The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

What Gets Measured, Part 2

In the world of "what gets measured gets done," how we measure is where the rubber meets the road. If we can't find a simple and effective way to measure, we won't. And if we won't, ____ doesn't get accomplished. This is a crucial concept I discuss with my coaching clients. It's imperative to find easy ways to measure what needs to be measured. Anything else will result in inevitable failure.

Last week, I published a piece about the importance of measuring the things we want to accomplish. After all, "what gets measured gets done." I framed the post through the lens of my newfound discovery that I walk far less than I thought. So, when my wife purchased a walking pad, I decided to do something about it.

In the world of "what gets measured gets done," how we measure is where the rubber meets the road. If we can't find a simple and effective way to measure, we won't. And if we won't, ____ doesn't get accomplished. This is a crucial concept I discuss with my coaching clients. It's imperative to find easy ways to measure what needs to be measured. Anything else will result in inevitable failure.

In the case of my walking, I luckily have a world-class tool at my fingertips. In fact, we all do. The built-in Health app on the iPhone is an amazingly simple and powerful tool for measuring many different aspects of our lives. It's a bit scary, but this app has measured my walking for the better part of a decade. I can see the data in black and white.

Given how well the data is measured, it's created more clarity and motivation for me. I consciously think about my walking now. Instead of being completely passive and out of mind, it's at the forefront. This has resulted in some interesting (and intentional) behaviors:

While waiting for my flight on Saturday afternoon, I paced back and forth through the terminal while on a Northern Vessel call with TJ.

Knowing I'd be sitting behind a desk all day on Sunday, I got a few thousand steps on the hotel treadmill early in the morning.

Since I did, in fact, sit behind a desk all day and didn't get to my new hotel until 10:30 PM that night, I still needed to rip out another 3,000 steps before bed. Unfortunately, the hotel's treadmill was broken. I improvised, pacing the hotel like a creepy stalker while talking to a friend on the phone.

What gets measured gets done! Want to see what that looks like for this silly little endeavor?

Boom! I went from 3,000 steps per day to 12,000 practically overnight. Part of why I've been preliminarily successful is the tool's strength. Look how clean and visual the data is. I'd be lying if I said it wasn't making a difference.

Finances are the same way. We need simple yet powerful tools. If you're looking to budget, EveryDollar Premium is hands down the best budgeting app on the market. I'm not Dave Ramsey fan (to put it lightly), but truth is truth. They created an ingenious tool, and it's 100% worth checking out. It must be the paid version, though. The free version, requiring manual entry, is brutal to use. This tool changes lives.

CapitalOne's 360 Performance Savings accounts are a fantastic tool to facilitate and track sinking funds.

CashApp is easily the best tool to house a single spending category, like personal spending, groceries, or dining out.

What gets measured gets done, and the right tools can be the make or break. What tools add value to your finances?

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

What if It Were Life or Death?

Many people struggle to save. There are many contributing factors to this type of wiring, spanning from nature to nurture.

We all have different financial wirings. Some of us are spenders. Some of us are savers. Some of us are givers. We can also be a combination of two to three, but our wiring is quite real. I'm a giver and a saver. My wife is a spender. That's neither good nor bad....it just is. What we do with our wiring is where we determine our perspective of and relationship with money.

Conversely, most of us have a natural weakness, some more glaring than others. Some people struggle to spend; I call them hoarders. Some people struggle to give; that's some form of selfishness. Others struggle to save; that's called irresponsibility. Back to my wife, Sarah. She is a great spender and has a generous heart, but she struggles mightily with saving. She's not alone, though!

Many people struggle to save. There are many contributing factors to this type of wiring, spanning from nature to nurture. Many people were simply born that way and have been exhibiting those traits since the toddler stage. For others, materialism and instant gratification were modeled front-and-center for them as children. Then, there's a population of people who grew up with very little. In the casualness of the word "poor," they were poor poor. For a large stretch of their life, they had very little. This has created a behavioral undercurrent where they will quickly spend any time they come into resources.

I regularly meet with a couple that struggles to save. Both are wired as spenders. They love spending (and are active givers), but they would rather endure a root canal than save money. This has resulted in much stress, tension, and turmoil in their financial life. They have several large expenditures coming soon, and they have no plan to pay for it.

"We just aren't good at saving," exclaimed the wife. "It's just not something we can do."

I reframed the conversation. "If you needed $5,000 to perform a life-or-death surgery for your kid, do you think you could save then?"

"Of course we could! We would find a way."

