The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

The Arms Race of Materialism

We have an arms race on our hands. It's a sexy, intoxicating endeavor: the violently aggressive pursuit of more. Bigger houses, newer cars, grander trips, trendier clothes. More, more, more. The problem with more is that every time we get more, more is still more. Ironically, it's an unwinnable race.

We have an arms race on our hands. It's a sexy, intoxicating endeavor: the violently aggressive pursuit of more. Bigger houses, newer cars, grander trips, trendier clothes. More, more, more. The problem with more is that every time we get more, more is still more. Ironically, it's an unwinnable race.

I recently met with a young couple who wanted some guidance. I'll lay out the scenario. Both spouses have good jobs at well-respected companies. They live in a big house (their "forever home"), drive new vehicles, and go on extravagant trips (of which the photos get repeatedly posted on their various social media channels). They are the couple everyone else looks at with jealousy and/or inspiration. People wonder how they are so rich, and aspire to be as "successful" as them.

However, as I can attest from my coaching experience, it's not always as it seems. Often, when we pull back the curtain, a different story reveals itself. This couple has a monthly after-tax take-home income of about $10,000. Their house payment is around $3,000/month, and they have two car payments totaling $1,700/month. Yes, their house and cars alone absorb approximately 47% of their take-home income. That feels tight to me, and it feels tight to them. They are stressed, but "It's worth it. We worked hard. We deserve it." No regrets, though.

Now, the twist. The reason for our meeting was to discuss their next steps. What next steps, you ask? They want to buy a different house—their new "forever home." That's the thing about the pursuit of more. Every time we get more, more is still more. What's a "forever home" today is just another house six months from now. Anyway, after doing the math, we concluded that this new house will cost them about $4,200/month.

Are you scratching your head yet? They are stressed with their current $3,000/month house payment, but want to increase it to $4,200? Yes, correct. This begs the question, "Why?" It took a few minutes to get there, but I finally got the real answer. Their best friends are building a new house (i.e. better than theirs), making them want to upgrade, too. It's the arms race!

I tried to explain that more isn't the answer. Meaning over money. Living with purpose. Career flexibility. Not allowing financial stress to drive a wedge into their marriage behind closed doors. Nevertheless, they left that meeting with a burning desire to build their new "forever home."

It's easy to dismiss this couple as "crazy" or an anomaly, but they represent a growing contingent in this country. I meet with multiple families per week who are deeply invested in the arms race of materialism. People are enveloped in it.

While I generally do a good job leaving my work at work, some of these families keep me up at night. I'm terrified of what's coming. A reckoning will happen. Perhaps soon. Perhaps decades from now. But it's coming. I repeatedly see how this story ends, and it's a nightmare.

Are you caught caught up in the arms race? If so, maybe today is the day to finally lay down your weapons.

Note: This couple granted me permission to share their story anonymously. I'm not sure why, but I'm grateful they did.

Leading Kids to (Financial) Hoarding

Do you see a theme? Guilt and shame. Not intentionally, usually. Slowly but surely, we're chipping away at their hearts for spending and generosity. We're trying to help them be "responsible" with money, but what we're really doing is grooming our kids to financially hoard. Get more. Have more. Build wealth. Become "independent.”

"You don't need that."

"Don't waste your money on that thing."

"You shouldn't be giving away so much."

"You need to save better."

"You shouldn't spend on that."

"You need that money more than they do."

These are the comments we make to our kids. Do you see a theme? Guilt and shame. Not intentionally, usually. Slowly but surely, we're chipping away at their hearts for spending and generosity. We're trying to help them be "responsible" with money, but what we're really doing is raising our kids to financially hoard. Get more. Have more. Build wealth. Become "independent."

If I had a nickel for every time a parent approached me and said, "My kid is so good with money. He/she doesn't spend anything. He/she saves everything."......well, I'd have a lot of nickels! See the narrative? Saving is responsible. Saving is THE win. If that's true, anything other than saving is irresponsible.

After twenty years of this narrative repeated over and over, we've created a generation of hoarders.

Like the family that makes $320,000 per year but "can only afford" to give $300/month.

Like the family with $1M in their checking account (yes, checking) that fears having nothing tomorrow.

Like the 60-year-old couple with $7M in their retirement accounts and two jobs they despise, but worry whether they can take care of themselves now and in the future.

Like the young single lady who makes $150,000 per year, but can't emotionally get over the hump to buy herself a pair of jeans.

Like the teenager who works a bunch of hours at his job, but declines invites from his friends to go out to eat on a Friday night, citing he "shouldn't waste money like that."

Like the family who saves $6,000 per month into retirement, but isn't yet able to give. However, once they have $x saved, they will be comfortable enough to start giving.

We parents have groomed our kids to become hoarders through guilt and shame. “Guilt” and “shame,” the two primary feelings expressed by countless adults when discussing their relationship with money. They feel guilt. They feel shame. Then, immediately after using those magic words, they share the comments made to them over the years (especially during their formative kid years). Ouch!

I have good news, though! No, we can't erase our past mistakes (unless you have a Delorean I can borrow!), but we can create a new narrative beginning today. Whatever your kids' age, even if they are adults, it's not too late to begin talking about money through a different lens.

While Sarah and I haven't gotten it all right with our kids, here are the narratives playing under our roof:

We can never be too generous....it's not ours to begin with

Spend money on fun things

Use discipline to save for bigger purchases

Work hard

I hope my kids are irresponsibly generous. I hope they buy fun things and sometimes experience buyer's remorse (it's a good, tough lesson). I hope they show discipline in saving. I hope they develop a strong work ethic. But I pray they don't turn into hoarders.

Our kids deserve better, and we parents have the power to give it to them. You got this!

The Irony of Debt and Income

Debt DOES discriminate based on income.....but in the opposite way you probably think. This is a dynamic I've seen play out over and over again (and it shocks me every time), but the higher income a family makes, the more likely they are to be crippled by debt. It's tremendously ironic.

I recently posted a few insights from my first 750 professional coaching sessions. I received a lot of positive feedback, but also criticism; the exact criticism I was expecting. To be specific, here's the part that I'm taking heat for:

"Debt does not discriminate based on income. It's not the lack of income that leads us into debt, but rather our decisions."

