The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

Plug the Leaks

It's interesting how our instinct is often to cut back on the most prominent (and important) things in our lives. These families aren't alone! We all do it to some extent. I suspect one of the reasons we do this is because those prominent things are front and center; they are obvious.

"We need to stop spending so much on dining out."

"We need to cut back on travel."

"We need to quit going to games."

These are three comments made to me in the past few weeks. They are from three separate clients, each with their own financial tensions. Things feel tight. There's not enough margin to keep the train on the track, never mind make financial progress. Their natural inclination is to cut back, which is fair. However, I think they are sniffing up the wrong tree.

The first family's love language is food. Going out to eat is one of their biggest bucket-fillers.

The second family's passion is travel. It's their #1 priority, and it fuels them.

The third family are avid sports fans. Watching their teams play is one of their unifying and family-centric hobbies.

It's interesting how our instinct is often to cut back on the most prominent (and important) things in our lives. These families aren't alone! We all do it to some extent. I suspect one of the reasons we do this is because those prominent things are front and center; they are obvious.

Here's what I think. I think it's prudent for these three families to cut back. However, I think cutting back on these suggested categories would be counter-productive and possibly detrimental. Instead, I recommend they find the leaks.....and plug them. Oh, there are always leaks! They have them, you have them, and I have them. Expenses (big or small) that are either redundant or fail to add value to our lives.

A subscription for a streaming service that we don't watch.

A membership for a gym we don't even use.

Extra product that we won't use or will ultimately go bad.

A loan payment (plus insurance, maintenance, etc.) for a vehicle rarely driven.

Instead of indiscriminately cutting some of these families' most valuable expenditures, we looked for leaks. Here's what we found: One family found $300 of monthly leakage, another found $650, and the third found $1,700!!!

With very little effort, these families were able to recoup this cashflow in their monthly budget, which reduced their financial tension. It also prevented them from having to cut back on the things they value most. Huge wins!

Plugging the leaks is so powerful! Maybe you have some leaks. I suspect you do. I challenge you to find them, plug them, and use that found money for things that truly add value to your life!

Move the Decimal Left

Far too often, we burn ourselves out by dwelling on the minutiae. We spend so much of our time and energy trying to get the tiny details right that we lose sight of the big picture. Some of you know exactly what I'm talking about!

$4,125.85

How do you read this number? The correct answer is four thousand, one hundred twenty-five dollars and eighty-five cents.

The better answer is forty-one hundred dollars.

16 syllables vs. 7 syllables.....and a whole lot of noise.

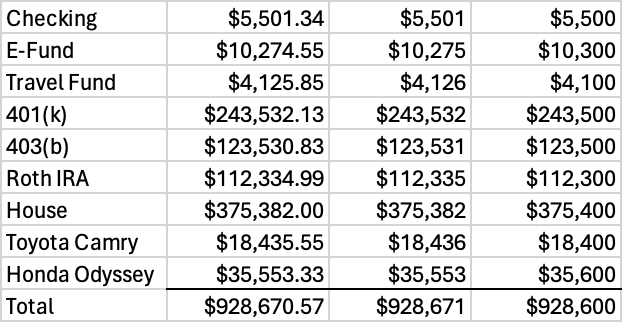

Whenever I work with clients, my mantra is simplify, simplify, simplify. I don't deal with precise numbers. When logging monthly budget numbers, I round to the nearest dollar. I've never once used cents, and I never will. Whenever I log assets and debt on a net worth statement (which happens every meeting for every client), I round to the nearest hundred dollars. Yes, hundreds. Here's an example:

Let's compare the three columns. The leftmost column represents the precise answer. The middle column shows the figures rounded to the nearest dollar. The rightmost column displays the figures rounded to the nearest hundred. Now, which column do you find the easiest to comprehend, visualize, and discuss? Undoubtedly, it's the right column! This simplified representation not only makes financial data more readable and digestible, but also empowers you to have more meaningful discussions about your finances. It might ruffle the feathers of my accountant friends, but that's just a little bonus treat for me!

Far too often, we burn ourselves out by dwelling on the minutiae. We spend so much of our time and energy trying to get the tiny details right that we lose sight of the big picture. Some of you know exactly what I'm talking about!

Confession: I haven't balanced my checking account in over 30 years. I intentionally budget each month and track what happens. I can tell you how much I've spent on gas over the last 15 years, but it's not a precise number. However, it's a correct number. Why? When we round thousands of transactions, the laws of probability tell us that half will round up and half will round down.....meaning it will all work out in the end. If I were to reconcile five years of my personal finances, I suspect my margin of error would be a fraction of a fraction of a percent......you know, a minuscule rounding error.

Is it perfect? No. But it's sustainable, digestible, and repeatable. If I had been obsessed with pennies in my budgeting process, I would have quit 15 years ago. Instead, I simplify, simplify, simplify. My process is clean, easy, and user-friendly.

I can't even tell you how many people I've worked with who insisted on getting everything perfect down to the penny, only to burn out and quit mere months later. This money stuff doesn't have to be rocket science. It should be simple, but it can only be simple if we make it simple.

Here's my encouragement for you today. Move that decimal point left! Don't zoom so far in that you miss the big picture. If using round numbers helps you understand and execute your money better, more power to you. Don't aim for perfection. Aim for progress!

Planned Impulsiveness

Some people are planners, and some people are impulsive. Both have pros and cons, but impulsive people are known for self-sabotage and occasional (or frequent!) irresponsibility. I

One of my favorite Meaning Over Money podcast episodes is called Planned Impulsiveness. It was our fifth episode, released more than three years ago. Unfortunately, Apple lost our first 15 episodes like my kids lose their shoes. Other platforms managed to keep track of them, though. Despite being missing from Apple for over two years, it's one of the ten most downloaded episodes we've ever had. You can find it HERE.

The premise is simple. Some people are planners, and some people are impulsive. Both have pros and cons, but impulsive people are known for self-sabotage and occasional (or frequent!) irresponsibility. I'm oddly wired for both. I'm very impulsive, but I'm also a planner. Along my financial journey, I realized I needed to harness my impulsivity and turn the cons into pros.

This is where the structure comes in. Travel is a great example. I have a separate bank account specifically for travel. Each month, we budget approximately $1,000 for it. We may not travel every month, but we treat it as an expense. That $1,000 physically gets moved from our primary checking account and into our travel fund. The money slowly builds over time. Then, when it's time to travel, we travel. Sometimes, the travel is planned well in advance, and sometimes, it's more impulsive. In either scenario, the money is there, just waiting to be spent on travel.

