The Daily Meaning

Take your mornings to the next level with a daily dose of perspective and encouragement to start your day off right. Sign-up for a free, short-form blog delivered to your inbox each morning, 7 days per week. Some days we talk about money, but usually not. We believe you’ll take away something valuable to help you on your journey. Sign up to join the hundreds of people who read Travis’s blog each morning.

Archive

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- August 2021

- November 2020

- July 2020

- June 2020

- April 2020

- March 2020

- February 2020

- October 2019

- September 2019

Ron Popeil Would Be Proud

When working with clients on investing, I stress the importance of simplicity, consistency, and patience. We choose broad, cheap funds. We make contributing a habit in our life. We remember how long our time horizon is.....so we don't freak out about the volatility along the way

When working with clients on investing, I stress the importance of simplicity, consistency, and patience. We choose broad, cheap funds. We make contributing a habit in our life. We remember how long our time horizon is.....so we don't freak out about the volatility along the way.

Years ago, I helped a young client set up her investments just this way. We selected one of the best index funds in the world, we automated it, and she understood the big picture. Aside from that, she did absolutely nothing.

Fast forward many years, this person had long moved on from my coaching services. I randomly ran into her on the bike trail. During our brief chat, we touched on her financial progress. In this exchange, I asked her how she felt about the recent stock market craziness.

"You told me not to stress out about the stock market, so I don't even think about it."

"Yeah, that's a really great approach! I'm glad you feel good about it....just as you should! How do your investments look?"

"I haven't logged on in a few years. You said it was all automated, and I don't have to do much, so I haven't. In fact, I don't even know my account login."

"You're right. No reason to obsess about it. But maybe you should at least know how to log in to your account!"

I encouraged her to get her login information and record it somewhere safe, so she can get into her account if/when she needs to (such as changing the amount automatically being contributed."

A week later, she calls me somewhat in a panic, very excitable. "Travis, do you know how much money is in this account!?!?!" She shared the number, then shared her utter disbelief. It was far more than she had imagined it would be. I explained this is exactly what happens when we make it simple, consistent, and patient. Her monthly contributions were now just a normal part of her monthly budget, and this plan is fully integrated into her life. Yet, it's made a massive difference in her journey. These are all ideas and numbers we talk about in our meetings, but it's another thing to see it materialize right in front of your eyes. This is one of the challenges of finance. Numbers on paper never feel real. Part makebelieve, part too-good-to-be-true, part I-wish-this-would-go-faster. I couldn't be prouder of her mindset and progress. Keep it simple. Be consistent. Be patient. Don't lose sleep over it. Just living her meaningful life. That's what it's all about.

Set it and forget it. Ron Popeil would be proud!

Gaining Control When It's Simple(r)

I recently met with a new 22-year-old coaching client. There’s something special about working with young people. They have big dreams, a ton of passion, and the energy to match it. They also have something else many of us more senior people don’t have: simplicity. Many young adults don’t have spouses, kids, houses, or weighty financial entanglements……yet. Instead, they have small bank accounts, a few assets, and a lot of time in front of them.

I recently met with a new 22-year-old coaching client. There’s something special about working with young people. They have big dreams, a ton of passion, and the energy to match it. They also have something else many of us more senior people don’t have: simplicity. Many young adults don’t have spouses, kids, houses, or weighty financial entanglements……yet. Instead, they have small bank accounts, a few assets, and a lot of time in front of them.

We, humans, are really good at making our lives progressively more complicated. These young adults will inevitably make their lives more complicated in due time, as well. However, I’m blessed with the opportunity to help some of them gain control of their finances where they stand today. This is a huge win, as it’s always easy to learn a new concept when it’s simple. Simple is good. As we parsed through his very short list of financial considerations, I knew something he doesn’t yet know. This is going to be a really easy process for him. Far easier than for most.

Many people come to me in their 40s, when life is anything but simple. Yes, someone at that stage can absolutely gain control and learn how to handle their finances better…..and I’m so excited for them when they do! Everyone can do it! But it’s trickier. There are more pieces to wrangle, less time to do it, and it’s tougher to gain control. That’s the beautiful part about being young. When you’re young, you have the opportunity to learn this stuff when it’s easy…..so that you can grow into it when life inevitably gets more complicated.

Today’s message is two-fold. First, it’s never too late or too early to gain control. your life is likelier simpler today than it will be in the future. So take control now and grow into your future life! Second, encourage the young people in your life to lean into these topics now, when they are young and life is simple. If they do, their future selves will feverishly thank their younger selves for the generous and sacrificial act.

The Dreaded B-Word

I talk about budgeting every single day. It’s a cornerstone of my coaching. It’s not because I especially love budgeting, but rather because of how important it is. It’s so important, in my perspective, that we need to get that right if we want to achieve the other financial goals in our life. People will often tell me they do great without a budget. That may be partially true, but they also don’t know what they don’t know. From my experience, they are driving a 5-speed transmission but only think it has 3 gears. 3rd gear feels really fast if you’ve never experienced a 4th or 5th gear. Something very powerful is unlocked when budgeting is done right.

I talk about budgeting every single day. It’s a cornerstone of my coaching. It’s not because I especially love budgeting, but rather because of how important it is. It’s so important, in my perspective, that we need to get that right if we want to achieve the other financial goals in our life. People will often tell me they do great without a budget. That may be partially true, but they also don’t know what they don’t know. From my experience, they are driving a 5-speed transmission but only think it has 3 gears. 3rd gear feels really fast if you’ve never experienced a 4th or 5th gear. Something very powerful is unlocked when budgeting is done right.

