The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

Get On the Stage

In the traditional model, you would practice, practice, and practice, hoping to eventually be good enough to perform on stage. Conversely, in this model, the stage performance is the practice.

The boys had their second rock concert yesterday. It was a fantastic experience, and I couldn't have been prouder of them. They played at a new venue in our town in front of hundreds of supportive fans. One kid had five songs, and the other four (with one overlapping song where they both performed together). As the event kicked off, the owner of their band organization addressed the audience. He explained their teaching philosophies are upside-down compared to the prevailing strategies. Instead of practicing to perform, they perform to practice.

In the traditional model, you would practice, practice, and practice, hoping to eventually be good enough to perform on stage. Conversely, in this model, the stage performance is the practice. The act of performing in front of hundreds of people builds resiliency, experience, and a love for the craft. It's not perfect. Heck, it's messy. After all, these are seven and eight-year-olds, and most have less than one year of experience. Finn and Pax had three months of total music experience when they did their first show, and six months now. Yet, they are on stage performing in front of hundreds of people. I love this backward model. The performance is the practice.

When this backward practice-as-performance concept was communicated yesterday, it reminded me of how so many of us live life in the conventional model. We tend to live in a world of theoreticals, what-ifs, and when-I'm-good-enoughs. We practice, dwell, and practice some more, hoping to one day be good enough to put our ideas into motion.

What if we followed this alternative model? What if instead of obsessing about trying to get it right or figuring out the perfect way of doing it, we simply did it? What if we just started investing?.....performing as practice. What if we just started budgeting?.....performing as practice. What if we just started paying off our debt?.....performing as practice. What if we just started applying for jobs or making phone calls?.....performing as practice.

We can practice, practice, practice all we want, but it won't move the needle nearly as much as getting up on that stage. Similar to my kids and their band, it's not perfect. It's messy. You're going to fail. But that's the gateway to greatness. Gain that experience, build resilience, and fall in love with the craft.

Pax and I had some interesting conversations yesterday. He was beyond excited about the performance, but equally terrified. He talked of having butterflies in his stomach. He said he thought he was going to throw up. I watched him anxiously pacing back and forth for 20 minutes before he walked up on stage. Then, when it was his turn, he confidently sat behind his drum kit, beat the daylights out of them, grooved with the music, and played up for the crowd. It was everything to him. As he walked off the stage, I caught him side-eyeing me; he gave me a little nod, then a smirk. That performance was exactly what he needed!

Get on the stage.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

When NOT to Push the Button

Yesterday, I talked about the behavioral phenomenon where people find more perceived security in their cash than the actual relief gained from using said cash to pay off their debt. I first framed it up through my illustrative Saw-esque concept, but then shared the story of an actual family that's continually struggled for seven years with $47,000 of debt (and a hefty $1,300/month combined payment to go along with it). All the while, they were sitting on $60,000 of cash in savings. At any point on the journey, they could have "pressed the button" and instantly paid off the debt (leaving them with $13,000 in savings and $1,300/month extra in their budget).

I said it without saying it, but I think we should push the button! Contrary to common belief, actual relief is almost always superior to the false sense of security of our cash. In the name of having "security," this family lived a stressed and low-quality life for the better part of a decade. The alternative scenario would have provided much fruit. Pay off the debt, use the additional monthly cashflow to rebuild savings (to whatever extent needed), and live with far more margin.

Today, though, I want to share when NOT to push the button. For as strongly as I feel about pushing the button, I'm equally as passionate about NOT pushing the button under one specific scenario: When the behavior that caused the financial mess in the first place hasn't yet been corrected.

In yesterday's example, this couple deeply wanted to create freedom and gain momentum. They made some very poor choices many years ago and were still haunted by them. They have since gained a healthier perspective on money, started budgeting, and found unity in their finances. In other words, they have addressed the root cause of the initial problem.

Let's assume they hadn't. Imagine this same couple came to me with $47,000 of non-mortgage debt, $60,000 of cash, and perpetually bad habits. They aren't budgeting. They still find themselves dipping into their credit cards each month. They plan to use debt to buy their next car. They haven't been sitting on $47,000 for a long time, but that number continues to grow and will likely be higher in the coming months.

In that scenario, using the cash to pay off the debt would be utterly destructive. Doing so would immediately create relief, but also cause a false sense of accomplishment. They would let their guard down, feel progressively more comfortable to spend, and mimic the same habits that led them into this mess. Translation: They will recreate the same situation they just "fixed." Fast forward 18 months, and they are back to $40,000-$50,000 of debt AND have no cash. That's a worst-case scenario I've seen played out far too many times.

Therefore, push the button. Please push the button! However, before doing so, make sure you have a healthy perspective, solid habits, and intentionality. Let the button be a blessing, not a curse.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

To Press or Not to Press (the Button)

They aren't alone in this sentiment; it's all too common! The perceived sense of security always emotionally outweighs the benefit of actual relief.

I want to start with a little thought experiment. Think of it as my PG-rated version of Saw. You're forced live your life carrying a 20-pound backpack on your shoulders. It's not impossible, but it doesn't feel great. You constantly feel the weight, and it's uncomfortable. It doesn't prevent you from living, but it's less than ideal. No single moment causes acute physical pain, but the cumulative impact of wearing it starts taking a toll. The whole time, however, you have the option of removing the weight forever. All that's required is you push a button on your kitchen counter. The moment you push the button, the weight disappears. Instant relief! There's one small catch: You can only press the button once. Would you press the button?

____

A couple walks into my office, struggling with debt. They are beaten down and frustrated. They look tired. Here's what their situation looked like:

Student Loan Debt: $22,000 (with a $580 minimum payment)

Car Loan: $15,000 (with a $520 minimum payment)

Credit Card: $10,000 (with a $200 minimum payment)

Additional context:

These are private student loans

The car has negative equity, meaning they would still owe money even if they sold it.

They've been roughly in this same spot for their entire 7-year marriage.

After factoring in these three minimum payments totaling $1,300, they have very little margin in their monthly budget. It's tight! They make it work most months, and are doing alright, but they feel the constant weight and tension. Month after month, year after year, they experience the cumulative impact of this weight. It's nothing acute, but it's starting to feel exhausting. They haven't gone deeper into debt in years but haven't found a way to make progress on it, either. Continually seeing this debt hover around $47,000 is taking a toll.