I knew I was saying something controversial when I wrote it, expecting to receive some pushback. That statement wasn't entirely true, and I knew it wasn't true. Debt DOES discriminate based on income.....but in the opposite way you probably think. This is a dynamic I've seen play out over and over again. The higher the income a family makes, the more likely they are to be crippled by debt. It's tremendously ironic.

First, let's take mortgages out of the equation. People with higher incomes are more likely to live in more expensive houses, which are more likely to have a higher mortgage balance. Let's acknowledge this fact, then throw it out the window.

Cars are another easy target. People with higher incomes typically drive newer and more expensive cars, and most car owners finance their vehicles. This is also too easy. People with higher incomes often have significantly higher car debt (and brutal payments). We'll throw this one out for today, too.

Let's focus on the most controllable and avoidable debt, especially when "being responsible" and having a good income: credit cards. I think we can all agree that carrying a credit card balance is an expensive and unwise endeavor. However, based on my ever-growing experience, the families who make the most money have the most credit card debt. Don't believe me? Let's look at the data.

Based on data recently released by the Federal Reserve Bank of New York and crisply reported by MoneyGeek, here is a breakdown of credit card balances (by household income levels). As you'll see, median and average credit card balances increase as income increases.

I'll synthesize the data and present it this way:

Families with an average household income in the BOTTOM 40% of Americans have a 38% chance of carrying a credit card balance, and are carrying an average balance of $4,250.

Families with an average household income in the TOP 40% of Americans have a 48% chance of carrying a credit card balance, and are carrying an average balance of $9,075.

In other words, families at the top of the income spectrum are 26% more likely to carry a credit card balance than those at the bottom of the income spectrum, and the average balance they carry is more than DOUBLE(!!) the lower income families.

This isn't me throwing a pity party for high earners. It's probably the opposite, in fact. We humans are an interesting breed, aren't we? Which leads me back to the sentence I took so much heat for saying: "It's not the lack of income that leads us into debt, but rather our decisions."

It's that whole human experience thing again. Luckily, you get to be a sample size of one: you. Make the most of your financial opportunities and choose wisely.

The Claws Tighten

The claws of status! I introduced yesterday's post by vaguely teasing my experience in KC, which triggered my introspection about status. Instead of sharing about what actually happened, I invited you to take a look in the mirror and conduct your own introspection about where status might have its claws in you. Thank you very much for the feedback. Your answers proved one major point I wanted to make. We all have our own. Here are yours……

I introduced yesterday's post by vaguely teasing an experience in KC, which triggered my introspection about status. Instead of sharing about what actually happened, I invited you to take a look in the mirror and conduct your own introspection about where status might have its claws in you. Thank you very much for the feedback. Your answers proved one major point I wanted to make. We all have our own. Here are yours:

Income

Job Title

Golf handicap

How grandkids are doing

How many grandkids you have

The boards you sit on

The neighborhood or town you live in

Clothes

What age you get to retire

Country club membership

The make and model of the car you drive

The restaurants you frequent

The vacations you take

How much time you get off from work

What careers your kids have

What colleges your kids go to

The notoriety of your business

The house you live in

The activities and teams your kids participate in

The success of your favorite sports team

The watches you wear

The beauty treatments you regularly get

How noble your chosen career is

That's quite the list! Indeed, each of these is a form of status that has the potential to get its claws in us.

Now, my story. While driving with my family in KC, we weren't far from my old house. It's the first house I owned, which I lived in from age 26-28 (until my company shut down and I experienced an involuntary relocation to Iowa). I thought it would be fun to take the kids to see the house where their dad lived when he was a young adult.

As we approached the house, I was flooded with nostalgia. Lots of memories danced through my head. That's also the moment I realized how much houses used to be my status symbol. When I purchased that house, it was bigger, newer, and nicer than I probably should have bought. It was pretty sweet. It was a great house, and still is (from the looks of it). I cared an awful lot about what that house said about me. It was my status. The claws of status tightened and caused me to make questionable choices in the pursuit of that status....and would for years to come.

Here's the irony. 15 years later, more accomplished and financially sound, I'm living in a house that’s inferior to the one I bought when I was 26. I've overcome the claws of status!

Or have I? The truth is, I don't think I have. In the past few years, I've realized that I still unhealthily find status in my house. While I'm cool living nearly anywhere, I recognize that I don't enjoy hosting people in my current house. Why? Status, most likely. Or perhaps more daily, the lack of status of my house. I find worth and status in my residence, which is a toxic trait. I'm grateful I can make practical and wise decisions around housing now, and I’m so glad we live where we live, but it bugs me that the claws of status are still tight. I'm disappointed in myself, but now I know what room in my mind must be cleaned next.

As G.I. Joe taught me as a kid, "And knowing is half the battle."

The Claws of Status

I just returned from a quick 24-hour trip to KC to celebrate my niece's 13th birthday. I took the 350Z and made a little convertible road trip out of it. It was an exhausting but fun little adventure. Yesterday, I had an experience that triggered today’s topic. I'm not going to share the exact story yet, as I want you to think about the topic through your own lens first.

Here's the idea I was pondering on my drive home last night: Our human pursuit of status is like an animal getting its claws into us. Once it takes hold—even just slightly—its natural instinct is to clamp down harder.

The crazy thing about status, though, is that each of us uses a different version of it to define success. Status comes in all shapes and sizes. Power, income, possessions, influence.....this list is endless. We don't all succumb to all of them, but rather there are likely one or two that are particularly alluring for you.

What makes status a unique feature in our lives is that it is extrinsic. In other words, it's present on the outside. Status is something that other people know we have. It's a signal. It's a means for comparison. It's a way that I can exhibit to you that I am ________. That blank represents how I want you to feel about me.

In a world of apples, oranges, and bananas, status is our simplified way of creating apples-to-apples comparisons between us and someone else. It's the measuring stick of something we want to be measured. It's a scorecard to determine who is winning the game.

So, before I delve into my story and my own thoughts on status and how it's situated in my own life, I have a question for you today. If you could put your finger on it, what is something that did or does give you status? Is there something particular that has its claws in you? If you're honest with yourself, do you find yourself pursuing a certain piece of status in your own journey? If so, can you please reply to this e-mail or drop a comment on the website? I'd love to hear your feedback. I'm not here to judge. I'm just as imperfect as anyone. What I'm looking for is sincerity and transparency, and that's what I offer to you in return. Tomorrow's post will be a follow-up piece, including some of your feedback.

