul's Cathedral, the architect of which was Sir Christopher Wren. The visitor stopped at the construction site and asked some of the workmen what they were doing. One said, 'I am working to get money to keep my family.' Another said, 'I am working here because it is the kind of work I have been trained to do.' A third man said, 'I am helping Sir Christopher Wren build a great cathedral.'"

Three different men, three different mindsets. All things being equal, I think we can assume that all three of these men were doing similar work and earning similar wages. However, they might as well have been living on different planets. Each of these men woke up in the morning, got dressed, commuted to work, and started their workday. All three of their daily routines might have also looked similar to one another.

What happened when they got to the worksite, though, is where everything changed. Sure, they were performing the same work, but the mindset behind said work changes everything.

One man was there because work is a necessary evil.

One man was there to put his training and skills into practice.

One man was there to make an impact.

Three men, three mindsets.

All work matters. Your work matters! Regardless of what you're doing today, your work matters. You might make the same dollar amount regardless of your mindset (I would argue even that's up for debate), but there's no doubt which mindset will drain our tank and which mindset will satiate something deep within us. Same paycheck, drastically different experience.

We can talk all we want about our work not having to have meaning, but considering we spend half our waking hours at work, feeling meaning in our work makes a world of difference in our journey. It has the power to turn terrible into okay, okay into good, and good into great. It puts an extra pep in our step, makes the tough moments worthwhile, and juices up the wins. Regardless of what work I'm performing, I want to be more like the third man. "I am helping Sir Christopher Wren build a great cathedral."

Meaning is a choice. Apathy is a choice. Impact is a choice. Misery is a choice. Choose wisely.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Like an Oncoming Freight Train

I celebrate my kids' failure!?!? Yes, correct; it’s fantastic!

I usually see the criticism coming! Most days, when I hit "publish," I know whether or not to brace myself for the backlash. Over the last five years of writing and podcasting, I feel like I have my finger well-placed on the pulse of oncoming anger. Well, I whiffed this week. A few days ago, I wrote a piece about how I put my kids in positions where failure is very much on the table. Here's one specific quote from that piece:

"My kids get sick of me talking about the pursuit of failure; I celebrate it. I applaud them each time they give something their best shot and subsequently fall flat on their face."

I celebrate my kids' failure!?!? Yes, correct; it’s fantastic! I don't revel in their misery or something twisted like that, but I celebrate the act of taking risks, failing, and getting back up. It builds character, grit, and perseverance. In a world that tells parents to protect their kids from failure, I'm leading my children into it like an oncoming freight train.

I'll take this sentiment one step further. I'd rather my two boys fail at every single dream and calling in their lives than to achieve success in something they don't give a rip about. I don't yet know what their dreams will be, but I'd rather they completely bomb in their relentless pursuit of them than take the easy way out and pursue a "safe" or "normal" path for the sake of avoiding failure.

Regret is the worst feeling in the world.....even worst than failure. Regret is looking back and wishing we had tried, while failure is knowing we gave it our best shot and it didn't work out. If those are my two options, give me the pain of failure every day of the week!

I hope my kids are tremendously successful in whatever they do, but I promise you (and them), I will root them on to relentlessly pursue their dreams and callings at every step of the way, even in the presence of painful, agonizing, gut-wrenching failure.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

A Question From Mr. Clear

We need to lean harder into the things that add value to our lives while simultaneously turning our backs on the things that don't. That's the recipe for finding more meaning in our money.

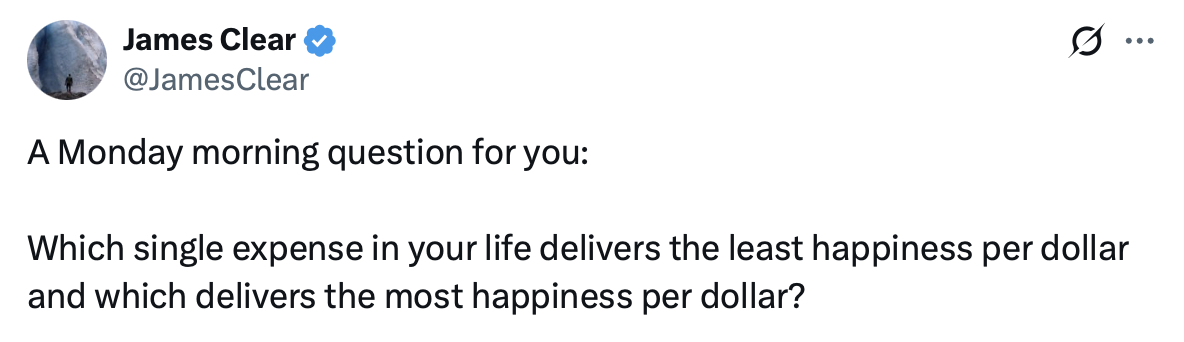

In doing some research for a potential project, I stumbled upon a Tweet yesterday afternoon. James Clear, the author of the best-selling phenomenon book, Atomic Habits, asked a profoundly meaty question:

This falls in line with my ongoing messaging about budgeting: "It's not about spending less, but rather spending better." We need to lean harder into the things that add value to our lives while simultaneously turning our backs on the things that don't. That's the recipe for finding more meaning in our money.

When I see families exhausted and frustrated by their finances, it almost always includes their unintentional spending on things that don't actually matter to them. Consequently, they don't have the resources to spend on things they actually care about. It's the ultimate emotional drain.