The moment she said that, a sheepish look formed on her face. It wasn't really about whether they could or not, but rather what priority it played in their lives. Up to this point, they couldn't successfully save because it wasn't actually a priority. Will it become a priority for them? Only time will tell.

This is a good mental hack to play on ourselves. Any time we struggle to accomplish something and feel defeated because we "can't do it," reframe it. Ask yourself if you could achieve it if it were life or death. If the answer is yes, then it's a prioritization issue, not an ability issue. I'm not saying it will be easy or come naturally, but the prioritization piece tremendously moves the needle!

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Being Responsibly Irresponsible

On the one hand, I repeatedly beat on the drum of values-based spending, investing in memories, and finding meaning in our finances. Then yesterday, I leaned into this idea that we shouldn't impulsively spend "extra" money that comes into our lives. Instead, we should apply all extra income to wherever we are in our plan. See the possible incongruency here?

As is the case most days, I opened my Daily Meaning e-mail inbox yesterday to find a message from my friend Randy. Randy consistently responds to my blog posts, including words of encouragement, a representative story, additional wisdom, or alternative perspectives. Yesterday's was a bit different. He pointed out that some readers might find yesterday's post (about not impulsively wasting extra money) incongruent with my typical message of using money on "spending for memories and meaning." He didn't personally find it incongruent, but he suspected others would......and he was right. I subsequently received a handful of questions and responses indicating such.

On the one hand, I repeatedly beat on the drum of values-based spending, investing in memories, and finding meaning in our finances. Then yesterday, I leaned into this idea that we shouldn't impulsively spend "extra" money that comes into our lives. Instead, we should apply all extra income to wherever we are in our plan. See the possible incongruency here?

Here's the bridge for this perceived gap: responsibility and intentionality. It all comes down to those two things. If we don't take responsibility for our finances (pay for needs, save for future expenses, and give), our finances get disjointed.....and stressful! Yes, we should use some of our money for fun and memorable things. However, having our financial ducks in a row is a must. If we're behind on rent, can't put food on the table, and the utility companies threaten a shut-off, we probably shouldn't be dumping our money into lots of wants (today). We need to solidify the foundation. Responsibility is critically important!

Second, intentionality. As I often mention, I don't personally care where you choose to allocate your money. People have different values, priorities, passions, and situations. It's inevitable that your "right" is different from my "right." Here's the second part of my slogan. I don't personally care where you choose to allocate your money......as long as it's intentional. It's planned. It's purposeful. It fits within the context of our broader finances. With intentionality comes peace; with impulse comes regret.

Three of my clients recently traveled to Europe for some epic summer trips. Believe me, I've been living vicariously through them all summer!!!! The pictures are beautiful, and I suspect the memories are much sweeter. Each of these trips cost them anywhere between $6,000-$14,000. That's a lot of money, but they put a ton of intentionality into it. Some of these families have been saving this money for years. Month after month after month of saving. Then, the planning. They got the flights, then the hotels, then started filling the days with museums, trains, tours, and restaurant reservations. So much intentionality! By the time the trip arrived, they had zero financial stress and, carried themselves confidently, knowing their overall finances were intact and thriving.

Let's call this living responsibly irresponsible. Do the things other people judge you for. Make them roll their eyes. Let them question your sanity. But behind the scenes, do it with much intentionality and responsibility.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Adding Plates to the Other Side

My goal wasn't to diminish or demean the role of saving, but rather try to redeem the value and dignity of spending and giving in a culture that ridicules them. I wanted to lift two up, not push one down.

You're at the gym, using a barbell. Maybe you're squatting, or perhaps the bench press. While changing out the weights, you inadvertently add too many plates to one side of the barbell, causing the entire apparatus to become uneven. Things start to become dangerous, and if you're not careful, the whole thing could crash and injure you.

I'm feeling a bit like that today. On the heels of my Leading Kids to (Financial) Hoarding post, I received a ton of positive responses from you all: e-mails, texts, DMs, and even phone calls. Generally speaking, it was a collective "I'm glad someone finally said it." I'm so grateful!

However, I also received some messages on the other side of the ledger. Most notably, from Ryan, my friend I've never actually met...that I should totally meet....that I can't believe I haven't met. I know Ryan as an extremely thoughtful person and always provides constructive feedback. So when I saw his comment, my immediate reaction was, "Uh oh, I think I need to add a plate to the other side of the bar." In an attempt to drive my point home, I think I inadvertently added too many plates to one side of the barbell.