I'll share my favorite (least favorite) story of my life. In the summer of 2016, Sarah and I were about to become parents. After a long adoption journey, we received word that our son was born. We went to bed with anticipation, excited to meet our little man the following day. As I was wrapping up a few things at work the following morning before getting on the road, I received a phone call. I immediately knew something was wrong. The following 30 seconds were the worst of my life, as I found out we lost our son.

Needless to say, the subsequent days were absolutely miserable in our house. Sarah was an absolute wreck, and I wasn't in a great position to hold her up. A few nights later, she told me she wanted to leave. Somewhere far, far away from our life. At midnight, I booked flights to Cancun and reserved a hotel room. We packed a few bags, took a nap, and drove to the airport five hours later. We spent the week crying, mourning, and eating our weight's worth of chips and salsa. It was terrible, but it was beautiful. It was impulsive, but it was planned. I'll always be grateful for that sad but memorable week with Sarah.

One of my clients recently had their first planned impulsiveness moment. They've been intentionally budgeting and using their travel sinking fund since December. Then, it happened! A significant event suddenly popped up, and they wanted to be there. In mere hours, they made arrangements and jumped on a plane. It was impulsive, but it was planned. Beautiful! They will remember that forever.

Be impulsive! Savor life. Make memories. But make it planned impulsiveness.

Putting the Pieces Together

What does it mean to win with money? I could ask 20 people and get 20 different answers. We all view it through a different lens. We each possess different skills, and we each have our shortcomings.

What does it mean to win with money? I could ask 20 people and get 20 different answers. We all view it through a different lens. We each possess different skills, and we each have our shortcomings. Some things we'll get right, and other things may be more of a challenge. We don't have to nail every aspect, but it's important to remove any glaring deficiencies. Most families thrive in some areas and struggle in others.

However, I recently met with a couple who inspired me to write about this topic. I've worked with this couple for over a year, but this meeting was particularly inspiring. They are a younger-ish couple, both teachers. In my mind, they've cracked the code on personal finance. No, they aren't geniuses in any one area, but they are doing good in pretty much every area. I'll summarize:

They have unity, a shared vision, and joint ownership of their finances.

They budget intentionally each month, leaning into their unique values.

They have an emergency fund to protect them for WHEN life punches.

They spend money on wants that add value to their life.

They utilize sinking funds to save for future purchases/expenses.

They give joyfully and sacrificially.

They paid off all their non-mortgage debt.

They invest with discipline, simplicity, and effectiveness.

They have cheap term life insurance policies that will replicate each person's respective income in the event of a tragic event.

They are in the process of setting up wills.

They both pursue work that matters, and find meaning and fulfillment in their careers.

They are creating financial margin to provide flexibility for future decisions and lifestyle shifts.

They are the total package! No, it's not because they have massive incomes and unlimited resources. Reminder, they are both teachers. They are normal people, making normal money, living a normal life. Except it's not a normal life. It's an extraordinary life.

What's their secret? Intentionality, discipline, humility, contentment, and consistency. That's it. Good choice after good choice after good choice. Oh yeah, and that whole unity, shared vision, and joint ownership thing. They are doing it together. There is no "mine" and "yours." Everything is "ours." For better or worse.

Yes, this is an opportunity for me to brag about this amazing couple. However, there's more to it. I hope you find encouragement in it. We ALL have the power to get better in the areas of money. The only thing stopping us is us. It's not easy, but it's so, so worth it. Get 1% better today! Then, get 1% better tomorrow. One day at a time. You got this!

“Daddy, When Does the New Month Start?”

I received at least a dozen messages about yesterday's post. Specifically, people were curious how we have open financial conversations with our kids (at age-appropriate levels) while avoiding them feeling the weight of it.

It reminds me of a recent interaction in my house. As I was working on something, Finn approached me with a question. "Daddy, when does the new month start?" "In about a week, bud. Why?" "I want to go to Chuck-E-Cheese to play games. Can we put it in the budget next month?"

I loved his heart in the question. There's something important to him. He recognizes it costs money. He also knows we handle our finances with intentionality. Therefore, he asked if we could prioritize it in the budget.

My response to him? "Of course we can, bud. But we might actually still have money left in the kids category this month. If we do, we should totally go to Chuck-E-Cheese today." I opened the budgeting app and we looked at how much was left. $75! He celebrated wildly, and then a few hours later, we shared laughs over Chuck-E-Cheese games." Side note: Did you know they recently got rid of their creepy animatronic band? I was so mad. Despite being terrifying, that dysfunctional band was a fun remnant of my childhood.

The narrative of our family's money conversations is intentional. We never use the phrase "We can't afford it." Those four words are the ultimate parenting shut-down. It wins the conversation every time. However, it also confuses our kids. For example, if our kid asks for a $30 Lego set and we respond with "We can't afford it," the child may think we literally don't have $30. It also leads them to believe that if we did have $30, we would 100% buy it. It's a weird narrative for kids to wrestle. All the while, we parents are oblivious to how these comments impact them.

Instead, we should talk about money through the lens of intentionality and prioritization. If our kids want something we aren't willing to buy right now, Sarah and I respond that "it's not in the budget this month." We CAN afford it, but it's not part of the plan right now. From there, we can choose not to prioritize it, or discuss adding it to a future budget. Either way, approaching things from the intentionality angle staves off the "I want it now" syndrome.

When we take this approach with our children, they learn the importance of patience, prioritization, planning, delayed gratification, communication, and responsibility. They also learn it's okay to buy fun things. We don't demonize wants. We don't treat fun purchases as wasteful. It's all part of developing a healthy perspective around spending, saving, and giving. Spending on fun things is important.....but it must be done responsibly. Even a seven-year-old can comprehend this if approached well.

Parents, what say you? I'd love to hear your feedback on this topic and any other ideas for engaging in healthy money conversations with your kids.

Smooth Out Your Lumpy Stuff

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses.

A few days ago, I wrote about my recent car maintenance frustrations. It was a bit unexpected, but I received a wave of messages from people asking for more insight on how to execute this concept.

First, what's the purpose of a sinking fund? A sinking fund is another name for an account funded over time for a specific future expense. These expenses don't happen every month, but you know they will happen at some point. It's not a matter of IF, but WHEN (and how much). I call them "lumpy" expenses. The goal is to smooth out the lumpy by slowly and steadily funding them over time, eliminating (or significantly reducing) the stress experienced when situations arise. Common sinking fund categories include car, house, travel, medical, giving, and kid activities. Each of these categories has a habit of sneaking up on us. When they do, these sudden and unexpected expenses sabotage our disposable income.....zapping our ability to make progress in other areas.