If only they had a button to push! Well, they do, actually! Here's one detail I haven't shared with you: They have about $60,000 in a savings account. "Have you considered using some of your cash to pay off the debt, which would free up $1,300/month in your budget?" I asked them. Like many people before them, they gave me the answer I prayed wasn't coming. "We can't use that cash. That's our security."

"Security?!?! You don't have any security. You're already drowning!!" I was probably sharper than I should have been, but I needed them to realize how badly they were already hurting. They could immediately pay off all $47,000 of debt and still have $13,000 of cash left.

They aren't alone in this sentiment; it's all too common! The perceived sense of security always emotionally outweighs the benefit of actual relief. This is one area where our psychology tricks us. I'm going to flip this on its head....here's what I believe to be the truth: Actual relief always outweighs our false sense of security. They could press the button, but continually choose not to.

Not all people have these buttons to push, but many do. And with that choice, many choose to continually suffer, all in the name of "security."

Would you press that button?

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

This May Only Make Half Sense

Sarah: "Aren't you going to write your blog?"

Me: "I feel like trash!"

Sarah: "You NEVER miss your blog. You've been far sicker than this, and you've never missed a single one."

Me: "I'll figure it out."

Sarah: "Good."

She has a great bedside manner, doesn't she? I expected something more like, "Oh, I'm so sorry you don't feel good. Is there anything I can do for you?" Instead, she immediately reacted with shock at the possibility of me missing my first writing day in nearly two years. The truth is, I can't even fathom a scenario where I don't publish on a given day. Even if both my hands were chopped off, there's a solution out there somewhere. "Hey Siri....."

This is a far cry from November 2022 when I started this blog. Things were going great.....until I got about 10 days in. At that point, I started wondering:

A) Am I crazy?

B) Do I even have time for this?

C) Will I run out of ideas in a matter of weeks.....or days?

With nearly 670 consecutive days under my belt, I can confidently answer these questions. Yes, I'm crazy. No, I don't have time.....but we make time for things that matter. No, there is no limit to the number of ideas if we give ourselves permission.

I did think about Sarah's comment a lot, though. She makes a very interesting point. There have been several days in the last few years where I've felt like I'm on my deathbed. Yet, I somehow wrote, edited, and published a blog each and every one of those days.

I went from not having time or ideas to publish even 2-3 articles per week to not willing to go a single day without writing/publishing.

As I sit here with only half a working brain, I can't help but think how profound the power of commitment is. When we do things because that's what we do, there's nothing that can stop us. This idea makes me think about so many of my clients. Once a new habit is set, it's etched in stone.

I have clients who spent 20 years without budgeting a single time (and being revolted by the idea) to have the practice be a completely non-negotiable part of their marriage and finances.

I have clients who struggled to pay off a single dollar of debt who now attack it monthly like their lives depend on it.

I have clients who lived in comfort and security their entire adult lives and now wake up each day actively pursuing discomfort and struggle.

It's amazing what happens when we stretch ourselves past our falsely-conceived boundaries and into uncharted territory. I hope this piece makes sense to read, as writing doesn't feel completely sensical. More importantly, I hope it gets you thinking about what boundary you need to break through and set a new practice into motion. It will change you. I promise.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Closing the Loop

This is where so many of us whiff. Whether it's ourselves or in our parenting, we don't close loops with finances. We take shortcuts, stop short of fully completing goals, and inadvertently rob ourselves (and our kids) of the tangibility.