My goal wasn't to diminish or demean the role of saving, but rather try to redeem the value and dignity of spending and giving in a culture that ridicules them. I wanted to lift two up, not push one down.

At the heart of the matter, saving is the art of discipline and delayed gratification. It's one of the simplest, purest, and most tangible forms of it. In other words, it's a tell. If we can practice the art of discipline and delayed gratification with our resources, those characteristics and strengths can translate into virtually every other area of life.

From a more practical perspective, saving is the proactive pursuit of avoiding debt. Take cars, for example. The average new car payment in America now exceeds $700/month. It doesn't take any discipline or delayed gratification to walk into a dealership, sign the loan docs, and walk out with a shiny, new car......and a boatload of debt hanging around your neck. The disciplined and self-sacrificing act of saving, on the other hand, will lead to a significantly better outcome. It journeys us to a place where we have a greater appreciation for our purchases, make different decisions doing so, and won't impair our financial life with expensive and prohibitive payments. This same principle can be applied to virtually every other area of money:

Travel

College

Phones and other technology

Insert your purchase here

Saving is also a protection mechanism for when life kicks back. Saving up sinking funds and an emergency fund can (partially) shield us from many of life's challenges: job losses, medical emergencies, house maintenance, car breakdowns, and a number of unexpected situations.

There are only three things we can do with money: spend, save, and give. Want to know which one is most important?

D: All of the above.

Planned Impulsiveness

Some people are planners, and some people are impulsive. Both have pros and cons, but impulsive people are known for self-sabotage and occasional (or frequent!) irresponsibility. I

One of my favorite Meaning Over Money podcast episodes is called Planned Impulsiveness. It was our fifth episode, released more than three years ago. Unfortunately, Apple lost our first 15 episodes like my kids lose their shoes. Other platforms managed to keep track of them, though. Despite being missing from Apple for over two years, it's one of the ten most downloaded episodes we've ever had. You can find it HERE.

The premise is simple. Some people are planners, and some people are impulsive. Both have pros and cons, but impulsive people are known for self-sabotage and occasional (or frequent!) irresponsibility. I'm oddly wired for both. I'm very impulsive, but I'm also a planner. Along my financial journey, I realized I needed to harness my impulsivity and turn the cons into pros.

This is where the structure comes in. Travel is a great example. I have a separate bank account specifically for travel. Each month, we budget approximately $1,000 for it. We may not travel every month, but we treat it as an expense. That $1,000 physically gets moved from our primary checking account and into our travel fund. The money slowly builds over time. Then, when it's time to travel, we travel. Sometimes, the travel is planned well in advance, and sometimes, it's more impulsive. In either scenario, the money is there, just waiting to be spent on travel.

I'll share my favorite (least favorite) story of my life. In the summer of 2016, Sarah and I were about to become parents. After a long adoption journey, we received word that our son was born. We went to bed with anticipation, excited to meet our little man the following day. As I was wrapping up a few things at work the following morning before getting on the road, I received a phone call. I immediately knew something was wrong. The following 30 seconds were the worst of my life, as I found out we lost our son.

Needless to say, the subsequent days were absolutely miserable in our house. Sarah was an absolute wreck, and I wasn't in a great position to hold her up. A few nights later, she told me she wanted to leave. Somewhere far, far away from our life. At midnight, I booked flights to Cancun and reserved a hotel room. We packed a few bags, took a nap, and drove to the airport five hours later. We spent the week crying, mourning, and eating our weight's worth of chips and salsa. It was terrible, but it was beautiful. It was impulsive, but it was planned. I'll always be grateful for that sad but memorable week with Sarah.

One of my clients recently had their first planned impulsiveness moment. They've been intentionally budgeting and using their travel sinking fund since December. Then, it happened! A significant event suddenly popped up, and they wanted to be there. In mere hours, they made arrangements and jumped on a plane. It was impulsive, but it was planned. Beautiful! They will remember that forever.

Be impulsive! Savor life. Make memories. But make it planned impulsiveness.

Putting the Pieces Together

What does it mean to win with money? I could ask 20 people and get 20 different answers. We all view it through a different lens. We each possess different skills, and we each have our shortcomings.

What does it mean to win with money? I could ask 20 people and get 20 different answers. We all view it through a different lens. We each possess different skills, and we each have our shortcomings. Some things we'll get right, and other things may be more of a challenge. We don't have to nail every aspect, but it's important to remove any glaring deficiencies. Most families thrive in some areas and struggle in others.

