The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

Smooth Out Your Lumpy Stuff

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses.

A few days ago, I wrote about my recent car maintenance frustrations. It was a bit unexpected, but I received a wave of messages from people asking for more insight on how to execute this concept.

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses. The goal is to smooth out the lumpy by slowly and steadily funding them over time, eliminating (or significantly reducing) the stress experienced when situations arise. Common sinking fund categories include car, house, travel, medical, giving, and kid activities. Each of these categories has a habit of sneaking up on us. When they do, these sudden and unexpected expenses sabotage our disposable income.....zapping our ability to make progress in other areas.

Here's a step-by-step of the mechanics:

Set up a separate savings/checking account for your desired category and name it accordingly. Most credit unions will let you set up multiple accounts, but most banks won't (with the exception of Wells Fargo). If your bank doesn't, I recommend CapitalOne's 360 Performance Savings.

Allocate money in your budget for this category. The amount can be steady or vary by month, but it must be included in the budget.

Just like you pay your electric bill, you pay your sinking fund. Whatever dollar amount you budget gets transferred to the sinking fund. I prefer to automate these transactions.

When expenses arise for a particular sinking fund category, use your primary checking account to pay the expense.

Immediately after paying for the expense, instruct your sinking fund to send that amount back to your checking account, essentially reimbursing your checking account from the sinking fund.

Repeat.

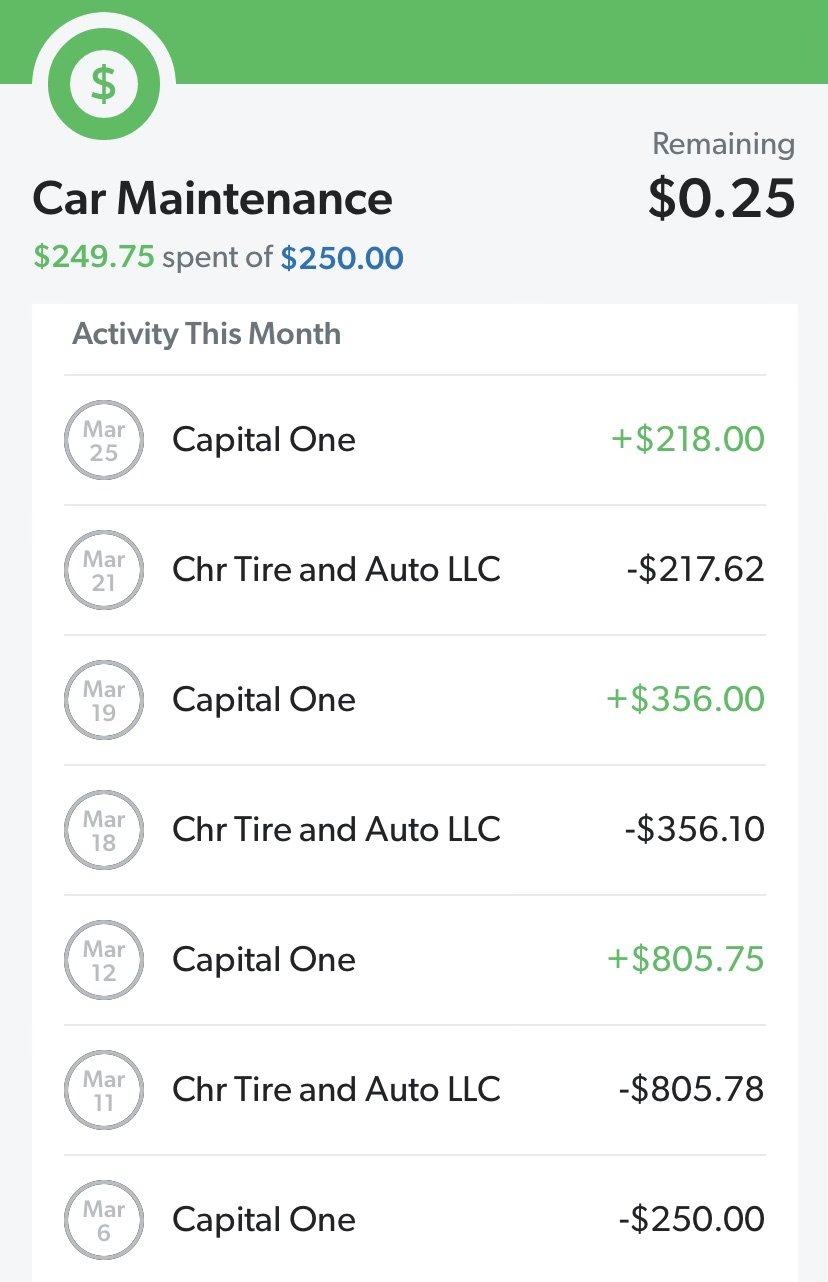

I'll share an example of my car fund from this month. For 19 years, I've budgeted (and automated) a monthly transfer from my primary checking account into my car fund. We currently budget $250/month. After March's $250 contribution (completed on 3/6), our car fund balance was $2,487. Then, we got hit with a hat trick of car bills: $806 for brakes on my main car, $356 for known issues with my new car, and $218 for the unknown issue with my new car. I budgeted $250, but got hit with $1,380 of actual expenses.....ouch! This situation would have crushed our budget had we not had a sinking fund. Instead, I simply reimbursed my checking account from my car fund for each, resulting in a total monthly car fund expense of $250 (the original planned contribution). It took something extremely lumpy and made it smooth. It went from a potential disaster to a minor inconvenience. Below is an image of how we executed it in our budget.

Setting up these extra accounts and steps may appear to make things more complex, but you'll quickly see how truly simplifying (and freeing) it can be! Best of luck smoothing out your lumpy stuff!

Catch That Breather

Warning: I'm about to share some financial advice that will deeply offend some financial people. If you're still reading this, you've been warned. I take no responsibility for any level of annoyance or disgust you're about to experience.

Warning: I'm about to share some financial advice that will deeply offend some financial people.

If you're still reading this, you've been warned. I take no responsibility for any level of annoyance or disgust you're about to experience.

I recently met with a couple in the middle of a butt-kicking financial journey. They got themselves into a pretty deep hole, and now they're digging out. It's been a slog of an endeavor, but they're making fantastic progress. However, they are flat-out tired. I can see it in their eyes. It's the financial version of seeing a basketball hunched over during a dead ball, clutching his shorts and panting heavily. You can clearly see the tank is empty. They've left everything they had on the court. That's this couple!