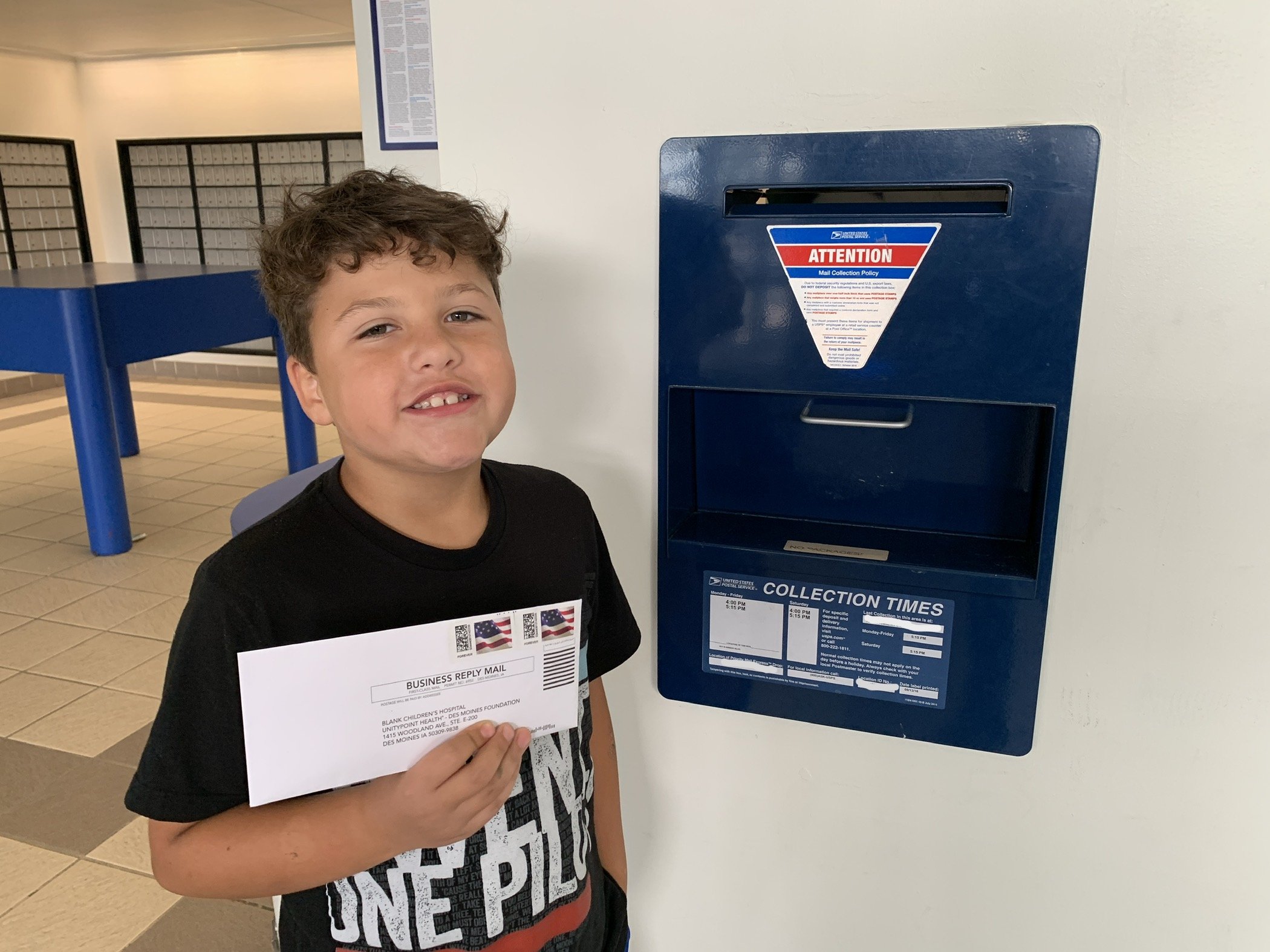

Finn and I were able to close the loop on his gift to the children's hospital yesterday. If you don't know what I'm referring to, I highly recommend reading it here! It was a beautiful time together. We packaged his letter, money, and paperwork, drove to the post office (where he personally dropped his gift in the mail), and we celebrated with ice cream. He was beaming, and I was so proud of him.

Closing the loop was such an important step. I could have made a gift on Finn's behalf and told him, "Good job," but him seeing it through to the natural end was critical for his growth. Here's what the entire loop looked like:

He worked hard and earned money (actual cash he could see and feel)

He spent some of that money on fun things (which he personally purchased with the cash)

He saved some of that money for a bigger purchase (a pocketknife....and yes, he cut himself the first day).

He set some of that money aside for giving (which he used for the gift to the children's hospital).

Each step, he was personally involved. He could touch and feel every part of the process. The pain and accomplishment of the work. The satisfaction of receiving compensation. The fun of spending. The discipline and sacrifice of saving. The selflessness and love of giving.

This is where so many of us whiff. Whether it's ourselves or in our parenting, we don't close loops with finances. We take shortcuts, stop short of fully completing goals, or inadvertently rob ourselves (and our kids) of the tangibility. When we do this, we lose something important. We lose the meaning, fulfillment, and humanity of the journey.

I wanted Finn to see, feel, and experience every step of this little journey. Once that loop was closed, it triggered so many questions:

"Do you think my gift will make a difference?"

"Can I give to the hospital again?"

"Can I give to other people, too?"

"Do you think God is happy with my decision?"

"If I work more, will I have more money to do things with?"

"Is it okay to save and give more of my money next time I get paid?"

"When can I get a job?"

His little mind is working overtime. This is the beauty of closing loops. Make a goal. Work toward the goal. Accomplish the goal. Celebrate the win. Start afresh. Life can be a series of awesome loops if we allow it.

I'm sure Finn will screw up many, many times. He'll do selfish things. He'll make mistakes. He'll hurt people. But yesterday, he took a step in a positive direction. He grew, and I probably did as well.

Create new loops, enjoy the journey, close them, and repeat.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

More Expensive, But Cheaper

My friend Ryan swears by Helm Boots. Whenever he talks about them, or I see him wearing them, I want to buy a pair.....until I see the $300 price tag. Ouch!

My friend Ryan swears by Helm Boots. Whenever he talks about them, or I see him wearing them, I want to buy a pair.....until I see the $300 price tag. Ouch!

I usually spend about $100 on a pair of boots, and I typically buy a new pair each year. $100 is a very reasonable price, and it feels like I get a lot for my money. Ryan, on the other hand, spends more than $300 on his!!! Here's his selling point: "Yeah, but I've been wearing this pair for six years!"

While it's true that he spends 3x as much as I do on his boots, mine are actually 2x more expensive than his ($100/year vs. $50/year). His are far more expensive than mine, yet cheaper.

When we boil this silly story down, it's really just a tale of quality over quantity. When we spend a little more money on things that have durability and longevity, they often provide a lower long-term cost. We're thinking long-term, not short-term. We're paying more today in exchange for less tomorrow. A different form of delayed gratification. Everything we own will end up in a landfill in due time, but perhaps it’s in our best interest to purchase things that will take longer to get there.

What's funny about this concept is that many of us embrace this principle in some areas, yet whiff on others. I buy solidly built vehicles, good jeans, and state-of-the-art technology (phones, TVs, computers, etc.) that lasts for a long time, yet I still buy crappy boots and cheap t-shirts that are trash within a year. It's funny how we have these little wiring quirks.

Where do you get this right? Wrong? It's worth looking in the mirror to assess it. Many of us could benefit from making some tweaks to our purchase decisions. It maybe more expensive on the front end, but much cheaper in the long run. Doing so also allows us to buy products that are just better…period. It’s a win/win!

Seriously, what are yours? I love hearing about other people's quirky wiring and behaviors. In the meantime, I'll be buying a pair of Helm boots!

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Heartbreak. Joy. Impact.

What makes you angry? What breaks your heart? What makes you sad? What puts a knot in your stomach? What gets you fired up?These are some of the questions I ask people when they are interested in giving, but don't know where to start.

What makes you angry? What breaks your heart? What makes you sad? What puts a knot in your stomach? What gets you fired up?

These are some of the questions I ask people when they are interested in giving, but don't know where to start. One of my biggest principles in cultivating generosity is making gifts we can emotionally connect to. This is an overlooked aspect of people's giving, which I believe can change everything. Once we connect our giving with our emotions and passions, it unlocks a gear we never knew we had.

I'm writing about this today because something transpired under my roof this weekend. On Saturday afternoon, Finn decided he was going to get the mail. Then, something caught his eye. "Dad, you got something from the children's hospital. It must be a bill." I explained it's probably not a bill, but rather the hospital asking for help. That sparked his interest, so without further ado, he tore open the envelope. He spent the next hour reading, inspecting, and re-reading the documents. He was fixated on this letter. It talked about caring for kids and making sure their families are taken care of.

Fast forward a few hours later, and we were on the couch watching the annual CyHawk football game featuring our Iowa State Cyclones vs. the Iowa Hawkeyes. As much as I don't like the Hawkeyes (sorry, Hawk friends!), they have one of the most beautiful traditions in all of sports. After the conclusion of the first quarter, every person in the stadium - fans, players on both sides, refs, coaches, stadium employees - stop everything, turn their attention to the next-door children's hospital towering above, and wave at all the kids and families in the windows. It's a special moment each and every time. I turn into a puddle just writing about it, and I suspect you'll be the same if you watch this ESPN story.