However, I recently met with a couple who inspired me to write about this topic. I've worked with this couple for over a year, but this meeting was particularly inspiring. They are a younger-ish couple, both teachers. In my mind, they've cracked the code on personal finance. No, they aren't geniuses in any one area, but they are doing good in pretty much every area. I'll summarize:

They have unity, a shared vision, and joint ownership of their finances.

They budget intentionally each month, leaning into their unique values.

They have an emergency fund to protect them for WHEN life punches.

They spend money on wants that add value to their life.

They utilize sinking funds to save for future purchases/expenses.

They give joyfully and sacrificially.

They paid off all their non-mortgage debt.

They invest with discipline, simplicity, and effectiveness.

They have cheap term life insurance policies that will replicate each person's respective income in the event of a tragic event.

They are in the process of setting up wills.

They both pursue work that matters, and find meaning and fulfillment in their careers.

They are creating financial margin to provide flexibility for future decisions and lifestyle shifts.

They are the total package! No, it's not because they have massive incomes and unlimited resources. Reminder, they are both teachers. They are normal people, making normal money, living a normal life. Except it's not a normal life. It's an extraordinary life.

What's their secret? Intentionality, discipline, humility, contentment, and consistency. That's it. Good choice after good choice after good choice. Oh yeah, and that whole unity, shared vision, and joint ownership thing. They are doing it together. There is no "mine" and "yours." Everything is "ours." For better or worse.

Yes, this is an opportunity for me to brag about this amazing couple. However, there's more to it. I hope you find encouragement in it. We ALL have the power to get better in the areas of money. The only thing stopping us is us. It's not easy, but it's so, so worth it. Get 1% better today! Then, get 1% better tomorrow. One day at a time. You got this!

Smooth Out Your Lumpy Stuff

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses.

A few days ago, I wrote about my recent car maintenance frustrations. It was a bit unexpected, but I received a wave of messages from people asking for more insight on how to execute this concept.

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses. The goal is to smooth out the lumpy by slowly and steadily funding them over time, eliminating (or significantly reducing) the stress experienced when situations arise. Common sinking fund categories include car, house, travel, medical, giving, and kid activities. Each of these categories has a habit of sneaking up on us. When they do, these sudden and unexpected expenses sabotage our disposable income.....zapping our ability to make progress in other areas.

Here's a step-by-step of the mechanics:

Set up a separate savings/checking account for your desired category and name it accordingly. Most credit unions will let you set up multiple accounts, but most banks won't (with the exception of Wells Fargo). If your bank doesn't, I recommend CapitalOne's 360 Performance Savings.

Allocate money in your budget for this category. The amount can be steady or vary by month, but it must be included in the budget.

Just like you pay your electric bill, you pay your sinking fund. Whatever dollar amount you budget gets transferred to the sinking fund. I prefer to automate these transactions.

When expenses arise for a particular sinking fund category, use your primary checking account to pay the expense.

Immediately after paying for the expense, instruct your sinking fund to send that amount back to your checking account, essentially reimbursing your checking account from the sinking fund.

Repeat.