Have a great day!

Side note: I'll be giving a message to a young adult group at a local church tonight. I'm going somewhere I've never gone in a public talk before (content-wise), so please keep me in your prayers as I try to deliver it crisply and confidently. I'll elaborate more about it on the blog soon!

One At a Time

At that moment, I triggered my motto, which I find helpful when these anxious feelings creep in: "One at a time." I can't categorize 68 transactions at once, but I can categorize one....then one.....then one.

Yesterday, I faced the same challenge many of my clients regularly encounter. After a few weeks of travel, sickness, and the Northern Vessel car crash sequel, my personal finances have taken a back seat to life. This is a natural consequence when life gets busy. It's not a matter of if, but when. Life WILL get crazy, and when it does, our finances may be a temporary victim.

Upon finally having a little spare time on my hands yesterday, I popped open my budgeting app to see what things looked like. Much to my despair, I was met with 68 uncategorized transactions. Crap! Few things cause anxiety and overwhelmingness quite like realizing you've fallen that far behind on tracking your finances.

At that moment, I triggered my motto, which I find helpful when these anxious feelings creep in: "One at a time." I can't categorize 68 transactions at once, but I can categorize one....then one.....then one. Here's how my brain works when starting my one-at-a-time process:

First, I start with the most recent transactions, as they are most likely fresh in my mind. I quickly categorize each item that's immediately familiar.

Second, I scan the transactions for vendors that are obvious categories. MidAmerican Energy is electricity. PureBarre is Sarah's fitness. Leaning Tower Pizza is dining out. Simple and clear.

Third, I choose a vendor that has multiple transactions popping up, and systemmatically knock out each transaction. Amazon is a great example. I had about a half dozen Amazon transactions. I logged into my Amazon account, scrolled through my recent orders (to determine what categories each transaction entailed), and categorized each transaction accordingly. I repeated this process for Target and Wal-Mart transactions by using their respective apps.

Fourth, after working through the first three steps above, my unallocated transactions shrunk from 68 to 15. These remaining transactions take a bit more work. They may involve a quick conversation with Sarah, an e-mail search for receipts, or logging into my bank account to see if there's an expanded transaction description. These are never fun, but it's a lot easier when there are only a handful of them.

One at a time. This is such an important perspective when dealing with our finances. Things can get complex and overwhelming. It's the nature of money and numbers, which is why so many people flounder or just give up. But when we take a one-at-a-time approach, nothing is overly intimidating. Just keep moving forward. Sure, we'd love to be sprinting every step of the way.....but even a crawl is still progress. Putting one foot in front of the other.

Apply this to all areas of money—heck, apply it to all areas of life! Break things down into digestible chunks. Make it approachable. Create opportunities for small wins. Execute. Repeat.

It feels good to get caught up on my budget tracking and again have clarity on where we stand. I'm sure I'll get derailed again at some point, but when I do, one at a time!

Move the Decimal Left

Far too often, we burn ourselves out by dwelling on the minutiae. We spend so much of our time and energy trying to get the tiny details right that we lose sight of the big picture. Some of you know exactly what I'm talking about!

$4,125.85

How do you read this number? The correct answer is four thousand, one hundred twenty-five dollars and eighty-five cents.

The better answer is forty-one hundred dollars.

16 syllables vs. 7 syllables.....and a whole lot of noise.

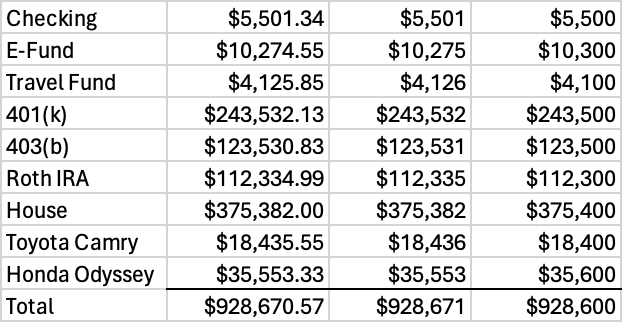

Whenever I work with clients, my mantra is simplify, simplify, simplify. I don't deal with precise numbers. When logging monthly budget numbers, I round to the nearest dollar. I've never once used cents, and I never will. Whenever I log assets and debt on a net worth statement (which happens every meeting for every client), I round to the nearest hundred dollars. Yes, hundreds. Here's an example:

Let's compare the three columns. The leftmost column represents the precise answer. The middle column shows the figures rounded to the nearest dollar. The rightmost column displays the figures rounded to the nearest hundred. Now, which column do you find the easiest to comprehend, visualize, and discuss? Undoubtedly, it's the right column! This simplified representation not only makes financial data more readable and digestible, but also empowers you to have more meaningful discussions about your finances. It might ruffle the feathers of my accountant friends, but that's just a little bonus treat for me!

Far too often, we burn ourselves out by dwelling on the minutiae. We spend so much of our time and energy trying to get the tiny details right that we lose sight of the big picture. Some of you know exactly what I'm talking about!

Confession: I haven't balanced my checking account in over 30 years. I intentionally budget each month and track what happens. I can tell you how much I've spent on gas over the last 15 years, but it's not a precise number. However, it's a correct number. Why? When we round thousands of transactions, the laws of probability tell us that half will round up and half will round down.....meaning it will all work out in the end. If I were to reconcile five years of my personal finances, I suspect my margin of error would be a fraction of a fraction of a percent......you know, a minuscule rounding error.

Is it perfect? No. But it's sustainable, digestible, and repeatable. If I had been obsessed with pennies in my budgeting process, I would have quit 15 years ago. Instead, I simplify, simplify, simplify. My process is clean, easy, and user-friendly.

I can't even tell you how many people I've worked with who insisted on getting everything perfect down to the penny, only to burn out and quit mere months later. This money stuff doesn't have to be rocket science. It should be simple, but it can only be simple if we make it simple.

Here's my encouragement for you today. Move that decimal point left! Don't zoom so far in that you miss the big picture. If using round numbers helps you understand and execute your money better, more power to you. Don't aim for perfection. Aim for progress!

Desperately Seeking Accountability

In a world where we don't want accountability, we really, really want accountability. We're desperately seeking accountability.