I get it, the idea of budgeting is terrible. Most people (fairly) assume budgeting will suck the fun out of their life. That’s simply how budgeting is approached by the vast majority of our financial world. Stop spending, be responsible, cut back. We treat it as a crash diet. I think we’re missing the point. The objective of a budget isn’t to spend less, but rather to spend better. It’s a way to live out our values. So through the lens of “spend less”, yeah, I’d hate budgeting, too. But through the lens of “spend better”, budgeting gives us life. It’s a tangible way to execute our hopes, dreams, values, and principles.

Last week, one of my 6-year-olds approached me and asked, “Daddy, when is the end of the month?” When I asked him why, he responded, “because I want to go to Chuck-E-Cheese and thought we could put Chuck-E-Cheese in the new budget.” “Yeah, bud, let’s put it in the budget next month. That will be a lot of fun. What else should we put into the budget?”

Even at 6, he’s realizing this money stuff shouldn’t suck. It shouldn’t rip the fun and enjoyment out of life. It shouldn’t hinder our ability to live a quality life. He’s already learning that it’s a way that we can intentionally plan for fun things and live out our family’s values.

As this week begins, I encourage you to look at money through the lens of “spend better”, not “spend less.”

Delayed Gratification

Later today, I’ll be delivering the keynote address at a Future Business Leaders of America conference. It will be comprised of 150-300 high school students interested in pursuing business careers. I’ll be talking about three myths I believed when I was younger, and why overcoming them can be transformational for their journey.

Later today, I’ll be delivering the keynote address at a Future Business Leaders of America conference. It will be comprised of 150-300 high school students interested in pursuing business careers. I’ll be talking about three myths I believed when I was younger, and why overcoming them can be transformational for their journey.

One topic I’ll bring up is delayed gratification. As humans, especially as young adult humans, we want what we want…..and we want it now. We also live in a culture that is tailored to give us the instant gratification we desire. Unfortunately, the important things in life rarely provide instant gratification. It’s a slow burn of patience, discipline, persistence, and maybe a bit more patience.

As I reflect back on some of my successes, it dawned on me just how patient I was (even if it didn’t feel like it at the time):

I offered financial coaching as a free ministry for more than six years before someone paid me to do it. Those years allowed me the opportunity to serve people well, learn my craft, carve out my approach, and discern my desired client base.

I gave 95 talks before someone paid me to speak. I suspect the first 30+ were terrible! Every repetition allowed me to get comfortable on the stage, try new techniques, and find my voice.

We’ve produced nearly 200 podcast episodes and haven’t made a single penny in revenue. That’s more than 60 hours of free content, available to the world. Maybe someday we’ll decide to create an income from the podcast, but until then our goal is to find our audience, add a ton of value to people’s lives, and start to bend the culture when it comes to work and money.

Patience isn’t easy, but it does get easier if we remember our why. My why is to make the deepest and broadest impact possible over the next 40 years. When I remind myself of this, it’s far easier to remain patient and keep my eyes focused on what truly matters (and what doesn’t).

Defining the Win

Later today, I’ll be coaching Finn and Pax’s 6-year-old basketball team. At this age, it’s a mess! Some can dribble, most can get the kid-sized ball up to the lowered hoop, and the defenders look lost. Even at this age, some of the kids obsess about the score. During last week’s game, I honestly don’t even know what the score was. I’m not sure it was even being kept. To me, that was completely irrelevant.

Later today, I’ll be coaching Finn and Pax’s 6-year-old basketball team. At this age, it’s a mess! Some can dribble, most can get the kid-sized ball up to the lowered hoop, and the defenders look lost. Even at this age, some of the kids obsess about the score. During last week’s game, I honestly don’t even know what the score was. I’m not sure it was even being kept. To me, that was completely irrelevant.

This brings to mind a crucial question I ask my clients early in the coaching journey. “What is a win?” It sounds like a dumb question, but the definition of a win can be dramatically different from person to person. In the case of my young basketball team, wins are defined as a) having fun, b) learning some basic fundamental skills, c) creating a culture of teamwork, and d) showing good sportsmanship. If these four things are accomplished, we’ve won. Keeping score and collecting wins shall come later when they get a bit older, but today we need to focus on these other wins.

Last week, I was sitting down with a new-ish client. They’ve amassed several million dollars of wealth over the past decade, and the conversation quickly went to how they could accelerate the process to garner a few million more. The elephant in the room, however, was a lot of discontentment with their careers and overall burdensome lifestyle. In the middle of this conversation, I asked again, “What do you REALLY want? What’s the real win?”

This unearthed an entirely new conversation that, instead of focusing on wealth and more, focused on being more present with their family, having the freedom to pursue more meaningful work, and waking up every day without a feeling of dread. It’s a chicken-and-egg scenario for many people. A commonly-held belief is that we need more money to create the life we want. Ironically, it’s often this pursuit of more money that creates the life we don’t want. Instead of running the race to financially create the life we think we want, we could simply take a different path and actually live the life we want….today. It’s not always that simple, but more times than not it is. Money doesn’t create meaning. Meaning creates meaning.