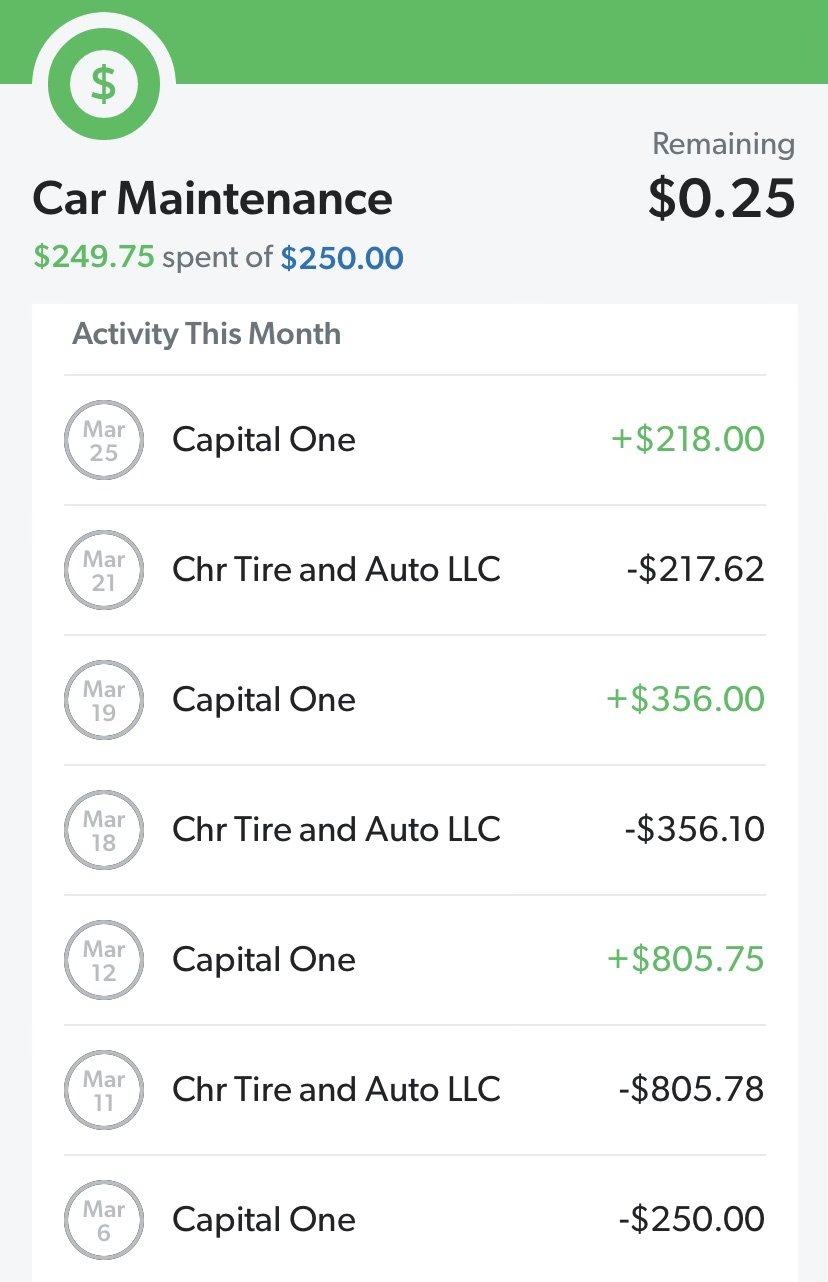

I'll share an example of my car fund from this month. For 19 years, I've budgeted (and automated) a monthly transfer from my primary checking account into my car fund. We currently budget $250/month. After March's $250 contribution (completed on 3/6), our car fund balance was $2,487. Then, we got hit with a hat trick of car bills: $806 for brakes on my main car, $356 for known issues with my new car, and $218 for the unknown issue with my new car. I budgeted $250, but got hit with $1,380 of actual expenses.....ouch! This situation would have crushed our budget had we not had a sinking fund. Instead, I simply reimbursed my checking account from my car fund for each, resulting in a total monthly car fund expense of $250 (the original planned contribution). It took something extremely lumpy and made it smooth. It went from a potential disaster to a minor inconvenience. Below is an image of how we executed it in our budget.

Setting up these extra accounts and steps may appear to make things more complex, but you'll quickly see how truly simplifying (and freeing) it can be! Best of luck smoothing out your lumpy stuff!

Not All Roses and Sunshine

I'm sad to report it's not been all roses and sunshine here in Nissan 350Z-ville. I wish I could tell you I've been happily cruising around in my sweet new (to me) ride for the last few weeks, but that hasn't been the case.

I'm sad to report it's not been all roses and sunshine here in Nissan 350Z-ville. I wish I could tell you I've been happily cruising around in my sweet new (to me) ride for the last few weeks, but that hasn't been the case.

Shortly after bringing the car home from Texas, I took it to my trusted mechanic to address some known issues (and inspect it for the unknown). It was a mixed bag of results, but all was well....or so I thought. I reunited with the car the following day, excited to run my list of errands (top down, of course).

Less than one hour after picking it up, something happened.....and by something, I mean the car wouldn't start. Oh crap! I pulled into the post office to check my PO box. Two minutes later, I couldn't get the car to start. It was dead dead. Crap crap! After some failed troubleshooting, my mechanic hired a tow truck to make the drive of shame to his shop (where it would have to sit over the weekend before getting a formal diagnosis).

Long story short, a little piece of rubber in the clutch wore out. The car is 18 years old, and I suppose that's what happens to things after nearly two decades of life. This little piece of rubber, the size and shape of a Lifesaver, notifies a sensor that the clutch is pressed and it's ok to start the car. When the dumb little Lifesaver broke, my car didn't think I had the clutch engaged. Thus, it wouldn't even turn over.

I'm glad it was a minor issue, but it wasn't cheap. The entire process took six days (it was hard to get a new Lifesaver) and $200 (including the tow). Ouch!