Yesterday's podcast episode hit unexpectedly hard. Within just a few hours after its release, I received at least a half-dozen messages. It was about how our human predisposition to make excuses robs us of the life we deserve. There's always an excuse if we want there to be one. Ultimately, though, the podcast episode meandered to the idea of accountability. This is where the episode hit so many people.

In a world where we don't want accountability, we really, really want accountability. We're desperately seeking accountability. To prove this point, I mentioned how hard it is for single people to successfully navigate their finances. In theory, this is backward. Single people have a simpler financial structure and don't have to deal with a partner's incongruent goals/desires. A single person is the boss, and they get to execute the plan solely in accordance with their wishes. Yet, single people struggle like no other.

Why? Accountability, accountability, and accountability. Or perhaps, more accurately, the lack of accountability. Yes, it's true that two married people will have financial disagreements, differing wants, and tension at times. All true! However, they also wake up each morning staring at their accountability. Every day, when I go out into the world to serve people and financially provide for my family, I'm accountable for doing what I say I'm going to do. Sarah is counting on me....and vice versa. We must follow through on our budgeting, saving, spending, giving, investing, paying the bills, keeping insurance policies in place, and several other financial-oriented tasks. That mutual accountability isn't the sole reason it all gets done, but boy, it's a big driver.

This is where my single friends can struggle. Ultimately, nobody is holding them accountable to budget, spend, save, give, etc. If it happens, it happens. If it doesn't, it doesn't. Nobody else will even know. There's something defeating about that. It lacks consequence. It lacks reward. It lacks celebration.

Whether you're single or married, you still face these same dynamics somewhere in your life. I have two: reading and lifting. I can't read a book or get my butt into the gym, but I've released two podcast episodes per week for three years and one blog post per day for 550 consecutive days. Why? Accountability! My podcast listeners and blog readers are there to hold me accountable. If my blog doesn't send at around 6AM CST, I immediately get texts from people checking to see if I'm ok. Many podcast listeners, similarly, have a set rhythm on how/when/where they listen to our podcast episodes each week, knowing new episodes will be released on Mondays and Wednesdays. That accountability is the difference between winning or losing. Between following a calling or falling apart. Between achieving a goal or whiffing.

If something is important, find accountability. If there's no natural accountability, manufacture it. Create structure that provides you with whatever ingredients you need to follow through. You don't have to, but you deserve to. We are desperately seeking accountability.

Never Let a Phone Do a Laptop’s Job

If you've followed my content for any period of time, you probably know I'm obsessed with behavioral science. It's been a passion of mine for the last decade, and it plays a vital role in my coaching work. One of my favorite dynamics of behavioral science is the differences between generations. Even before I get to know someone, I have a baseline understanding of some of their behavioral wirings just based on their age. Here are some examples (these are generalizations, not absolutes):

Baby Boomers are very secretive about money, while GenZ and younger Millennials tend to be extremely transparent (almost shockingly so).

Most Millennials weren't taught about money as kids.

Boomers and GenX are more likely to value possessions, while Millenials and GenZ are more likely to lean into experiences.

GenZ is far less likely to let finances drive their decision-making (especially job selection).

Boomers and GenX prefer to purchase products from people, whereas Millenials and GenZ prefer to buy directly (without the relational aspect).

Some of these differences are profound, while others may seem trivial. However, there's no denying that the era we grew up in has left an indelible mark on how we perceive the world today. Despite sharing the same world, we all interact with it in our unique ways.

That brings us to today's topic. There's one fun little nuance that I've watched play out for years. Then, as I was scrolling through some news articles last night, I finally saw it discussed. You can read about it here. In short, there's a silent generational divide about how transactions should be made. Let's do a little quiz. Answer "yes" or "no" to each.

Would you buy the following item on your phone?

Laundry Detergent?

Movie Tickets?

Kitchen Gadgets?

Hotel Room?

Fridge?

Airline Flight?

Signing an Apartment Lease?

Buying a Car?

Signing Documents to Buy a House?

Some of you started sweating as you moved down the list. Where the anxiety kicks in is probably an indication of your age. The cultural phenomenon at hand is how the younger generation will literally make the most significant transactions in their life on their little cell phone screen. I gotta be honest. As an old Millennial, I start getting anxious after the hotel room bullet point. That's my cutoff. Anything further down merits busting the computer out. No quesitons, no excuses. To me, that's just being prudent. To someone younger, it's a paranoid waste of time.

I once had a young client purchase a car using only his cell phone. I about had a heart attack. I buy hotel rooms monthly on my phone, but the idea of buying flights on my phone sounds terrifying. And don't even get me started about legal documents. Give me the biggest screen I can find!

What's the point? It’s NOT to make sweeping criticisms of any generation. Rather, it's to highlight how differently each of us experiences and interacts with the world. Explore those differences. Celebrate those differences. Laugh about those differences. Learn from those differences. We have so much to learn.....from both those older AND those younger.

Stepping Over Quarters

This is a perfect example of how a scarcity mindset can cost us. In an effort to save a few bucks, we inadvertently cost ourselves far more than we were trying to save in the first place.

During a recent conversation with a friend, he began sharing about how prudent and wise he is with his money. I didn't solicit this information, but these types of conversations tend to come my way. Anyway, he shared several examples of how he saves money through his various day-to-day decisions. Like this one: "I save $3 in tolls every day by taking the non-toll roads to work." $3 per day works out to roughly $60 saved per month. On the surface, that would appear to indeed be a prudent move.

Then, I asked a follow-up question: "How much longer is your commute this way than if you just pay the tolls?" His response: 20 minutes per day.

My next question: "How much do you make at your job?" His response: I bill at $65/hour.

I explained that he is effectively making $9/hour by not taking toll roads, but giving up $65/hour of billable work time in exchange. In other words, for every day he saves $3 by taking the longer commute, he costs himself $21.67 of revenue. That $18.67/day difference equates to a $373 worse outcome over a four-week stretch! That's more than $4,800/year he's losing out on!!!!!

"Yeah, but I save $3 every single day!"

This is a perfect example of how a scarcity mindset can cost us. In an effort to save a few bucks, we inadvertently cost ourselves far more than we were trying to save in the first place. Or as the expression goes, stepping over quarters to pick up nickels.

