The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

Adding Plates to the Other Side

My goal wasn't to diminish or demean the role of saving, but rather try to redeem the value and dignity of spending and giving in a culture that ridicules them. I wanted to lift two up, not push one down.

You're at the gym, using a barbell. Maybe you're squatting, or perhaps the bench press. While changing out the weights, you inadvertently add too many plates to one side of the barbell, causing the entire apparatus to become uneven. Things start to become dangerous, and if you're not careful, the whole thing could crash and injure you.

I'm feeling a bit like that today. On the heels of my Leading Kids to (Financial) Hoarding post, I received a ton of positive responses from you all: e-mails, texts, DMs, and even phone calls. Generally speaking, it was a collective "I'm glad someone finally said it." I'm so grateful!

However, I also received some messages on the other side of the ledger. Most notably, from Ryan, my friend I've never actually met...that I should totally meet....that I can't believe I haven't met. I know Ryan as an extremely thoughtful person and always provides constructive feedback. So when I saw his comment, my immediate reaction was, "Uh oh, I think I need to add a plate to the other side of the bar." In an attempt to drive my point home, I think I inadvertently added too many plates to one side of the barbell.

My goal wasn't to diminish or demean the role of saving, but rather try to redeem the value and dignity of spending and giving in a culture that ridicules them. I wanted to lift two up, not push one down.

At the heart of the matter, saving is the art of discipline and delayed gratification. It's one of the simplest, purest, and most tangible forms of it. In other words, it's a tell. If we can practice the art of discipline and delayed gratification with our resources, those characteristics and strengths can translate into virtually every other area of life.

From a more practical perspective, saving is the proactive pursuit of avoiding debt. Take cars, for example. The average new car payment in America now exceeds $700/month. It doesn't take any discipline or delayed gratification to walk into a dealership, sign the loan docs, and walk out with a shiny, new car......and a boatload of debt hanging around your neck. The disciplined and self-sacrificing act of saving, on the other hand, will lead to a significantly better outcome. It journeys us to a place where we have a greater appreciation for our purchases, make different decisions doing so, and won't impair our financial life with expensive and prohibitive payments. This same principle can be applied to virtually every other area of money:

Travel

College

Phones and other technology

Insert your purchase here

Saving is also a protection mechanism for when life kicks back. Saving up sinking funds and an emergency fund can (partially) shield us from many of life's challenges: job losses, medical emergencies, house maintenance, car breakdowns, and a number of unexpected situations.

There are only three things we can do with money: spend, save, and give. Want to know which one is most important?

D: All of the above.

I Wasn't Going to Step Over That Cob

Though it's been nearly a month, I'm still thinking about the "Don't step over cobs looking for cobs" quote from my friend Bobbi. That idea hit me hard, and it's been brewing under the surface of my life ever since. And last night, it came out in a very meaningful way.

Though it's been nearly a month, I'm still thinking about the "Don't step over cobs looking for cobs" quote from my friend Bobbi. That idea hit me hard, and it's been brewing under the surface of my life ever since. And last night, it came out in a very meaningful way.

I had a brutal day at work. It was a great day, and I was honored to serve many people, but I was toasted. I was tired, stressed, and frustrated by a few challenges I encountered along the way. When I got home, I knew I still had a bunch of work in front of me before I went to bed. Overwhelmed is the only word to describe it.

That's when the test hit me. While eating dinner, Pax asked if we could get ice cream, cruise around in the convertible, and jam out to Twenty One Pilots together. Though I had very little left in the tank, I wasn't about to step over that corn cob! We did just that. We grabbed ice cream, ate it while cruising with the convertible top down, and cranked up the new Clancy album to an annoyingly loud volume. It was, is, and will forever be a beautiful memory. Afterward, Finn, Pax, and I spent the next hour geocaching near our house (we found three treasures!).

Showing off their first find, discovered inside a tree.

It's so easy to look past life's "normal" repetitiveness. It's easy to take for granted the ordinary while dreaming about the extraordinary. It's all too common to eagerly anticipate the exotic while wading through the mundane. I could have missed last night's opportunity! In my attempt to see the day through and prepare for the next, I could have stepped over that cob while looking for more cobs. This time, luckily, I didn't.

As I look back at my life, I shudder to think about how many cobs I stepped over while looking for cobs. I was overtaken by life. In my pursuit of success, progress, achievement, money, and whatever else I was chasing earlier in my adult life, I probably missed out on so many opportunities that would have added meaning and richness to my life. If that's not accidental self-sabotage, I don't know what is.

I'm really enjoying the cobs these days, and I hope you are, too!

Leading Kids to (Financial) Hoarding

Do you see a theme? Guilt and shame. Not intentionally, usually. Slowly but surely, we're chipping away at their hearts for spending and generosity. We're trying to help them be "responsible" with money, but what we're really doing is grooming our kids to financially hoard. Get more. Have more. Build wealth. Become "independent.”

"You don't need that."

"Don't waste your money on that thing."

"You shouldn't be giving away so much."

"You need to save better."

"You shouldn't spend on that."

"You need that money more than they do."

These are the comments we make to our kids. Do you see a theme? Guilt and shame. Not intentionally, usually. Slowly but surely, we're chipping away at their hearts for spending and generosity. We're trying to help them be "responsible" with money, but what we're really doing is raising our kids to financially hoard. Get more. Have more. Build wealth. Become "independent."

If I had a nickel for every time a parent approached me and said, "My kid is so good with money. He/she doesn't spend anything. He/she saves everything."......well, I'd have a lot of nickels! See the narrative? Saving is responsible. Saving is THE win. If that's true, anything other than saving is irresponsible.

After twenty years of this narrative repeated over and over, we've created a generation of hoarders.

Like the family that makes $320,000 per year but "can only afford" to give $300/month.

Like the family with $1M in their checking account (yes, checking) that fears having nothing tomorrow.

Like the 60-year-old couple with $7M in their retirement accounts and two jobs they despise, but worry whether they can take care of themselves now and in the future.

Like the young single lady who makes $150,000 per year, but can't emotionally get over the hump to buy herself a pair of jeans.

Like the teenager who works a bunch of hours at his job, but declines invites from his friends to go out to eat on a Friday night, citing he "shouldn't waste money like that."

Like the family who saves $6,000 per month into retirement, but isn't yet able to give. However, once they have $x saved, they will be comfortable enough to start giving.

We parents have groomed our kids to become hoarders through guilt and shame. “Guilt” and “shame,” the two primary feelings expressed by countless adults when discussing their relationship with money. They feel guilt. They feel shame. Then, immediately after using those magic words, they share the comments made to them over the years (especially during their formative kid years). Ouch!