Here's a step-by-step of the mechanics:

Set up a separate savings/checking account for your desired category and name it accordingly. Most credit unions will let you set up multiple accounts, but most banks won't (with the exception of Wells Fargo). If your bank doesn't, I recommend CapitalOne's 360 Performance Savings.

Allocate money in your budget for this category. The amount can be steady or vary by month, but it must be included in the budget.

Just like you pay your electric bill, you pay your sinking fund. Whatever dollar amount you budget gets transferred to the sinking fund. I prefer to automate these transactions.

When expenses arise for a particular sinking fund category, use your primary checking account to pay the expense.

Immediately after paying for the expense, instruct your sinking fund to send that amount back to your checking account, essentially reimbursing your checking account from the sinking fund.

Repeat.

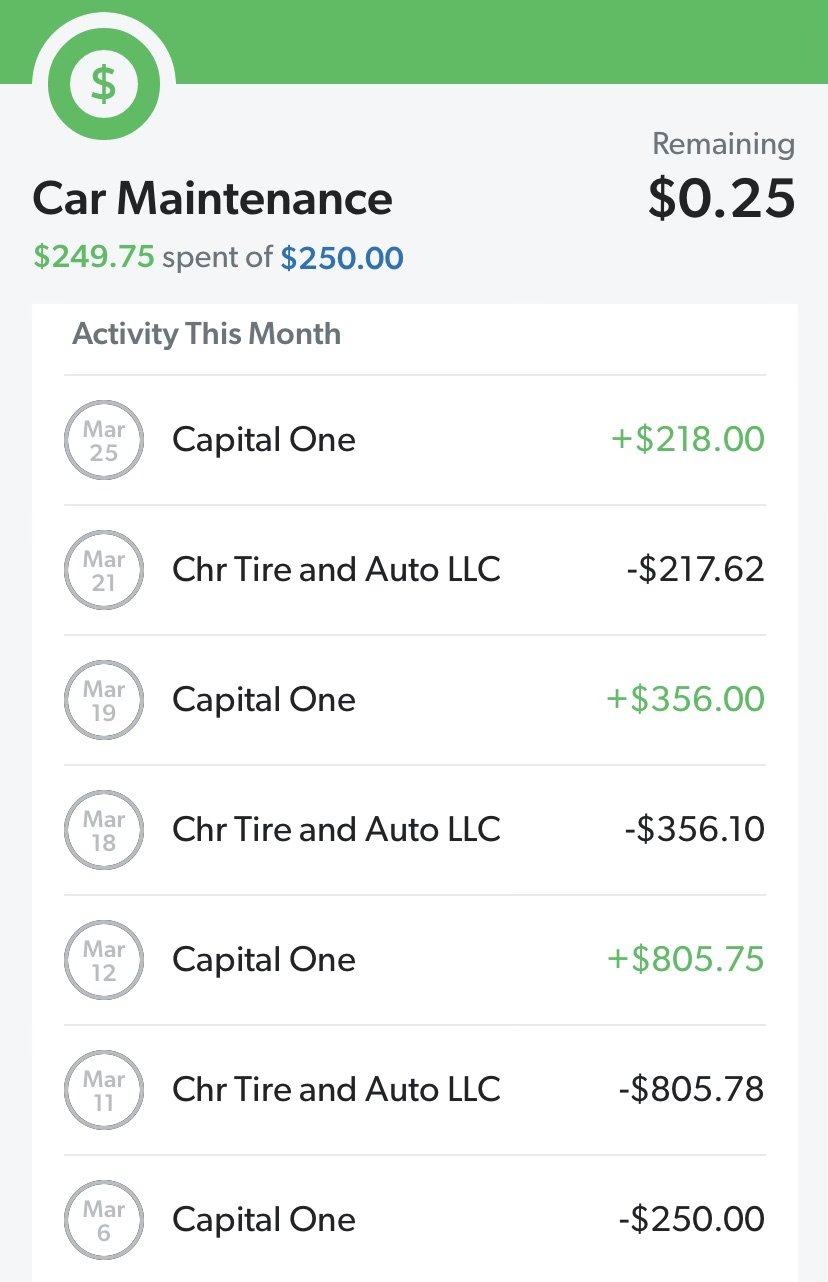

I'll share an example of my car fund from this month. For 19 years, I've budgeted (and automated) a monthly transfer from my primary checking account into my car fund. We currently budget $250/month. After March's $250 contribution (completed on 3/6), our car fund balance was $2,487. Then, we got hit with a hat trick of car bills: $806 for brakes on my main car, $356 for known issues with my new car, and $218 for the unknown issue with my new car. I budgeted $250, but got hit with $1,380 of actual expenses.....ouch! This situation would have crushed our budget had we not had a sinking fund. Instead, I simply reimbursed my checking account from my car fund for each, resulting in a total monthly car fund expense of $250 (the original planned contribution). It took something extremely lumpy and made it smooth. It went from a potential disaster to a minor inconvenience. Below is an image of how we executed it in our budget.

Setting up these extra accounts and steps may appear to make things more complex, but you'll quickly see how truly simplifying (and freeing) it can be! Best of luck smoothing out your lumpy stuff!

Not All Roses and Sunshine

I'm sad to report it's not been all roses and sunshine here in Nissan 350Z-ville. I wish I could tell you I've been happily cruising around in my sweet new (to me) ride for the last few weeks, but that hasn't been the case.

I'm sad to report it's not been all roses and sunshine here in Nissan 350Z-ville. I wish I could tell you I've been happily cruising around in my sweet new (to me) ride for the last few weeks, but that hasn't been the case.

Shortly after bringing the car home from Texas, I took it to my trusted mechanic to address some known issues (and inspect it for the unknown). It was a mixed bag of results, but all was well....or so I thought. I reunited with the car the following day, excited to run my list of errands (top down, of course).

Less than one hour after picking it up, something happened.....and by something, I mean the car wouldn't start. Oh crap! I pulled into the post office to check my PO box. Two minutes later, I couldn't get the car to start. It was dead dead. Crap crap! After some failed troubleshooting, my mechanic hired a tow truck to make the drive of shame to his shop (where it would have to sit over the weekend before getting a formal diagnosis).