Whenever we make financial or life decisions, we have to weigh both sides of the equation. For every benefit there's a cost, and for every cost there's a benefit. When we focus on just one side, we'll make poor decisions. I guarantee you're doing it right now. Heck, I guarantee I'm doing it right now.

As I've discussed at length on this blog and the podcast, cost isn't the metric we should dwell on. Rather, we should aim to understand the value we're getting for the cost. Some cheap things are expensive, and some expensive things are cheap. It's our job to assess it through our own unique lens, and make whatever decision is best for us.

I texted my friend yesterday morning. He took the toll road.

The Paradox of Choice

Have you ever been to Cheesecake Factory? Reviewing their menu feels like you're thumbing through the Bible, attempting to find the Book of John. It's nuts!

Over the last few months, my social media feed has been inundated with Mother's Day gift ideas (the algorithm must see me as a stereotypical dad). I'm talking about crazy, unique, creative, amazing ideas. I love them all!

Nearly 20 years ago, I read a book called The Paradox of Choice, by Barry Schwartz. It's a fantastic read, and I highly recommend it. The premise is simple: While we think we want more choices and more options, science shows that an abundance of options actually causes stress, paralysis, frustration, and, eventually, regret.

Have you ever been to Cheesecake Factory? Reviewing their menu feels like you're thumbing through the Bible, attempting to find the Book of John. It's nuts! Here's my experience with Cheesecake Factory. I spent 7 minutes reviewing and re-reviewing the menu. When every member of my party has already ordered, and the waitress is glaring down impatiently for me to speak, I stressfully blurt something out. Then, when the food arrives, I'm immediately crushed with order regret. Why? Because the abundance of choices created a scenario where it's inevitable that I'll be disappointed. Yes, I'm weird.....but it's science!

Contrast that with a different type of restaurant. It's called Teriyaki Boys. I used to dine there when I worked in downtown Des Moines. Yes, their food is solid. However, there was a different reason why I frequented their establishment. They only have one menu item! It's a Teriyaki dish; you just select your meat (check out their menu). That's it! It's that simple.

So many things in our lives are impacted by the paradox of choice. We act as though more options are better, but we're being harmed by our culture's abundance of choices every step of our journey. Unfortunately, we can't wave a magic wand to eliminate all the choices from our world.....that would be weird and evil. Instead, we can intentionally narrow the options on our own proverbial plate. Here are some examples in my own life:

Sarah and I enjoy watching TV shows together after the boys go to bed. We only have one show going at a time. We either watch that show or watch nothing. There are no other options.

When I go to our coffee shop, Northern Vessel, I only order one of two menu items: a cortado or a chagaccino. The other drinks are wonderful, but I don't want to burn my mental energy trying to decide.

When we give out of our budget each month, there are only two places it can go: our giving fund or set aside for people in need. Once it's in those locations, it can be administered as needed. But our budgeting choice is simple....two options only.

When we invest, there's only one option: the total stock market index. It may be one option, but it includes nearly 4,000 companies, all rolled into one cheap fund. This is the simplest of simple approaches. Zero brain damage, zero friction.

The paradox of choice will crush us if we're not careful. I still don't have a Mother's Day gift......

The Cure For the Sunday Scares

Statistics show that 4PM on Sundays is the most depressing hour of the week. It makes sense. We've spent the last 48 hours relaxing, spending time with people we love, possibly traveling, and perhaps engaging in fun hobbies. Then, reality sets in. We realize we'll be in bed in a few hours, then wake up to five days of doing something we probably don't want to do. Ouch!

I had a fantastic weekend! Good food, good travel, good activities with the kids, and (mostly) good rest. Last night, as I was preparing for a 3AM wake-up to fly to Houston, I couldn't help but think about how excited I was for my week. Not because it's going to be fun (it won't be), but because it matters. I have the opportunity to serve my client for the next four days, including some difficult projects and challenging meetings. Fun isn't a word I'd use to describe it, but meaningful is. I usually feel that excited anticipation on Sunday nights, and it's something I love most about my life.

What about you? How do you feel on Sunday nights? Do you get the Sunday Scaries? You know exactly what I'm talking about. Maybe your chest tightens up, you yearn for more weekend time, or you start dreading what's to come. Statistics show that 4PM on Sundays is the most depressing hour of the week. It makes sense. We've spent the last 48 hours relaxing, spending time with people we love, possibly traveling, and perhaps engaging in fun hobbies. Then, reality sets in. We realize we'll be in bed in a few hours, then wake up to five days of doing something we probably don't want to do. Ouch!

There is a cure for the Sunday Scaries, though. Want to know what it is? It's not an answer so much as a question. As you sit in your Sunday Scaries, what would the next day or next week need to look like for you not to feel that way? Maybe it's adding something. Maybe it's subtracting something. Maybe it's altering something.

If your answer is, "I'd rather be sitting by the pool with a margarita," you're thinking too short-sighted. Don't get me wrong, I'll take a margarita by the pool any day! But that's not life. That's a treat. Yes, treat yourself. Yes, find time to do cool things.

Through the lens of living a productive life where you serve others and provide financially for your family, what would tomorrow need to look like to not feel the Sunday Scaries? Many of you already know the answer. However, there's a cost.....and the cost can feel steep. It may include one or more of the following:

Less security

Less income

Less comfort

Less status

Less wants

Less wealth

Less predictability

Pursuing a different sort of life may require the loss of something you hold dear. However, it's also important to recognize what you'll gain:

Meaning

Fulfillment

Purpose

Impact

Contentment

Adventure

On the surface, the upside of the latter doesn't seem nearly as weighty as the downside of the former. But let me put it this way. I've seen countless people pursue money and comfort, only to turn away from it. On the flip side, I've never seen someone pursue meaning and then decide it's not for them.

I encourage you to reflect on your Sunday Scaries, and ask yourself what the cure is. Believe me, there is one!

The Phase We Never Outgrow

That's the power of needs. Needs compel us to act. Needs incentivize us to hurry. Needs encourage us to throw common sense out the window. Needs must be met, and meet them we shall.

Every night, I ask the kids what they learned at school. I wish I could tell you I always get productive answers, but I don't. As Forrest Gump says, it's like a box of chocolates: I never know what I'm going to get. Recently, though, Finn dropped some gold on me. Here was his answer to my question:

"We did needs and wants, and I got a LOT of wants!"