I guess I should answer my own question, “what is a win?” Here’s how I would answer it:

I’m fully present for my family.

I wake up every day knowing I’m about to do the work I’m called to do.

I make enough money, this month, to earn the right to serve those who I wish to serve, again next month.

What’s your definition of a win?

The Fear of the Unknown

I recently had an initial coaching session with a new client. They were excited to get started, but honestly more scared than anything. This is fairly typical and I expect that going in. I used to be surprised by this, especially from families who are obviously (to me) doing well. Here’s what I’ve learned, though. Most people don’t truly know how well they are doing (or not doing). All they know is their situation, and have little else to compare it to. They may feel like a mess behind the walls of their own home, and all they see from everyone else is the tidy curated exterior. This breeds a quiet feeling of failure.

I recently had an initial coaching session with a new client. They were excited to get started, but honestly more scared than anything. This is fairly typical and I expect that going in. I used to be surprised by this, especially from families who are obviously (to me) doing well. Here’s what I’ve learned, though. Most people don’t truly know how well they are doing (or not doing). All they know is their situation, and have little else to compare it to. They may feel like a mess behind the walls of their own home, and all they see from everyone else is the tidy curated exterior. This breeds a quiet feeling of failure.

So when we sit around a table and begin to look at their finances head-on, there’s a fear. It’s not a fear of the known, but rather a fear of the unknown. This may be the first time in a while (if ever) they’ve looked this closely at their finances. The fear of the unknown is almost always worse than reality.

One of my favorite parts of these meetings is when the couple shifts from a posture of anxiety and fear to cautious confidence mixed with building optimism. They go from the fear of the unknown to an understanding of reality…..and oftentimes a reality that far exceeds what they thought was possible.

This fear of the unknown is the same reason people don’t go to the doctor, don’t open their mail, don’t apply for that job, and don’t step on the scale. It’s that dang unknown. Just like all these other areas, when we step through our fear of the unknown in our finances, we’re often surprised that our reality is much better than what we’ve been fearing. And once we have awareness, that’s when the real work (and progress) begins.

Old Habits Die Hard

“I’m sorry, but old habits die hard.” These were frustrated words proclaimed by a client during a recent coaching meeting. This quote was thrown out during a somewhat tense conversation about a few of his questionable decisions and repeat offenses. I wasn’t asking him to perform brain surgery….these were simple adjustments in behavior.

“I’m sorry, but old habits die hard.” These were frustrated words proclaimed by a client during a recent coaching meeting. This quote was thrown out during a somewhat tense conversation about a few of his questionable decisions and repeat offenses. I wasn’t asking him to perform brain surgery….these were simple adjustments in behavior.

Though my perspective of these changes being “simple” is correct, so too are his words. Old habits do indeed die hard. We can’t repeat the same behaviors and processes for decades then suddenly make a 180-degree shift overnight. That’s now how human behavior works. It took years to establish these harmful behaviors, so it’s going to take several months (at a minimum) to re-wire them into healthy behaviors.

I don’t say all this to demean my friend. In fact, he’s in the perfect spot. He has a keen self-awareness of his behavioral pitfalls, he’s taking steps to create new structure around it, he’s persistent, he knows his “why”, and he’s giving himself grace along the way. This is all we can ask for. I know he’s going to win. Why? Because he’s playing the long game. Get a little better each month, and do it for the right reasons. He’s definitely going to fail along the way. After all, old habits die hard. But this is more about the journey than the destination.

If you’re in your 30s, 40s, or 50s (or older), it’s never too late. It’s going to take some time and intentionality, but you, too, can re-wire these behaviors to create a healthy relationship with money. If you’re in your 20s, you probably haven’t had a chance yet to fall deeply entrenched into bad financial behaviors. What an opportunity for you! This is the beauty of getting this money stuff right when you’re young. It’s so much easier to create healthy habits and behaviors when you’re fresh in the adulting game, preventing you from having to dig out and re-wire further down the road when it’s significantly harder to do so.

What’s one financial habit you can start/stop during this season of life? Pick one thing and try to get a little better each day/week/month.

** If you want to learn more about creating healthy habits around money, check out my recent appearance on the Happily Every Habits podcast and connect with host Jason Harwood’s content. This guy is awesome and he knows his stuff!

Prepare, Hope

The last 24 hours have been surreal. The NCAA formally decided to host the NCAA Tournament without fans, the NBA suspended its season indefinitely, the World Health Organization officially declared COVID-19 a pandemic, and trading in the stock market was halted for the second time in a week. First and foremost, I’m not a doctor. I don’t even play one on TV. I’m over here in my little corner of the world trying to figure out how to navigate this situation for my family. As of right now, I don’t have clarity on that but have been actively seeking wise counsel from my friends in the medical world.

However, I do have a lot of insights and opinions as it relates to how we should be approaching our finances. I’ll let you decide how much value you want to attribute to them. These are my opinions and my opinions alone. If I were you, I’d strongly consider what I have to say, strongly consider what others have to say, and use the collective insights to make the best possible decisions for your family.

I have one overarching fear. We’ve had 11 years of up. 11 years of growth. 11 years of good. That’s an absurd amount of time to be on a winning streak. This unthinkable run does have consequences, though. Specifically, if you’re under the age of 35, you’ve never experienced what economic turmoil looks like first-hand. You’ve never felt the sharp pain of watching your investments evaporate into thin air, or lived through the fear of waking up every day wondering “will I still have a job by the end of the day?” You haven’t watched your peers, one-by-one, experience a financial collapse. You haven’t felt the harsh consequences of debt (and there’s a lot of debt!).