Anyway, I could sense they were about ready to break (which is a terrible outcome!). Therefore, I took extreme measures in our last meeting. I encouraged them to stop paying debt next month. Yes, completely stop. No debt payoffs, no saving, no investing.....nothing "responsible." Instead, aside from their needs, minimum debt payments, and giving, they will use ALL of their extra income for "irresponsible" things. Dining out, travel, personal spending, and maybe a few fun things for their house. Totally irresponsible!

Three powerful things will happen when they follow through with this ridiculous-sounding plan:

They will get a much-needed break. They are exhausted, and this one-month progress break will be the equivalent of a coach giving their star player a short breather. This break will give them the energy to get back on the court and finish the game strong.

They will experience first-hand that it was not wants that hurt them in the past, but a lack of intentionality. On the flip side, when they experience a month chock-full of fun want spending while simultaneously keeping the financial train on track, it will show them that wants aren't the problem. It's all about intentionality. This experience will change them!

These things won't inherently make them happy. They will be fun, but they won't move the satisfaction needle as much as those progress months do. This will further embolden them to get back on the court and take care of business once and for all.

"Irresponsible" spending only. No progress. No wise moves. No debt payoffs. No saving. No investing. Just fun things. Just because. This is the break they need. This is just what the doctor ordered to propel them to that next level.

If you can relate to this couple, perhaps you need a break. Maybe you need to catch that breather. It's ok if you do. Even Jordan needed one every now and then.

The Tension Brings Clarity

When we refuse to use debt to purchase vehicles, it creates a very palpable tension. It's hard to save a big chunk of money for vehicles. It's a long, thankless, and often unrewarding task. That's precisely the point, though. That process brings with it a tension that must be reckoned with.

I had a fun e-mail exchange with a friend regarding my recent car-related posts. He shared how "liberating" life has been since becoming debt-free four years ago. However, his next comment is what got me. Since he was a new and now-committed member of the debt-free club, buying a truck would be a different experience. This now meant he "could not even consider" buying a truck without having the cash in hand. This changes everything! He added that while he had the cash to buy whatever truck he wanted (impressive move!), he ultimately decided to spend $10,000 less on his purchase (humble move!).

When we refuse to use debt to purchase vehicles, it creates a very palpable tension. It's hard to save a big chunk of money for vehicles. It's a long, thankless, and often unrewarding task. That's precisely the point, though. That process brings with it a tension that must be reckoned with. When it's finally time to pull the trigger on that new ride, we're faced with the reality of parting ways with so much of our hard-earned cash. That tension is brutal...and the cost high!

That tension also brings clarity. To explain this dynamic, I'll use the opposite example. Let's say my friend was truck shopping with the intent of using debt (you know, the normal way). He finds what he's looking for, falls in love with it, and needs to make a decision. He has two options in front of him: a $40,000 truck and a $50,000 truck (I made those prices up). The $50,000 truck is clearly better. It has all the bells and whistles....and a bigger engine! After doing the math, he realizes the $50,000 vehicle will "only" cost him $150/month more than the other. Considering that the $50,000 vehicle is superior and he likes it more, $150/month seems like an absolute no-brainer! See, there's no tension in the decision-making process. It's a number on a piece of paper. $150. That's not a needle-mover in many people's lives. We won't talk about the fact it's $150/month for the next 84 months.....that's for future him to worry about. Current him gets the nice truck right now!!! Again, no tension.

On the other hand, he's living in a new reality where debt is not an option. He has the same decision in front of him: buy the $40,000 or $50,000 truck. This time, however, there's a difference. Since he's writing a check no matter what vehicle he buys, he's faced with the proposition of trading an extra $10,000 of his hard-earned money for the nicer truck. It's ok if he chooses that one, but he will immediately have $10,000 less in his bank account. There's the tension!

The tension brings clarity. When faced with that tension, we almost always make better, clearer decisions. He knew exactly what he was getting, exactly what he was paying for it, and would face the consequences immediately. Tension and clarity!

He clearly and confidently chose the $10,000 cheaper option. That tension is a beautiful thing.

Pot, Meet Kettle

After learning about my recent 2006 Nissan 350Z purchase, my friend shared his less-than-savory opinion about it. Specifically, he called it a "boujee move" and added, "It's a bad look for you, Travis." Translation: I'm a hypocrite for buying such a fancy luxury, and it feels a bit over the top.

Today, I have the pleasure of sharing a funny (to me) story from a recent conversation with a buddy. Fortunately for you, he gave me his blessing to share it. I appreciate that he doesn't take himself too seriously.

After learning about my recent 2006 Nissan 350Z purchase, my friend shared his less-than-savory opinion about it. Specifically, he called it a "boujee move" and added, "It's a bad look for you, Travis." Translation: I'm a hypocrite for buying such a fancy luxury, and it feels a bit over the top.

These comments were the most pot-calling-the-kettle-black moments of my year. Why? This guy can out-boujee anyone. Here's the thing, though. Most people who are boujee don't know they are boujee. In his mind, he lives a bare-bones lifestyle. He only buys things he "needs." You know, like new luxury vehicles (gotta have reliable transportation!), mini-mansions (good school districts are key!), a stylish wardrobe (dress to impress!), and country club memberships (it's networking!). Need, need, need, and need.

On the other hand, my extra car is a boujee waste of money, according to him. He even went a step further and called it "irresponsible." This is where the conversation took a turn for the hilarous, and why I wanted to write about it. As we debated whether this 350Z was boujee, I pointed out that my family's three cars, combined, are worth less than half of his truck. He drives a $60,000 truck, and our three vehicles are worth a combined $25,000! Further, his truck payment is $1,400/month, and we haven't made a vehicle payment in 12 years.

Do you see the irony here? This is how we get so twisted up in our culture when it comes to money, stuff, and status. He sincerely believes he's living a conservative, responsible life. Meanwhile, he truly believes I made a "boujee move" with this car.

This is one of the many reasons I never use other people to measure my decisions. Our culture is pervasive, and its impacts are contagious. Instead, I will continue to lean into meaning every step of the way while wholeheartedly bucking the societal trends and pressures of what we're supposed to do. I hope you find your own unique ways to do the same. Don't worry about what others think. Stay true to your path and lean into your values. You will most certainly screw up along the way, but you'll do so while going in the right direction.....your direction.