As the wave began, both my kids were curious about what was happening. Finn especially took an interest in this. The cameras zoomed in on the kids at the windows, wildly waving at the stadium crowd with huge smiles on their faces. Some kids were bald from their treatment regimen, while others were in beds. Finn looked at the kids on the TV, then down to the pictures of kids in the hospital letter he had been reading.

Something clicked inside him. He looked sad, almost introspective. Then, without a word, he walked out of the living room toward his bedroom. He returned a few seconds later with a baggie of cash. "Dad, can I send my giving money to the kids' hospital?"

"You bet, bud. We absolutely can." We filled out the giving form, he delicately placed his $16 into the provided return envelope, and he wrote them a note explaining his gift. He had so much joy doing this. Later today, I'll drive him to the post office so he can personally drop the envelope in the mailbox.

Heartbreak. Joy. Impact. Finn is starting to get it.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

A Different Kind of Structure

While I'll die on the hill of getting our financial structure in order, I have a similar feeling about our geographical and logistical structure of life. To me, no amount of money can compensate for having a life structure that entails endless commutes and 24/7 to-and-froms.

A few days ago, I wrote about the importance of getting our financial structure right. If we don't have a reasonable financial structure, we will likely have a rough go with our finances. Then, in the hours that followed, it triggered a few parallel thoughts. Specifically, I experienced a sequence of events that reminded me of another type of structure.

My morning was tightly wound, so I needed to hustle. I had to drop the kids off at school, drive back home, switch cars, then pop into the office for a coaching meeting. Here's the fun part. That entire sequence took less than 10 minutes. Home>School>Home>Office. 10 minutes! That's when I started reflecting (again) on the idea of structure.

While I'll die on the hill of getting our financial structure in order, I have a similar feeling about our geographical and logistical structure of life. To me, no amount of money can compensate for having a life structure that entails endless commutes and 24/7 to-and-froms. As such, I've spent just as much time and energy on my life structure as I have my financial structure. I think this image from the ETA app illustrates it quite well:

My house is 2 minutes from the office, 2 minutes from our children's school, 2 minutes from the grocery store, 6 minutes from our recording studio, 7 minutes from church, and 16 minutes from Northern Vessel. That's my life in a nutshell. I sometimes take it for granted, but when I take a step back, I realize how absurd it is and blessed I am. It wasn't an accident, though. Much thought, planning, and intentionality has gone into this structure. Consequences were made. Inconveniences were experienced.

However, when I wake up each day and experience life as it's structured, I'm so sincerely grateful. This hasn't always been the case. I've lived in realities of 45-minute commutes each way, with constant back-and-forths cannibalizing my days/weeks. I have countless friends that spend 2-3 hours commuting daily. Lots of people drive an hour to get to church, or 30 minutes just to get groceries.

I'm willing to make almost any sacrifice to live my simple life. We've had countless amazing opportunities presented to us, but when looked at through the lens of our intentionally simple structure, they don't look very attractive. And whenever we're faced with the option of keeping/saving money or have a simpler and more efficient life, I'll trade away the money in a heartbeat.

This isn't a topic thought about much, never mind talked about. Maybe today is the day for you. Instead of just accepting that your structure is your structure, what would you change if you could wave your magic wand? Maybe it's time to wave said wand. Your future self just might thank you.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

She Completely Blanked

I ran into a former client at a coffee shop recently. I haven't seen her or her husband in upwards of three years. As we exchanged pleasantries, she exclaimed, "We did it!!!" To be honest, I had no idea what she was talking about.....so I asked for clarification. "The trip!!!" Ah, yes, the trip! I knew exactly what she was talking about!

I ran into a former client at a coffee shop recently. I haven't seen her or her husband in upwards of three years. As we exchanged pleasantries, she exclaimed, "We did it!!!" To be honest, I had no idea what she was talking about.....so I asked for clarification. "The trip!!!" Ah, yes, the trip! I knew exactly what she was talking about!

Ever since the day I first met her, she and her husband had been talking about going on a specific type of trip. It was an exotic and unique idea. It was also costly. This trip was a big mental and emotional roadblock for them during our coaching relationship. They had the ability to save up for it, but they hesitated. After all, it was expensive and they had many more "responsible" things they should do with their money. Therefore, they continually kicked the can down the road.

But eventually, long after I was gone, they decided to pull the trigger. They went on the trip of a lifetime! They sacrificed, saved, planned, and enjoyed.

After learning about this beautiful development during our coffee shop encounter, I asked her, "Well, how much did it end up costing?" This was a huge sticking point for them, and one of the main reasons they considered skipping it to begin with. She stared at me for about ten seconds, almost as if she was searching her brain for the applicable information. Then, she sheepishly responded, "I don't actually remember." I loved that answer.

This is one of the most perfect examples of meaning over money. She's telling me about the most memorable, beautiful, and game-changing trip she's ever been on. The one she's been dreaming about since she was a kid. The one she will be telling people about for the rest of her life. Then, in her next breath, she can't even remember how much it cost. So powerful!

They invested in experiences and memories. Yes, they have less money because of it. But they also have something in return that can never be taken from them: memories. These memories won't be hoarded in a bank account. They won't eventually end up in a landfill. They won't become boring and out-of-date. Decades from now, those memories will be just as beautiful - if not more - than the day they experienced them.

When I asked her about the memories, her face lit up and she talked my ear off. When I asked her about the cost, she completely blanked. That's telling. That's beautiful.

It’s Hard to Overcome Our Structure

Unfortunately, it's hard to overcome our structure. This family had created a really expensivefinancial structure for their household. Based on THEIR choices, more than 70% of their income was already spoken for before it hits their bank account. No amount of trimming or cutbacks can help this family remedy what ails them.

Someone contacted me with a problem. A couple in their mid-40s, two kids. They believed they were being responsible with their money, but it felt nearly impossible to make financial progress. As they put it, they didn't waste money, spend money frivolously, or buy nice things. Yet, they lived month-to-month and had much financial tension in their marriage.

I sat down with them to review their numbers. Here's what I found (shared with their permission):

Combined Take-Home Income: $8,200

Mortgage Payment: $3,600

Car Payments: $1,600

Other Debt Payments: $700

Do you see a problem here? Just their house payment is 43% of their take-home income. The house plus the cars account for 63%. Then, when you tack on the rest of the debt, these three categories account for 72% of their take-home income.

That means they only have $2,300 left for all other needs, wants, giving, and saving. That's not nothing, but wow, it's tight. So when they say they don't waste a bunch of money or spend frivolously, I believe them. There's no money to waste!

Here was their question: "How do we find margin? Where do we cut?"