Long story short, a little piece of rubber in the clutch wore out. The car is 18 years old, and I suppose that's what happens to things after nearly two decades of life. This little piece of rubber, the size and shape of a Lifesaver, notifies a sensor that the clutch is pressed and it's ok to start the car. When the dumb little Lifesaver broke, my car didn't think I had the clutch engaged. Thus, it wouldn't even turn over.

I'm glad it was a minor issue, but it wasn't cheap. The entire process took six days (it was hard to get a new Lifesaver) and $200 (including the tow). Ouch!

This isn't a sob story—far from it. I'm blessed to have this car, and we sign up for this when we own vehicles. It's not all roses and sunshine. Things happen; life happens. I'm talking about cars, but I'm talking about far more than cars, too. Things happen; life happens.

Since there's nothing we can do to stop life from happening, we have two choices:

Allow life to beat us up, rip us apart, and cause us much stress and turmoil.

Anticipate life happening and be prepared to soften the blow(s).

In the financial world, this looks like sinking funds. I don't know when my car will break, or how much it will cost, but I know it's coming. Therefore, for the last 19 years, I've allocated money in my monthly budget for car repairs. Then, I literally move it to a special savings account for that purpose only. I uncreatively call that account "car fund." Subsequently, when (not if) my car breaks, the money is already set aside to pay for it.

It turned my expensive week from a potential disaster to a minor inconvenience. It's not all roses and sunshine, but it doesn't have to feel like a downpour. What area(s) of your life do you need a sinking fund? They can change everything!

Catch That Breather

Warning: I'm about to share some financial advice that will deeply offend some financial people. If you're still reading this, you've been warned. I take no responsibility for any level of annoyance or disgust you're about to experience.

Warning: I'm about to share some financial advice that will deeply offend some financial people.

If you're still reading this, you've been warned. I take no responsibility for any level of annoyance or disgust you're about to experience.

I recently met with a couple in the middle of a butt-kicking financial journey. They got themselves into a pretty deep hole, and now they're digging out. It's been a slog of an endeavor, but they're making fantastic progress. However, they are flat-out tired. I can see it in their eyes. It's the financial version of seeing a basketball hunched over during a dead ball, clutching his shorts and panting heavily. You can clearly see the tank is empty. They've left everything they had on the court. That's this couple!

Anyway, I could sense they were about ready to break (which is a terrible outcome!). Therefore, I took extreme measures in our last meeting. I encouraged them to stop paying debt next month. Yes, completely stop. No debt payoffs, no saving, no investing.....nothing "responsible." Instead, aside from their needs, minimum debt payments, and giving, they will use ALL of their extra income for "irresponsible" things. Dining out, travel, personal spending, and maybe a few fun things for their house. Totally irresponsible!

Three powerful things will happen when they follow through with this ridiculous-sounding plan:

They will get a much-needed break. They are exhausted, and this one-month progress break will be the equivalent of a coach giving their star player a short breather. This break will give them the energy to get back on the court and finish the game strong.

They will experience first-hand that it was not wants that hurt them in the past, but a lack of intentionality. On the flip side, when they experience a month chock-full of fun want spending while simultaneously keeping the financial train on track, it will show them that wants aren't the problem. It's all about intentionality. This experience will change them!

These things won't inherently make them happy. They will be fun, but they won't move the satisfaction needle as much as those progress months do. This will further embolden them to get back on the court and take care of business once and for all.

"Irresponsible" spending only. No progress. No wise moves. No debt payoffs. No saving. No investing. Just fun things. Just because. This is the break they need. This is just what the doctor ordered to propel them to that next level.

If you can relate to this couple, perhaps you need a break. Maybe you need to catch that breather. It's ok if you do. Even Jordan needed one every now and then.

A Different Way to Travel

One of the most pervasive myths floating around our society is that we NEED a credit card to travel. People believe this so much that they are willing to play Russian Roulette with our finances to make it happen.

One of the most pervasive myths floating around our society is that we NEED a credit card to travel. People believe this so much that they are willing to play Russian Roulette with their finances to make it happen. Here's a very real example. One of my clients had more than $30,000 of credit card debt. It's a chunk of debt that's expanded and contracted for more than a decade. Fortunately, they decided to lock down and aggressively pay it off. Getting debt-free took about 14 months, and they celebrated mightily upon completion!

I pleaded with them to cancel their cards—I literally begged! Then, the dreaded phrase came out of their mouths: "We NEED to keep at least one open for travel." Uh oh, the myth still had them captive! Despite my best efforts, they elected to keep this card open "just for travel." You can probably guess where this is going. Life happened, and they ended up back in credit card debt.

There's a better way! A simpler way! We don't need a credit card for travel. I haven't had a credit card for more than 14 years now. I've traveled to nearly 30 countries during that span.....with no credit card in my possession. I buy plane tickets with a debit card. I book hotel rooms with a debit card. I rent cars with a debit card. I buy meals, Ubers, and activities with a debit card. It's possible to travel without a credit card. I don't just preach it.....I live it.

All that said, it's not enough for me to simply say, "Stop using credit cards for travel." I'll also share how I structure my travel life:

I have a designated sinking fund for travel. But instead of using a savings account, I have it set up as a checking account. It's a separate checking account ONLY for travel use.

Each month, we allocate money for travel in our budget. When we do, we literally take that money and move it from our primary checking into our travel fund. We treat it as an expense, and actually "pay" that expense.

When we travel, we use the debit card associated with our travel fund to pay for all travel-related expenses: cars, hotels, flights, food, activities, etc. Everything!

The money comes directly from our travel fund, leaving our monthly budget completely unscathed.

If that sounds too simple, it's because it is. Simplicity always wins. If there's money in the account, we travel. If there's not, we don't. No exceptions. There's zero chance of making a mistake, going into debt, or getting ourselves into trouble. Handling travel this way also forces us to be intentional with our budget each month, as our travel fate relies on us actually setting money aside.

I know I'm fighting an uphill cultural battle with this one, but I felt compelled to share this alternative way of thinking today. Try it for yourself. I have a feeling you'll love it as much as we do.

Focusing on Margin

There are many metrics we can use as a scorecard for money. Income, bank account balances, and net worth are all tremendously popular statistics to monitor. They each have their merit, for sure. Today, I'd like to shine a light on one that gets overlooked, underappreciated, and dismissed: Margin.

There are many metrics we can use as a scorecard for money. Income, bank account balances, and net worth are all tremendously popular statistics to monitor. They each have their merit, for sure. Today, I'd like to shine a light on one that gets overlooked, underappreciated, and dismissed: Margin. In short, margin is the gap between our take-home income and how much of it is committed to expenses. Here's a simple example. If you make $1,000 and have $700 of expenses, your margin is $300.