This isn't a sob story—far from it. I'm blessed to have this car, and we sign up for this when we own vehicles. It's not all roses and sunshine. Things happen; life happens. I'm talking about cars, but I'm talking about far more than cars, too. Things happen; life happens.

Since there's nothing we can do to stop life from happening, we have two choices:

Allow life to beat us up, rip us apart, and cause us much stress and turmoil.

Anticipate life happening and be prepared to soften the blow(s).

In the financial world, this looks like sinking funds. I don't know when my car will break, or how much it will cost, but I know it's coming. Therefore, for the last 19 years, I've allocated money in my monthly budget for car repairs. Then, I literally move it to a special savings account for that purpose only. I uncreatively call that account "car fund." Subsequently, when (not if) my car breaks, the money is already set aside to pay for it.

It turned my expensive week from a potential disaster to a minor inconvenience. It's not all roses and sunshine, but it doesn't have to feel like a downpour. What area(s) of your life do you need a sinking fund? They can change everything!

The 3-Bucket E-Fund Approach

On the heels of publishing a podcast episode about this topic, a few readers suggested I share the same advice on the blog. It was an episode about my variation on the traditional emergency fund concept.

On the heels of publishing a podcast episode about this topic, a few readers suggested I share the same advice on the blog. It was an episode about my variation on the traditional emergency fund concept.

First, what's an emergency fund? It's a specifically designated pool of money that we keep handy for when (not if) life throws us a curveball. It's not money to be used for the new iPhone or that next vacation. This is money to be used only in the event of a red-alert event. The car breaks down, someone gets sick, the furnace goes out, we lose a job, etc.

I won't get into how much we should have in our emergency fund, as it's a personal decision and a longer discussion. However, there are two main approaches: 1) 3-6 months' worth of expenses, and 2) a set dollar amount based on what the worst possible emergency could be for your family. For our example today, let's assume this family needs a total emergency fund of $25,000.

Instead of having all $25,000 in a savings account, I like to look at it as three separate buckets. Another way to perceive it is three lines of defense.

Bucket 1: This is money we would potentially need immediately (same day). It should be kept in a savings account attached to our checking account. It may not earn interest, but we can access it at a moment's notice. This is key!

Bucket 2: This is money we would need in a matter of days. Since we have a little timing flexibility, we can house it outside our primary bank. A high-yield savings account or money market fund would work well, as it would pay you interest, give you quick access, and have zero risk. For example, Vanguard's money market fund is currently paying 5.3%, and CapitalOne's 360 Performance Savings accounts are paying 4.3%.

Bucket 3: This is money we have quick access to, but we'd also like it to grow over time. It's also money that is a nice-to-have, not a need-to-have. Why? Because it will be invested in the stock market and could experience ups and downs over time. A taxable brokerage account is perfect for this. If invested in the S&P 500 index or total stock market index, it should provide you with a long-term 9% (but a short-term bumpy ride). But either way, it's available for us to access as needed. Fidelity and Vanguard are both great places for these types of accounts.

Back to our example family (which also happens to be a real client). Here's how they decided to allocate their three buckets:

Bucket 1: $4,000 in a savings account tied to their joint checking.

Bucket 2: $10,000 in a money market fund in their Vanguard taxable brokerage account.

Bucket 3: $11,000 in VTI (total stock market index) in their Vanguard taxable brokerage account. They will also grow this account over time for multiple uses (college, retirement, cars, etc.).

Simple, but powerful. Got questions?

Preparing for the (Winter) Storm

One such consequence that's becoming increasingly apparent is the stress on businesses. Simply put, people mostly stay home with these harsh conditions. That means less business for retailers, restaurants, coffee shops, and entertainment venues. In other words, business came to a screeching halt for many entrepreneurs.

Well, it's official: The Midwest is getting absolutely obliterated by a winter storm. Every city is different, but in mine, we received +/- 20 inches of snow in a 3-day stretch and are now getting crushed with -40-degree wind chills. This type of weather has many different consequences.....and none of them are good.

One such consequence that's becoming increasingly apparent is the stress on businesses. Simply put, people mostly stay home with these harsh conditions. That means less business for retailers, restaurants, coffee shops, and entertainment venues. In other words, business came to a screeching halt for many entrepreneurs.

Unfortunately, this will most certainly be the undoing of some businesses. It's sad, but inevitable. I don't wish that upon anyone, and I feel for people going through it.