These are tough situations. Unfortunately, it's hard to overcome our structure. This family had created a really expensivefinancial structure for their household. Based on THEIR choices, more than 70% of their income was already spoken for before it hits their bank account. No amount of trimming or cutbacks can help this family remedy what ails them.

Whether we want to admit it or not, these are OUR choices. The cities we reside in. The residences we choose. The cars we buy. We can cry foul all we want, but at the end of the day, we have choices to make; and these choices will dictate our structure.

Here's what happened. I pointed out that there are very few options to help this family without them significantly altering their structure. They can't cut groceries, utilities, dining out, clothing, entertainment, or any other budget items enough to move the needle. It's hard to overcome our structure! I couldn't let them go home empty-handed, though. Here are the options I floated by them:

Increase their income

Downsize their residence

Sell one or both vehicles (and replace them with cheaper alternatives).

Use some of their assets to pay off their non-car and non-mortgage debt.

Outside of these four levers, very few options exist to help them. Their structure is their structure, and it must be addressed for what it is. It's tough, but reality.

I hope this family takes a hard look in the mirror and decides to take drastic action; only time will tell. I sincerely believe their life will unlock if they are willing to humble themselves and make difficult choices.

The same goes for you....and me. We can trim around the edges all we want, but our financial structure significantly impacts our journey. For some of you, it may be time to alter your structure.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

The Destinationless Journey

Nobody said, "Wow, I'm just really looking forward to packing it in and riding off into the sunset." It was quite the opposite, actually. It was about finding new ways of making an impact, investing in their families, volunteering, and pursuing new types of work. Meaning, meaning, meaning, and meaning.

I was blessed to run into a group of friends yesterday. They were enjoying their weekly coffee outing together, so I crashed their conversation for a few minutes. Though that interaction was only 5-10 minutes, it blessed my day so much.

These four women are a few years ahead of me on their journey. I don't remember how the topic came up, but we began discussing upcoming career shifts (or what most people would refer to as retirement). It was interesting to hear each person's perspective on the topic. All were different and unique, but there was a common thread to each of their responses: What's about to happen is a new stage of the journey, not a destination.

I was so encouraged by their sentiment, which was brimming with impact and meaning. As I always say, work that matters matters. We were created to work, be productive, and serve others. These four women echoed those values in their words, which doesn't surprise me, having known them for many years.

Nobody said, "Wow, I'm just really looking forward to packing it in and riding off into the sunset." It was quite the opposite, actually. It was about finding new ways of making an impact, investing in their families, volunteering, and pursuing new types of work. Meaning, meaning, meaning, and meaning.

There is no finish line. It's a destinationless journey. When we view our lives through that lens, it changes everything. It reminds me of a conversation with a friend in his late 50s. He's done well for himself, and he's been encouraged to retire by many people around him. "You've earned it," they tell him. But every time the R-word gets brought up, he feels his mortality. Why? Because to him, it feels like the finish line of his productive life. In a way, that's cool; but in another way, it's quite sad.

I told him I thought it was all BS. He's in his 50s.....he's young! He still has 20-30 productive years left in him! That's like a long-distance Olympic runner completing two laps around the track, stopping, and calling it a race. The race isn't done yet, man!

I look up to my four friends. I'm so glad I had the chance to spend a few minutes with them yesterday. It encouraged me more than they will ever know. Impact knows no age. Servanthood doesn't retire. Meaningful work is available to all.

It's a destinationless journey. Keep running.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

A December to Remember

It has everything! Financial self-sabotage, unilateral decisions, financial illiteracy, status-seeking behaviors, out-of-whack priorities, marital strife, buyer's remorse, and a hint of adultery.

I'll never fully understand the ease with which people make car purchase decisions.

One of my friends decided to visit the dealership on a boring Saturday afternoon "just to look around," and walked out with a $0 down, $45,000 car loan with a $750/month payment.

Another friend was having a few issues with their 5-year-old SUV. It was going to cost a few thousand to fix it, so they elected to purchase a new $65,000 SUV less than 48 hours later. This one came with a $900/month payment.

One of my former youth group kids graduated from college and started his first adult job. At the encouragement of his parents (you know, to get something "reliable), he immediately purchased a $30,000 vehicle with a $600/month payment.

Another friend had their second child and decided a family of four no longer fit in a mid-size SUV. They quickly traded in their paid-off vehicle and purchased a new slightly larger model.....with a $525/month payment.

See the consistencies between stories? Each person acted swiftly and ended up with expensive monthly payments. Oh yeah, there's one more: All four families are now experiencing financial stress and turmoil due to these decisions.

One of my favorite parts of the holiday season (besides AE Egg Nog....IYKYK) is the ridiculous array of car dealership commercials. You know what I'm talking about! The commercials where one spouse tells the other they have a surprise for them (often while romantically standing under the Mistletoe), then leads them outside to reveal a brand new vehicle with a bow fixed atop (with powdery snow wafting through the air). The recipient spouse, overwhelmed with joy, falls into their partner's arms and gives them a gratitude-filled smooch.

Has anyone ever stopped to think how absurd these commercials are? They exemplify our culture's very real casualness of buying cars, but are completely unhinged. "Merry Christmas, Honey! Here's a car you'll get bored of six months from now, with daunting payments that will haunt us for the better part of a decade!"

For a long while, I roamed this earth believing I was the only soul who thought these commercials were insane and reckless. But then, Saturday Night Live stepped in and affirmed me by producing this hilarious skit a few years ago:

It has everything! Financial self-sabotage, unilateral decisions, financial illiteracy, status-seeking behaviors, out-of-whack priorities, marital strife, buyer's remorse, and a hint of adultery. It's a more hilarious and twisted version of how my brain envisions what the consequences of A December to Remember actually looks like. It's a mess!

The truth is that while this is a hilarious parody skit, it doesn't stray too far from what's actually happening in people's homes. People regularly defend these types of insane financial decisions because, well, they've been normalized in our culture. But I have the luxury of meeting with people on the back side of them once the financial and relational consequences set in.

Don't let your household resemble a sketch comedy. Ignore our culture's push toward flippant financial decisions and instead choose intentionality.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Quality is Quality

By nearly every measure, we have a higher standard of living today than at any time in the history of our civilized world. More people have access to medical care, internet, cars, cell phones, internet, air conditioning, and indoor heating than ever. Houses are bigger, transportation more prominent, technology progressively better and cheaper. Our standard of living continues to skyrocket.