The 17-Year Wait

It's 2007. I am out to breakfast with my new-ish girlfriend (now wife), Sarah. I'm decently arrogant, think I have life figured out, and most certainly want to impress this girl. I start sharing how I'm planning to buy a new car. It's a 2006 Nissan 350Z. It's a convertible stick-shift, of course. It also has a $40,000 price tag.

It's 2007. I am out to breakfast with my new-ish girlfriend (now wife), Sarah. I'm decently arrogant, think I have life figured out, and most certainly want to impress this girl. I start sharing how I'm planning to buy a new car. It's a 2006 Nissan 350Z. It's a convertible stick-shift, of course. It also has a $40,000 price tag.

However, instead of looking impressed and excited, my girlfriend's eyes looked dead. She sat quietly for the longest time, then chimed in, "So I guess you don't see me in your future." What!?!?!?

First, it's not Sarah's personality to say something this direct and this harsh. Second, how could she not be excited about this? It's a convertible stick-shift!!! She explained that it seemed like an irresponsible move, ripe with arrogance, served with a side dish of caring about what others thought about me. Ouch! Needless to say, I didn't buy the car. She was right, I was wrong, and a rational decision was made.

Ever since then, I wanted to buy a fun car like that. But life happens, and we've made sure to prioritize the things that need to be prioritized. However, Sarah has been adamant that we would one day buy a fun car. It morphed over time, though. I didn't just want any car. I wanted that exact car. I wanted to hold on to that original vision and be content with that same dream.

There were a few times when we almost pulled the trigger. We were about to buy one in 2016, but then received a phone call about a few babies who would soon (two days later!) become part of the Shelton family. The car got put on the back burner. We were about to buy one in 2019, but I left my career, and our family took a 90% pay cut. The car got put on the back burner again.

Fast forward to 2024. I've been casually looking at cars, but I haven't really seen anything that fits the bill. Then, during a recent trip to Texas, I curiously decided to see if anything was available in that market. There was just one......so I scheduled a test drive. Fast forward 24 hours, and I am the proud owner of the very car I wanted 17 years ago! It's a 2006 Nissan 350Z (convertible stick-shift, of course) with 70,000 miles. $9,000! It's far from perfect. It's endured a lot of bruises and scars over the past 18 years, but then again, so have I. I canceled my flight home and made the 15-hour road trip in my new ride.

Delayed gratification sucks. We want what we want, and we want it now.

Me buying a $40,000 car at age 26 is the equivalent of a 26-year-old today purchasing a $65,000 car. It would have crushed me! Instead, I paid just $9,000 for a vehicle I can truly appreciate.....and share with people around me. As much as I'm excited to drive it, I'm equally excited for others to enjoy it. The 17-year wait was so, so worth it!

Actually, delayed gratification is awesome.

Wants Are Not Waste

Instead of lumping things into a need bucket or a want bucket, I think we should take a different approach. I'd prefer we categorize them based on adding value to our life and not adding value to our life. Some of my "needs" don't necessarily add value, but some "wants" add tremendous value.

As I was scrolling through social media a few days ago, I stumbled upon a post by Dave Ramsey. Whenever I see something posted by Dave or anyone on his team, there's a 50/50 chance I'll disagree with it. On one hand, no human in history has helped more people out of debt than him. For that, sincere props. That's amazing work. On the other hand, he has many perspectives that I flat-out disagree with. This post, though, frustrated me to a different level.

"How to waste $5,000 a year: Spend $13.70 a day on things you don't need."

Did you catch it? Did you notice it? At the heart of the message is an appeal for people to harness their income for good. Or as I like to say, gain awareness, gain control, and gain traction. These are inherently good things. Take responsibility. Have ownership. Be disciplined. Yes, yes, and yes. But there's something else in there.....

"How to WASTE $5,000 a year: Spend $13.70 a day on things you DON'T NEED."

In other words, spending money on things you don't need (i.e. wants) is wasteful. Now, Dave isn't alone in expressing this sentiment. This is the perspective of much of our culture….and I find it utterly toxic. Despite the prevailing narrative that today's young people are out recklessly and irresponsibly spending money, a significant portion of our population has been conditioned into feeling deep guilt and shame when spending money on things they "don't need."

Then, there's the blurring of the lines between need and want. In order to justify spending and remove guilt, people will twist wants into needs. Here's an example. I need a car. I need a reliable car. I need something big enough to transport my family. So I'll use those very real needs to justify buying a $75,000 luxury SUV. On the flip side, I'd argue some wants are actually needs. Personal spending is a great example. What we use our personal spending money to buy are definitely wants. A drink with a friend. Lunch at a fun restaurant. A new video game. Want, want, and want. But in the decision to spend that money is a release valve. It allows us to be human and enjoy a little bit of what we're blessed with. I'd argue that's a need.

Instead of lumping things into a need bucket or a want bucket, I think we should take a different approach. I'd prefer we categorize them based on adding value to our life and not adding value to our life. Some of my "needs" don't necessarily add value, but some "wants" add tremendous value.

When we look at purchases through the lens of adding value to our lives, we're less likely to justify bad decisions or feel guilt. Instead, we get to make an honest and self-aware decision and then go about living our meaningful lives. In my opinion, that's meaning over money.

Focusing on Margin

There are many metrics we can use as a scorecard for money. Income, bank account balances, and net worth are all tremendously popular statistics to monitor. They each have their merit, for sure. Today, I'd like to shine a light on one that gets overlooked, underappreciated, and dismissed: Margin.

There are many metrics we can use as a scorecard for money. Income, bank account balances, and net worth are all tremendously popular statistics to monitor. They each have their merit, for sure. Today, I'd like to shine a light on one that gets overlooked, underappreciated, and dismissed: Margin. In short, margin is the gap between our take-home income and how much of it is committed to expenses. Here's a simple example. If you make $1,000 and have $700 of expenses, your margin is $300.

Margin provides us with flexibility, relief, cushion, and opportunities, It makes sense if you think about it. If all of your income is committed to expenses, it's a stressful place to be. There's no wiggle room. There's no margin for error. There's no room for unforeseen expenses.

Margin is a choice, but it takes intentionality. Without intentionality, any margin in our lives can quickly be absorbed by impulsive purchases, lifestyle creep, and misaligned spending. Also, I'd like to squash one myth. Most people believe income equals margin. More money, more margin. While this can be true, it has a much lower correlation than you would imagine. The more money a family makes, the higher potential for margin. On the flip side, our culture encourages us to fill our margin gap with any and every type of expense. I'll share a recent example from my coaching.

