Move the Decimal Left

$4,125.85

How do you read this number? The correct answer is four thousand, one hundred twenty-five dollars and eighty-five cents.

The better answer is forty-one hundred dollars.

16 syllables vs. 7 syllables.....and a whole lot of noise.

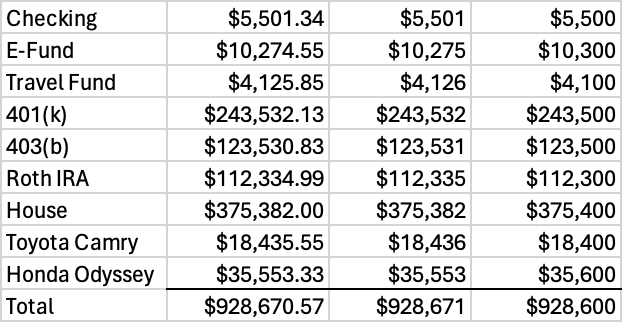

Whenever I work with clients, my mantra is simplify, simplify, simplify. I don't deal with precise numbers. When logging monthly budget numbers, I round to the nearest dollar. I've never once used cents, and I never will. Whenever I log assets and debt on a net worth statement (which happens every meeting for every client), I round to the nearest hundred dollars. Yes, hundreds. Here's an example:

Let's compare the three columns. The leftmost column represents the precise answer. The middle column shows the figures rounded to the nearest dollar. The rightmost column displays the figures rounded to the nearest hundred. Now, which column do you find the easiest to comprehend, visualize, and discuss? Undoubtedly, it's the right column! This simplified representation not only makes financial data more readable and digestible, but also empowers you to have more meaningful discussions about your finances. It might ruffle the feathers of my accountant friends, but that's just a little bonus treat for me!

Far too often, we burn ourselves out by dwelling on the minutiae. We spend so much of our time and energy trying to get the tiny details right that we lose sight of the big picture. Some of you know exactly what I'm talking about!

Confession: I haven't balanced my checking account in over 30 years. I intentionally budget each month and track what happens. I can tell you how much I've spent on gas over the last 15 years, but it's not a precise number. However, it's a correct number. Why? When we round thousands of transactions, the laws of probability tell us that half will round up and half will round down.....meaning it will all work out in the end. If I were to reconcile five years of my personal finances, I suspect my margin of error would be a fraction of a fraction of a percent......you know, a minuscule rounding error.

Is it perfect? No. But it's sustainable, digestible, and repeatable. If I had been obsessed with pennies in my budgeting process, I would have quit 15 years ago. Instead, I simplify, simplify, simplify. My process is clean, easy, and user-friendly.

I can't even tell you how many people I've worked with who insisted on getting everything perfect down to the penny, only to burn out and quit mere months later. This money stuff doesn't have to be rocket science. It should be simple, but it can only be simple if we make it simple.

Here's my encouragement for you today. Move that decimal point left! Don't zoom so far in that you miss the big picture. If using round numbers helps you understand and execute your money better, more power to you. Don't aim for perfection. Aim for progress!