Uh oh! One sentence in yesterday's post has triggered a firestorm. It was this one: "Their standard of living will likely fall off a cliff, but their quality of life should prosper."

I'll summarize the collective feedback: Standard of living = quality of life. When our standard of living increases, so too does our quality of life. They are one and the same.

By nearly every measure, we have a higher standard of living today than at any time in the history of our civilized world. More people have access to medical care, internet, cars, cell phones, internet, air conditioning, and indoor heating than ever. Houses are bigger, transportation more prominent, technology progressively better and cheaper. Our standard of living continues to rise.

If all that's true, and standard of living and quality of life are correlated, why do we have continually rising mental health issues, suicides, divorces, loneliness, crime, and overall brokenness? It's hard to acknowledge all the pain our modern society is enduring and argue that our collective quality of life is higher today than in years past.

I would propose that standard of living and quality of life have a positive correlation.....to a point, and the point is when our basic needs are consistently met. For example, if we're living under the constant threat that our electricity or water will be shut off, our quality of life will suffer. If we're teetering on the edge of getting evicted from our residence, our quality of life will suffer. If we don't have reliable transportation to get us to and from, our quality of life will suffer.

However, once our needs are consistently met and we can sufficiently live without the fear of imminent destruction, standard of living and quality of life disconnect. At that point, our quality of life is dictated by our choices:

If we give generously, we'll have a lower standard of living but an increasing quality of life.

If we choose a high-paying job we hate, our standard of living will go up while our quality of life goes down.

If we choose to have children, our standard of living will probably go down while our quality of life likely goes up.

If we invest in relationships, our standard of living will stay the same, but our quality of life will skyrocket.

If we buy an expensive car with debt, our standard of living will go up (at least when we're driving), but our quality of life will likely be impaired (because of the opportunity cost of the debt payments).

The best way to achieve a poor quality of life is to pursue a higher quality of life by increasing our standard of living. This, in my opinion, is one of the reasons why our collective quality of life is eroding amidst record-high standards of living.

Here's my overly-simplistic remedy: pursue a higher quality of life.....period. Disconnect it from standard of living. Pursue meaning. Find purpose. Serve others. Invest in relationships.

Quantity isn’t quality. Quality is quality.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Resetting the Reset

So today, I want to share some real-world examples of how clients are creating resets in their own journey. My hope is that one of these stories will resonate with you, and perhaps trigger your creativity.

Yesterday's post didn't sit well with me. Nothing was inherently wrong with it, and I entirely back what I said. However, upon further review, it was too much about me and not enough about you. In it, I suggested that being intentional about getting a reset (with whatever endeavor you're pursuing) can be a springboard to longevity and renewed energy.

So today, I want to share some real-world examples of how clients are creating resets in their own journey. My hope is that one of these stories will resonate with you, and perhaps trigger your creativity.

First, I think about a 40-something couple that seemingly has it all. A big house, newer cars, and careers that provide status. However, they feel overwhelmed and discontent. They have everything the world says they should pursue, yet it feels a bit empty. Their kids are growing up too fast, and their priorities are flip-flopped. As such, both spouses are in the process of making significant career shifts. This is a massive reset that should revolutionize their life. Their standard of living will likely fall off a cliff, but their quality of life should prosper. The growing pains of this reset will be significant, but it will likely lead to a beautiful place.

Second, I think about a young client who fell into the debt trap early in her journey. She accrued a ton of student loans, plus the ancillary consumer debt that commonly goes hand-in-hand with growing into adulthood. She wants to pay it off quickly, but doesn't want to "throw her life away" either. Therefore, we made a compromise that would allow her to have her cake and eat it, too. Throughout the majority of the year, she's grinding through debt. Then, once per year, she takes an epic 3-4 week trip abroad. She explores, meets new people, experiences new cultures, and most importantly, she doesn't pay off debt. It's her annual reset. That annual reset gives her the excitement and perseverance to achieve her goals.

Third, I think about a couple that has four kids under four. Life is a grind, but a beautiful grind. The wife stays home, which has always been the dream. Money is tight, and they budget prudently. Like many moms, this woman struggles to spend money on herself, instead deferring to everyone else first. Twice per year, though, they cut back on a bunch of budget categories and allocate a nice chunk of money for her clothing. She then uses that money to reset her wardrobe. It's a beautiful little treat for them, providing her with renewed energy.

Last, it reminds me of an idea that I and many of my clients execute. Each quarter, I plan a 1-2 night hotel retreat for myself. I think, write, plan, and rest. Oh yeah, and enjoy a few unique meals. I go into those trips stressed and tired, and come back refreshed. A wonderful reset.

Opportunities for resets are everywhere! We just need to look for them, and more importantly, give ourselves permission to do it.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Sometimes, We Need a Reset

Yesterday was a huge day in the life of Northern Vessel. No, nothing big actually happened. In the overall scheme of things, it probably doesn't even hit the top 25 list of things we've done. We got a reset. We closed for five days for the first time in our company's history. That in and of itself was a weird experience.

The primary driver for the closing was to refinish the floors, a to-do item since dealing with the blood, glass, and wreckage of the first car crash. But since it took seven months to completely fix the shop, and we were only at full strength for 59 days before the second car crash, we just never got around to it. Our mentality was that if we were forced to close the shop for five days, we would get a reset. Here's what happened:

The floors got refinished, of course. They look beautiful!

Repainted the entire interior.

Rebuilt our merch wall, which was destroyed in the first crash.

Introduced the first two items of our new merch line.

Added many visual accents to the interior, including a lot of greenery.

Installed exterior concrete benches to prevent a third car crash!!

Reimagined our exterior signage.

Give the team a breather after our intense summer.

None of these single items were massive shifts, but combined, it feels like we're entering an entirely different universe. Sometimes, we need a reset!

I think about resets often. Some professions have natural, built-in resets. It's one of the reasons I always get jealous of my teacher friends. There's a natural rhythm to their years, which includes intentional resets. Some professions, like mine, feel like one continuous journey with no jumping-off points. Can you relate?

Sometimes, though, we need a reset! This applies to all areas of life, including finances I find that our finances are a reflection of our broader life. When life gets hectic and stressful, so too do our finances. It can feel like too much at times.

The same applies when we're focusing on major financial goals. Saving for a big purchase, getting out of debt, and making investing headway are common examples. When Sarah and I were in the midst of paying off $236,000 of debt (it sucked as bad as you can imagine), we reached a point where we felt beat down. One crappy month ran into the next, and it felt unrelenting. We were making solid progress but were running out of steam. We needed a reset.