Here are two couples I've recently worked with. Both are similar in age, and each has one small child. They also happen to live within one mile of each other. Here's what each of their situations look like:

Couple 1: This couple has a monthly take-home income of $14,000 (one spouse is in finance, and the other stays home with their child). After accounting for all their monthly commitments, they only have about $700 of margin. They want to pay off debt, travel, invest in retirement, and save for their children's college, but there isn't a lot of margin to work with. Further, an unexpected expense always seems to pop up to claim that $700. Their marriage is strained, and money causes them a lot of fights.

Couple 2: This couple has a monthly take-home income of $6,500 (one spouse is a teacher, and the other is in ministry). After accounting for all their monthly commitments, they have about $2,500 of margin. Our coaching meetings typically include a visual mapping and prioritization of how this margin should be used. It's normally a combination of travel, giving, and investing. Money has become a fun conversation in their marriage, and they are thriving. They feel very little financial stress, which becomes progressively lessened as they use their margin to create a solid foundation.

On the surface, the first couple looks significantly better. Their jobs obviously provide a higher income, their lifestyle portrays an image of success, and they appear wealthy. Looks can be deceiving. Margin is a great measuring stick to see the real truth.

Let Splurges Remain Splurges

I was working at a client site earlier this week when I was struck with a dilemma. Not an earth-shattering, life-altering dilemma. Just a normal everyday sort of dilemma. Due to some logistical snags to start the day, I didn't bring my lunch. Most days, Sarah generously makes me a lunch that I either take on my way out the door, or swing home to grab when time allows. On this day, however, I didn't have lunch and was about 15 miles from home. Thus, the dilemma.

I had a few options available. I could grab fast food for maybe $6. I could hit a nearby deli to grab a sandwich and chips for $11. I could sit down at one of the neighborhood's trendy restaurants and drop $15-$20. Typically, I'd probably go with the first or second option. Quick and inexpensive is an efficient combo. However, this time, I chose door #3. There was a highly-touted restaurant just a few blocks away, so I excitedly walked there for a unique meal. Though I sat a bit longer and spent nearly $20, it was a tremendously satisfying experience. I tried something new, it was executed with excellence, the service was top-notch, and I really enjoyed my time there.

Did I need to spend $20 on lunch? Not at all. Am I glad I did it? Absolutely! It was a fun and impulsive little splurge. I had personal money for such an occasion, it added value to my day, and I had zero guilt. That's how it's supposed to work.

There's one key word here: splurge. The fact I don't do it every day makes it a more enjoyable and guiltless endeavor. Spending $20 on lunch each day would slowly bleed me out financially (as it does for countless people.....you wouldn't believe the number of people who are literally eating their future). Once in a while, however, it becomes a fun little blessing. Too much of a good thing isn't always a good thing. We need to create scarcity in our life. Doing so allows those fun, impulsive splurges to add value to our life without breaking the bank. It creates anticipation and gives us something to look forward to. But the moment we turn a splurge into a normal part of our life, some of the magic dies. It just becomes another piece of "normal," and the lifestyle ratchet clicks up a notch.

Let splurges remain splurges. You won't regret it.

Important to Her, Important to Me

The real issue wasn't the debt, or a lack of resources. Instead, it was the fact he viewed his desired purchase as being important, and hers not. This is a toxic slippery slope, which needed to be immediately addressed.

Today, I'm bringing you a fun story from a recent coaching session. I was sitting with a young couple, discussing wins, losses, learnings, and questions from their first few months of budgeting. I could sense some tension brewing, and just as I was about to ask about it, the wife brings it to the surface.

The wife wants to buy an item that costs approximately $500. It's important to her. She's been talking about it for a long time. Immediately, I could tell the husband was not keen on the idea. He had several reasons why they shouldn't buy it right now. His primary reason is they are in the midst of paying off student loan debt (they are crushing it, by the way!).

What happened next is where the story gets interesting. No more than three minutes later, the husband brings up something he wants to buy soon.....which coincidentally also costs $500. Similar to the wife's desired purchase, this is clearly a want. But it's important to him. He quickly listed the reasons they should immediately pull the trigger on this item. However, in the midst of his sales pitch, he recognized the irony (and the hypocrisy).

The real issue wasn't the debt, or a lack of resources. Instead, it was the fact he viewed his desired purchase as being important, and hers not. This is a toxic slippery slope, which needed to be immediately addressed. I quickly jumped in and shared my perspective. And since this is a commonly occurring dynamic, I thought it was worth sharing today:

It's ok if something is a want. We need to stop demonizing wants as irresponsible and unnecessary. Wants can be nearly as important as needs, and should be treated as such.

The husband's opinion on her desired purchase is irrelevant. If it's important to her, it's important. Period. This can be a hard pill for spouses to swallow. Since spouses have different interests and desires, it's inevitable one spouse will want something the other doesn't care about.

If it fits within the scope of the budget and can be done without compromising their spending, saving, giving, and debt plan, they should do it.

Who makes how much income shouldn't play any role in the discussion. If one spouse makes 90% of the income, it's still a 50/50 decision. The moment we get married, everything we have (including our income) should be combined and viewed jointly. The words "mine" and "yours" need to be abolished and replaced with "ours."

We aren't allowed to feel guilt when purchasing something important. Guilt cheapens the purchases and sabotages the reason we bought it.

Ultimately, here is my recommendation. Since the husband's desired purchase has some urgency tied to it, I recommended they pull the trigger this month. However, that recommendation was contingent upon him agreeing to put her desired purchase in the budget next month.

Be generous with your partner. If it's important to them, it should be important to you.

A Glimpse Under the (Cruise) Hood

I've shared bits and pieces about our family's recent cruise vacation. Some of the finer details must have perked people's interest, as at least a half-dozen readers asked if I would be sharing more about the economics of the trip. There's a voyeuristic side in each of us, where we like hearing the details of other people's situations.

I've shared bits and pieces about our family's recent cruise vacation. Some of the finer details must have perked people's interest, as at least a half-dozen readers asked if I would be sharing more about the economics of the trip. There's a voyeuristic side in each of us, where we like hearing the details of other people's situations. I think that's why our personal budget reveal episode was/is so popular.