Margin provides us with flexibility, relief, cushion, and opportunities, It makes sense if you think about it. If all of your income is committed to expenses, it's a stressful place to be. There's no wiggle room. There's no margin for error. There's no room for unforeseen expenses.

Margin is a choice, but it takes intentionality. Without intentionality, any margin in our lives can quickly be absorbed by impulsive purchases, lifestyle creep, and misaligned spending. Also, I'd like to squash one myth. Most people believe income equals margin. More money, more margin. While this can be true, it has a much lower correlation than you would imagine. The more money a family makes, the higher potential for margin. On the flip side, our culture encourages us to fill our margin gap with any and every type of expense. I'll share a recent example from my coaching.

Here are two couples I've recently worked with. Both are similar in age, and each has one small child. They also happen to live within one mile of each other. Here's what each of their situations look like:

Couple 1: This couple has a monthly take-home income of $14,000 (one spouse is in finance, and the other stays home with their child). After accounting for all their monthly commitments, they only have about $700 of margin. They want to pay off debt, travel, invest in retirement, and save for their children's college, but there isn't a lot of margin to work with. Further, an unexpected expense always seems to pop up to claim that $700. Their marriage is strained, and money causes them a lot of fights.

Couple 2: This couple has a monthly take-home income of $6,500 (one spouse is a teacher, and the other is in ministry). After accounting for all their monthly commitments, they have about $2,500 of margin. Our coaching meetings typically include a visual mapping and prioritization of how this margin should be used. It's normally a combination of travel, giving, and investing. Money has become a fun conversation in their marriage, and they are thriving. They feel very little financial stress, which becomes progressively lessened as they use their margin to create a solid foundation.

On the surface, the first couple looks significantly better. Their jobs obviously provide a higher income, their lifestyle portrays an image of success, and they appear wealthy. Looks can be deceiving. Margin is a great measuring stick to see the real truth.

Let Splurges Remain Splurges

I was working at a client site earlier this week when I was struck with a dilemma. Not an earth-shattering, life-altering dilemma. Just a normal everyday sort of dilemma. Due to some logistical snags to start the day, I didn't bring my lunch. Most days, Sarah generously makes me a lunch that I either take on my way out the door, or swing home to grab when time allows. On this day, however, I didn't have lunch and was about 15 miles from home. Thus, the dilemma.

I had a few options available. I could grab fast food for maybe $6. I could hit a nearby deli to grab a sandwich and chips for $11. I could sit down at one of the neighborhood's trendy restaurants and drop $15-$20. Typically, I'd probably go with the first or second option. Quick and inexpensive is an efficient combo. However, this time, I chose door #3. There was a highly-touted restaurant just a few blocks away, so I excitedly walked there for a unique meal. Though I sat a bit longer and spent nearly $20, it was a tremendously satisfying experience. I tried something new, it was executed with excellence, the service was top-notch, and I really enjoyed my time there.

Did I need to spend $20 on lunch? Not at all. Am I glad I did it? Absolutely! It was a fun and impulsive little splurge. I had personal money for such an occasion, it added value to my day, and I had zero guilt. That's how it's supposed to work.

There's one key word here: splurge. The fact I don't do it every day makes it a more enjoyable and guiltless endeavor. Spending $20 on lunch each day would slowly bleed me out financially (as it does for countless people.....you wouldn't believe the number of people who are literally eating their future). Once in a while, however, it becomes a fun little blessing. Too much of a good thing isn't always a good thing. We need to create scarcity in our life. Doing so allows those fun, impulsive splurges to add value to our life without breaking the bank. It creates anticipation and gives us something to look forward to. But the moment we turn a splurge into a normal part of our life, some of the magic dies. It just becomes another piece of "normal," and the lifestyle ratchet clicks up a notch.

Let splurges remain splurges. You won't regret it.

Fun, But Measured

Similar to the power of saying "no," the opposite is also true. There's power in being able to say "yes." When we intentionally set aside money for a specific purpose (travel in this case), we've already said yes. By definition, that money has already been spent on travel. However, the who, what, when, where, and how haven't yet been defined. That's where the fun begins.

In yesterday's post, I mentioned my family contributes $1,000/month to our travel fund. As has been the case for the past decade, giving and travel (mission and memories) are the two largest non-housing categories in our budget. Several of you reached out to comment on this. Some people think that's an absurdly high amount. Considering it's a want, perhaps they are right. Other readers believe $12,000/year is practically nothing. Or, as one person put it, "That's like one trip."

Similar to the power of saying "no," the opposite is also true. There's power in being able to say "yes." When we intentionally set aside money for a specific purpose (travel in this case), we've already said yes. By definition, that money has already been spent on travel. However, the who, what, when, where, and how haven't yet been defined. That's where the fun begins. We know the money is available, but decisions must be made. Do we go all-out and blow the entire $12,000 on a single trip, or take a more measured approach to get more mileage out of those funds. In most cases, we take a measured approach. Fun, but measured.

Here's a real-time example. My family is currently on our first-ever cruise. A few weeks ago, I found out one of my closest friends is also going on a cruise soon. We compared notes. They also have a family of four, traveling with the same cruise line, in a similar geographic vicinity. The biggest difference is they are gone 7 nights vs. our 6 nights. In other words, it's almost apples-to-apples. When I asked what it cost, she said, "A little more than $7,000" (before flights, excursions, add-ons, or any other goodies). Our total cost was $1,800, or nearly one-fourth of what they paid for a similar trip. She cringed. Ouch! There were a few drivers on why ours was so much less:

We specifically picked a route that was on the more affordable side.

We specifically picked a week when that route was even cheaper.

We waited until the cruise line offered a promo. This one was 30% off for all adults, plus kids sail free. The cost melted away faster than Frosty getting locked in the greenhouse.

Question: Will my friends have 4x as much fun as us? Or will we create one-fourth as many memories as they will? Of course not! Also, this isn't a knock on them. I hope they have the time of their lives. They get to do whatever they want, and I'll support them every step of the way. Our family's priority is to make the best use of our limited (and blessed) $1,000/month of travel funds. I pray that we share amazing experiences together and create lifelong memories that our boys will someday share with their kids.

Go enjoy some amazing travel, but don't feel the pressure to break the bank. It won't necessarily create better experiences or more meaningful memories. Stay measured, remain intentional, and make the most of whatever travel resources you set aside for your family. Fun, but measured.