I don’t say all this to incite panic or worry. Rather, I want us to look at this issue directly in the eyes, prepare ourselves, and navigate the rough waters that are likely in store. As the saying goes, “Prepare for the worst, hope for the best.” That’s what we’ll do. With that being said, let’s dive in!

INVESTMENTS

As of this morning, the stock market (S&P 500) is down 25% in just over three weeks. Wow, that’s scary! However, let me frame it up a bit differently. After this huge 25% decrease, the stock market is sitting at values not seen since……well, February 2019. Yes, you read that correctly. We are sitting at the same place we were just over a year ago. We’re also double where we were before the last stock market crash and nearly 4x as high as we were at the bottom of the last recession. Perspective matters! In its 150-year history, the U.S. stock market has provided an average 9% return to its investors. That’s not a 9% return during the good times. That’s a 9% return through all the times, good and bad. That 9% includes two world wars, the assassination of a president, 9/11, the tech bubble burst, 29 recessions, and countless other tragedies. The point: our country’s stock market is resilient, and over a long period of time (15+ years), poses far less risk than most believe. In fact, if you’ve put your money in the stock market and left it for 15 years at any point in the last 150 years, you’ve NEVER lost money. There are a few instances of losses over a 10-year period, but the stock market has never lost money over a 15-year period.

So what does that mean for you? What decisions should you make in light of today’s crazy situation? In short, nothing. Assuming you’re invested in diverse, low-cost, stock index funds, you should do absolutely nothing. Stay the course! If you’re currently making periodic investments into these same index funds, whether its via paycheck deductions into a 401(k)/403(b), or by you manually investing into IRAs or taxable accounts, continue to do it. Stay the course! It feels yucky at the moment, but in the long run you will be so grateful you stuck to the plan.

EMERGENCY FUND

There is so much uncertainty in our global economy right now. China is isolated from the world. Italy just went into total shutdown mode. Airlines are shutting down portions of their fleet. Public events (large and small) are being canceled altogether. So many weird things. The system is being stressed right now, and it’s hard to tell how it all plays out. One thing is for sure, this amount of stress is going to result in some casualties. Some companies will go under, some jobs will be cut, and overall business activity will slow as COVID-19 becomes a more tangible reality in our communities. It would be irresponsible for me to make any specific predictions on who will be impacted and how, but the writing is on the wall that some people are going to be materially impacted, economically-speaking. I would also caution you to not look at the situation and say “I don’t work in the ‘insert name’ industry, so I won’t be impacted.” That’s short-sighted. If there’s this much stress on the system, we will all feel it. Let’s use the travel industry as an example. If people from the travel industry lose their jobs, they may not be able to make their rent/mortgage payments (negatively impacting landlords, financial institutions, and taxing authorities), they may not have a lot of money to buy things (hurting businesses in their community), and there will be more competition for available jobs (lower pay and more stress for prospective employees in other industries). Lots of possible ripple effects.

With that in mind, we would all be wise to make sure we have our emergency funds topped off during the season ahead. Having cash available could be the difference between paying the bills or not paying the bills. If you already have a healthy emergency fund (say 3-6 months of expenses), awesome! Make sure that cash stays available for immediate withdrawal. If you have the ability to increase your emergency fund in the near-term, you may want to do that as well. If you’re actively paying off debt (awesome, by the way!), you may want to push pause on that effort and instead place that money into your emergency fund. You may want to trim back some of the extras in your budget to find additional cash for your emergency fund. I would NOT advise anyone to sell stock index fund investments in order to raise cash for their emergency fund. If at all possible, please leave that money alone. We don’t want to voluntarily sell those investments in the middle of a 25% decline. Hopefully you never need to use any of this cash, but it will be there for you in the event rough waters do hit your family. When all the smoke clears and you’ve successfully navigated this mess, then that money will still be available to do whatever you were previously going to do with it (pay off debt, go on that trip, replace your car, etc.).

MAJOR DECISIONS

I’ll say this very clearly……this is NOT a good time to be making major financial decisions. If you’re thinking about buying a home, purchasing a new car, retiring imminently, or taking any other action that results in a material change to your finances, I simply wouldn’t do it. These are all great things, and I want them to happen for you, but I don’t want them to turn your life into a nightmare. My best advice is to be patient, let this season pass, and then make these awesome decisions with more clarity, full confidence, and less fear. Some of you might be thinking “well I can get a great deal if I act now.” These are also the same people I mentioned above that weren’t old enough to live through the Great Financial Crisis. Today, in this moment, some major decisions can make sense. But what happens tomorrow or next week when your world gets unsuspectedly turned upside-down? This is when fear sets in and we start to snowball bad decision after bad decision. Please don’t put yourself at risk for something like this. If you have house or car fever today, it may be time to take a cold shower. Those houses and cars will still be there for you when all this calms down, and probably at a really good price!