I have good news, though! No, we can't erase our past mistakes (unless you have a Delorean I can borrow!), but we can create a new narrative beginning today. Whatever your kids' age, even if they are adults, it's not too late to begin talking about money through a different lens.

While Sarah and I haven't gotten it all right with our kids, here are the narratives playing under our roof:

We can never be too generous....it's not ours to begin with

Spend money on fun things

Use discipline to save for bigger purchases

Work hard

I hope my kids are irresponsibly generous. I hope they buy fun things and sometimes experience buyer's remorse (it's a good, tough lesson). I hope they show discipline in saving. I hope they develop a strong work ethic. But I pray they don't turn into hoarders.

Our kids deserve better, and we parents have the power to give it to them. You got this!

Excellence Isn’t Optional

I'm a broken record on this one. We business owners don't deserve anyone's support. Instead, we must earn the right to serve someone, then through delivered excellence, re-earn the right to serve them again. And if we've been excellent enough, they might tell someone else about us. Then repeat.

Uh oh, I've opened the floodgates. After repeated blog posts about how business owners shouldn't expect people to "support" them, I now receive multiple messages from readers every week. These messages usually include screenshots or linked posts from businesses in their town, laying on the guilt of "lack of support." The narrative is usually the same (paraphrasing):

Our business is struggling because we've been a victim of several challenges (insert inflation, rent, competition, lack of awareness, and a multitude of other issues here). To top it off, you haven't done a good enough job of supporting us. Because of that, and in the absence of you immediately and heavily supporting us, we might not make it.

I'm a broken record on this one. We business owners don't deserve anyone's support. Instead, we must earn the right to serve someone, then through delivered excellence, re-earn the right to serve them again. And if we've been excellent enough, they might tell someone else about us. Then repeat.

The key word is excellence. Excellence isn't optional. With it, we earn the right to serve people again. Without it, we die. Take all the recent reader messages, for example. You've probably sent me at least 20 examples of this in the past few weeks alone. I know a few of these businesses personally, and I can attest they are anything but excellent. One business, which I know quite well, cited all the challenges they've faced over the last few years. I don't doubt a single one of them. These are common challenges that nearly ALL businesses face. What they didn't mention were all the ways in which they were grossly lacking excellence:

Inconsistent product.

Inconsistent service.

High prices.

Poor location.

Lack of brand identity.

Poor marketing.

Yet, the natural conclusion from their messaging (and the people on social media) was that people need to better support small businesses. Hear that? "Support." Meanwhile, several other small businesses in proximity to this business are absolutely crushing it. Weird how people "support" those small businesses.

The key word isn't "support"—it's "excellence." Excellence isn't optional. People aren't discriminating, lacking care, or turning their backs on small businesses. People expect excellence. Scratch that—they demand excellence.

If you're a business owner, big or small, simply provide excellence. When you do, you'll earn the right to serve people again....and they just might tell a few others in the meantime. The presence of excellence will allow you to thrive, but the absence of excellence will cause you to die. It's a harsh but beautiful reality.

If you're a consumer (and we all are), don't fall for the "support" guilt trap. Demand excellence. Yes, try a new business. Give people a shot. Put them to the test. Give them the right to show you excellence, and hopefully earn the right to serve you again. That's the greatest gift you can give to a business. Give them the opportunity to serve you with excellence, not the other way around.

Suffer Now or Suffer (More) Later

Can we be honest? It's hard to watch our kids learn hard lessons. To watch them suffer, hurt, and face the consequences of their actions. We love our kids, and our instinct is to protect them from pain. With that said, we have two options: watch them suffer when they are young (when we're there to help them navigate and grow), or watch them suffer in adulthood (when the stakes are higher, the consequences steeper, and we're not there to save them).

The majority of how we adults view, perceive, and handle money originated in our childhoods. Whether we like it or not, we are a product of how we were raised. I see how this dynamic has played out in my life, and I've watched it play out in hundreds of people's lives I've had the honor of walking alongside.

Can we be honest? It's hard to watch our kids learn hard lessons. To watch them suffer, hurt, and face the consequences of their actions. We love our kids, and our instinct is to protect them from pain. With that said, we have two options: watch them suffer when they are young (when we're there to help them navigate and grow), or watch them suffer in adulthood (when the stakes are higher, the consequences steeper, and we're not there to save them).

We had one such lesson yesterday. While walking around a shopping center in Branson, MO, Pax found something he really, really, really, really(!!) wanted to buy. However, he didn't have enough money to buy it. This consequence hurt him deeply. He didn't understand why we couldn't just buy it for him, and he felt it was unfair he didn't have enough money. He was livid.

Why didn't he have enough money?

First, he spent other money on things he probably shouldn't have purchased. We try to guide him on some of his purchasing decisions, but ultimately, we must let him fail in this way as well. It's important to get a taste of buyer's remorse when you're young. Kids need to learn about opportunity cost. We can't have everything. For every dollar we spend on one thing, it's one less dollar we have to spend on something else. We need to allow our kids to feel that tension and be forced to make those decisions.

Second, he had less money in the first place. He could have had much more resources, but he repeatedly turned down opportunities to earn. Projects around the house, side jobs, etc. In the moment, not working seemed like a better decision than working......until he realized he needed the money. He immediately regretted not working as much.

Those two factors culminated in a perfect moment of pain for Pax yesterday. He faced the harsh reality that he couldn't afford the one thing he really wanted. It was a fantastic hard lesson, and I was there to console and coach him through it. A few hours later, after he had a chance to think about it, he told me he should probably do more work and asked if I thought he could make enough money to buy this toy soon. "Yeah, bud. We can absolutely make that happen."

This is life. Our kids will face these same challenges for decades, except the stakes will get steeper every step of the way. Whatever their ages, help them learn hard lessons while the consequences are smaller and you're there to walk alongside them. These are some of the best gifts you'll ever give them.

Sobering Reminders

Gratitude is the only word that makes sense to me. When we look at the world through the lens of gratitude, there's no other option than to be positive and optimistic.....even when dealing with immense pain.