Well, your wish is my command. I dug through the numbers and will now share the total economics of our recent trip. For context, our family of four took a 6-night cruise on Royal Caribbean out of the Fort Lauderdale port. The ship was called Symphony of the Seas, which I believe is the second-largest ship in the world (and it was amazing!). When the dust settled, we spent approximately $5,100 all-in, broken down as follows:

Cruise: $1,830 (We took advantage of a 30% off + kids sail free deal on the Royal Caribbean website. We stayed in an interior room, which was small but efficient. This price included all food).

Flights: $740 (We saved $700 by flying out of Minneapolis - a 3-hour drive - instead of Des Moines. Not ideal, but we agreed it was worth it).

Food & Fuel to/from Minneapolis: $140

Airport Parking: $210 (Given the -45 degree wind chill and the fact we wouldn't have coats with us, we elected to park in the terminal instead of taking the long-term parking shuttle).

Fort Lauderdale Hotel: $220 (We didn't want to risk having a delayed flight ruin our trip, so we flew in the night before).

Ubers: $140 (Ubers to/from airport/port).

On-Ship WiFi: $300 (This was a hard pill to swallow, but we ultimately decided to get WiFi on three devices. Looking back, we're glad we did).

Drinks: $380 (This included alcoholic beverages, some fun drinks for the kids, and Sarah's fancy coffees).

Aquapark Excursion: $50

Pig Beach Excursion: $700 (A lot of money, but it created some lifelong memories).

Automatic Tips: $220 (By default, Royal Caribbean charges you $18/person/day for tips. However, this isn't mandatory. We elected to turn this off for the kids so we could use that extra money to give specific tips)

Cash Tips: $200 (Primarily for our room attendant and the kids club staff. Our kids spent 7PM-10PM every night in the kids club, and they had a blast. There were a lot of tears saying goodbye that last night).

There you have it. It wasn't cheap and ultimately cost more than we anticipated, but we don't have many regrets. It was a wonderful trip; we'd do it again in a heartbeat.

Thoughts? Questions? Insights? Reactions? Would love to hear your feedback. Hit reply to this e-mail or drop a comment below on the webpage.

I'll wrap it up this way: Meaning over money. That money could have been invested, or saved for something "more responsible," but our family primarily invests in two things: mission and memories.

Capitalist Pigs

That's the entire point of capitalism. Someone creates a product, sets the price, and either people buy it or they don't.

Remember when I paid $700 to play with pigs? Well, yesterday was pig day! We were in Nassau, Bahamas, on our cruise, and it was finally time to experience Pig Beach with my family. It was a truly amazing experience. We started with a beautiful 30-minute boat ride to Pearl Island, where we spent a few hours playing on the beach with crystal-clear waters. Then, we were treated to a local lunch that more-then-hit the spot. Finally, we hopped on a speed boat for a short jaunt to Pig Beach. Once there, we fed the pigs apples (and even bottle-fed a piglet), petted them, and ran around in the ocean with them. Every part of the experience was spot-on. While spending $700 for this excursion still feels expensive, it will no doubt go in the record books as one of the most memorable experiences our family has had together. Money well spent!

This is baby Katy Perry. She pooped on my arm about 5 seconds after this pic was taken….

While hanging out at the beach in the morning, I overheard a group of men talking about the excursion. "They really milk those pigs for all they're worth." "Nothing like taking advantage of a lucky situation. Those pigs were just left there" "They are practically screwing us."

Do you see any irony in this? A bunch of grown men, who are traveling to the Caribbean on money earned from living in a capitalist society, are demonizing the local business owners who are trying to make a living by being capitalistic. Nobody forced a single one of them to purchase that excursion. That's the entire point of capitalism. Someone creates a product, sets the price, and either people buy it or they don't. If you think the price is too expensive, then simply choose not to buy. Considering how many people were in our group, I'd say their pricing is working just fine.

Are the local folks making a handsome living from this endeavor? I hope so! Good for them! They are doing a fantastic job at it, too. Overall, the entire experience was well done and full of hospitality. They served their customers well and truly made us feel welcome. I'm glad I went, and I'll recommend it to anyone who asks.

This is the beauty of business. We are free to create any product we want, price it, market it, try to execute it, and let the chips fall how they may. No matter how good our product is, some will think it's a rip-off. That's not a bad thing! Rather, it's necessary. That's the gateway to understanding who values you and who doesn't. I once had a client prospect tell me how much of a rip-off my pricing was, only to have another prospect (90 minutes later) tell me it was the world's biggest bargain. One valued me, and one didn't. It doesn't make one good and one bad, but now I know who I am called to serve.

Don't feel bad for making a living. Add value. Serve others well. Let the chips fall how they may.

Fun, But Measured

Similar to the power of saying "no," the opposite is also true. There's power in being able to say "yes." When we intentionally set aside money for a specific purpose (travel in this case), we've already said yes. By definition, that money has already been spent on travel. However, the who, what, when, where, and how haven't yet been defined. That's where the fun begins.

In yesterday's post, I mentioned my family contributes $1,000/month to our travel fund. As has been the case for the past decade, giving and travel (mission and memories) are the two largest non-housing categories in our budget. Several of you reached out to comment on this. Some people think that's an absurdly high amount. Considering it's a want, perhaps they are right. Other readers believe $12,000/year is practically nothing. Or, as one person put it, "That's like one trip."

Similar to the power of saying "no," the opposite is also true. There's power in being able to say "yes." When we intentionally set aside money for a specific purpose (travel in this case), we've already said yes. By definition, that money has already been spent on travel. However, the who, what, when, where, and how haven't yet been defined. That's where the fun begins. We know the money is available, but decisions must be made. Do we go all-out and blow the entire $12,000 on a single trip, or take a more measured approach to get more mileage out of those funds. In most cases, we take a measured approach. Fun, but measured.

Here's a real-time example. My family is currently on our first-ever cruise. A few weeks ago, I found out one of my closest friends is also going on a cruise soon. We compared notes. They also have a family of four, traveling with the same cruise line, in a similar geographic vicinity. The biggest difference is they are gone 7 nights vs. our 6 nights. In other words, it's almost apples-to-apples. When I asked what it cost, she said, "A little more than $7,000" (before flights, excursions, add-ons, or any other goodies). Our total cost was $1,800, or nearly one-fourth of what they paid for a similar trip. She cringed. Ouch! There were a few drivers on why ours was so much less:

We specifically picked a route that was on the more affordable side.

We specifically picked a week when that route was even cheaper.

We waited until the cruise line offered a promo. This one was 30% off for all adults, plus kids sail free. The cost melted away faster than Frosty getting locked in the greenhouse.