HEALTH INSURANCE

As I reiterate often with my clients, not having health insurance is never an option. This was true 10 years ago, it was true yesterday, it is true today, and it will be true 10 years from now. Without health insurance, we are one bad day away from absolute financial ruin. Please don’t allow yourself to be unnecessarily vulnerable to this risk, especially when the issue at hand is a global pandemic! If you’re 26 or younger and on your parents’ health insurance plan, great! If you have health insurance through your employer, great! If you’re uninsured today, not so great! If that’s you, one of the most affordable and efficient options is a health sharing program. I’m a big believer in these programs and actually use one myself. My family uses Medi-Share and I can’t say enough good things about them. Here’s an article that explains what health sharing programs are, and it even compares a few of the larger programs. I’m not affiliated with this blog, but I think you’ll find this information useful. We don’t need the Rolls Royce of health insurance plans, but we do need something. Look at it like auto insurance. We don’t rely on our auto insurance to pay for our oil changes, or brake pads, or alternators. No, we rely on our auto insurance to protect our financial life when we wrap our car around a light pole. It protects us against the really bad stuff. Our health insurance should be the same way. Find a plan that offers you enough protection that one bad day won’t blow up your life, but affordable enough for you to work it into your monthly budget.

GIVING

If you give generously, and I really hope you do, please do not let fear deter you from giving. Based on many of my words above, the need for joyful, generous givers may be more important in the months ahead than it has been for the last decade. There are people hurting and they will continue to need people like you and I to step in and show God’s love through our generosity. There are a lot of places in our financial life to cut back on, but I don’t think generosity should be one of them. The moment we stop giving (or materially pull back our giving) is the moment we start living in fear and making it all about us. If you’re a person of faith as I am, this is a great season to test your trust in God and his provision in your life. If we can be generous and selfless through a season of uncertainty and nervousness, just picture how much we can grow in our faith in the season ahead!

Those are my five key takeaways today. Stay the course on investing, keep as much cash in your emergency fund as possible, push pause on any major decisions, make sure you have health insurance, and keep being generous. If there are other topics or questions on your mind, please ask them in the comment section below. I will either address them in the comments, in a private exchange with you personally, or in a subsequent blog post. Lastly, please share this with people in your life so they too can get prepared for the season ahead. Now let’s go from here and make sure we’re taking care of our family! After all, money is never about money.

“Those are my five key takeaways today. Stay the course on investing, keep as much cash in your emergency fund as possible, push pause on any major decisions, make sure you have health insurance, and keep being generous.”

The Pull of More

Sarah’s three love languages: quality time, words of affirmation, and resorts on the ocean.

I just had an ugly conversation with my wife. She was mad, she was upset, and she was tired. There were definitely some other issues at play, but it all came bursting out in four all-too-understandable words, “I miss the money!” She went on to tell me how she misses being able to “buy whatever I want.” Or “just go to Mexico.” Honestly, I feel her. I have these types of feelings every so often, and it can be frustrating and humbling. I’d be lying if I said I was immune to jealousy, materialism, and comparison. We are all human and nobody can be fully immune to it…….even people who teach it and talk about it every day. It can be a surreal experience coaching families with $30,000/month (yes, per month) take-home incomes. These types of conversations can be somewhat disorienting. But here’s what I know to be true from my own experience and from the experiences of my coaching relationships: money NEVER causes happiness, and some people would give up all the money in the world to have a sense of meaning, purpose, and impact. Some of these wealthy families do have a high level of meaning, impact, and purpose, but it’s not caused by the money. Side note: I’m not singling out my wealthy clients, as I have many clients making $40,000/year battling the same considerations.

So yeah, this stuff can be disorienting. Money can twist us up in all types of ways, and the second I let my guard down is the moment I fall right back into that trap. There are lots of things that can trigger me. Stick-shift convertible sports cars, exotic vacations, a beautiful house, high-tech gadgets. I crave all these things! It’s also hard when I’ve tasted so many of these cool things. Travel to dozens of countries, business-class flights, ridiculous restaurants, some of the most beautiful hotels in the world. So cool! However, I can also take a step back and ask myself what’s most important. Would I trade a life of passion for these things? Absolutely not! There’s nothing in this world money can buy that would deter me from living each and every day with the purpose and meaning I’ve been called to pursue. I don’t want to leave you thinking I’m married to a materialistic wife who hates our life. That couldn’t be further from the truth. As the conversation went on and we hashed through it, she concluded “I don’t want our old life back. I don’t want you to give up this career. I’m just having a bad day. I love our life now. I’m just having a bad day.”

I don’t blame her. I have these types of days, too. Certain experiences, or conversations, or social media posts can trigger these types of feelings. Materialism has a hold on us, and I’m not just referring to Sarah and I. I’m referring to all of us. We live in a culture here in the US that’s built around materialism. That’s a fact of life. So the answer is not to simply expect the culture to change, but rather to navigate the culture in a healthy way. Here are a few simple steps we can take to help us work through it without losing our way:

Trip to Mexico on 12-hours notice after the loss of our first child. Feels weird to think about that. Side note: Smiles were a rare occurrence on this trip, but breakfast on a balcony overlooking the ocean did it for her!

Surround yourself with like-minded people who also desire to navigate this journey of life without falling into the materialism trap. If you’re married, I hope the person sleeping on the other side of your bed is one of them! If not, we have some trouble coming our way. Aside from our spouse, find friends who also see the bigger picture and have a commitment to a life of meaning rather than the pursuit of more. Don't search for perfect people, as there aren’t any……they are just as messed up as you and me. Find people with a fire for purpose, a commitment for better, and the honesty to hold you to a higher standard.