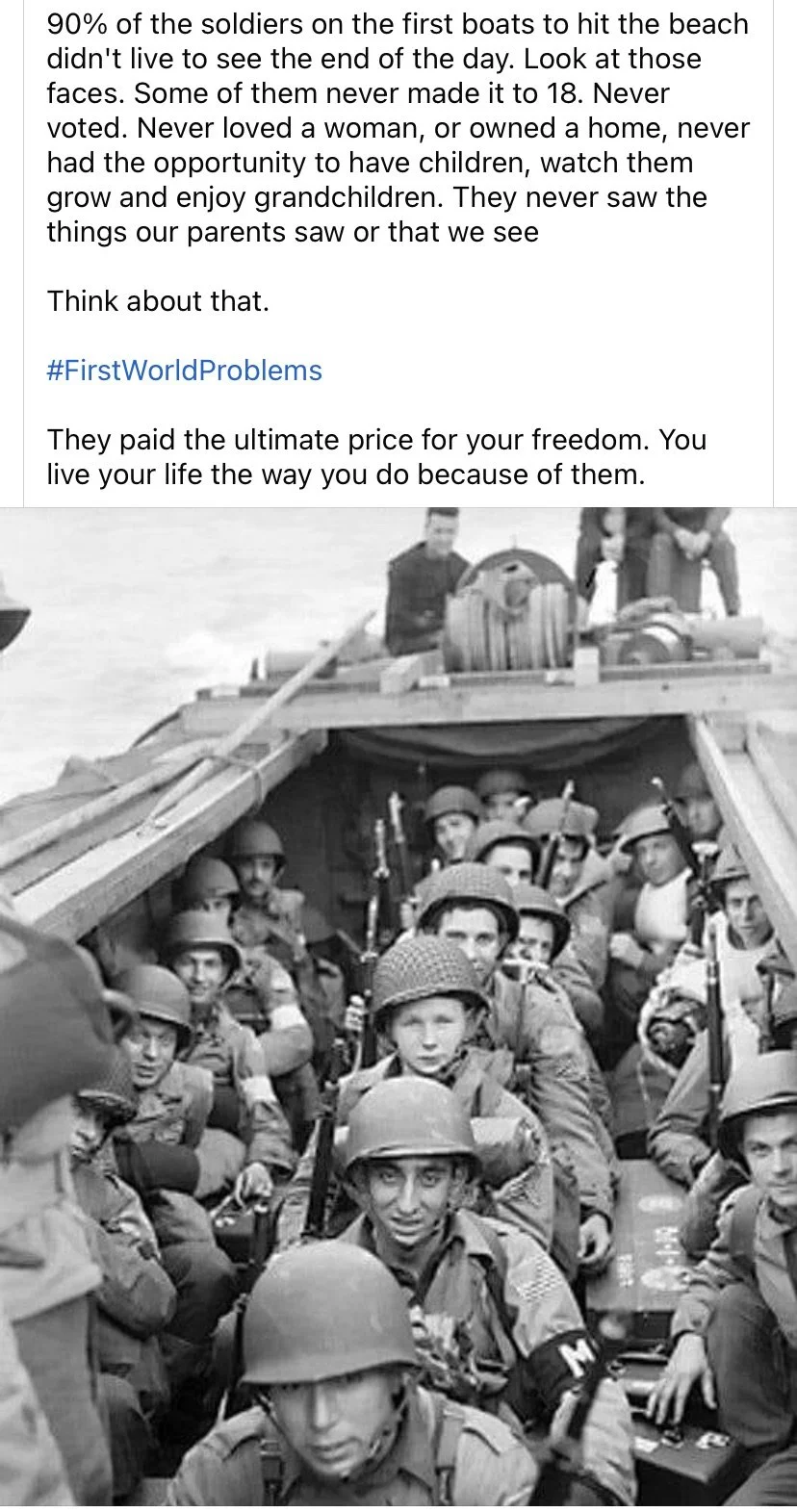

The other day, I was sitting in my chair, pondering all the massive challenges I was simultaneously facing. I was overwhelmed, frustrated, and somewhat paralyzed. It all felt like too much. So I did what any self-sabotager would do: I pulled up social media. I decided to scroll for a few minutes to clear my mind. That's when I (luckily) stumbled upon this:

You know what this is? It's a sobering reminder of how blessed we are. Yeah, I was dealing with some crap that day. But my crap is nothing compared to what so many people have dealt with or are dealing with. Sometimes, we need a stark reminder of where we really stand. The moment I saw this post, it was like someone hit the reset button on me. I realized what I'm dealing with is child's play in the overall scheme of things. Yes, it's difficult. Yes, it's going to be an immense challenge. Yes, it will stretch me. However, I'm so unbelievably blessed. I'm grateful for the courage of those who came before me.

Gratitude is the only word that makes sense to me. When we look at the world through the lens of gratitude, there's no other option than to be positive and optimistic.....even when dealing with immense pain.

Whatever you're dealing with today, I'm sorry. I'm sorry you have this on your shoulders. I know first-hand that some of you are dealing with tremendous strife and turmoil. But you got this. I hope, through all of it, you're able to put your gratitude glasses on and see your situation through those lenses. It's not easy to do, but if you can, it will provide a much-needed jolt of positivity and optimism. I, for one, think you deserve that today.

When the Distraction is the Work

I said hello to the older woman sitting beside me on the flight. We exchanged pleasantries as I was getting my computer situated for the onslaught of work I would soon crush. However, the pleasantries led to a much longer conversation. To summarize, she was traveling for very tragic reasons. Behind that was another tragic story, probably one of the saddest and most intense stories I've ever heard.

I returned home yesterday from a long but productive work trip to Houston. It was an unexpected trip. While at my friend Alex's wedding on Sunday evening, I received a call from my Texas client. After a few minutes of discussion, we decided I would hop on a flight the next day. I'm glad I made the trip, but it was a sudden shift in my work. Admittedly, because of this sudden trip, I didn't do a good job knocking out some of my other responsibilities earlier in the week. I felt terrible about it.

This isn't a pity party or a way for me to justify my failings. Rather, I need to set up what happened next. When I arrived at the airport yesterday, I hurried through security and on to the plane, where the plan was to crush all the work I whiffed on earlier in the week. I had a clear mission and a window to accomplish it. My goal was to serve people through the work I needed to do for them. However, something happened next. I got distracted.

I said hello to the older woman sitting beside me on the flight. We exchanged pleasantries as I was getting my computer situated for the onslaught of work I would soon crush. However, the pleasantries led to a much longer conversation. To summarize, she was traveling for very tragic reasons. Behind that was another tragic story, probably one of the saddest and most intense stories I've ever heard.

The truth is, I think she just needed someone to dump a lot of this on. She was carrying a heavy burden—so heavy, in fact, I don't even know how she was still standing. She needed to offload some of it, and I was that person. We had a wonderful talk, and she walked off the plane in great spirits.