Saying “No” to Yourself

The willingness (er, commitment) to say "no" to important and alluring things is a life-changing endeavor. If we have the discipline to say no to ourselves when we haven't earned the right to say yes, a few things happen.

In a recent client meeting, we discussed where this couple would prioritize their discretionary income in 2024. Giving, investing, and travel are their big three. But the question was how much to allocate to each. I shared a few different strategies and ideas to consider, including setting non-negotiable dollar amounts to specific categories. As a reference point, I communicated that our family makes a mandatory $1,000/month contribution to our travel fund. It's as non-negotiable as our housing payment or groceries. No, it's not a need, but it is critically important to us.

Amidst this conversation, one spouse asked, "What do you do if you don't have money in your travel fund? Just not go?"

Correct. No money, no travel. No excuses. No justifications. No cheating. No credit cards. No robbing other accounts. If there's no money in the travel fun, there's no travel. That's why it's important for us to fund this account each month. It would be a real bummer for our family to have a travel opportunity arise, but we have to say no because we don't have those resources available.

The willingness (er, commitment) to say "no" to important and alluring things is a life-changing endeavor. If we have the discipline to say no to ourselves when we haven't earned the right to say yes, a few things happen:

It provides a genuine incentive to do it better next time. If we're willing to cheat ourselves to get what we want, there's no real reason to get our act together.

When we learn to say no, we teach ourselves contentment. On the flip side, there's no better way to erode contentment than by giving yourself everything you want, no matter the cost or consequences.

Speaking of consequences, when we're willing to say no, we can avoid putting ourselves into questionable (or destructive) financial situations. We don't thrust ourselves into debt, rob other important spending categories, or irrationally drain our emergency savings.

This concept goes deeper than travel. If our family doesn't have dining out money remaining, we don't go out to eat. If we don't have kids money remaining, we don't buy anything for our kids. If we don't have any grocery money remaining, we don't go to the grocery store. That may seem extreme, but it's amazing how creative we can get by diving deep into our freezer and pantry. Further, running out of grocery money sucks enough that it provides great motivation to learn from our mistakes next time.

Learn to say no to yourself. It often sucks in the moment, but it creates contentment, growth, resilience, discipline, and gratitude. That's a winning formula!

The Undercurrent of Culture

One thing separates my normal dining out experience from this one-off $88 breakfast experience: intentionality.

We recently released a podcast episode titled "287 - Controlling Dining Out Without It Controlling You." In it, I talked about the ever-increasing narrative that dining out is simply too expensive. Yes, inflation has caused prices to ratchet up to frustrating levels. However, when people talk about this topic, they share ridiculous stories, attempting to highlight why they (and others) are screwed and in no way, shape, or form can financially succeed (never mind thrive) in this reality. In the episode, I used the example of one Tweet where someone said their family of four (including "two small children") spent $75 on a trip to Panera. Mom, Dad, and two small children.....$75 for Panera. I recently saw another example where someone said it cost their family $60 to eat at McDonalds.

I received several critical comments on the heels of releasing this episode, with the most common one revolving around the idea that I just live in a cheap part of the country (i.e. I don't know what people are really dealing with). While it's true that I don't live in THE most expensive markets in the country, neither do most people on social media ranting and raving about this topic.

I recently decided to do a little experiment with my own family. It was Sarah's birthday, and she wanted to take the boys to a trendy new breakfast restaurant in our town. Since it was her birthday, and knowing I wanted to perform this experiment, I simply instructed the family to get whatever they wanted. Sarah and I each enjoyed an entree (which we split and share with each other because that's what we always do), plus coffee. The boys elected for fun kid-sized options of chicken and waffles.....and hot chocolates, of course. After a 20% tip, the meal came to $88. $88 for breakfast!?!? Yep, my little experiment went precisely as I had hoped.

One thing separates my normal dining out experience from this one-off $88 breakfast experience: intentionality. When we have a set monthly budget for dining out, it forces us to be intentional with our decisions. On a normal day, that meal would have cost less than half of that. However, since we didn't have intentionality (boundaries, practicality, or rational thought), we were going to be the victim of whatever that final bill came out to be.

I'm glad we did. That was the point. It was Sarah's birthday. We had plenty in our dining-out budget this month, and it was a perfect time to perform my little experiment. Win, win, win. But we weren’t victims. We made those choices.

The next time you're out to eat but also trying to live with financial boundaries, choose intentionality. You can still have a wonderful experience and create fun memories. It CAN cost $88 for breakfast, but it doesn't have to. Luckily, you get to choose.

Preparing for the (Winter) Storm

One such consequence that's becoming increasingly apparent is the stress on businesses. Simply put, people mostly stay home with these harsh conditions. That means less business for retailers, restaurants, coffee shops, and entertainment venues. In other words, business came to a screeching halt for many entrepreneurs.

Well, it's official: The Midwest is getting absolutely obliterated by a winter storm. Every city is different, but in mine, we received +/- 20 inches of snow in a 3-day stretch and are now getting crushed with -40-degree wind chills. This type of weather has many different consequences.....and none of them are good.

One such consequence that's becoming increasingly apparent is the stress on businesses. Simply put, people mostly stay home with these harsh conditions. That means less business for retailers, restaurants, coffee shops, and entertainment venues. In other words, business came to a screeching halt for many entrepreneurs.

Unfortunately, this will most certainly be the undoing of some businesses. It's sad, but inevitable. I don't wish that upon anyone, and I feel for people going through it.

It brings me to an idea I constantly reinforce for my family and business clients. We need to be prepared! When we're in the midst of our normal life, we're just living. Things generally feel good, and we're operating as though life will perpetually feel this way. That's the risk. Life won't always be normal like this. A storm will come, whether that's a literal or figurative storm. As such, we must be prepared! It's not an if, but rather a when. It's coming! And for countless businesses in the Midwest, the when is right now.

Whether you're a business or a family, the preparation process is similar. Here's a quick guide to getting yourself ready:

First, recognize that a storm WILL come.

Second, set aside some cash reserves that will only be used when the storm approaches. To determine the right amount, we must ask ourselves what the worst-case scenario is. If we're a business, it might be a situation where we aren't open for a few weeks. If so, what will that cost? We need to account for our overhead expenses, lost revenue, product waste, and possibly owner distributions (if our family relies on them to survive). In my business, I always keep $10,000 of cash on hand. At Northern Vessel, we keep at least $25,000 liquid. I have other business clients that keep $100,000-$300,000 in reserve for the storm.