However, when we can be laser-focused on what actually matters to us, blocking out all the noise around us, it oftentimes feels like we got a raise. Further, life just feels better when our resources go toward valuable things. There's no worse feeling than spinning our tires by spending all our hard-earned income on stuff that doesn't move the needle in our lives.

I'll answer Mr. Clear's questions, but after I do, I challenge you to answer them for yourself.

What single expense in my life delivers the least amount of happiness per dollar spent?

This might be an unpopular opinion in my house, but some of our streaming services. If it were up to me, we'd justhave YouTubeTV and Netflix.....that's it. However, because x show is on y platform, we subscribe to y platform. And z show is on b platform, we subscribe to b platform. In my mind, this is one of the least effective categories in our budget.

If this is true, I should probably engage Sarah about this and see how important it is to her (and how important it is for me to push back on).

What single expense in my life delivers the most amount of happiness per dollar spent?

Dining out, and there's not a close second. I so cherish the time our family spends dining out, whether it's a quick meal with the kids or a date night with Sarah.

The other one I was debating was Travel, but on a dollar-for-dollar basis, dining out offers a far higher return.

If this is true, it would argue that we should consider increasing our dining out category each month. I think we skimp on this one far too often.

Your turn.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

The Endless Pursuit of Better

However, it's clear we've carved out some level of success. If that's true, "why rock the boat?" as my friend so bluntly inquired?

We had our first official full-day experiment with our canned drink concept at Northern Vessel last week. To say people were excited would be a gross understatement. I could figuratively see people's brains melting before my eyes. Needless to say, the overwhelming feedback tells us we're on the right track.

To summarize, we're trying to innovate the way we serve our customers. About 70% of our beverages are served iced, even in the dead of winter. Instead of serving our iced drinks in traditional cups, we're piloting a process to can handmade drinks on the fly. Here's what it looks like in action:

I firmly believe this will be one of the most revolutionary things we've ever done at NV. It will have ripple effects that I don't yet even know about. Can you tell I'm excited?!?!

One of my friends happened to stop by the shop on that canning test day. He sent me the following text several hours later: "What's the point in doing this? You're already the best coffee shop in the state....probably the Midwest. Why rock the boat?"

Whether we're the best shop in the state or region is entirely up for debate. That's what we desire to be, but it's obviously a subjective topic. However, it's clear we've carved out some level of success. If that's true, "why rock the boat?" as my friend so bluntly inquired?

I've received this question countless times over the past 3+ years since we began building NV into what it is today. "It's good enough" is another way it's often phrased.

All this brings me back to an idea I can't let go of: The endless pursuit of better. If there's a better way to do something, don't we owe it to those we serve to find it? If our drinks can be better, why not serve them better drinks? If the experience can be enhanced, why not provide it? Sure, there's a "normal" way to do things in every industry. But sometimes, we need to look past normal and find "better."

All of us have things in our day-to-day lives that fall into the "good enough" camp. It's good enough, and good enough is good enough. But what if we could find a better way? A better way to do the laundry. A better way to handle our money. A better way to get to work. A better way to serve our clients. A better way to keep the madness in order. Better is better. This isn't about lack of contentment, but rather a deep-seated desire to grow, improve, and make a more impactful difference in the world.

Back to the canned drinks. Why would we blow up our entire workflow, increase our COGS (cost of goods sold), lower our gross margins, further constrain our already-tight dry storage capacity, and risk losing customers when we've already established ourselves as "successful"? Because our guests deserve better, and we firmly believe this will provide a better overall experience.

I invite you into the endless pursuit of better….in all you do. It's a fun and humbling journey, but we ALWAYS end up better for it.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Scared of the Medicine

See the irony in that? We regularly accept a 0% chance of success in xyz goal because not even trying feels better than trying and failing.

As yesterday unfolded, I kept coming up with new ideas for today's post. I have so many things to write about. I could write about this, or maybe that. What about that really cool thing that happened? Oh, wait, what about this other thing? Needless to say, my brain melted.

Considering I publish every day, I have plenty of time to unpack these stories in the coming days/weeks. One thread seemed to weave through each of my ideas, though: Failure.

On the whole, we humans are terrified of failure. We're scared enough that we go to great lengths to avoid it. We'd rather not pursue something we want out of fear that we might not get it. See the irony in that? We regularly accept a 0% chance of success in xyz goal because not even trying feels better than trying and failing.

Here's the wild part about failure. Failure isn't the manifestation of a loss. It's not some finality that ends the story. Rather, failure is the admission price to success. Failure isn't losing.....it's a necessary step toward the victory we seek.

Yesterday, I watched the product of failure. In multiple situations, I saw pain turn into glory, fear into joy, and terror into confidence. My kids get sick of me talking about the pursuit of failure; I celebrate it. I applaud them each time they give something their best shot and subsequently fall flat on their face. It's never fun in the moment, but that's where our character and grit are built. Not only do I not shield my kids from failure, but I put them in situations to fail.

I want to unpack this idea more in the coming days, but until I do, just know that we've had a LOT of failure over here in the Shelton household. And that, friends, is where the beauty comes from. I can't wait to share those stories soon!

Here are three questions for you to sit on today:

Where have you let fear of failure hold you back from doing something that mattered?

When have you shielded your kids from potential failure?

How might these situations played out differently if instead of trying to avoid failure, we chased it?

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.