Question: Will my friends have 4x as much fun as us? Or will we create one-fourth as many memories as they will? Of course not! Also, this isn't a knock on them. I hope they have the time of their lives. They get to do whatever they want, and I'll support them every step of the way. Our family's priority is to make the best use of our limited (and blessed) $1,000/month of travel funds. I pray that we share amazing experiences together and create lifelong memories that our boys will someday share with their kids.

Go enjoy some amazing travel, but don't feel the pressure to break the bank. It won't necessarily create better experiences or more meaningful memories. Stay measured, remain intentional, and make the most of whatever travel resources you set aside for your family. Fun, but measured.

Saying “No” to Yourself

The willingness (er, commitment) to say "no" to important and alluring things is a life-changing endeavor. If we have the discipline to say no to ourselves when we haven't earned the right to say yes, a few things happen.

In a recent client meeting, we discussed where this couple would prioritize their discretionary income in 2024. Giving, investing, and travel are their big three. But the question was how much to allocate to each. I shared a few different strategies and ideas to consider, including setting non-negotiable dollar amounts to specific categories. As a reference point, I communicated that our family makes a mandatory $1,000/month contribution to our travel fund. It's as non-negotiable as our housing payment or groceries. No, it's not a need, but it is critically important to us.

Amidst this conversation, one spouse asked, "What do you do if you don't have money in your travel fund? Just not go?"

Correct. No money, no travel. No excuses. No justifications. No cheating. No credit cards. No robbing other accounts. If there's no money in the travel fun, there's no travel. That's why it's important for us to fund this account each month. It would be a real bummer for our family to have a travel opportunity arise, but we have to say no because we don't have those resources available.

The willingness (er, commitment) to say "no" to important and alluring things is a life-changing endeavor. If we have the discipline to say no to ourselves when we haven't earned the right to say yes, a few things happen:

It provides a genuine incentive to do it better next time. If we're willing to cheat ourselves to get what we want, there's no real reason to get our act together.

When we learn to say no, we teach ourselves contentment. On the flip side, there's no better way to erode contentment than by giving yourself everything you want, no matter the cost or consequences.

Speaking of consequences, when we're willing to say no, we can avoid putting ourselves into questionable (or destructive) financial situations. We don't thrust ourselves into debt, rob other important spending categories, or irrationally drain our emergency savings.

This concept goes deeper than travel. If our family doesn't have dining out money remaining, we don't go out to eat. If we don't have kids money remaining, we don't buy anything for our kids. If we don't have any grocery money remaining, we don't go to the grocery store. That may seem extreme, but it's amazing how creative we can get by diving deep into our freezer and pantry. Further, running out of grocery money sucks enough that it provides great motivation to learn from our mistakes next time.

Learn to say no to yourself. It often sucks in the moment, but it creates contentment, growth, resilience, discipline, and gratitude. That's a winning formula!

The Undercurrent of Culture

One thing separates my normal dining out experience from this one-off $88 breakfast experience: intentionality.

We recently released a podcast episode titled "287 - Controlling Dining Out Without It Controlling You." In it, I talked about the ever-increasing narrative that dining out is simply too expensive. Yes, inflation has caused prices to ratchet up to frustrating levels. However, when people talk about this topic, they share ridiculous stories, attempting to highlight why they (and others) are screwed and in no way, shape, or form can financially succeed (never mind thrive) in this reality. In the episode, I used the example of one Tweet where someone said their family of four (including "two small children") spent $75 on a trip to Panera. Mom, Dad, and two small children.....$75 for Panera. I recently saw another example where someone said it cost their family $60 to eat at McDonalds.

I received several critical comments on the heels of releasing this episode, with the most common one revolving around the idea that I just live in a cheap part of the country (i.e. I don't know what people are really dealing with). While it's true that I don't live in THE most expensive markets in the country, neither do most people on social media ranting and raving about this topic.

I recently decided to do a little experiment with my own family. It was Sarah's birthday, and she wanted to take the boys to a trendy new breakfast restaurant in our town. Since it was her birthday, and knowing I wanted to perform this experiment, I simply instructed the family to get whatever they wanted. Sarah and I each enjoyed an entree (which we split and share with each other because that's what we always do), plus coffee. The boys elected for fun kid-sized options of chicken and waffles.....and hot chocolates, of course. After a 20% tip, the meal came to $88. $88 for breakfast!?!? Yep, my little experiment went precisely as I had hoped.

One thing separates my normal dining out experience from this one-off $88 breakfast experience: intentionality. When we have a set monthly budget for dining out, it forces us to be intentional with our decisions. On a normal day, that meal would have cost less than half of that. However, since we didn't have intentionality (boundaries, practicality, or rational thought), we were going to be the victim of whatever that final bill came out to be.

I'm glad we did. That was the point. It was Sarah's birthday. We had plenty in our dining-out budget this month, and it was a perfect time to perform my little experiment. Win, win, win. But we weren’t victims. We made those choices.

The next time you're out to eat but also trying to live with financial boundaries, choose intentionality. You can still have a wonderful experience and create fun memories. It CAN cost $88 for breakfast, but it doesn't have to. Luckily, you get to choose.

Pigs Over Money

While scanning the various port options/excursions, one caught my eye: Pig Island!

Our family will be taking our first cruise soon. I never thought I'd be a cruise guy, but it made sense with the age of our kids, the number of activities available, a robust children's program (#datenights!), and the fact it's a safe, contained environment. Who knows, maybe I'll come back with a whole new perspective (and fandom) of cruises. Crazier things have happened (such as Rex Grossman leading the Bears to a Super Bowl).

I don't like planning my day-to-day activities on vacation, but I now realize that's critical in the cruise world. This includes on-ship activities, as well as port activities. While scanning the various port options/excursions, one caught my eye: Pig Island! Have you ever heard of Pig Island? It's exactly what it sounds like. It's a bunch of wild pigs that live on a tropical island, and you can go play with them. Visiting this place has been on our bucket list since we married. Now, it shows up as a port-day option for our upcoming cruise! It's fate!

I was pretty excited.....until I saw the price: $700. Ouch! That's a lot of money to pay for a 5-hour excursion, especially considering our entire 6-night cruise cost us $1,800 (children-cruise-free promo!).