Maintain distance from people who will pull you deeper into the materialism trap. We all have them in our lives! Friends, co-workers, family, neighbors. You know, the people who care way too much about what others think. The people who believe there’s a direct correlation between how much you spend and how much fun you can have. The people who every time they get something new (car, house, gadget, etc.), they are already dreaming of the next upgrade. The people who judge others for making humble decisions around their spending habits. I’m not saying we shouldn’t be friends these types of people. Not at all. Instead, I’m suggesting we give them a little less time and a lot less influence in our day-to-day lives. A wise man once said we become the average of the five people we spend the most time with. I think that applies here.

Don’t feel guilty or defeated when you get a materialistic urge. It just makes you human. Instead, we need to process it by asking ourselves two key questions. What triggered that feeling and why? Something we saw, or experienced, or heard? Understanding what stimuli is triggering these emotions is so important, as then we’ll have some control on how many triggers we’re potentially exposing ourselves to. It’s also important to understand why we were triggered. Is it our desire to be accepted? Or as a way to outwardly portray our career/financial success? Or perhaps our way of masking a lack of confidence? Or maybe we just simply want to do what others are doing? If we can understand the answer to the “why” question, we can have a better self-awareness to our own deficiencies and stop subconsciously masking them with spending. Knowing the answer to these two questions (what and why) can make all the difference in the world!

Consider the broader context. In a vacuum, sure, we would all like to have a nicer house, a cooler car, a more exotic vacation, and the newest technology. But we don’t live in a vacuum, we live in a wild and crazy world. There’s a give-and-take to everything. Every time we start to desire something, we need to figure out where it fits in the overall scheme of our life. Many people are selling their dreams and their happiness for a nicer car, or a bigger house. It’s about priorities. If your absolute top priority is to switch careers, or start a business, or stay at home with your kids, your spending decisions need to reflect this priority. We can’t say our dream is to stay at home with our kids, then turn around and purchase a $50,000 car. However, if you’re living a meaningful life creating impact on others, pursuing work that matters, and you understand money is not the source of happiness, then buying that car (without debt) could be an ok decision in your life. It’s all about understanding your true priorities/values and making sure your spending decisions align with them.

Know it’s ok to have nice things! As long as your spending decisions align with your broader priorities, and you’re doing it for the right reason(s), then you can do it in a healthy way. Later this year, we’re planning to spend some time in Thailand with our kids. We want to go on an adventure, expose our kids to new cultures/foods, explore with them what real diversity looks like, and create memories that will last a lifetime. This trip will cost money, but it falls at the top of our priority list and closely aligns with our priorities and values. Therefore, we will have to make sacrifices in other areas of life to ensure this gets to happen. Then when it happens, we will do it with joy, with excitement, and most importantly, without guilt!

I love my wife, and I honestly love how she’s able to be that raw and honest about something as toxic as materialism. As I told her in this conversation, it’s not going away. It’s something we’ll have to navigate for the rest of our lives. However, if we navigate it well, the quality of our life will be so grand and so meaningful, and in hindsight, we’ll be so grateful we didn’t fall into the trap.

The Choice

I didn’t set out to plagiarize my close friend and mentor Dr. Gary Hoag’s amazing book, The Choice, when I started writing this post……but here we are. Sorry, Gary! Rather, I was contemplating a text I received from a friend this morning. After some back-and-forth regarding a few of my recent blog posts, I asked him a question: “Which topics/components do you think resonate with people?” He responded with “There’s a desire to make a difference, but a feeling that you have to either get paid to work for the man, or make a difference and be a struggling artist type.”

As I’m sitting in my office pondering these words, I look down and spot my copy of Gary’s book sitting before me (see, Gary, I am reading your stuff!!!). Two simple words in big, bold white letters, “The Choice”, scream right off the cover of the book and into my periphery. We make choices every day. We choose what to wear, what to eat, who to spend our time with, what podcasts to listen to, and what NBA superstar jersey we’re going to buy our toddlers next (just me?). But there seems to be this HUGE choice that lingers over all of us, every single day. The choice of what to do with the majority of our waking hours. The choice of how we are going to use our talents and passions to make an impact. The choice of where our life’s energy will go. Such a huge choice!

As I’m considering my buddy’s words about this choice, I thought back to a very intense conversation I had with Gary over FaceTime last year. I was teetering back-and-forth on the idea of leaving my awesome career to do something totally crazy. It was one of those days where the self-talk was thick. “What are you doing!?!” “You’re going to fail!” “Don’t be irresponsible, you can never make a living doing what you want to do.” Every insult possible was hurled my way…..by my own mean self. I did what I always do when the self-talk ramps up……I engage a trusted mentor. This was one of those I-remember-exactly-where-I-was-when-it-happened kind of moments. I distinctly remember shouting at Gary - in my doubt and frustration - “Yeah, but what I’m thinking about doing hasn’t even been legitimized. There’s no proof this will actually work.” Gary smiled and responded (too) calmly, “Only God gets to decide what’s legitimate.” Thus I started chewing on the slice of humble pie Gary was serving up, piping hot!

One of Gary and I’s many Asian adventures!!

Fast forward several months, I left my career, took a 90% pay cut, and set out to build a new career. Nine months later, I’m able to support my family financially, the business is growing, and I’m already dreaming about what’s next. I often think back to that conversation with Gary and his virtual slap in the face. He was right! Had I not listened to him, and instead listened to my self-talk and the culture around us, I would have made a different choice. I would have chosen “normal”, safe, predictable, and comfortable. Instead, I chose uncertainty, impact, trust, and purpose.