We made a controversial decision to pause the debt payoff, save for a trip to Europe, and get away for 10 days. To this day, it was one of the best trips we've ever taken. While, in theory, it slowed our debt payoff progress, it actually sped us up. That reset was exactly what the doctor ordered. We came back with renewed focus and fresh energy.

Are you losing momentum? Do you need a reset? If so, make it happen. It may be exactly what the doctor ordered!

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

A Silent Echo

That's the thing about generosity; it's a silent echo. Whether we see it or not, its impact reverberates through people's lives long after it occurs.

Happy first Saturday of the college football season! Regardless of who your team is (yes, even you, Hawkeye fans), I hope you enjoy your season and make tons of fun memories. In a few hours, my family will pack up the car and drive to Ames to cheer on our Iowa State Cyclones.

Each year, this day reminds me of a beautiful gift my family received from a friend four seasons ago. As the football season was approaching, our friends unexpectedly and generously gifted my family Iowa State season tickets. That year was full of memories, fun, and the infamous Brock Purdy / Breece Hall duo. It was an amazing gift, and one that I will tell people about until the day I die.

A pic from that very first game, four seasons ago.

That's the thing about generosity; it's a silent echo. Whether we see it or not, its impact reverberates through people's lives long after it occurs. The following year, we purchased our own season tickets. Throughout the season, we blessed a handful of families with our tickets. Families that had never been to a college football game before. Families that couldn't afford tickets. Families who, for whatever reason, weren't going to connect all the dots and make it to a game. Each time we gifted our tickets, it was a tribute to our friends who made that original gift. A silent echo.

As this season approached, we cringed as we looked at our calendar. I'll be out of the country for one game. I'll have to miss two other games for speaking engagements. There's also Finn and Pax's basketball games, which are still TBD. Needless to say, it's not looking great to attend Cyclone games this season.

Then, the proverbial lightbulb turned on over our heads. While it was hard to justify buying season tickets when we probably won't make many games, we decided to look at it through a different lens. Knowing our availability is limited, these tickets weren't primarily entertainment; they were generosity. We purchased them largely to bless families. We want people to create their own memories and curate stories that will be shared for years. A silent echo.

One friend buys another friend tickets once, and the silent echo carries for years. There's no telling how many people will ultimately benefit from the impact made back in 2021. Dozens? Hundreds? What about the people that we bless? They may, in turn, be inspired to bless others along their journey as well.

The silent echo is multiplication, not addition. It compounds over time. It's beautiful and powerful. I'm probably more excited to give these tickets away than I am to attend myself (ssshhhhh, don't tell my kids I said that). Knowing that we get to help other people create lifelong memories is one of the greatest blessings we can receive.

Today, though, I'm going to make some memories with my boys. They are beyond excited, and hopefully, the Cyclones will put on a good show. Happy college football Saturday, everyone!

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

You Don’t Have to Justify Fun

She doesn't need to justify fun, and neither do you! Do you ever find yourself trying to justify a purchase you "don't need?" We play this little mind game with ourselves constantly. At the heart of this toxic practice is guilt. Deeply ingrained, culturally driven, self-deprecating guilt. Therefore, we play mental gymnastics with ourselves in order to remove or lessen the guilt.

I was meeting with a client when this came out of her mouth: "I really want to buy a ____, but I need to find a way to justify it."

Me: "You don't have to justify fun!"

Seriously! She doesn't need to justify fun, and neither do you! Do you ever find yourself trying to justify a purchase you "don't need?" We play this little mind game with ourselves constantly. At the heart of this toxic practice is guilt. Deeply ingrained, culturally driven, self-deprecating guilt. Therefore, we play mental gymnastics with ourselves in order to remove or lessen the guilt.

"I'm really stressed out right now, and I haven't been a good friend to Stacy lately, so it's okay if I buy a plane ticket to fly to San Diego to see her."

"I haven't spent much money lately, and I just had a good sales quarter, so I'm going to treat myself and buy this purse."

"I just lost 10 pounds, so I need to go buy a few new pairs of jeans."

"I don't get to see my friends much, so signing up for fantasy football is an investment in my relationships."

From an early age, many of us are made to feel guilty for spending money on things we don't need. Quit spending. Save. Be responsible. Don't waste your money. That's what many of us hear throughout our childhoods. Then, we eventually become adults and are given the car keys to life, and we're surprised when we struggle to spend money on ourselves without guilt, regret, or mental games?

I have a solution to this problem. If something adds at least as much value to your life as it costs you, buy it. Plan for it, allocate the money for it, buy it, and enjoy. No, don't be irresponsible and blow up your goals or other priorities; this isn't about being reckless. Rather, it's about being financially intentional, honest with yourself, and true to your values.

You want to fly to San Diego to visit your friend? Awesome! Put it in your budget and go.

You want to buy a new purse? Excellent! Make it happen.

You want a new pair of jeans? Great! Hop in the car and drive to the mall.

You want to play fantasy football with your boys? Sounds fun! Enjoy bombing your draft.....again.

We must remove the guilt if we want to have a healthy relationship with money. If we can't, we don't control our money.....our money controls us. And that, my friends, is a sign we've already lost the game.

Be intentional. Set your goals. Aggressively pursue them. Be generous along the way. Save responsibly. Serve others well. Live a meaningful life. Oh yeah, and don't justify fun!

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Uncle Joe Wants to Know the Alternative

That brings us to our quandary. If it's possibly true that people prematurely passing away is, in part, caused by a loss of meaning upon retirement, we're kind of stuck between a rock and a hard place.

We have a bit of a quandary on our hands. In yesterday's post, I highlighted the common "coincidence" of people tragically passing away shortly after retiring. In it, I proposed that perhaps we shouldn't underestimate the non-financial value that work provides in our lives, namely meaning and fulfillment.

That brings us to our quandary. If it's possibly true that people prematurely passing away is, in part, caused by a loss of meaning upon retirement, we're kind of stuck between a rock and a hard place.

In one scenario, we just keep working our butts off and never "actually enjoy life" (but at least we stay alive).

In the other scenario, we quit working ASAP so we can squeeze out every ounce of leisure until our limited days are numbered (and hopefully don't become an Uncle Joe).

Those are terrible opposing realities. Or, in the words of an e-mail I received yesterday, "So what am I supposed to do, then? Spend the rest of my life working at this sh**ty job, be too old to actually enjoy myself, and have it all be for nothing?"