These are the types of dilemmas I love. It doesn't intuitively make sense. There's no world where spending $700 to swim with pigs for a few hours feels rational. On the flip side, this is a bucket list activity for us. It could very well go down as one of our family's favorite all-time travel memories....or not. But there's only one way to find out. That's the risk....and the opportunity.

We decided to book it. While the financial cost is expensive, the memories and shared experiences will be priceless. We probably won't remember what it even cost when we wake up ten years from now. But those memories will last a lifetime. Here's one last thought. There's very little chance we'll regret doing it, but on the flip side, there's a high likelihood we'd regret not doing it. I hate living with regret. Take my money, pig people!

Meaning Over Money. Strike that. Pigs over money!

Stay Vigilant, My Friends

We need to stay vigilant. We must focus on the details, ensure we're crossing our T's and dotting our I's, and follow through with diligence.

Throughout the course of life, it's staggering how many financial mistakes we make. Some are big, some are small, and the count is high. I'd like to tell you it's possible to completely eliminate them, but it's not. With the sheer number of decisions we make each day/week/month/year, we'll eventually get bit by the mistake bug.

This was my week. I was pretty upset with myself, but after deciding it would make for good blog content, I'll reclassify it as an "investment" in my head (or so I tell myself). Here's the situation. My family is preparing for an international trip that's coming up. In the process, we decided to get the kids their own suitcases. Until now, we've just packed their clothes in our luggage whenever we travel. But it's time for them to get their first set of luggage.

After doing some shopping, we picked out a few cool options (Minecraft for Finn and Spiderman for Pax). Luckily, the bags are also mirror images of each other.....just with a different design. Perfect! They were also fairly affordable at $65 each. Doubly perfect! I pulled the trigger and washed my hands of that chore. Until today.....

As I was reviewing transactions earlier in the day, I noticed one for $213. Wait, what is that!?!? If the suitcases were only $65 each, that math doesn't math. When I clicked on the invoice, my fears were realized. The bags were, in fact, $65 each, but I got dinged with a $77 shipping charge. Oh crap!

Pure and simple, I just made a boneheaded decision. I screwed up. I made a mistake. And the primary reason is the same as when we typically make financial mistakes: lack of vigilance. I didn't pay close enough attention.....and I paid the price for it. I was with the kids when I pulled the trigger (and one of them was melting my brain), so I completely whiffed on the shipping details. Ouch!

Though I'm still pretty frustrated, I'll get over it. I've made more expensive mistakes than that. Ultimately, we'll have a couple of suitcases that will serve us well for years to come. It won't break us. It won't move the needle in the big picture. But it's a great lesson. We need to stay vigilant. We must focus on the details, ensure we're crossing our T's and dotting our I's, and follow through with diligence.

Also, one last thought. Give yourself grace WHEN (not IF) you make a mistake. Mistakes will happen, so it's important you process them, learn from them, and ultimately put them in the rearview mirror. It's amazing how much these things will haunt us if we let them (yes, even this dumb $77 mistake). It certainly won't be my last mistake, and you'll also collect some as well. But if we handle ourselves with intentionality, we can limit them.

Stay vigilant, my friends!

More Control Than We'll Admit

But we also need to take account of all the areas in our lives that we've inflated (whether intentionally or unintentionally). Just because we can spend on something, it doesn't mean we should.

Oh, inflation. Inflation, inflation, inflation. Inflation is a topic that doesn't seem to go away. It's now as engrained in our cultural narrative as Taylor Swift, TikTok, and my Bears being terrible. Inflation is an easy target. It's easy to point to a single number as proof of why we're screwed. "Well, gas prices were x, and now they are y," or "My weekly grocery haul used to cost b, and now it costs c." While those facts may be true, they don't properly account for the overall picture. They are just numbers in a vacuum.

I had a conversation ask week that may illustrate the topic. While meeting with a client, we were looking closer at their current monthly budget. This exercise was through the lens of changing circumstances and a desire to carve out more margin. This family's monthly needs are approximately $9,000. This accounts for food, housing, utilities, transportation, and other items that are essentially needs.

Curious about the broader context of this number, I flipped back to some of their older budgets (from four years ago). Much to their dismay, their apples-to-apples monthly needs were just $5,000 back then......less than half of what they are today! You may be thinking to yourself, "How do monthly needs go up by $4,000 in just four years!?!?" There are a few reasons this happens, which primarily include:

Inflation

Changing seasons of life

Lifestyle creep

Evolving definition of "need"

I don't highlight this to point fingers. This isn't a condemnation of them (or anyone else). Rather, this is a great opportunity to look in the mirror, be honest with ourselves, and act accordingly.

Yes, inflation has done a number on this family. That's a very real thing. We can go category by category and see how their monthly spending has changed over the years (one of the benefits of budgeting and tracking over a long period of time). Inflation has played a role in this.

But we also need to take account of all the areas in our lives that we've inflated (whether intentionally or unintentionally). Just because we can spend on something, it doesn't mean we should. It's so easy to squint our eyes and decide xyz is now a need, or what was once needed isn't enough anymore. We humans justify all sorts of decisions this way.

We also have to look at our major decisions and how they impact our financial journey:

The cars we buy

The house we live in

The childcare we choose

The stores we shop at

The food we eat

Not all decisions are created equal. Some decisions can transform our budget to the tune of hundreds or thousands per month. It's critical that we view each decision through the lens of our broader life and what's most important to us.

So as we enter a new year, perhaps this is a great time to take a look at your numbers. Take back control. Focus on meaning. Create margin. Give yourself peace. You deserve it!

Inflation, the Tale of Two Families

I've discussed it on this blog before, but we humans tend to view reality through our personal lens. It's a sample size of one: me. Our own experiences, perspectives, and situations largely inform how we perceive these external forces.

Inflation has oddly become a polarizing topic in recent months. To millions of Americans, the weight of it has been heavy, often destructive. The impact of inflation can be felt in nearly every aspect of their lives. It's ever-present, and it feels overwhelming.

Others, however, seemingly roll their eyes at the topic. They acknowledge it exists, but on the whole, believe most people are being overly dramatic about the entire thing. This group sometimes thinks people use inflation as a scapegoat to deflect their poor financial decisions.

I've discussed it on this blog before, but we humans tend to view reality through our personal lens. It's a sample size of one: me. Our own experiences, perspectives, and situations largely inform how we perceive these external forces. Recently, though, I stumbled upon a TikTok video that illustrates this concept so well.