If we're a family, we need to do a similar exercise. What's the worst that can happen to us? This question typically leads to the following types of situations:

Job loss

Car breakdowns (usually a $5,000 cap)

House maintenance issues (typically capped at $10,000-$12,000)

Medical situations (dependent upon health insurance, but can be upwards of $10,000)

Some families feel comfortable with $5,000 liquid, while others need upwards of $30,000. If you're feeling uneasy, pick a higher number.

Third, we must pre-determine what we'll do to our monthly budget when the storm comes. I have a lot of my clients do this exercise at some point. If you need to cut $1,000/month, what would you cut? I call it "red alert lockdown." Know what the cuts will be.

Fourth, remember all storms pass....eventually. If you're in one, this too shall pass.

Be safe out there, friends.

There’s a Hole in the Boat!

The hole in the boat is us. We're the hole. Impulse buys, friction in our day-to-day lives, the pursuit of convenience, external forces, forgetting upcoming items, lumpy expenses, or underestimating how quickly small things add up. Each of these factors leads us down the road of a leaky boat.

Do you ever feel like you're living month-to-month or paycheck-to-paycheck with your money? You're trying to make progress, but there's just not enough money to make it happen? You try to cut back and create margin, but it's just too dang hard? You're not alone! This is the plight of millions of Americans.

I have a little secret for you. You might not believe me at first, but I'm dead serious. You probably have more margin than you think. The money that you've been looking for is probably already in your paycheck. But there's a problem: There's a hole in the boat!

One of my favorite parts about starting a new coaching relationship is the first spin through their monthly budget. They've already provided me with all their monthly needs, wants, and debt payments. I digest all this information and visually lay it out on the screen. Then, we go through it, line by line. I encourage them to jump in if we're missing anything or need to edit a particular item. Then, the grand finale that I always eagerly anticipate is the moment we hit the bottom of the budget, only to discover hundreds or thousands of dollars left over.

There's a moment of confusion and bewilderment, almost as if they forgot to include their mortgage payment or grocery expenses in the above information. But they didn't. It's all been accounted for.....and there's still a ton of money left over. Sometimes, a family has $500 of unexpected margin......sometimes it's $5,000. Most families have $1,000-$3,000. But whatever it is, the look on their face is priceless. It's the look of hope and optimism. There's also some embarrassment at play, but here's my encouragement: They aren't alone! You aren't alone! So many other people are dealing (or have dealt with) the very same thing....myself included.

The hole in the boat is us. We're the hole. Impulse buys, friction in our day-to-day lives, the pursuit of convenience, external forces, forgetting upcoming items, lumpy expenses, or underestimating how quickly small things add up. Each of these factors leads us down the road of a leaky boat.

Good news, though! We can plug the hole. It's simple and effective. A budget! A budget is a surefire way to plug the leak. Not to rob ourselves of fun and enjoyment, but rather to harness that margin for what's most important. If you want to save up for a big family trip, plugging that leaky hole may be THE answer. If you're trying to save for retirement or your children's college, that leaky boat may be the reason you never get there. If you want one spouse to stay at home but can't make the numbers work, fixing that leak may be what the doctor ordered.

Once we fix the leak, we regain control. We're the boss. We get to determine the fate of that money. It's going to go somewhere, so we might as well be the ones directing traffic.

Plug that leaky boat! Lean into YOUR values.

More Control Than We'll Admit

But we also need to take account of all the areas in our lives that we've inflated (whether intentionally or unintentionally). Just because we can spend on something, it doesn't mean we should.

Oh, inflation. Inflation, inflation, inflation. Inflation is a topic that doesn't seem to go away. It's now as engrained in our cultural narrative as Taylor Swift, TikTok, and my Bears being terrible. Inflation is an easy target. It's easy to point to a single number as proof of why we're screwed. "Well, gas prices were x, and now they are y," or "My weekly grocery haul used to cost b, and now it costs c." While those facts may be true, they don't properly account for the overall picture. They are just numbers in a vacuum.

I had a conversation ask week that may illustrate the topic. While meeting with a client, we were looking closer at their current monthly budget. This exercise was through the lens of changing circumstances and a desire to carve out more margin. This family's monthly needs are approximately $9,000. This accounts for food, housing, utilities, transportation, and other items that are essentially needs.

Curious about the broader context of this number, I flipped back to some of their older budgets (from four years ago). Much to their dismay, their apples-to-apples monthly needs were just $5,000 back then......less than half of what they are today! You may be thinking to yourself, "How do monthly needs go up by $4,000 in just four years!?!?" There are a few reasons this happens, which primarily include:

Inflation

Changing seasons of life

Lifestyle creep

Evolving definition of "need"

I don't highlight this to point fingers. This isn't a condemnation of them (or anyone else). Rather, this is a great opportunity to look in the mirror, be honest with ourselves, and act accordingly.

Yes, inflation has done a number on this family. That's a very real thing. We can go category by category and see how their monthly spending has changed over the years (one of the benefits of budgeting and tracking over a long period of time). Inflation has played a role in this.

But we also need to take account of all the areas in our lives that we've inflated (whether intentionally or unintentionally). Just because we can spend on something, it doesn't mean we should. It's so easy to squint our eyes and decide xyz is now a need, or what was once needed isn't enough anymore. We humans justify all sorts of decisions this way.

We also have to look at our major decisions and how they impact our financial journey:

The cars we buy

The house we live in

The childcare we choose

The stores we shop at

The food we eat

Not all decisions are created equal. Some decisions can transform our budget to the tune of hundreds or thousands per month. It's critical that we view each decision through the lens of our broader life and what's most important to us.

So as we enter a new year, perhaps this is a great time to take a look at your numbers. Take back control. Focus on meaning. Create margin. Give yourself peace. You deserve it!

Inflation, the Tale of Two Families

I've discussed it on this blog before, but we humans tend to view reality through our personal lens. It's a sample size of one: me. Our own experiences, perspectives, and situations largely inform how we perceive these external forces.

Inflation has oddly become a polarizing topic in recent months. To millions of Americans, the weight of it has been heavy, often destructive. The impact of inflation can be felt in nearly every aspect of their lives. It's ever-present, and it feels overwhelming.

Others, however, seemingly roll their eyes at the topic. They acknowledge it exists, but on the whole, believe most people are being overly dramatic about the entire thing. This group sometimes thinks people use inflation as a scapegoat to deflect their poor financial decisions.