Here’s an interesting thing about this choice, specifically the two options laid out by my friend. We don’t actually have to choose between “getting paid” and “making a difference.” Though I took a 90% pay cut, there’s a legit chance I eventually get to the point where I make as much (or more) in my new career than I did in my old career. If I’m pouring out my passion, using my gifts, serving people well, making an impact, and truly setting out to make the difference I know God is asking me to make, there’s no reason the income can’t follow. That doesn’t drive my decisions and ultimately I don’t really care, but that’s a reality we often don’t think about. It’s not an either/or type of choice. Rather, it’s an “I trust God” or “I don’t trust God” type of choice…….and an “I value money” or “I value meaning” type of choice. Whether we realize it or not, we make these choices every day, as not making a choice is still making a choice.

If I were still at my old job, this week I would have received a pretty sizable bonus. Out of respect for my former employer I won’t disclose what it would be…….but it’s a LOT! A former co-worker asked me a few days ago if this “lost bonus” gives me any regrets. Honestly, no. That money would be nice and could do a lot of cool things, but today my life is awesome and I get to dedicate each and every day to doing cool things. It’s honestly an unfair exchange, in my favor. Giving up a large chunk of money to violently pursue what I know to be God’s calling in my life. Knowing what I know today, in hindsight, it was the easiest decision I ever made.

So as I try to land this plane, here are my top three takeaways about this choice:

Every day is a new opportunity to make a choice.

Not making a choice is still making a choice.

Find a few amazing mentors in life that will build you up, be real with you, encourage you when you need it most, and help you make better choices. We can’t do it alone…..and luckily we don’t have to!

What choice will you make?

"Throwing Away" a Career

Sometimes people tell me one of the reasons they don’t want to follow their dream is because they don’t want to “throw away” the career they’ve spent so much time and so much energy building. There is a mentality that this singular, specific job is what matters. It’s not, and as long as we think it is, we miss the bigger picture. What matters is the experience, the skills, the relationships, and the growing you’ve achieved during your time at the job. Nobody can take away any of those things from you. They can take away your desk, and your computer, and your telephone, and your paycheck, but they cannot take away the growth you’ve experienced during your tenure.

People also seem to have the mindset their old career was a total waste of time if their new career sends them in a different direction. Even if your dream is a total one-eighty from your prior career, you wouldn’t be where you’re at had you not attained that priceless experience, those valuable skills, those meaningful relationships, and all that growth. Take me, for example. I’ve wanted to be a writer for as long as I can remember. Early last year, at 37-years-old, I was sitting on a plane with my wife lamenting the fact I hadn’t written in nearly two decades. Her response: “well, then write.” Wow, that was obvious…..and blunt. My response was something along the lines of “well I’m probably going to be terrible since I haven’t written in so long…..blah, blah, blah.” So I spent the next few hours writing. What’s odd about that experience is the words flew out of my brain and onto the screen with very little effort. It felt really good! I was dumbfounded. How could I not write for nearly 20 years and then have it feel so natural?

Then it hit me! Everything I was telling myself was a lie. I write all day, every day. E-mail after e-mail after e-mail. Report after report after report. It may not be creative writing, but it’s writing nonetheless. Fast forward to when I decided to “start writing.” I opened a blank Word document and it was as if the floodgates had opened. I didn’t think I had it in me to just sit down and write, but all of this experience and acquired skill came flowing out. As I venture into this season of life, I love those little moments where I realize how something I’ve been doing for 10, 15, or 20 years will become immediately relevant to my current journey, but in a new way.