It brings me to an idea I constantly reinforce for my family and business clients. We need to be prepared! When we're in the midst of our normal life, we're just living. Things generally feel good, and we're operating as though life will perpetually feel this way. That's the risk. Life won't always be normal like this. A storm will come, whether that's a literal or figurative storm. As such, we must be prepared! It's not an if, but rather a when. It's coming! And for countless businesses in the Midwest, the when is right now.

Whether you're a business or a family, the preparation process is similar. Here's a quick guide to getting yourself ready:

First, recognize that a storm WILL come.

Second, set aside some cash reserves that will only be used when the storm approaches. To determine the right amount, we must ask ourselves what the worst-case scenario is. If we're a business, it might be a situation where we aren't open for a few weeks. If so, what will that cost? We need to account for our overhead expenses, lost revenue, product waste, and possibly owner distributions (if our family relies on them to survive). In my business, I always keep $10,000 of cash on hand. At Northern Vessel, we keep at least $25,000 liquid. I have other business clients that keep $100,000-$300,000 in reserve for the storm.

If we're a family, we need to do a similar exercise. What's the worst that can happen to us? This question typically leads to the following types of situations:

Job loss

Car breakdowns (usually a $5,000 cap)

House maintenance issues (typically capped at $10,000-$12,000)

Medical situations (dependent upon health insurance, but can be upwards of $10,000)

Some families feel comfortable with $5,000 liquid, while others need upwards of $30,000. If you're feeling uneasy, pick a higher number.

Third, we must pre-determine what we'll do to our monthly budget when the storm comes. I have a lot of my clients do this exercise at some point. If you need to cut $1,000/month, what would you cut? I call it "red alert lockdown." Know what the cuts will be.

Fourth, remember all storms pass....eventually. If you're in one, this too shall pass.

Be safe out there, friends.

It’s WHEN, Not IF

For most families, finances are generally ok......IF unforeseen issues don't pop up. That's the problem. We tend to live life as though it's an IF, but it's not. It's a WHEN. Unforeseen issues will absolutely rear their ugly head, but we won't know when, where, or how much. And WHEN they do, they can wreak havoc on our finances.

For most families, finances are generally ok......IF unforeseen issues don't pop up. That's the problem. We tend to live life as though it's an IF, but it's not. It's a WHEN. Unforeseen issues will absolutely rear their ugly head, but we won't know when, where, or how much. And WHEN they do, they can wreak havoc on our finances.

Take this recent client story, for example. In a three-day stretch, this couple experienced a hat trick of crazy:

Hit a deer with their car

Coyotes attacked their dog

Backed into their garage door

All that in three days!!! Wow. It wasn't an IF, but rather a WHEN. And WHEN happened to be an already busy week in the middle of November. They never saw it coming. They never anticipated a single one of these issues, never mind all three. They had enough life going on that they didn't need this to weigh them down.

But they were prepared! This is the beauty of getting right with our finances. Instead of destroying their financial life and creating a ton of relational stress in their marriage, it was a mere bump in the road. An ugly bump, but a bump. Here's how/why they were able to navigate this week without it crushing them:

They have a strong emergency fund for WHEN (not IF) life happens.

They are adequately insured to protect against significant liabilities falling on their plate.

They have sinking funds specifically for key categories (pets and home maintenance, in this case).

They have margin in their monthly budget, allowing them to reallocate income to meet unforeseen needs, WHEN necessary.

They are a wonderful case study of what it looks like to get this money stuff right. It didn't happen by accident. I began working with them in the spring to bring intentionality, preparedness, and acceleration to their financial life, but they have spent years building a strong foundation. Nothing here was good luck. I don't think anyone can accuse them of good luck after the crazy week they just had.

They focused on getting their money right, so they don't have to dwell on their money when life hits hard. They practiced proactivity in the past, which resulted in them not having to practice reactivity in the present. It's not making money our number one priority, but rather putting intentional focus on financial matters so that we can continue to push money down on our priority list of life. It's living with financial margin, which prevents any single life situation from knocking us down. It's called humility and contentment.

That's what it looks like to live meaning over money.

Intensity vs. Diversity

Does it ever feel like there are too many needs and not enough money? You're not alone! There are lots of priorities vying for our money. We may need to buy a car soon. We'd love to purchase a house one day. We want to buy an engagement ring for the love of our life. That trip to Europe looks pretty fun. We have a medical procedure coming up in a few months. So many things!

Does it ever feel like there are too many needs and not enough money? You're not alone! There are lots of priorities vying for our money. We may need to buy a car soon. We'd love to purchase a house one day. We want to buy an engagement ring for the love of our life. That trip to Europe looks pretty fun. We have a medical procedure coming up in a few months. So many things!