Join the club, Finn! His teacher jokingly pointed out that most kids had a lot of wants and struggled to draw a proper line between what's a need and what's a want. I guess it's the phase we never outgrow.

This is one of the biggest challenges for young and old alike. We have LOTS of wants, and the line is blurred between what's a need and what's a want.

Today, I want to settle on that last part—the blurred line between needs and wants. This isn't a first-grader problem; it's a human problem. And the problem is that it's often not intentional. There's a psychological game at play where we subconsciously shift something from a want to a need to justify its existence.

To exhibit this concept, I'll list what people have told me are "needs." I'm not condemning these purchases; instead, I'm questioning whether it's a need. I'll let you decide for yourself. Without further ado, here's a list of "needs" from people I've conversed with:

$10,000 for a next-gen TV

A $75,000 basement remodel project

$2,500/month for dining out

$2,000/month for clothing

A brand new Tesla

Monthly botox injections

Country club membership

A lake house (2nd home)

A speedboat

Each of these was firmly thrust into the need camp. And do you know what we do if something is a need? We purchase it by any means necessary. That's the power of a need.

If I need to put food on the table, I'll go to extreme lengths to make it happen (including going into debt if that's the difference between eating or being hungry).

If I need a $40,000 speedboat, I'll go to extreme lengths to make it happen (including going into debt if that's the difference between my hair blowing in the wind and being a loser sitting on the shore watching the boats go by).

That's the power of needs. Needs compel us to act. Needs incentivize us to hurry. Needs encourage us to throw common sense out the window. Needs must be met, and meet them we shall.

One of my roles as a parent will be to help my kids successfully manage the tension between needs and wants. However, I'll simultaneously be working on that myself. It's the phase we never outgrow.

The Status of Status

Whether we realize it or not, much of life is the pursuit of status. Status is at play in nearly everything we do, the decisions we make, and how we spend our money.

Whether we realize it or not, much of life is the pursuit of status. Status is at play in nearly everything we do, the decisions we make, and how we spend our money.

First, what is status? One definition is "the relative social, professional, or other standing of someone or something." Here's another: "position or rank in relation to others."

We humans are obsessed with status. We fixate on being ranked higher "in relation to others." We do this in small ways and in significant ways:

Which logo appears on our clothes and shoes.

The emblem on our vehicle.

The zip code or school district in which we live.

The university we attend.

Our job title.

The alphabet soup of credentials that follow our name.

Where we vacation.

Who we associate with.

How much is in our bank account.

What phone we use.

The career field we enter.

The size of our house.

Each of these decisions, whether consciously or subconsciously, involves our pursuit of status (or perceived status). This is at the center of keeping up with the Joneses. Remember, the definition of status isn't about what we have. It's about what we have "in relation to others." Therefore, when we make decisions, a part of us is trying to improve our relative position of status. The chase! This is a dangerous and slippery slope.

No, buying a car with a certain emblem isn't evil. No, having a new iPhone isn't stupid. No, going to a particular university isn't wrong. No, gaining credentials isn't an act of arrogance. None of these things are inherently evil. However, we must continually look in the mirror and ask ourselves why we're really making xyz decision.

I'm literally watching many families disintegrate before my eyes. They are losing their freedom, values, and unity. Slowly but surely, their finances are eroding. It's not for lack of income. In fact, this often happens to families on the upper end of the financial spectrum. The pursuit of status is an expensive and soul-sucking endeavor.

What's the alternative? For me, it's simple but difficult. Instead of focusing on trying to improve our position in relation to others or care about what others think, we simply need to focus on what's most important for our family. Easier said than done, I know.

It's sometimes hard watching my friends make many multiples of our income when I could flip the switch and join them. It's sometimes hard living in the house and driving the cars we have. It's sometimes hard to know I continually turn my back on a high-status career (with a ridiculous paycheck tied to it).

On the flip side, if we can resist the urge to pursue status, we get to pursue a life that's truly meaningful for us and our families. It's the hardest endeavor, but also a priceless one.

I won't ever fully eliminate the desire for status, but with enough intentionality, I can hopefully minimize it and remember what’s most important. You can do it, too.

Zoom Out or Freak Out

Have you heard!?!? Everything is falling apart!!! The stock market is collapsing!!!! It's the end of the world!!!! Right on cue, countless people are gripped with fear over how bad the stock market is doing. Everyone's posting about it on social media, and I've received no less than 15 questions about it just this week.

Have you heard!?!? Everything is falling apart!!! The stock market is collapsing!!!! It's the end of the world!!!! Right on cue, countless people are gripped with fear over how bad the stock market is doing. Everyone's posting about it on social media, and I've received no less than 15 questions about it just this week.

After all, the stock market is down 4.6% in just the last 20 days. Considering the stock market is supposed to go up 8-10% per year, losing nearly 5% in a three-week stretch feels like the end of the world.

Things are so bad that the market is down to a level not seen since......well, seven weeks ago.....when it hit yet another all-time 153-year high. And after this white-knuckle three-week stretch and watching our investments get beat to smithereens, the stock market is now up only 21% in the last 12 months. Even worse, it's only up 70% over the last five years! Whatever shall we do!?!?

I hope you picked up the sarcasm, as I was laying it down pretty thick. If we don't have a proper context of what's happening, we can really freak ourselves out. Alternatively, we can simply zoom out. When we do, we see a different picture. Like this chart:

This is what the market looks like over the last five years. That little downward blip on the right-hand side of the image is this scary, nasty, terrifying collapse everyone is on pins and needles about. I'll stress the world "blip." Context matters. Context always matters. And, like with most situations, we need to zoom out to gain a proper context.

I won't claim to know what will happen next. The stock market may hit a new all-time high next week, or it could be on the way to experiencing a 50%+ collapse. Either way, I don't much care. Here's what I do care about, though. I care that history tells us, over a long period of time, the market will provide something in the ballpark of 9% per year. I also care that there has never been a 15-year period in history where the market lost money. Lastly, I care that the worst the stock market has done over a 30-year period of time is end up 4.4x higher than it started.

We can zoom out or freak out. I hope you'll join me on the zoom out side of the line. Life is far more peaceful and meaningful when we do.