I have maximum empathy for people with this quandary-filled perspective. It feels suffocating, like the walls are closing in. Today, I hope to offer a different perspective for my frustrated friend (and maybe for you, too). First, there are a few cultural assumptions embedded in our conundrum:

Work = bad

Not working = good

The sole purpose of work is to earn financial resources.

If 2/3 of our waking hours are spent working, then our working season of life is supposed to suck (but it will be made up for when we retire).

Once we retire, we get those 2/3 of our waking hours back (i.e. not work), thereby finally enjoying life.

With that, here is my proposed reconciliation of this quandary:

ALL seasons of life should be filled with meaning, fulfillment, and joy. Yes, even this week, this month, and this year. You deserve to live with meaning, fulfillment, and joy today, tomorrow, and every day.

Work provides far more meaning and fulfillment than we give it credit for. Whether it's full-time, part-time, or volunteering, work that matters matters. We need to find meaning in our work.....or go find more meaningful work.

Leisure, in and of itself, provides nothing of value. It's only when other components are added to the pot that we canenjoy the taste of leisure. Vacations are awesome because they are vacations. The moment vacations become life, it's just, well, life.

We often view life as too binary. We shouldn't spend decades in a season that's 90%-100% work and 0%-10% leisure, then immediately transition into a season that's 0%-10% work and 90%-100% leisure. Instead, one might consider going from 60/40 to 40/60.

I'll put it another way. Let's create a life worth living today. Then next year, we do the same. 10 years from now, do it again. 30 years from now, ditto. If we're constantly pursuing meaning, we'll find just that: a meaningful life.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

Racing Toward (Untimely) Death?

Everyone has an "Uncle Joe" in their life. Uncle Joe worked his entire adult life. Eventually, Joe was finally able to retire so he could "actually enjoy life." Then, 12 months later, he died.

I had coffee with blog reader Ryan yesterday (yes, this Ryan!). Meeting him and spending time with him filled my tank, for sure! During our discussion, he referenced a comment he made on the webpage last week. It was regarding my sudden wealth syndrome post. Here's what he said:

"Have you heard of the observation from small rural towns that when old farmers retire and move to town, they frequently pass away within 18 months? The medical reasons are varied but the correlation to loss of purpose would seem to be real. When financial independence strikes, don't lose your purpose and meaning."

Yes! Yes! Yes! Ryan for the win.....again. I think about this topic a lot and incorporate this concept into my keynote talk. Here's how I explain it.

Everyone has an "Uncle Joe" in their life. Uncle Joe worked his entire adult life. Eventually, Joe was finally able to retire so he could "actually enjoy life." Then, 12 months later, he died. If Joe had only found a way to retire sooner, he would have actually been able to enjoy his life. Moral of the story: We should race to the finish line, retire as quickly as possible, and start enjoying life (while we use the story of Uncle Joe's coincidental and untimely passing as Exhibit A for the urgency).

What Ryan is alluding to, and what I'd like to someday study, is the possibility that perhaps these tragic and untimely deaths aren't unfortunate coincidences. Perhaps there's more to the story. Maybe, just maybe, our work provides meaning. Maybe, just maybe, we weren't created to live lives of leisure. Maybe, just maybe, in pursuit of "actually enjoying life," we self-sabotage our meaning and fulfillment.

It reminds me of a news story I saw a few years back. An elderly man had just turned 102, and the news anchor was marveling (in a confused sort of way) that this man was still employed at his job. "Have you ever thought about retiring so you can enjoy the fruits of your labor?" I can't remember the man's response, but it was something like (paraphrasing), "I live a wonderful and healthy life. That is the fruit." Mic drop!

Maybe, just maybe, we should stop racing to the finish line.

____

Did someone forward you this post? We're glad you're here! If you'd like to subscribe to The Daily Meaning to receive these posts directly in your inbox (for free!), just CLICK THIS LINK. It only takes 10 seconds.

The Poison Looks Tasty

It's like your friend who goes to the casino. Notice how you only hear about it when they win big? We all know they are probably getting crushed most nights, but if we only hear about those huge payouts, we might start to believe going to the casino is a reliable path to riches.

I inadvertently stumbled into a social media mess. It was a personal finance influencer sharing the story about how they (husband and wife) cashed out their retirement plans about five years ago, ate all the taxes and penalties for doing so, and invested the money into AirBNB properties.

Here's the moral of the story: We got rich doing this, and you can, too!

This, my friends, is THE definition of survivorship bias. I've talked about this subject before, but survivorship bias is the phenomenon where a small group of people who succeeded xyz becomes the the most visible people in the room, thereby communicating (intentionally or not) that their path is a recipe for success. One problem: The people speaking are the few who survived. They are the audible voices on the subject because, well, everyone else crashed and burned and doesn't want to speak of said trainwreck.

It's like your friend who goes to the casino. Notice how you only hear about it when they win big? We all know they are probably getting crushed most nights, but if we only hear about those huge payouts, we might start to believe going to the casino is a reliable path to riches.

I don't fault this couple for sharing their story. It's actually a pretty cool story. However, the post's comments are terrifying. Hundreds of people expressed interest in following a similar path, eager to make their millions.

This couple might have been skilled in their approach, but they also received some tailwinds by, with the benefit of hindsight, getting into the AirBNB game at exactly the right moment. The short-term rental model was gaining steam, interest rates were at all-time lows, real estate prices were reasonable, and they eventually rode the wave of one of the biggest price appreciations we've ever witnessed.

They won! But what about the other people who didn't get it right? The ones who started at a different time, or didn't get the right properties, or stumbled upon crushing issues, or missed on record-low rates, or jumped in after the short-term rental market was saturated?

The book Rich Dad Poor Dad is another wonderful example of survivorship bias. It advocates taking massive financial risks in order to accelerate wealth building. The author's personal testimony shows it works, as do the testimonies of thousands of his loyal followers. What's not visible, though, are the tens of thousands of people who had their lives destroyed by following this advice: the non-survivors. These people played a dangerous game, and lost. Meanwhile, for the maybe 5%-10% that actually survived such rash decisions, their voices speak the loudest (because they are the only ones speaking).

Survivorship bias is everywhere. Unfortunately, it's hard to shake people from its electrifying allure and dangerous consequences.....until it's too late. If you have friends or family members who have stepped into something questionable, I'm sorry. You might not be able to pull them out of it, but you'll be there to help them pick up the eventual pieces.

In the meantime, be mindful of your own decisions. Shiny objects are everywhere!