However, I failed at my mission. My goal was to serve people with that time, but I got distracted. I whiffed again. In the middle of the flight, as I was beating myself up, I remembered a story a pastor friend once told me. He talked about how he was trying to get work done one day, but he encountered distraction after distraction. Person after person needed something, and he failed to complete his work. Then, a mentor figure reminded him of something: "The distraction is the work."

Yes, my job yesterday was to serve people. Yes, I got distracted from the tasks I was trying to accomplish. However, that distraction was the work for me yesterday afternoon. That's exactly where I needed to be. I did serve people with that time: her.

Life is funny like that. Often, we're so fixated on trying to do our work that we miss our most important work. I'm grateful my impatience, stubbornness, and narrow focus lost to my compassion yesterday. I did accomplish my work, but just not the work I had planned.

Sometimes, the distraction is the work. I need to remember that, and perhaps you do, too.

The Irony of Debt and Income

Debt DOES discriminate based on income.....but in the opposite way you probably think. This is a dynamic I've seen play out over and over again (and it shocks me every time), but the higher income a family makes, the more likely they are to be crippled by debt. It's tremendously ironic.

I recently posted a few insights from my first 750 professional coaching sessions. I received a lot of positive feedback, but also criticism; the exact criticism I was expecting. To be specific, here's the part that I'm taking heat for:

"Debt does not discriminate based on income. It's not the lack of income that leads us into debt, but rather our decisions."

I knew I was saying something controversial when I wrote it, expecting to receive some pushback. That statement wasn't entirely true, and I knew it wasn't true. Debt DOES discriminate based on income.....but in the opposite way you probably think. This is a dynamic I've seen play out over and over again. The higher the income a family makes, the more likely they are to be crippled by debt. It's tremendously ironic.

First, let's take mortgages out of the equation. People with higher incomes are more likely to live in more expensive houses, which are more likely to have a higher mortgage balance. Let's acknowledge this fact, then throw it out the window.

Cars are another easy target. People with higher incomes typically drive newer and more expensive cars, and most car owners finance their vehicles. This is also too easy. People with higher incomes often have significantly higher car debt (and brutal payments). We'll throw this one out for today, too.

Let's focus on the most controllable and avoidable debt, especially when "being responsible" and having a good income: credit cards. I think we can all agree that carrying a credit card balance is an expensive and unwise endeavor. However, based on my ever-growing experience, the families who make the most money have the most credit card debt. Don't believe me? Let's look at the data.

Based on data recently released by the Federal Reserve Bank of New York and crisply reported by MoneyGeek, here is a breakdown of credit card balances (by household income levels). As you'll see, median and average credit card balances increase as income increases.

I'll synthesize the data and present it this way:

Families with an average household income in the BOTTOM 40% of Americans have a 38% chance of carrying a credit card balance, and are carrying an average balance of $4,250.

Families with an average household income in the TOP 40% of Americans have a 48% chance of carrying a credit card balance, and are carrying an average balance of $9,075.

In other words, families at the top of the income spectrum are 26% more likely to carry a credit card balance than those at the bottom of the income spectrum, and the average balance they carry is more than DOUBLE(!!) the lower income families.

This isn't me throwing a pity party for high earners. It's probably the opposite, in fact. We humans are an interesting breed, aren't we? Which leads me back to the sentence I took so much heat for saying: "It's not the lack of income that leads us into debt, but rather our decisions."

It's that whole human experience thing again. Luckily, you get to be a sample size of one: you. Make the most of your financial opportunities and choose wisely.

Randy Off the Top Rope!

“If you don't have your priorities straight, a job or career change is not going to help. You will just be unhappy in a different place, and it could be with less income and more financial strain.”

I received a message from my friend Randy after a recent blog post about a couple in England who recently made drastic career shifts. Here's what he said:

"If you don't have your priorities straight, a job or career change is not going to help. You will just be unhappy in a different place, and it could be with less income and more financial strain."

Sharp. Sharp, but true. I want to sit on this thought for today. I often get criticized for advocating that people leave their jobs and pursue work that matters. I need to clarify this perspective. I'm not actually advocating for people to leave their jobs as much as I'm advocating for people to simply pursue a life of meaning. Considering 70% of Americans dislike or hate their jobs, and we've collectively been lulled into lives of tolerance (or quiet suffering), my sentiment often seems to point in that direction.

The truth, however, is that my friend Randy is right. Change, for change's sake, provides no long-term meaning, satiation, contentment, or fulfillment. Without truly understanding our priorities or how we define a meaningful life, a career shift isn't the remedy we're looking for.

For many of us, and I think Randy's career testimony would be a perfect representation of this, we're already in meaningful jobs. However, if we're pursuing everyone else's definition of success, status, and winning, we might lose sight of what actually matters to us. I'll give you an example.

One of my clients was discontent with his job. He felt frustrated and bored. He looked around and saw his co-workers being promoted to "more important positions." While he was good at his work, he started feeling like it was beneath him. He was impatient and fidgety. He started waking up every day with a slight dread about his day. In other words, he joined the 70% club. As we started talking about it, however, he realized something. When he was able to set his jealousy of co-workers aside, stop worrying about status, and remember why he took this job in the first place, his perspective shifted. He realized the following:

He was dang good at his job, and used his skills to benefit many people.

He believes in the mission of the organization.

His current role allows him to find a healthy balance between work, marriage, and parenting responsibilities. His lifestyle was exactly what he wanted.

He made a solid income that allowed his family to pay for needs, give sacrificially, afford some fun things/experiences, and save for future wants/needs.

He has many valuable relationships with co-workers and clients alike. He cherishes these relationships.

His office is near his house, offering an amazing commute.

In other words, he was living in misery while working a job that's perfect for him. Because he didn't have his priorities straight, as Randy points out, no change was going to save him. However, after realizing what's truly important, he understands he's truly blessed.

Perspective matters! Clear priorities matter, too!

750 Sessions, Oh My

After accounting for May's meetings, I have conducted 750 coaching sessions since leaving my prior career in 2019. This doesn't include consultations, touchpoints, one-off meetings, or providing insights to non-clients—750 formal coaching sessions with clients. I initially thought that was an error, but nope (!), it's the real deal. So today, I thought it would be appropriate to share with you 10 insights from my first 750 coaching sessions.

I had a wild realization yesterday when meeting with my assistant, Alyssa. We were updating our client tracking spreadsheet when something caught our eye. After accounting for May's meetings, I have conducted 750 coaching sessions since leaving my prior career in 2019. This doesn't include consultations, touchpoints, one-off meetings, or providing insights to non-clients—750 formal coaching sessions with clients. I initially thought that was an error, but nope (!), it's the real deal.