Creating Begets Creating

One of my clients has a business idea. It's a simple but effective idea. It likely won't make him a massive profit. Heck, it probably won't even provide enough income to live on. For many months now, I've been beating the drum of go, go, go. He NEEDS to put his idea into practice. He NEEDS to move forward....but not for obvious reasons. Here's why: creating begets creating.

One of my clients has a business idea. It's a simple but effective idea. It likely won't make him a massive profit. Heck, it probably won't even provide enough income to live on. For many months now, I've been beating the drum of go, go, go. He NEEDS to put his idea into practice. He NEEDS to move forward....but not for obvious reasons. Here's why: creating begets creating.

Right now, he's stuck with all these ideas in his head. Until it moves from his head to his hands, it will forever remain an idea. Sure, he could collect those ideas and eventually take them to the grave with him. However, I believe he and everyone else deserve to have his vision come to life.

If he ultimately follows through, whether he fails or succeeds, the act of creating will beget more creating. It will set off a chain of events and practices that will ultimately lead to more creating. For that reason, I don't even think it matters how successful this first endeavor is. Instead, it's about the act, the action. I wholeheartedly believe the moment he puts this idea into motion is the moment his life will forever change.

This business plan is an idea, but it's probably not THE idea. THE idea is buried somewhere deep within him, but it can't materialize until he becomes someone who creates. Once that happens, he can unlock everything else beneath the surface.

This concept applies to business ideas, but it also applies to so much else in life. The reason Taylor Swift can write smash album after smash album is because one time, when she was a teenager, she wrote songs. Then wrote songs. Then wrote more songs. Then became one of the most famous musicians on the planet. Creating begets creating.

It's the reason I can record two podcast episodes and write seven blogs every week. In theory, I should have run out of ideas years ago. However, creating begets creating.

It's the reason my guy Cole continues to raise his filmmaking game. Every time he creates something, it spawns an entirely new idea that transcends the last. Fast forward enough reps, and he's creating content that melts my brain. Creating begets creating.

Whatever gift, passion, or idea you have brewing inside you, move it from your head to your hands. Put it into action. Even if it sucks. Even if it fails. Even if it doesn't come out the way you've envisioned it. Just create. Once you do, the real gems living inside you will materialize and eventually bless us all.

Don’t Fall for the Facade

That's the dilemma - and danger - of facades. We watch everyone's perfectly curated lives, very well knowing how imperfect things are behind our home's front door. It can be demoralizing. Self-talk creeps in. Doubt can take over. We begin asking ourselves why our life sucks so badly compared to our friends, family, co-workers, and neighbors.

We had a wonderful Easter church service yesterday morning. It's always a special day, and we're grateful for the opportunity to celebrate. It was fun crossing paths with many friends who were also there to celebrate the big day. Based on what they saw, most people probably believed we were having an amazing Easter Sunday. They would have been terribly wrong. It was a facade. We were in the midst of one of the worst days of our parenting lives. We were absolutely miserable. Grateful, but miserable.

When I say facade, I'm not referring to an intentional act of deception. Rather, people don't know what they don't know—a half-truth of sorts. We weren't trying to be disingenuous; we were just trying to live life. Meanwhile, some people who saw us appearing to be having a great day were also having a harder day than was visible on the surface.

That's the dilemma - and danger - of facades. We watch everyone's perfectly curated lives, very well knowing how imperfect things are behind our home's front door. It can be demoralizing. Self-talk creeps in. Doubt can take over. We begin asking ourselves why our life sucks so badly compared to our friends, family, co-workers, and neighbors.

Social media only escalates this dynamic. Social media allows us the opportunity to perfectly and intentionally curate what gets shared with the world. It puts this entire concept on steroids, blasts it out to hundreds or thousands of people, and then gets further juiced by the positive reinforcement of likes and comments.

This is also an ever-increasing problem when it comes to money. I regularly hear people put certain families on a pedestal, essentially viewing them as the pinnacle of success. They drive the best cars, live in the biggest houses, wear the nicest clothes, go on the fanciest trips, and have the perfect kids. You know who I'm talking about! I get an interesting perspective in my work. I get an intimate, up-close perspective of what really goes on behind the curtain. Here's what I can tell you. Looks can be oh-so deceiving. That perfect family that you unfairly compare yourself with? All is not what it seems.

Behind the appearance of wealth and success is often stress, turmoil, financial tension, growing debt, lack of career freedom, and marital strife. I'm not saying this to demean any family. I have so much empathy for these families. I'm not trying to knock them off some perceived pedestal. Instead, I want to encourage you to stop comparing yourself to someone else's half-truth facade. There's more going on than you know, and it's probably not as rosy as it appears.

On the other hand, perhaps we should try living with a little less facade. I'm not advocating that we air all our dirty laundry to every listening ear, but maybe we can be a bit less curated and a little more authentic. Let's be ok with our imperfections. Our lives aren't perfect, but neither is theirs.

The Drink That Satiates

When I was a kid, I distinctly remember an advertising battle between Coke and Pepsi. The rivalry ran so deep that they would openly bash one another in their TV and print ads (at least that's how my questionable childhood brain remembers it). Anyway, one of the nuances I remember playing out was this back-and-forth debate about taste tests. Despite Coke being the overwhelmingly favorite drink of consumers, Pepsi continually (and oddly) produced studies showing they were preferred in taste tests.

When I was a kid, I distinctly remember an advertising battle between Coke and Pepsi. The rivalry ran so deep that they would openly bash one another in their TV and print ads (at least that's how my questionable childhood brain remembers it). Anyway, one of the nuances I remember playing out was this back-and-forth debate about taste tests. Despite Coke being the overwhelmingly favorite drink of consumers, Pepsi continually (and oddly) produced results showing they were preferred in taste tests.

Here's where things get interesting, and it has to do with one particular word: "taste." Pepsi would win taste tests, yet people would buy Coke. Why? People don't taste pop; they drink it. Pepsi's taste was more appealing (dare I say sexy?), but it wasn't satiating. The surface-level appeal works great as long as you're just tasting it......but that's not how the product is consumed.

Happiness is the same thing. It tastes great. It's extremely appealing....even sexy. We violently pursue it with our actions and behaviors (often counterproductively). But just like Pepsi, it's not satiating. And like our pop-drinking experience, we're not in the tasting business. We don't taste life.....we drink it….we live it.