I've discussed it on this blog before, but we humans tend to view reality through our personal lens. It's a sample size of one: me. Our own experiences, perspectives, and situations largely inform how we perceive these external forces. Recently, though, I stumbled upon a TikTok video that illustrates this concept so well.

In short, this man theorizes that the American inflation experience is strongly formed around two variables: 1) When someone bought their house, and 2) The age of their children. Depending on the combination of these two variables, it drastically changes the shape of their financial life. While you/I may disagree with his specific numbers, I believe the concept is true, and his assessment is spot-on.

On the cheaper end of the spectrum are people who purchased their house before 2020 (lower prices and record-low interest rates) and don't have young children requiring childcare. These families have a combined house payment and childcare bill of approximately $1,500/month.

On the most expensive end of the spectrum are people who purchased their house within the last 12-18 months ($4,000/month) and have kids requiring childcare ($2,500/month). Therefore, these families have a combined house payment and childcare bill of approximately $6,500/month.

Comparing these two families, that's a $5,000/month difference....just from two categories. That equates to $60,000/year of spending differential, or closer to $80,000 of gross salary to make up the difference. Again, we can disagree with the specific numbers, but either way, the disparity between these two groups (revolving around just these two categories) is staggering. Also, these two families could live next door to one another. They could live similar and parallel lives, but have completely different financial experiences.

It's no wonder how two people who make similar money can disagree on the topic of inflation. I think this is a great perspective for us all to think about. Some of us live on the cheaper side of this spectrum, and others on the more expensive side.

First, I encourage you not to judge or demean others and their experiences. They are likely doing the best they can, and yes, it probably includes some unwise decisions along the way. Second, I also encourage you not to constantly compare yourself to others. It's so easy to play the woulda, coulda, shoulda game. Unfortunately, we can't hop into a Delorean and make different decisions. We must play the cards we are dealt. So let's play the best hand possible! You got this.

Cultural Narratives: College Edition

In yesterday's post, I discussed the importance of seeing through false cultural narratives. I framed the post through the lens of common misunderstandings around the stock market. However, I listed a handful of other cultural narratives wreaking havoc on our society. One raised more than a few eyebrows: "It's impossible to attend college without student loans."

Oh, this is a good one! And by good, I mean toxic and destructive. In my work, student loan debt is one of the top factors ripping people's lives apart. It's not uncommon to see $40,000-$100,000 of student loan debt......per person! I have a lot of empathy for people in these situations, for a few reasons:

Student loans are the only debt that's non-bankruptable. The only way out is to die. That doesn't feel like "good" debt to me.

Student loans are torching people's ability to live a meaningful life. Instead of pursuing work that matters, people must pursue work that pays the inflated bills.

It's not their fault! It's easy to blame people for their student loan debt, but they were only 17 or 18 when these decisions were made. They likely didn't understand the future consequences and implications. In most cases, the blame primarily lies on the parents. Parents don't trust their teens to stay at home alone for the weekend, but the very next day, they trust their kids to freely make a life-altering decision that will implode their financial life for decades.

Kids deserve better. My kids deserve better, and your kids deserve better! Luckily, better is available. Yes, college is expensive. There's no way around that. The cultural narrative is that the only way to go to college is via student loans. It's a lie! I'll explain why. First, it's essential to break things down so we can look at them from a different perspective.

In-state public universities in my state cost approximately $24,000/year. Some states are more, and some are less. I'm using public, in-state as my example, as it's a common and accessible option. We can make other choices, such as community college, trade school, out-of-state universities, and private colleges, but all choices have consequences (good and bad).

That's a lot of money, for sure. But we aren't going to pay $24,000/year. Most schools have an array of in-house scholarships to offer. In my state, most students will end up paying +/- 80% of sticker price, or $19,200ish.

That's still a lot of money. Let's break it down further. This equates to $1,600/month over 12 months. Ok, now we're getting somewhere. That's a lot, but attainable. Once we know this number, we have an array of options to pay for it:

Savings

College fund

Parents' monthly budget

Student work

Other scholarships

And several other options.

We don't need them all.....we just need some combination of them to total $1,600/month. I'm not saying it's easy, but it's 100% attainable for most families. And countless kids/families are doing it!

Methodically and intentionally piece together $1,600/month, or suffer for decades? The narrative pushes us to the latter, but we have the power to change the narrative.

It’s WHEN, Not IF

For most families, finances are generally ok......IF unforeseen issues don't pop up. That's the problem. We tend to live life as though it's an IF, but it's not. It's a WHEN. Unforeseen issues will absolutely rear their ugly head, but we won't know when, where, or how much. And WHEN they do, they can wreak havoc on our finances.

For most families, finances are generally ok......IF unforeseen issues don't pop up. That's the problem. We tend to live life as though it's an IF, but it's not. It's a WHEN. Unforeseen issues will absolutely rear their ugly head, but we won't know when, where, or how much. And WHEN they do, they can wreak havoc on our finances.

Take this recent client story, for example. In a three-day stretch, this couple experienced a hat trick of crazy:

Hit a deer with their car

Coyotes attacked their dog

Backed into their garage door

All that in three days!!! Wow. It wasn't an IF, but rather a WHEN. And WHEN happened to be an already busy week in the middle of November. They never saw it coming. They never anticipated a single one of these issues, never mind all three. They had enough life going on that they didn't need this to weigh them down.

But they were prepared! This is the beauty of getting right with our finances. Instead of destroying their financial life and creating a ton of relational stress in their marriage, it was a mere bump in the road. An ugly bump, but a bump. Here's how/why they were able to navigate this week without it crushing them:

They have a strong emergency fund for WHEN (not IF) life happens.

They are adequately insured to protect against significant liabilities falling on their plate.

They have sinking funds specifically for key categories (pets and home maintenance, in this case).

They have margin in their monthly budget, allowing them to reallocate income to meet unforeseen needs, WHEN necessary.

They are a wonderful case study of what it looks like to get this money stuff right. It didn't happen by accident. I began working with them in the spring to bring intentionality, preparedness, and acceleration to their financial life, but they have spent years building a strong foundation. Nothing here was good luck. I don't think anyone can accuse them of good luck after the crazy week they just had.

They focused on getting their money right, so they don't have to dwell on their money when life hits hard. They practiced proactivity in the past, which resulted in them not having to practice reactivity in the present. It's not making money our number one priority, but rather putting intentional focus on financial matters so that we can continue to push money down on our priority list of life. It's living with financial margin, which prevents any single life situation from knocking us down. It's called humility and contentment.

That's what it looks like to live meaning over money.