How do we juggle all these priorities when there's more need than money? There are two primary lines of thinking: intensity and diversity. Intensity is just that, intense. It's the strategy by which we focus on one particular goal until we achieve it, then shift our focus to the next one. Diversity is the opposite. It's recognizing there are several priorities in life, and then spreading the dollars over each one. We make less progress on any given goal, but we're making progress on several.

Let's use an illustration. Let's say we have $2,000/month of discretionary income. Also, here are the upcoming needs/wants:

Car: $10,000 (needed by year-end 2024)

Engagement Ring: $4,000 (proposing in the spring)

Travel: $2,000 (needed by year-end)

House Down Payment: $20,000 (not urgent)

Medical: $500 (needed in January)

If we take a more diverse approach, we might allocate $400/month to each of these sinking funds. We'll slowly make progress on each. However, we'll fall short of the necessary timing on a few.

If we take the intensity approach, we'll focus 100% of the funds on the next item on the list. It might look something like this:

November: $500 to medical (done) and $1,500 to travel

December: $500 to travel (done) and $1,500 to engagement ring

January: $2,000 to engagement ring

February: $500 to engagement ring (done) and $1,500 to car

March, April, May, and June: $2,000 to car

July: $500 to car (done) and $1,500 to house

Aug+: $2,000 to house

We can refer to this as cashflow mapping. This is a common exercise we do to help clients prioritize, plan, and execute their goals. There's also a third option. I call it the hybrid approach. Instead of diversifying or putting 100% focus on the next item, we determine what monthly saving is needed to hit each goal by the deadline. Let's use the $10,000 car as an example. Instead of going all-in on the car in early 2024, we recognize we have 14 months to hit the $10,000 goal. This equates to approximately $715/month. So, instead of crushing the car with absolute intensity, we can meter it out while attacking other goals at the same time.

This is a helpful tool to add to your arsenal. Definitely try it sometime, especially when the needs start stacking up. It can give us a lot of clarity and much more control. Personalize it to your needs and lean into your values. And as always, meaning over money! Always meaning over money.

Letting the Wins Add Up

I recently received a call from a friend. He had a question. “I just got a $110k inheritance that’s sitting in my checking account. I need it in about a year for ______. I feel like I should do something with it between now and then. Do you have any good investing ideas?” It was an interesting question, and I had an immediate idea for him.

I recently received a call from a friend. He had a question. “I just got a $110k inheritance that’s sitting in my checking account. I need it in about a year for ______. I feel like I should do something with it between now and then. Do you have any good investing ideas?” It was an interesting question, and I had an immediate idea for him.

I explained that if he opens a Vanguard taxable brokerage account, and deposits the cash but doesn’t actually invest it, he would receive risk-free monthly interest payments of about $500. I was anticipating an excited, dare I say giddy, response. However, he reacted with complete disinterest. “Nah, doesn’t seem worth the hassle.” Not knowing what his hangup was, I responded that I’d be happy to sit down with him to set it up…..it would only take 15 minutes or so. Again, he declined, stating it wasn’t worth the time and effort for “only five hundred bucks per month.” In a last-ditch attempt to change his mind, I reminded him it’s 100% risk-free, and he could take the money out whenever he wants. No bueno. He ended the conversation by saying he has a buddy with some good stock tips he might look into. Put another way, he just gave up $6,000+ of income that would have taken him a maximum of 15 minutes of his time……ouch!

Sometimes we’re so busy looking for the life-changing opportunity that we miss the little wins available to us along the way. Perhaps $500/month wouldn’t change his life, but what if he made this decision, then the next one, then the next one? Wins add up, big or small. Occasionally, I’ll take an inventory of a client’s wins over 6, 12, or 18 months. I’ll take stock of all the little choices they made and the net result of them. Each win, in and of itself, feels small. However, when viewed through a wider lens of cumulative impact, these small wins account for a significant shift in their finances.

Mind those little wins. They add up fast!

This man’s story doesn’t directly impact you, but perhaps his non-decision raises your eyebrows. Yes, you can get a risk-free 5.25% by simply depositing money into a Vanguard taxable brokerage account. No strings, no commitments, no risk. Here’s how you do it:

Go to www.vanguard.com

Open a taxable brokerage account

Transfer your money into your new Vanguard account

DON’T invest it. Just let it sit there.

Watch the interest payments land in your account on the last day of each month.

Transfer money back to your bank account whenever you want.

Or you can just shoot me a message and I’ll help you! It’s quick and easy.