Smooth Out Your Lumpy Stuff

A few days ago, I wrote about my recent car maintenance frustrations. It was a bit unexpected, but I received a wave of messages from people asking for more insight on how to execute this concept.

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses. The goal is to smooth out the lumpy by slowly and steadily funding them over time, eliminating (or significantly reducing) the stress experienced when situations arise. Common sinking fund categories include car, house, travel, medical, giving, and kid activities. Each of these categories has a habit of sneaking up on us. When they do, these sudden and unexpected expenses sabotage our disposable income.....zapping our ability to make progress in other areas.

Here's a step-by-step of the mechanics:

Set up a separate savings/checking account for your desired category and name it accordingly. Most credit unions will let you set up multiple accounts, but most banks won't (with the exception of Wells Fargo). If your bank doesn't, I recommend CapitalOne's 360 Performance Savings.

Allocate money in your budget for this category. The amount can be steady or vary by month, but it must be included in the budget.

Just like you pay your electric bill, you pay your sinking fund. Whatever dollar amount you budget gets transferred to the sinking fund. I prefer to automate these transactions.

When expenses arise for a particular sinking fund category, use your primary checking account to pay the expense.

Immediately after paying for the expense, instruct your sinking fund to send that amount back to your checking account, essentially reimbursing your checking account from the sinking fund.

Repeat.

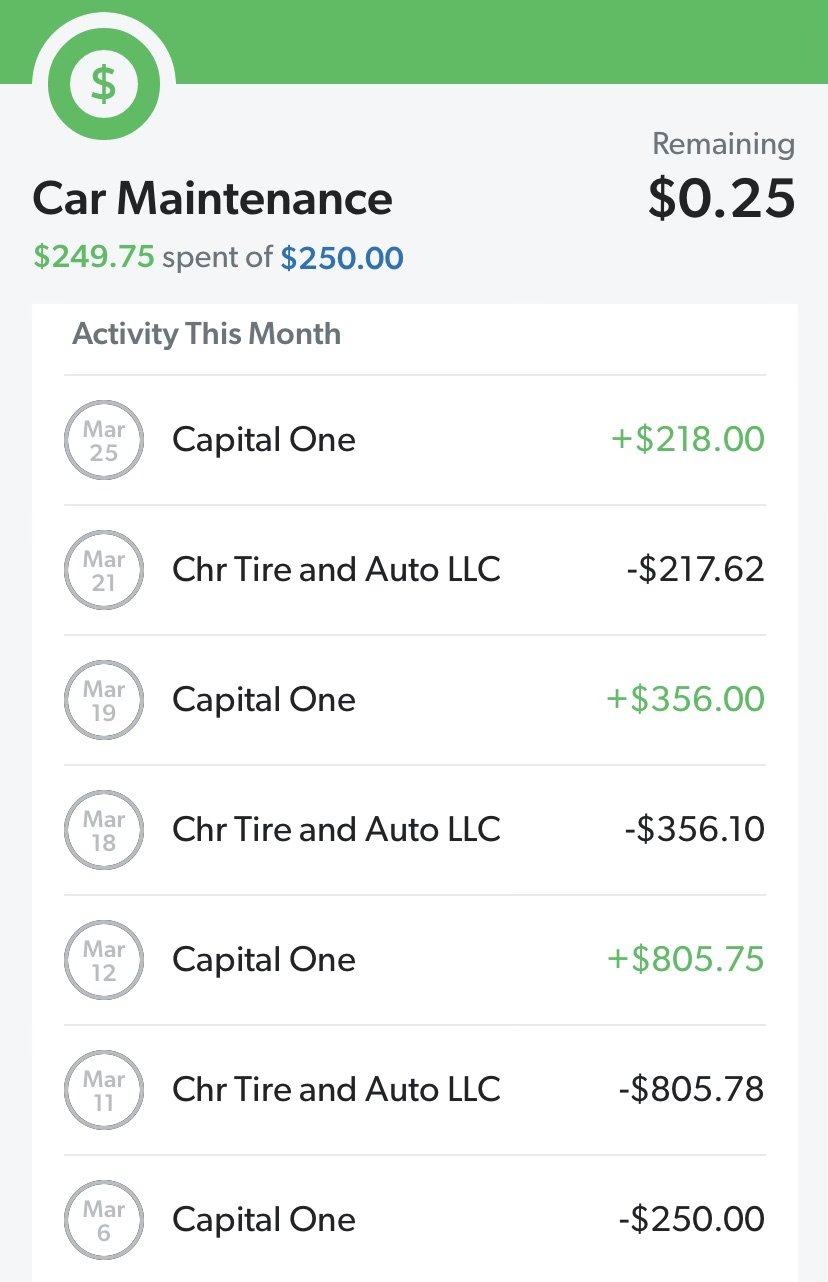

I'll share an example of my car fund from this month. For 19 years, I've budgeted (and automated) a monthly transfer from my primary checking account into my car fund. We currently budget $250/month. After March's $250 contribution (completed on 3/6), our car fund balance was $2,487. Then, we got hit with a hat trick of car bills: $806 for brakes on my main car, $356 for known issues with my new car, and $218 for the unknown issue with my new car. I budgeted $250, but got hit with $1,380 of actual expenses.....ouch! This situation would have crushed our budget had we not had a sinking fund. Instead, I simply reimbursed my checking account from my car fund for each, resulting in a total monthly car fund expense of $250 (the original planned contribution). It took something extremely lumpy and made it smooth. It went from a potential disaster to a minor inconvenience. Below is an image of how we executed it in our budget.

Setting up these extra accounts and steps may appear to make things more complex, but you'll quickly see how truly simplifying (and freeing) it can be! Best of luck smoothing out your lumpy stuff!