While every family's situation differs, some consistent and common themes repeatedly pop up. This was never more evident than one day when I had back-to-back coaching meetings. The first was with a first-year elementary teacher trying to carve her path into adulthood. The second was with an NFL player who recently signed an eight-figure contract while navigating multiple endorsement opportunities. I think you and I would agree these two individuals live in entirely different worlds. Here's the thing, though. I had nearly the exact same conversation with both of them. That's the wonder of the human experience and our psychological wiring. While life presents differently for each of us, we often experience similar situations, challenges, and obstacles. It's a beautiful and ironic reminder that money is NEVER about money.

So today, I thought it would be appropriate to share with you 10 insights from my first 750 coaching sessions:

Debt does not discriminate based on income. It's not the lack of income that leads us into debt, but rather our decisions. Debt is a trap that's crushing people from every age, race, income, education, profession, and geography.

A family's ability to make progress in any area of life is only limited by their belief in the outcome and their discipline to see it through. Countless people have achieved feats that make my accomplishments look like child's play. Never underestimate the power of someone crazy enough to believe it's possible.

Combining finances in marriage always yields better results. Better financial results. Better relational results. Better alignment of meaning and purpose. Better execution of the plan. I'll die on this hill. Yes, we can do ok with separate finances, but it's like driving a five-speed car and only believing there are three gears. That third gear feels fast if we don't know the fourth and fifth gears exist.

If you pursue money, you might find it. It will be cool and exciting. But if you pursue meaning, you will absolutely find it.....and you'll likely find some money along the way. People who pursue meaning live ridiculously amazing lives. Not easy lives; amazing lives.

A well-executed budget is the gateway to any and every goal you want to accomplish. Once you unlock that, anything is possible.

Work that matters matters. You wear it in your eyes, and it leaks into every aspect of your life, whether you want it to or not.

People are usually doing better than they think, but they have nothing to compare it to other than social media.

Nothing changes lives like joyful and sacrificial generosity. Nothing! And I'm not talking about the recipient....the giver!

You SHOULD spend money on wants, but only those that add value to YOUR life.

Simplify, simplify, simplify. The simpler you make your finances, the more time and energy you can invest in living a meaningful life.

Sorry for the long post today, but it just felt right. Have an amazing day!

Drumming is a “Waste of Resources”

I want to share one particular comment I received from a close-ish friend. This friend is a fellow finance guy. He's brilliant and has carved a name for himself in the world of finance and investing. Here's what he told me, "That whole thing seems like a waste of resources." Oh really? Tell me more.

Holy cow! I'm overwhelmed by the number of texts, calls, e-mails, and comments from yesterday's post about Pax's live drumming debut. I'm beyond grateful for all the kind words. I'll probably package them together and store them away until I'm ready to share them with him when he gets older.

Today, though, I want to share one particular comment I received from a close-ish friend. This friend is a fellow finance guy. He's brilliant and has carved a name for himself in the world of finance and investing. Here's what he told me, "That whole thing seems like a waste of resources." Oh really? Tell me more. He continued explaining that we're getting nothing in return for this expense. Pax won't grow up to be a musician, but in the rare chance he does, he'll be poor. This newfound drumming skill won't lead to a valuable college scholarship. It's a dead-end hobby....no upside. Meanwhile, all the money we are spending on it could be invested and used to "build generational wealth" that can actually help my kids.

This, my friends, is THE reason Meaning Over Money exists. Our finance world (and the culture around it) is impersonal, greedy, materialistic, and selfish. This entire industry is about how to get more, have more, and keep more. It's about dollars and cents. It's cold and calculated. It's a bunch of numbers on a screen, and projections splayed out on a spreadsheet. I love spreadsheets as much as the next financial weirdo, but I'm staunchly against our prevailing culture around finance.

Meaning Over Money is just that: meaning OVER money. In the case of Finn and Pax's musical endeavors (or any other endeavor, for that matter), it's not about getting a return on my investment. For me, it's about allowing my kids the opportunity to explore the world, unearth potential passions, learn who they are, build confidence, create relationships, pursue failure, and accomplish more than they knew they had in them. That's meaning. That's purpose. That's everything.

Please, never allow your finances to become cold and calculated. Don't lose sight of the meaning. Don't forget what's most important. Don't let the money drive you or your decisions. Yes, we need to be responsible with our finances. Yes, we need to ensure our family is taken care of. But don't forget what you're fighting for. You're worth far more than money.

Unearthing Hidden Gems

Yesterday was a weird day. It was Finn and Pax's first rock concert. Yes, rock concert. Having literally zero musical talent, it's odd to see my kids thrive with music. The kids' band played a 9-song set. Finn played the electric guitar, and Pax played the drums. Watching them grow over the last several months has been an odd journey.

Yesterday was a weird day. It was Finn and Pax's first rock concert. Yes, rock concert. Having literally zero musical talent, it's odd to see my kids thrive with music. The kids' band played a 9-song set. Finn played the electric guitar, and Pax played the drums. Watching them grow over the last several months has been an odd journey.

Yesterday marked the 90-day mark since they each picked up their respective instrument. Finn is learning quickly, and it's fun to see him progress. Pax, however, is a different beast. Seeing him drum yesterday was a surreal experience. I kind of knew it was going to happen, but it was crazy to watch it play out in real-time. He absolutely crushed it. He did things I couldn't wrap my head around. Here's a video of one of his songs.

Seriously, I just can't understand how he does what he does. He's only been doing it for three months! The crowd saw it, I saw it, and our family saw it. He unlocked something special, and I'm not even sure he recognizes it.

This is such an amazing testimony of life. Sometimes, we have so much more to offer the world. There are unearthed gems just waiting to be discovered. The kids showed an interest in music, and we decided to give them an opportunity to learn. It could have been a dud, but it appears this thing may have legs.

The truth is, there is only one way to find out. We don't know what we don't know. Now that we are giving it a chance, we're finding out. For whatever reason, I think Pax may have found something amazing for his journey. If he wants to continue it, we're here for it. If not, that's cool, too. We never expected rock band to be a thing, but here we are. We potentially unearthed a gem, and we'll roll with it as it develops.

This is the beautiful part of life. Each of us has unearthed gems waiting to be discovered. We might have found Pax's, but what about yours? One of mine is the coffee business. My partnership with TJ and his Northern Vessel endeavor has changed my life. Another is podcasting. It, too, has significantly altered my life. I never knew until I knew. What else is in store for me? We'll find out! What else is in store you for you? What yet-to-be-found skills or passions await your discovery? I hope we find out! Go find your unearthed gems!