This is why, in my humble but convicted opinion, we often live with a void in our lives. We do everything we can to fill this void with happiness, but happiness is fleeting. I drove my new (to me) 350Z for a bit yesterday. It was only 36 degrees out, but I rolled the top down and cranked up the Twenty One Pilots. It made me happy. It was pure fun. It was also fleeting. That's not to demean the experience or treat it as if it doesn't matter. Rather, it's fair to recognize money, stuff, and status cannot satiate us. They can provide a momentary jolt of happiness (tastes great!), but it doesn't fill the void.

It's okay to taste the Pepsis of life. They taste good! They're appealing. They're fun. Absolutely nothing wrong with that! On the flip side, we need to recognize those things can never and will never satiate. They aren't the prescription for what ails us. They aren't the solution to fill the void.

Instead, what we're really searching for meaning and fulfillment. We're looking for something that motivates us to get out of bed and gives us the opportunity to make a difference. That idea takes a few different forms. First, generosity. Generosity fills our tanks unlike any material self-satisfying purchase can. Generosity always wins, and the giver is often the biggest beneficiary of the gift. Second, we need to pursue work that matters. Not work that pays a ton. Not work that gives us status. Not work that's fun. Not work that's easy. Work that matters. Using our gifts and passions to make a difference. Be productive. Add value to others. It’s simple, but powerful.

That's the Coke of life. It's not as appealing or sexy, and it doesn't give us that instant jolt, but man, it satiates! Drink up!

“Never Tell Me the Odds”

"Never tell me the odds," quipped Han Solo after C-3PO warned him about the ultra-low probability of surviving an asteroid field. This is one of my all-time favorite Star Wars quotes, and it's one of the things I like most about Han Solo. He didn't care if the cards were stacked against him; he was just crazy enough to believe he would succeed.....and he did.

"Never tell me the odds," quipped Han Solo after C-3PO warned him about the ultra-low probability of surviving an asteroid field. This is one of my all-time favorite Star Wars quotes, and it's one of the things I like most about Han Solo. He didn't care if the cards were stacked against him; he was just crazy enough to believe he would succeed.....and he did.

Oakland University took a page out of Han Solo's playbook last night by knocking off one of the all-time great college basketball programs, Kentucky. It was a massive upset and a joy to watch. Wrapped up in all the craziness was one specific Oakland player who knocked down a mind-melting ten (10!!!) threes. Oakland had no business beating Kentucky, yet here we are! Nobody must have told them the odds!

I think we should all have a little Han Solo in our DNA. We live in a world that tells us we can't. We're provided a million excuses and justifications for why it won't work. Even if we're able to get our hopes up, there's a friend or family member who is more than happy to add a discouraging remark. "Don't get your hopes up." "In your dreams." "Only if you're lucky." "You need to think more practical." "Enjoy it while it lasts."

One of the biggest complaints I hear from clients is their frustration with not receiving sincere, genuine, unselfish encouragement and support from their loved ones. People in our lives either don't believe we can do it or are jealous of the mere idea that it's possible. Therefore, it's in people's self-interest to dissuade us from following through on our dreams.

Pay off those student loans. Get that dream career. Start that business. Bring one spouse home with the kids. Stop living month-to-month. Send those kids to college without debt. I think you CAN do it. Strike that. I think you SHOULD do it. No, strick that again. You WILL do it.

When I look at my life, I think about C-3PO telling me the ridiculous odds of this actually coming true. I think the same thing about so many of my clients. Some of these people in my life are doing mind-boggling things that I have difficulty comprehending. There's one common thread with all these people: They were crazy enough to believe it could be done. That's the Han Solo in their DNA. They didn't care if other people believed in them. They chose to move forward anyway....and they did!

Oakland didn't want to know the odds. I didn't want to know the odds. Hopefully you don't want to know the odds, either. Just go make it happen. There are a million reasons you can't. There are a ton of excuses for not. Or maybe, just maybe, you do it anyway. If you need someone to believe in you and cheer you on (because others won't), count me in!

Pot, Meet Kettle

After learning about my recent 2006 Nissan 350Z purchase, my friend shared his less-than-savory opinion about it. Specifically, he called it a "boujee move" and added, "It's a bad look for you, Travis." Translation: I'm a hypocrite for buying such a fancy luxury, and it feels a bit over the top.

Today, I have the pleasure of sharing a funny (to me) story from a recent conversation with a buddy. Fortunately for you, he gave me his blessing to share it. I appreciate that he doesn't take himself too seriously.

After learning about my recent 2006 Nissan 350Z purchase, my friend shared his less-than-savory opinion about it. Specifically, he called it a "boujee move" and added, "It's a bad look for you, Travis." Translation: I'm a hypocrite for buying such a fancy luxury, and it feels a bit over the top.

These comments were the most pot-calling-the-kettle-black moments of my year. Why? This guy can out-boujee anyone. Here's the thing, though. Most people who are boujee don't know they are boujee. In his mind, he lives a bare-bones lifestyle. He only buys things he "needs." You know, like new luxury vehicles (gotta have reliable transportation!), mini-mansions (good school districts are key!), a stylish wardrobe (dress to impress!), and country club memberships (it's networking!). Need, need, need, and need.

On the other hand, my extra car is a boujee waste of money, according to him. He even went a step further and called it "irresponsible." This is where the conversation took a turn for the hilarous, and why I wanted to write about it. As we debated whether this 350Z was boujee, I pointed out that my family's three cars, combined, are worth less than half of his truck. He drives a $60,000 truck, and our three vehicles are worth a combined $25,000! Further, his truck payment is $1,400/month, and we haven't made a vehicle payment in 12 years.

Do you see the irony here? This is how we get so twisted up in our culture when it comes to money, stuff, and status. He sincerely believes he's living a conservative, responsible life. Meanwhile, he truly believes I made a "boujee move" with this car.

This is one of the many reasons I never use other people to measure my decisions. Our culture is pervasive, and its impacts are contagious. Instead, I will continue to lean into meaning every step of the way while wholeheartedly bucking the societal trends and pressures of what we're supposed to do. I hope you find your own unique ways to do the same. Don't worry about what others think. Stay true to your path and lean into your values. You will most certainly screw up along the way, but you'll do so while going in the right direction.....your direction.