In short, this man theorizes that the American inflation experience is strongly formed around two variables: 1) When someone bought their house, and 2) The age of their children. Depending on the combination of these two variables, it drastically changes the shape of their financial life. While you/I may disagree with his specific numbers, I believe the concept is true, and his assessment is spot-on.

On the cheaper end of the spectrum are people who purchased their house before 2020 (lower prices and record-low interest rates) and don't have young children requiring childcare. These families have a combined house payment and childcare bill of approximately $1,500/month.

On the most expensive end of the spectrum are people who purchased their house within the last 12-18 months ($4,000/month) and have kids requiring childcare ($2,500/month). Therefore, these families have a combined house payment and childcare bill of approximately $6,500/month.

Comparing these two families, that's a $5,000/month difference....just from two categories. That equates to $60,000/year of spending differential, or closer to $80,000 of gross salary to make up the difference. Again, we can disagree with the specific numbers, but either way, the disparity between these two groups (revolving around just these two categories) is staggering. Also, these two families could live next door to one another. They could live similar and parallel lives, but have completely different financial experiences.

It's no wonder how two people who make similar money can disagree on the topic of inflation. I think this is a great perspective for us all to think about. Some of us live on the cheaper side of this spectrum, and others on the more expensive side.

First, I encourage you not to judge or demean others and their experiences. They are likely doing the best they can, and yes, it probably includes some unwise decisions along the way. Second, I also encourage you not to constantly compare yourself to others. It's so easy to play the woulda, coulda, shoulda game. Unfortunately, we can't hop into a Delorean and make different decisions. We must play the cards we are dealt. So let's play the best hand possible! You got this.

Cultural Narratives: College Edition

In yesterday's post, I discussed the importance of seeing through false cultural narratives. I framed the post through the lens of common misunderstandings around the stock market. However, I listed a handful of other cultural narratives wreaking havoc on our society. One raised more than a few eyebrows: "It's impossible to attend college without student loans."

Oh, this is a good one! And by good, I mean toxic and destructive. In my work, student loan debt is one of the top factors ripping people's lives apart. It's not uncommon to see $40,000-$100,000 of student loan debt......per person! I have a lot of empathy for people in these situations, for a few reasons:

Student loans are the only debt that's non-bankruptable. The only way out is to die. That doesn't feel like "good" debt to me.

Student loans are torching people's ability to live a meaningful life. Instead of pursuing work that matters, people must pursue work that pays the inflated bills.

It's not their fault! It's easy to blame people for their student loan debt, but they were only 17 or 18 when these decisions were made. They likely didn't understand the future consequences and implications. In most cases, the blame primarily lies on the parents. Parents don't trust their teens to stay at home alone for the weekend, but the very next day, they trust their kids to freely make a life-altering decision that will implode their financial life for decades.

Kids deserve better. My kids deserve better, and your kids deserve better! Luckily, better is available. Yes, college is expensive. There's no way around that. The cultural narrative is that the only way to go to college is via student loans. It's a lie! I'll explain why. First, it's essential to break things down so we can look at them from a different perspective.

In-state public universities in my state cost approximately $24,000/year. Some states are more, and some are less. I'm using public, in-state as my example, as it's a common and accessible option. We can make other choices, such as community college, trade school, out-of-state universities, and private colleges, but all choices have consequences (good and bad).

That's a lot of money, for sure. But we aren't going to pay $24,000/year. Most schools have an array of in-house scholarships to offer. In my state, most students will end up paying +/- 80% of sticker price, or $19,200ish.

That's still a lot of money. Let's break it down further. This equates to $1,600/month over 12 months. Ok, now we're getting somewhere. That's a lot, but attainable. Once we know this number, we have an array of options to pay for it:

Savings

College fund

Parents' monthly budget

Student work

Other scholarships

And several other options.

We don't need them all.....we just need some combination of them to total $1,600/month. I'm not saying it's easy, but it's 100% attainable for most families. And countless kids/families are doing it!

Methodically and intentionally piece together $1,600/month, or suffer for decades? The narrative pushes us to the latter, but we have the power to change the narrative.

As Much as We Bargained For

Annoyed, he retraced his steps to the gate, handed his boarding pass to the employee, and exclaimed, “I paid $1,500 for this motherf’ing ticket. I’ll do what I want.”

Picture this. I’m standing at the gate, waiting to scan my boarding pass and walk onto the plane. As I was about to scan my phone’s QR code, a man hurriedly walked around me and onto the jet bridge. The gate employee, equally confused as she was concerned, shouted at the man to stop. Annoyed, he retraced his steps to the gate, handed his boarding pass to the employee, and exclaimed, “I paid $1,500 for this motherf’ing ticket. I’m not waiting in line.” Without even taking his ticket back, he started toward the jet bridge. She again shouted at him to come back to gate-check his roller bag (since they had run out of overhead space on the plane). He ignored her command and scurried onto the aircraft with his bag in hand. When we got onto the plane, he discovered (shockingly!) that there were no spots for his bag. He was resourceful, though. His solution was to remove someone else’s bag and put his in their bag’s spot, randomly discarding the other person’s bag in the aisle. As you can imagine, this didn’t go over well. He was surprisingly allowed to stay on the flight, but I navigated my way back to my toilet-adjacent seat, where I’d luckily never have to see him again.

As I reflect on this man and his antics, I can’t help but think about how sometimes in life, we unreasonably expect more than we bargained for. Sporting events are a great example. Fans often act as though their ticket purchase includes the right to demean, berate, and abuse the referees, coaches, and players. We buy one thing and expect it to come with other fringe benefits. Like this airline passenger who believed his $1,500 ticket price earned him the right to board the flight whenever and however he wanted (with a side bonus of disrespecting everyone he encountered along the way).

I often think about this idea when buying products or services. Not the whole being a completely disrespectful jerk part, but the idea that I’m only getting what I’m getting. I try to think through what this product will and will not give me. Buying those Air Jordan’s may make me look cool, but they won’t make me jump higher. That fancy car may be a more comfy and satisfying ride than my aging Nissan Altima, but it won’t actually make me more important. The new iPhone will give me some added features (and perhaps run a bit smoother), but it won’t inherently make my life better.

There’s nothing wrong with any of these things, but we need to be honest with ourselves about what we’re getting…..and what we’re not. If we take a moment to sincerely think about it, we’ll likely make different decisions. This sounds silly and ridiculous to even point out (call me Captain Obvious), but we’ve all fallen for this trap.

Anyway, I hope you all have a better weekend than that airline passenger! Make the most of it!