“It IS Possible”

I recently received the most beautiful message from a stranger: "It IS Possible." For a while, that's the only message I saw. You can probably guess the bewilderment I felt when I received that message from a total stranger. Luckily, another message followed.

I recently received the most beautiful message from a stranger: "It IS Possible."

For a while, that's the only message I saw. You can probably guess the bewilderment I felt when I received that message from a total stranger. Luckily, another message followed. It was from a 40-something in England. He is married with two young teens. He explained that he's lived his entire career with the mindset that his primary objective is to provide as much income (and build as much wealth) as possible, and then retire as soon as possible. He was living a normal life, but it felt increasingly intolerable.

Then, he found our Meaning Over Money podcast. He said he connected with some of the stories we shared but thought our meaning over money principles sounded absurd (especially from Americans, whom he stereotypes as materialistic and money-hungry). However, the more he listened, the more he wondered if there was, in fact, a better life for him and his family.

Eventually, he did something drastic. He and his wife took a sharp turn, and both made drastic career shifts. "It was the scariest thing we've ever done. Still is." They elected to buck culture's narrative about work, money, and wealth to pursue something better. Fast forward more than a year, he said their lives have been transformed. They make a little less money, care much less about building wealth, and are leaning hard into work that matters. They also shared how their kids have noticed a shift in their attitudes, demeanor, and marriage. I loved that part, and I'm so grateful they took the time to share this amazing story with me! It IS possible!

Multiple times per week, I'm told that my ideas are far-fetched, naive, impractical, and/or dangerous. While I don't love these comments, I get it. The entire premise of living a meaning over money life is kinda crazy, and significantly counter-cultural. It's a tough pill to swallow to consider these principles may actually produce a rich and meaningful life. Deciding to jump off the hamster wheel of more is one of the scariest things ever. Even if you feel confident in that decision, nearly every area of life will make you doubt yourself. Friends, family, co-workers, movies, music, TV.....everything! I understand the odds are stacked against us here. So when someone reaches out to communicate their recent pursuit of a different kind of life, I celebrate. Just one of those messages can drown out 500 criticisms.

It IS possible to live a rich and meaningful life where you wake up each morning excited about what you're about to do—not because it's fun, but because it matters. A life that you aren't in a hurry to retire from.

If you're living such a life today, this is my virtual fist bump to you. You've already won. I don't care how much money you make, what your title is, or how wealthy you are. You won! If this isn't you, please know it IS possible.

Good Morning, Bob Ross

Hello, Bob Ross! Yes, you! You're an artist, you know. Today is the first of the month, which means you woke up to a blank canvas. Whatever happened last month is gone....it's on that old, messy canvas. My May canvas was a disaster. We had surprise expenses, mishaps, and oversights. We screwed up. I didn't like the painting we ended up with.

Hello, Bob Ross! Yes, you! You're an artist, you know. Today is the first of the month, which means you woke up to a blank canvas. Whatever happened last month is gone....it's on that old, messy canvas. My May canvas was a disaster. We had surprise expenses, mishaps, and oversights. We screwed up. I didn't like the painting we ended up with.

But today? Today we each wake up with a clean, white, beautiful canvas. For the next 30 days, we'll curate a new piece of art. We'll make money, spend money, save money, give money, and invest money. Thousands of transactions and events will slowly paint the canvas, stroke by stroke.

We have two choices today. We can either grab brushes and haphazardly begin tearing across the canvas with reckless abandon, or we can make a plan. Many people attack their clean and beautiful canvas with chaos, reactivity, and urgency, resulting in crazy artwork akin to what my toddlers used to bring home from pre-school. Others will take a few minutes before picking up a brush to determine the objective of this potential masterpiece. Where the trees will go, how fluffy the clouds will be, and where the water meets the horizon. No, it won't be perfect; perfect doesn't exist. But when the painting is complete, it will be beautiful.

Here's my encouragement for you today:

Reflect on what happened last month: the good, the bad, and the ugly. Learn from it. Celebrate the wins and forgive yourself for the losses.

Put the past behind you. You can't drive forward by staring into the rear-view mirror. That's a recipe for a disastrous crash. Eyes forward!

Take 15 minutes to create a plan for your money money. How much is coming in, and from where? What are your needs? What debts need to be paid? How much will you give? Make sure to add some fun in there. Determine which saving initiatives need attention. Make sure every dollar of income has its marching orders. No soldiers left behind. Each is important.

Commit to yourself (and if relevant, your partner) to follow your plan. After all, it's your plan.

Execute with confidence and conviction. Paint that canvas!

Repeat the same process next month.

This money stuff can suck. It can be the source of so much pain, suffering, turmoil, and tension. But if done well, it can also lead to some beautiful places. Perfect, no. Beautiful, yes. Instead of viewing it as dollars and cents, see it as bringing your values, aspirations, and meaning to life. Treat it like a blank canvas, just waiting for a Bob Ross masterpiece to be painted. Your masterpiece.

Driving Value From Our Lives

After some of my recent lamenting about repeated and annoying car maintenance expenses, I had a fun conversation with a buddy. He found entertainment in my recent woes, as he and I have had a years-long back-and-forth about cars. His position, which he happily shared with me in this most recent conversation, is that it's cheaper to buy a newer and more reliable vehicle than the "beaters" I buy.

After some of my recent lamenting about repeated and annoying car maintenance expenses, I had a fun conversation with a buddy. He found entertainment in my recent woes, as he and I have had a years-long back-and-forth about cars. His position, which he happily shared with me in this most recent conversation, is that it's cheaper to buy a newer and more reliable vehicle than the "beaters" I buy. At the heart of his argument is the assertion that any money I save on buying a cheaper car is given right back through my maintenance expenses.

Today, I want to illustrate these contrasting viewpoints with a real-life comparison. We've owned Sarah's Toyota Highlander for approximately 72 months. It was seven years old when we bought it, so it's now 13 years old and has a ton of miles. We paid $15,000 for it, and its private party resale value is approximately $7,000 (according to KBB). That works out to an $8,000 erosion of value, or $111/month. On top of that, we've spent about $9,000 maintaining and fixing it (or $125/month). Adding these two numbers together, this vehicle has cost us approximately $236/month for the last six years.

Now, my friend's scenario. He originally purchased a new SUV almost six years ago. He paid $61,000 for it, and it's worth approximately $28,000 today (KBB private party value). Therefore, his vehicle cost him roughly $458/month over the last six years. This doesn't include maintenance; he said there hasn't been any (not sure I believe that).