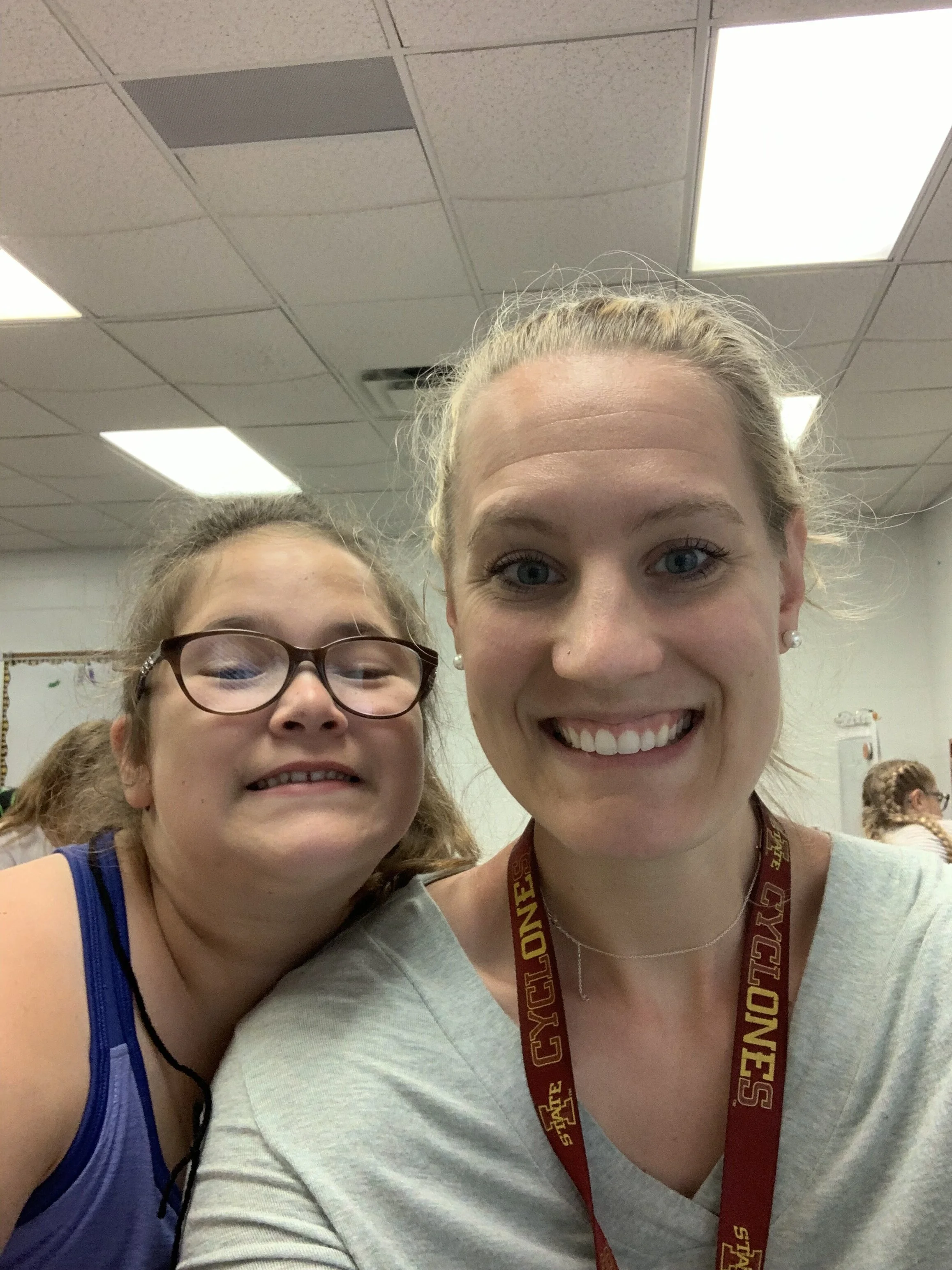

When I think about this topic, so many people come to mind. However, none more so than my friend Anna DeHamer (formerly Prins). Anna was a basketball player who was tremendously gifted in both height (6’7”) and talent. She was the 2009 Colorado Gatorade Player of the Year, was named All-American honorable mention both her junior and senior year, amassed a 106-4 high school record, and won three consecutive state titles (**season-ending injury mid-freshman year prevented the possibility of an even more absurd fourth title). She went on to play Division I basketball at Iowa State University, where she became one of the biggest rivals of Brittney Griner (women’s basketball legend!). Anna went to the NCAA Tournament four times, making it as far as the Sweet 16. As her collegiate career came to an end, she was blessed further by being selected as the 23rd overall pick in the WNBA draft.

I don’t say all this to brag about Anna. In fact, she’ll probably cringe when she reads this (she’s overly humble like that!). I tell all this to you because of what comes next. Anna walked away from basketball. Here’s a woman who spent her entire life building a basketball career. All the accolades, all the fans, all the achievements……..to eventually get drafted into the most prestigious league in the world…….and she walked away. I didn’t know Anna personally during this season of her life, but I suspect the world looked at her as if she was crazy. Basketball had blessed Anna for more than a decade, and there was more possible blessing to come, but she had a new dream. She wanted to get married, settle down, and become a teacher. And that’s exactly what she did. She “threw away” her basketball career, left the limelight and the identity the world put on her due to her basketball prowess, and she set out to pursue a new dream.

Anna got married to her now-husband Ryan and found a job as a third-grade teacher. She took all her life experience from sports, and education, and life, and channeled it into the lives of malleable young people who wanted and needed a role model. She taught them, she encouraged them, and she helped make them better people. She was living out her new dream, and life was good. Several years into her teaching career, she started to feel a nudge for something different, and a new dream started to take form.

In another decision that’s considered counter-cultural in our world, Anna “threw away” her teaching job to start her own company where she offers professional basketball training (www.hammerbasketball.com). Today, Anna trains young basketball players to elevate their game and their character to a higher level. Pretty different than teaching third grade, but the skills she gained from her teaching career have directly impacted her new career. Teaching kids, encouraging them, helping them be better people. Totally different……but not. Some might look at her journey and say she “wasted” all that time teaching if this basketball training is ultimately where she’s supposed to be. Conversely, I would propose she’d never be where she is today without first teaching third grade. Those experiences shaped her in very profound ways, ultimately making her a better basketball trainer. That’s what’s fun about work that matters. It’s not linear, it’s not clear, and it’s not obvious. But when we look back, it all makes perfect sense. Basketball prodigy, turned third-grade teacher, turned professional basketball trainer for young people. Nobody could have seen that coming, but hindsight truly is 20/20. Anna is exactly where she needs to be, and it wouldn’t surprise me if someday she “threw away” something else in the pursuit for her highest and best purpose. I’m proud of my friend Anna, and her journey is an inspiration to me each and every day.

“That’s what’s fun about work that matters. It’s not linear, it’s not clear, and it’s not obvious. But when we look back, it all makes perfect sense.”