Even though we've spent around $9,000 to fix and maintain our vehicle over the years, it cost us roughly half of what it cost him. This $222/month discrepancy equals a $16,000 difference over the six-year period. However, there's also one major component missing here. I can save up and write a $15,000 check to buy a vehicle, but the only way for him to acquire a $61,000 vehicle is to finance it. His $458/month cost doesn't include maintenance OR interest from his loan payments. And it's a big loan! That's opportunity cost. Every month, he's eating those payments instead of using that money for something more meaningful.

The X-factor in all of this is depreciation. Generally speaking, vehicles lose roughly 15% of their value each year. He will lose 15% and I'll lose 15%, but not all 15% losses are created equal. When he purchased his vehicle, he was losing 15% of $61,000 ($9,100 loss in year 1) and I was losing 15% of $15,000 ($2,300 loss in year 1). Those losses add up over time! In the same six-year span, I lost $8,000 of value and he lost $33,000.

Yeah, I've been hit with a bunch of car maintenance expenses recently. But we need to zoom out and see the bigger picture. He lost as much value in his "reliable" vehicle in year 1 as I've spent on maintenance in six years. It's simple math, but it's powerful....and it changes everything.

Cars are important, but they shouldn't impair or impede other aspects of life that are far more meaningful.

Just Move One Piece

With as complicated as our finances can become, there are a lot of moving pieces. Sometimes, families feel the need to adjust every number every month. They try to focus on all the categories and prioritize everything, then get overwhelmed. Instead, I encourage people to "just move one piece."

Finn recently decided to be a chess player. It was an unexpected development in our household, but I dig it. I'm not good at chess, but it's fun to compete with him and watch his little brain work. In the first few games, I had to remind him, "just move one piece." You move one, I move one.

With as complicated as our finances can become, there are a lot of moving pieces. Sometimes, families feel the need to adjust every number every month. They try to focus on all the categories and prioritize everything, then get overwhelmed. Instead, I encourage people to "just move one piece." If there are one or two categories that we need to get better control of, focus more dollars to, or gain more intentionality on, put your energy there.

We shouldn't try to do everything. If we can hone in on one or two things this month, then maybe we can grab another next month. Music lessons and cell phone replacements are two categories for us. After a trial run for drum and electric guitar lessons for the kids, it's time for Sarah and I to build that expense into our budget for the foreseeable future. That's a priority for us, and we need to create margin and consistency with it.

Second, Sarah's phone is in hospice care. We need to make quick decisions, or she'll be living in 1994 again. Therefore, we'll lean hard into this category and find a way to replace her phone quickly.

It's the power of the just moving one (or two) piece(s). We can't move the needle on every goal, every category, and every habit. But we can move the needle on a few, then next time a few more, then eventually a few more.

As one more visual, let's say you have five different priorities, each costing $500. Let's also pretend you have $500 of monthly discretionary income after all needs, wants, and giving have been accounted for. If you prioritize them equally and try to do everything at once, you'll contribute $100 to each of them. At that pace, it will take five months to achieve a win. On the flip side, if you decide to prioritize just one (and contribute all $500 to it), you accomplish a goal in the first month. If you do the same in the second month, you achieve another goal. Constant momentum.

Many financial situations in our lives involve this principle. If we just move one piece, we can move the needle quickly while gaining confidence from the wins.

The new month is quickly approaching. What one (or two) piece(s) will you move?

The Claws Tighten

The claws of status! I introduced yesterday's post by vaguely teasing my experience in KC, which triggered my introspection about status. Instead of sharing about what actually happened, I invited you to take a look in the mirror and conduct your own introspection about where status might have its claws in you. Thank you very much for the feedback. Your answers proved one major point I wanted to make. We all have our own. Here are yours……

I introduced yesterday's post by vaguely teasing an experience in KC, which triggered my introspection about status. Instead of sharing about what actually happened, I invited you to take a look in the mirror and conduct your own introspection about where status might have its claws in you. Thank you very much for the feedback. Your answers proved one major point I wanted to make. We all have our own. Here are yours:

Income

Job Title

Golf handicap

How grandkids are doing

How many grandkids you have

The boards you sit on

The neighborhood or town you live in

Clothes

What age you get to retire

Country club membership

The make and model of the car you drive

The restaurants you frequent

The vacations you take

How much time you get off from work

What careers your kids have

What colleges your kids go to

The notoriety of your business

The house you live in

The activities and teams your kids participate in

The success of your favorite sports team

The watches you wear

The beauty treatments you regularly get

How noble your chosen career is

That's quite the list! Indeed, each of these is a form of status that has the potential to get its claws in us.

Now, my story. While driving with my family in KC, we weren't far from my old house. It's the first house I owned, which I lived in from age 26-28 (until my company shut down and I experienced an involuntary relocation to Iowa). I thought it would be fun to take the kids to see the house where their dad lived when he was a young adult.

As we approached the house, I was flooded with nostalgia. Lots of memories danced through my head. That's also the moment I realized how much houses used to be my status symbol. When I purchased that house, it was bigger, newer, and nicer than I probably should have bought. It was pretty sweet. It was a great house, and still is (from the looks of it). I cared an awful lot about what that house said about me. It was my status. The claws of status tightened and caused me to make questionable choices in the pursuit of that status....and would for years to come.

Here's the irony. 15 years later, more accomplished and financially sound, I'm living in a house that’s inferior to the one I bought when I was 26. I've overcome the claws of status!

Or have I? The truth is, I don't think I have. In the past few years, I've realized that I still unhealthily find status in my house. While I'm cool living nearly anywhere, I recognize that I don't enjoy hosting people in my current house. Why? Status, most likely. Or perhaps more daily, the lack of status of my house. I find worth and status in my residence, which is a toxic trait. I'm grateful I can make practical and wise decisions around housing now, and I’m so glad we live where we live, but it bugs me that the claws of status are still tight. I'm disappointed in myself, but now I know what room in my mind must be cleaned next.

As G.I. Joe taught me as a kid, "And knowing is half the battle."

The Claws of Status

I just returned from a quick 24-hour trip to KC to celebrate my niece's 13th birthday. I took the 350Z and made a little convertible road trip out of it. It was an exhausting but fun little adventure. Yesterday, I had an experience that triggered today’s topic. I'm not going to share the exact story yet, as I want you to think about the topic through your own lens first.

Here's the idea I was pondering on my drive home last night: Our human pursuit of status is like an animal getting its claws into us. Once it takes hold—even just slightly—its natural instinct is to clamp down harder.

The crazy thing about status, though, is that each of us uses a different version of it to define success. Status comes in all shapes and sizes. Power, income, possessions, influence.....this list is endless. We don't all succumb to all of them, but rather there are likely one or two that are particularly alluring for you.

What makes status a unique feature in our lives is that it is extrinsic. In other words, it's present on the outside. Status is something that other people know we have. It's a signal. It's a means for comparison. It's a way that I can exhibit to you that I am ________. That blank represents how I want you to feel about me.

In a world of apples, oranges, and bananas, status is our simplified way of creating apples-to-apples comparisons between us and someone else. It's the measuring stick of something we want to be measured. It's a scorecard to determine who is winning the game.

So, before I delve into my story and my own thoughts on status and how it's situated in my own life, I have a question for you today. If you could put your finger on it, what is something that did or does give you status? Is there something particular that has its claws in you? If you're honest with yourself, do you find yourself pursuing a certain piece of status in your own journey? If so, can you please reply to this e-mail or drop a comment on the website? I'd love to hear your feedback. I'm not here to judge. I'm just as imperfect as anyone. What I'm looking for is sincerity and transparency, and that's what I offer to you in return. Tomorrow's post will be a follow-up piece, including some of your feedback.

Have a great day!

Side note: I'll be giving a message to a young adult group at a local church tonight. I'm going somewhere I've never gone in a public talk before (content-wise), so please keep me in your prayers as I try to deliver it crisply and confidently. I'll elaborate more about it on the blog soon!

One At a Time

At that moment, I triggered my motto, which I find helpful when these anxious feelings creep in: "One at a time." I can't categorize 68 transactions at once, but I can categorize one....then one.....then one.

Yesterday, I faced the same challenge many of my clients regularly encounter. After a few weeks of travel, sickness, and the Northern Vessel car crash sequel, my personal finances have taken a back seat to life. This is a natural consequence when life gets busy. It's not a matter of if, but when. Life WILL get crazy, and when it does, our finances may be a temporary victim.

Upon finally having a little spare time on my hands yesterday, I popped open my budgeting app to see what things looked like. Much to my despair, I was met with 68 uncategorized transactions. Crap! Few things cause anxiety and overwhelmingness quite like realizing you've fallen that far behind on tracking your finances.

At that moment, I triggered my motto, which I find helpful when these anxious feelings creep in: "One at a time." I can't categorize 68 transactions at once, but I can categorize one....then one.....then one. Here's how my brain works when starting my one-at-a-time process:

First, I start with the most recent transactions, as they are most likely fresh in my mind. I quickly categorize each item that's immediately familiar.

Second, I scan the transactions for vendors that are obvious categories. MidAmerican Energy is electricity. PureBarre is Sarah's fitness. Leaning Tower Pizza is dining out. Simple and clear.

Third, I choose a vendor that has multiple transactions popping up, and systemmatically knock out each transaction. Amazon is a great example. I had about a half dozen Amazon transactions. I logged into my Amazon account, scrolled through my recent orders (to determine what categories each transaction entailed), and categorized each transaction accordingly. I repeated this process for Target and Wal-Mart transactions by using their respective apps.

Fourth, after working through the first three steps above, my unallocated transactions shrunk from 68 to 15. These remaining transactions take a bit more work. They may involve a quick conversation with Sarah, an e-mail search for receipts, or logging into my bank account to see if there's an expanded transaction description. These are never fun, but it's a lot easier when there are only a handful of them.

One at a time. This is such an important perspective when dealing with our finances. Things can get complex and overwhelming. It's the nature of money and numbers, which is why so many people flounder or just give up. But when we take a one-at-a-time approach, nothing is overly intimidating. Just keep moving forward. Sure, we'd love to be sprinting every step of the way.....but even a crawl is still progress. Putting one foot in front of the other.

Apply this to all areas of money—heck, apply it to all areas of life! Break things down into digestible chunks. Make it approachable. Create opportunities for small wins. Execute. Repeat.

It feels good to get caught up on my budget tracking and again have clarity on where we stand. I'm sure I'll get derailed again at some point, but when I do, one at a time!

Can’t Have the Good Without the Bad

Do you ever wish you could just wave a magic wand and get rid of all the junk that's bringing you down? The frustrations, pain, suffering, failures, and setbacks. Life would be so much easier if we could just remove the crap. Unfortunately, it's a package deal. We HAVE to take the bad with the good. It's all part of the deal. To take it a step further, we can't have the good without the bad. Without the bad, the good isn't good. The challenge is what makes the good so much sweeter.

Do you ever wish you could just wave a magic wand and get rid of all the junk that's bringing you down? The frustrations, pain, suffering, failures, and setbacks. Life would be so much easier if we could just remove the crap. Unfortunately, it's a package deal. We HAVE to take the bad with the good. It's all part of the deal. To take it a step further, we can't have the good without the bad. Without the bad, the good isn't good. The challenge is what makes the good so much sweeter.

If you've been following along this week, we've recently had a mess of a time with Northern Vessel. The second car crash into our shop in nine months is a gut punch like no other. Further, the story behind what actually happened is getting weirder and more unsavory as the pieces come together. I still can't share details, but I will as soon as we're able. Needless to say, we're faced with monumental challenges as we work to rebuild our space, serve our customers, and ensure our team is healthy and taken care of. A big piece of me wishes I could wave my magic wand and just undo this part of our life.

On the flip side, the good is so good. We're in a rhythm that's hard to explain. Yes, the closure of our shop hurts. We've only two months removed from having reconstruction completed from the last crash. We're finally into the groove we've always wanted......then crash! However, we aren't defined by our setbacks and the incident that recently occurred. We've been able to fulfill our obligations to LifeTime Fitness, which carries our products in the Des Moines location. Yesterday was also our weekly farmer's market. We've spent the past three weeks growing, learning, and tweaking, culminating in yesterday's affair. After watching it all beautifully come together, we sold 100 gallons of our signature oat milk cold brew latte in just over four hours. We ran out of product with about 40 minutes remaining in the market. More than 1,200 people. Nearly 5 coffees a minute for 4+ hours. The team was locked in, the lines flowed, and the vibe was right.

Despite all the pain and suffering, it was beautiful. We can't have the good without the bad. It's a package deal. As I've spent my last week working through so many challenges in my life and businesses, I repeatedly wanted to wave my magic wand. But then, I catch myself. These are the challenges that make it all worth it.

I think back to the $236,000 of debt I used to have. That was painful, but the beauty of working through it was so satisfying.

I think back to my 20-year career and all the ups and downs. Some of it was painful, but that only adds to the beauty of where it's come.

I think about all my clients who are fighting their own battles. I don't want to wave my magic wand to make their struggles go away. Doing so would rob them of the beauty of what's about to happen.

We can't have the good without the bad.